Taxes on Goods and Services: A State by State Guide

As a freelancer or small business owner, you are responsible for charging applicable taxes when invoicing your clients. There are three principal categories of taxes that may apply to goods and services: sales tax, value added tax (VAT), and shipping tax. The rules vary by state and by country.

How Do Taxes on Goods and Services Work?

Governments require sellers to charge taxes on certain transactions. Any taxes collected are due to the government when the seller files taxes (a process called remitting). To be in compliance with tax requirements, you may need to obtain a seller’s permit for your business and add tax charges to your invoices for all relevant goods and services.

Should You Charge Sales Tax On Your Invoices?

When it comes to sales tax, there is no one-size-fits-all rule. Sales tax, calculated as a percentage of the price, depends on the location where the sale takes place, the type of goods being sold, and the type of business entity under which the seller is operating.

In general, sales tax is likely to be required on the sale of physical goods (though several exceptions apply). Services and digital products come with their own sets of sales tax rules. It’s important to research the relevant laws in your state to find out what sales taxes you should be adding to your invoices. Use TaxJar to find a sales tax by zip code and head to your state government’s website to research local requirements.

Sales Tax Rates (U.S.)

Are Services Taxed?

Taxes may apply to services based on the service provider’s location. The majority of states do not broadly apply taxes to services the way sales tax is charged on tangible goods, though local rules may vary depending on the type of service. Only four states require taxes to be collected on general services:

- Hawaii – 4% (tax.hawaii.gov)

- New Mexico – 5.125% (avalara.com)

- South Dakota – 4.5% (dor.sd.gov)

- West Virginia – 6% (tax.wv.gov)

Value-Added Tax (VAT) by Country

Most countries require something called the Value-Added Tax (VAT) to be charged on certain categories of services. Use Avalara to find the VAT for your country and to find out whether it’s required for your particular service.

| COUNTRY | VAT | SOURCE |

| USA | 0% (though there is sales tax in most states) | N/A |

| Argentina | 21% | PWC |

| Australia | 10% | TransferWise |

| Bangladesh | 15% | nbr.gov.bd |

| Belgium | 21% | belgium.be |

| Brazil | Depends on the State. Average is 17% | Avalara |

| Bulgaria | 20% | tmf-group.com |

| Canada | 5% to 15% | worldwide-tax.com |

| Chile | 19% | Avalara |

| China | 13% | tradingeconomics.com |

| Colombia | 19% | Avalara |

| Dominican Republic | 18% | KPMG |

| Finland | 24% | Finland Ministry of Finance |

| France | 20% | tmf-group.com |

| Germany | 19% | tradingeconomics.com |

| Greece | 24% | tradingeconomics.com |

| Hong Kong | 0% | scmp.com |

| Hungary | 27% | Avalara |

| India | 12.5% to 15% | www.tradingeconomics.com |

| Ireland | 23% | Irish Tax and Customs |

| Israel | 17% | Avalara |

| Italy | 22% | Ministry of Economy and Finance |

| Jamaica | 16.5% | Trading Economics |

| Kenya | 0% or 16% | Kenya Revenue Authority |

| Malaysia | 6% | lawofficemalaysia.com |

| Mexico | 16% | Avalara |

| Morocco | 7%, 10%, 14%, or 20% (standard is 20%) | ecovis.com |

| Netherlands | 0%, 9%, or 21% (standard is 21%) | Government of Netherlands |

| New Zealand | 13% | www.world.tax-rates.org |

| Nigeria | 7.5% | Avalara |

| Norway | 25% | The Norwegian Tax Administration |

| Pakistan | 17% | taxsummaries.pwc.com |

| Panama | 7% (10% and 15% for alcohol and tobacco, respectively) | TaxSummaries |

