W-4 vs. W-9: The Basics

Knowing which documents apply to you can be tricky with more than 800 IRS tax forms and schedules. One particular point of confusion is the difference between Form W-4 and Form W-9.

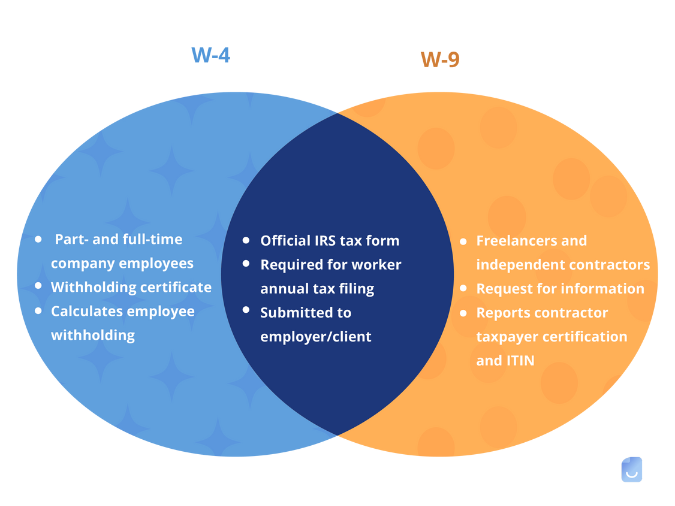

Make a Free Invoice NowSince both documents request similar information, many assume they serve a similar purpose. However, there are some key differences between the two. Namely, the W-4 helps companies determine federal income tax withholdings, while the W-9 helps freelancers communicate tax information to clients.

Let’s take a closer look at the similarities and differences between Forms W-4 and W-9.

What is a W-4 Form?

A W-4, or Employee’s Withholding Allowance Certificate, is a tax form employees complete when they start a new part-time or full-time job. This document helps companies calculate how much federal income tax they must withhold from an employee’s paychecks.

It’s the employee’s responsibility to complete Form W-4 correctly. Failing to do so can mean:

- Overpaying taxes throughout the year and receiving a large refund; or

- Underpaying taxes and getting slapped with a whopping balance and, in some cases, underpayment penalties.

Elements of IRS Form W-4

Form W-4 requests personal information, including

- First and last name;

- Address;

- Social security number;

- Tax filing status;

- Income generated by other jobs, your spouse’s employment, or other sources;

- Total number of dependent children;

- Total number of other qualifying dependents; and

- Deductions you plan on claiming.

Employers use the information provided on the W-4 to calculate tax withholdings. However, they are no longer required to submit W-4 forms to the IRS routinely.

How to Fill Out the W-4 Form

Though a generous tax refund isn’t the worst thing, no one wants to be surprised by a massive bill come tax season. That said, it’s essential to understand how to complete Form W-4 correctly.

The current W-4 has five steps, one of which is optional:

Step 1: Personal Information

This section requests personal information, including name, social security number, and address.

Box C also asks for tax filing status with the following options:

- Single or married filing separately;

- Married filing jointly or qualifying surviving spouse; and

- Head-of-household.

To claim head-of-household status, you must be unmarried and pay more than half of the household expenses shared with a qualifying individual.

Step 2: Multiple Jobs or Spouse Works

This section is for individuals with more than one job. You must also complete this section when married, filing jointly, and both spouses work.

To complete this section correctly, either:

- Use the Multiple Jobs Worksheet. This worksheet is attached to the W-4 and will help determine how much your employer should withhold each pay period. Enter the value into Step 4(c).

- Check the box in Step 2(c). Choose this option if there are two jobs total (e.g., you are single with two jobs or you and your spouse each have a job), and the pay at the lower-paying job equals more than half of the income at the higher-paying job.

Step 3: Claim Dependents and Other Credits

Step 3 of the W-4 asks you to note how many children you have under 17. It also asks for the total number of other qualifying dependents.

Step 4: Other Adjustments (Optional)

In this section note the following:

- Other income: This accounts for passive income. For example, if you generate money through investments, consider increasing withholdings.

- Deductions: If you plan on claiming deductions other than the standard deduction, you may want to decrease withholdings. Do this by completing the Deductions Worksheet attached to the W-4 and entering the value in Step 4(b).

Step 5: Your Signature

By this step, all the heavy lifting is done. Now, it’s time to sign and date.

What is a W-9 Form?

A W-9, or Request for Taxpayer Identification Number and Certification, is a single-page document that businesses use to obtain tax information from external parties.

W-9s are most commonly used by independent contractors and freelancers who earn more than $600 from any given client in a year.

For example, if you’re a freelance graphic designer hired by Company A, you provide Company A with a W-9. Company A uses the information on the W-9 to file a Form 1099-NEC with the IRS.

You will also receive a copy of the 1099 and use this document to file your taxes. You are solely responsible for paying income taxes as a freelancer or independent contractor – clients have no obligation to withhold taxes from your payments.

Elements of IRS Form W-9

Whether you’re a freelance web designer or a long-haul trucker working on a contractual basis, you must complete a W-9. This tax form requests personal information such as your:

- Full name;

- Address;

- Social security number or employer identification number (if you own a business);

- Tax exemptions; and

- Signature.

Like with Form W-4, businesses are not required to file W-9s with the IRS.

How to Fill Out the W-9 Form

Compared to Form W-4, the W-9 is reasonably straightforward. However, there are a few confusing sections.

Line 3

In this section, you must select your appropriate tax classification. There are seven options:

- Individual/sole proprietor;

- C Corporation;

- S Corporation;

- Partnership;

- Trust/estate;

- Limited liability company; and

- Other.

Unless your business is an LLC, you need to check “individual/sole proprietor.” A sole proprietor owns an unincorporated business and pays personal income tax on profits earned.

Line 4

This section is for designating exemptions. Generally speaking, freelancers and independent contractors can leave this section blank.

W-4 vs. W-9: What’s the Difference?

As we’ve seen above, Form W-4 and Form W-9 request similar information but serve different purposes. There are a few things to consider before deciding which form to fill out.

Do I Need to Complete a W-4 or W-9?

It can be confusing to know whether to complete a W-4 or a W-9. As a general rule, employees of a company submit a W-4, while freelancers and independent contractors submit a W-9.

If you’re a part- or full-time employee for a business, complete a W-4 on your first day at a new job to prevent payroll issues. It’s wise for freelancers to complete a W-9 as soon as they begin working with a new client to avoid payment delays.

W-4 vs. W-9 FAQs

Are Form W-4 and Form W-9 the same?

No. The W-4 form is used by businesses to calculate tax withholdings for employees. Comparatively, the W-9 form is used by freelancers and independent contractors to communicate tax information to clients.

Is a W-2 the same as a W-4?

No. A W-4 is a form that an employee fills out to help an employer determine tax withholdings. Comparatively, a W-2 form is a document that an employer issues to report an employee’s total earnings and withholdings to the IRS.

Who needs to complete a W-9?

Freelancers and independent contractors who make more than $600 for a single client in one year must complete a W-9.

Do I have to report my W-9 to the IRS?

Freelancers don’t have to report W-9s to the IRS. Instead, they receive a 1099-NEC from each of their clients. Freelancers submit these documents to file and pay their taxes.

Do I need to fill out a W-9 every year?

No. But it’s a good idea to provide clients with updated W-9s when critical information changes (e.g., your mailing address) or the IRS updates the form.