| Peru | 18% | Avalara |

| Philippines | 0% to 12% | Philippines Bureau of Internal Revenue |

| Poland | 23% | Podatki |

| Portugal | 23% | Avalara |

| Puerto Rico (USA) | 0% | N/A |

| Russia | 10% or 20% (updated from 18% in 2019) | Federal Tax Service of Russia |

| Saudi Arabia | 15% | Avalara |

| Singapore | 7% | Inland Revenue Authority of Singapore |

| South Africa | 15% | South African Revenue Service (SARS) |

| Spain | 21% | Spanish Tax Agency |

| Sri Lanka | 15% | Sri Lanka Inland Revenue |

| Sweden | 6%, 12%, and 25% (standard is 25%) | Swedish Tax Agency |

| Switzerland | 7.7% | Swiss Federal Tax Administration |

| Thailand | 7% | Thailand Revenue Department |

| Ukraine | 20% | Avalara |

| United Kingdom | 20% | gov.uk |

| Vietnam | 5% or 10% | Ministry of Justice |

| Zimbabwe | 14% | Zimbabwe Revenue Authority |

Is Shipping Taxed?

Shipping taxes are dependent on the final destination of the product. In the United States, shipping is taxed in about half the states as long if the shipping charge is clearly separated from the sale.

Shipping Tax Requirements (U.S.)

| State | Is Shipping Taxed? | Source |

| Alabama | Not subject to sales tax if the shipping charges are listed separately on the invoice. | Admin Code 810-6-1-.178 |

| Alaska | No sales tax. | N/A |

| Arizona | Not subject to sales tax. Handling charges are taxed. If shipping and handling, the entirety is taxed. | Admin Code § R15-5-133 |

| Arkansas | Subject to sales tax. | GR-18 |

| California | Not subject to sales tax if the shipping charges are listed separately on the invoice. | Publication 100 (Shipping and Delivery Charges), Article 12 Regulation 1628 |

| Colorado | Not subject to sales tax if the shipping charges are listed separately on the invoice. | Colorado Sales Tax Guide (Page 10) |

| Connecticut | Subject to sales tax. | Page 13 of IP-2018(5) |

| Delaware | No sales tax. | N/A |

| Florida | Not subject to sales tax if the shipping charges are listed separately on the invoice. | Sales Tax Rules 12A-1.045, FAQ from FL Dept. of Revenue |

| Georgia | Subject to sales tax. | § 48-8-2(34)(A)(iv) |

| Hawaii | Subject to sales tax. | § 237-3 |

| Idaho | Not subject to sales tax if the shipping charges are listed separately on the invoice. | tax.idaho.gov (Retailers), § 63-3613(b)(7) |

| Illinois | Subject to sales tax. | Nancy Kean vs Wal Mart Stores Inc., § 130.415(b)(1)(D)(ii) |

| Indiana | Subject to sales tax. | § 6-2.5-1-5(a)(4), Sales Tax Information Bulletin #92 |

| Iowa | Not subject to sales tax if the shipping charges are listed separately on the invoice. | tax.iowa.gov (Sales and Use Tax Guide) |

| Kansas | Subject to sales tax. | Sales Tax and Compensating Use Tax (Page 15), § 79-3602(ll) |

| Kentucky | Not subject to sales tax if the shipping charges are listed separately on the invoice. | Kentucky Sales Tax Facts (Page 2), KRS 139.010(15)(a)(4), KRS 139.210 |

| Louisiana | Not subject to sales tax if the shipping charges are listed separately on the invoice. | RS 47:301(3)(a), Revenue Ruling No. 01- 007 |

| Maine | Not subject to sales tax if the shipping charges are listed separately on the invoice. | Title 36, § 1752(14), Business Guide to Sales, Use, and Service Provider Tax |

| Maryland | Not subject to sales tax if the shipping charges are listed separately on the invoice. | COMAR 03.06.01.08 |

| Massachusetts | Not subject to sales tax if the shipping charges are listed separately on the invoice. | Directive 04-5, Directive 98-5 |

| Michigan | Subject to sales tax. | § 205.51(1)(d) |

| Minnesota | Subject to sales tax. | § 297A.61(7)(a) |

| Mississippi | Subject to sales tax. | Dept. of Revenue FAQs, Mississippi State Tax Commission Part IV Sales and Use Tax (Pages 16-17) |

| Missouri | Not subject to sales tax if the shipping charges are listed separately on the invoice. | Senate Bill No. 16 |

| Montana | No sales tax. | N/A |

| Nebraska | Subject to sales tax. | § 77-2701.35, Nebraska Sales and Use Tax Guide on Delivery Charges |

| Nevada | Not subject to sales tax if the shipping charges are listed separately on the invoice. | NAC 372.101, NRS 360B.480, NRS 360B.290(2), Tax Bulletin SUT 15-0002 |

| New Hampshire | No sales tax. | N/A |

| New Jersey | Subject to sales tax. | Publication ANJ-10, Notice: Sales and Use Tax Rate Change, Bulletin S&U-4, § 54:32B-2(oo)(1), Admin. Code § 18:24-27.2 |

| New Mexico | Subject to sales tax if the Seller is making the payment to the carrier. In other words, shipping is almost always taxable. | N.M. Code R. § 3.2.1.15(D) |

| New York | Subject to sales tax except for grocery food | § 1101(a)(b)(3), § 1115(n)(3) |

| North Carolina | Subject to sales tax. | § 105-164.3(203), Sales and Use Tax Bulletins (Page 83), North Carolina Dept. of Revenue FAQs |

| North Dakota | Subject to sales tax. | § 57-39.2-01(7), § 81-04.1-01-10 (Page 6) |

| Ohio | Subject to sales tax. | § 5739.01(H)(1)(a)(iv), § 5703-9-52 |

| Oklahoma | Subject to sales tax. | § 710:65-19-70, 68, § 1352(12.a) |

| Oregon | No sales tax. | N/A |

| Pennsylvania | Subject to sales tax. | 61 Pa. Code § 54.1 , Pennsylvania Dept. of Revenue FAQ |

| Rhode Island | Subject to sales tax. | § 44-18-12(a)(iv), Regulation SU 07-33 |

| South Carolina | Subject to sales tax. | § 117-310, Dept. of Revenue (FAQs) |

| South Dakota | Subject to sales tax. | Rule 64:06:02:34, South Dakota Dept. of Revenue (Publication) |

| Tennessee | Subject to sales tax. | § 67-6-102 , 1997 Letter Ruling #97-22, Dept. of Revenue FAQs, |

| Texas | Subject to sales tax. | Sec. 151.007, Texas Comptroller FAQs |

| Utah | Not subject to sales tax if the shipping charges are listed separately on the invoice. | § 59-12-102(103)(c)(ii), Tax Commission FAQs |

| Vermont | Subject to sales tax. | § 9701(4)(A), Dept. of Taxes FAQs |

| Virginia | Not subject to sales tax if the shipping charges are listed separately on the invoice. | 23VAC10-210-6000(A) |

| Washington | Subject to sales tax. | § 82.08.807, WAC 458-20-110(3) |

| West Virginia | Subject to sales tax. | § 11-15B-2(49)(A)(iv), § 110-15-89 (Page 142) |

| Wisconsin | Subject to sales tax. | § 77.51(15b)(b)4, Dept. of Revenue FAQs |

| Wyoming | Not subject to sales tax if the shipping charges are listed separately on the invoice. | § 39-15-105(a)(ii)(A), Dept. of Revenue (Freight and Transportation Charges) |

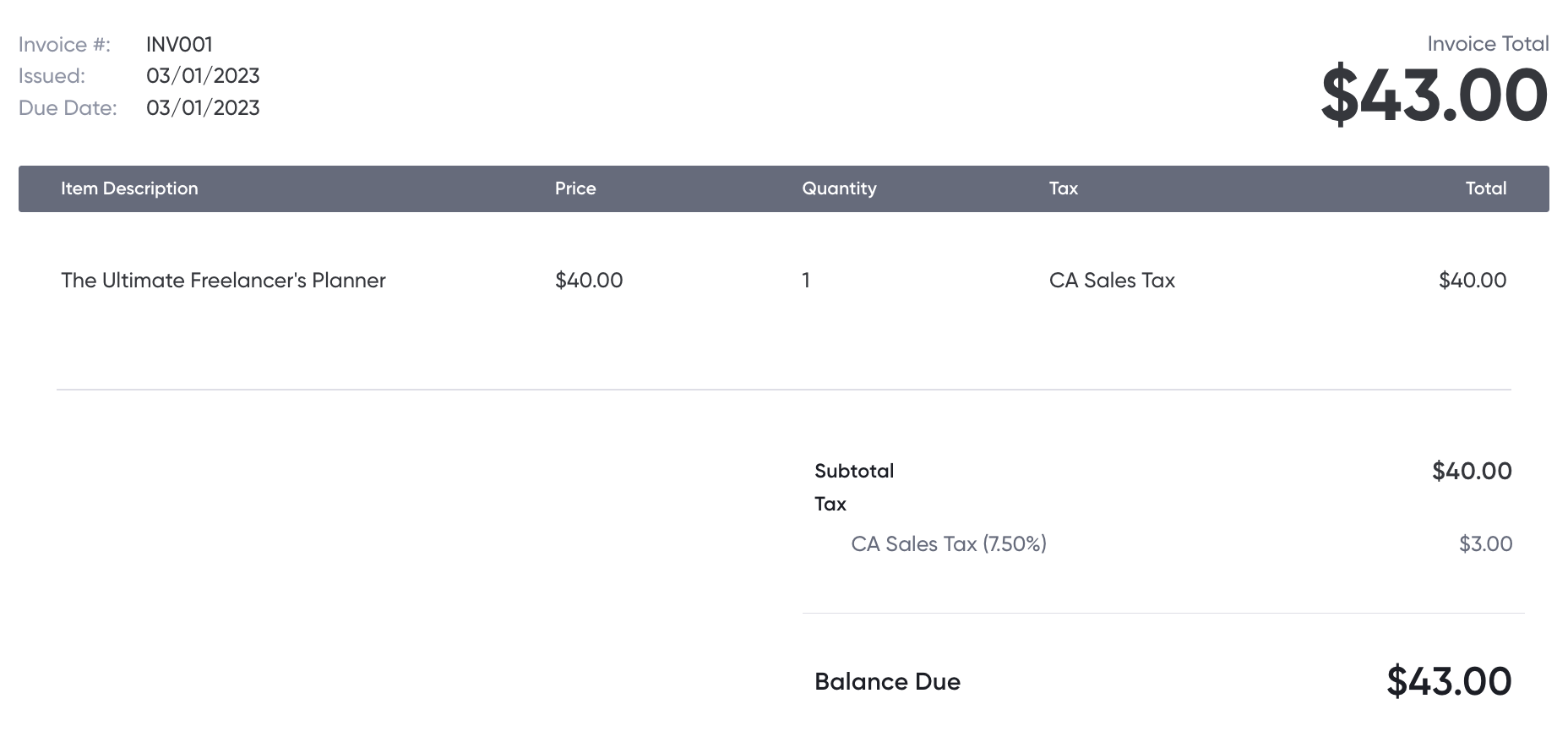

How to Add Tax to Your Invoice

Our online invoice generator calculates taxes, subtotals, and totals automatically based on the percentage rate inputted. This keeps your records clean and shows your client exactly what they’re paying. The optional tax add-on can be customized for each line item in the invoice. Simply select the “Tax” option alongside each line item, label the tax (e.g. “CA Sales Tax”), and add the percentage rate.