How to Create an Hourly Billing Invoice for Your Business

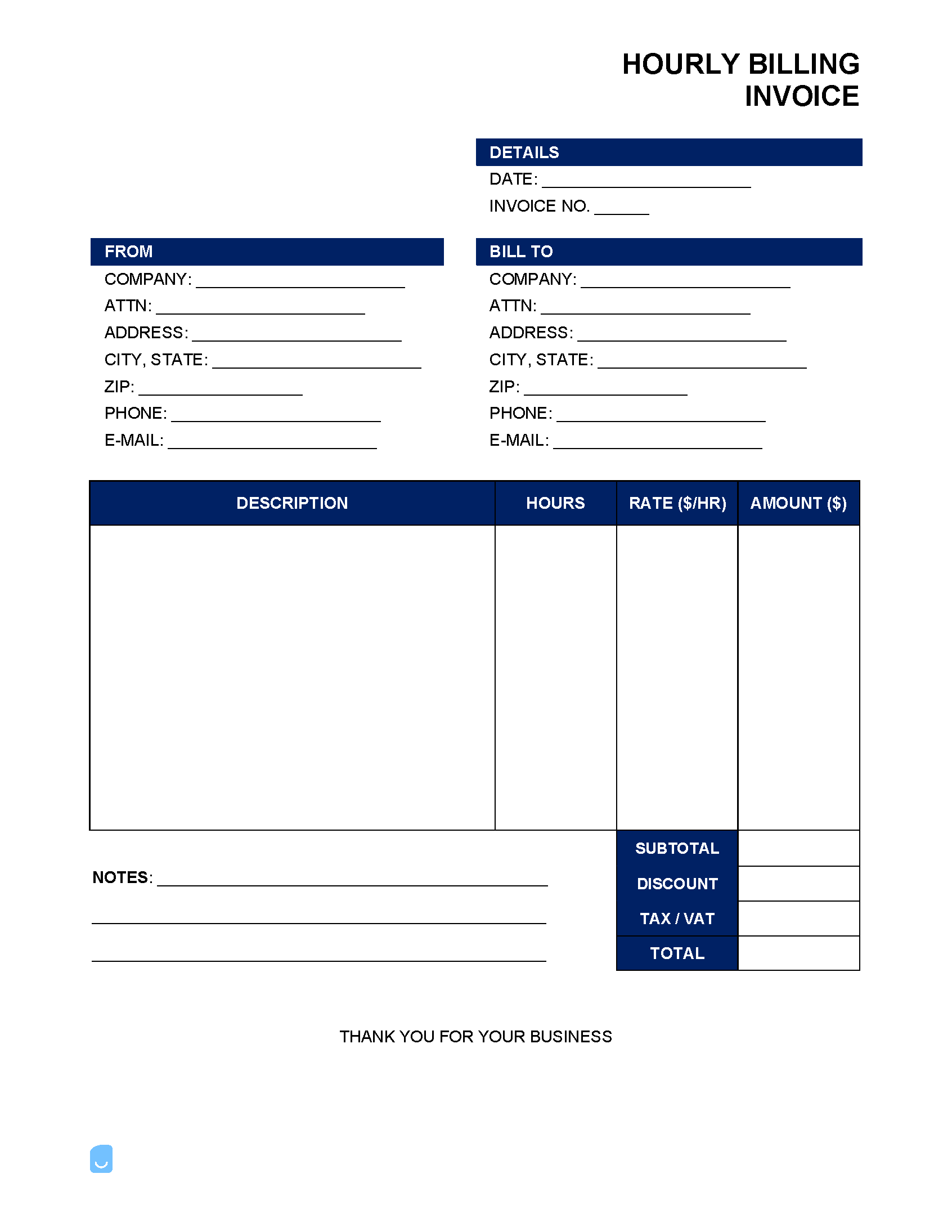

The first step in creating an hourly invoice is to track hours spent on a project. These can be tracked in a spreadsheet or using accounting software and can be categorized by day or month. The next step is generating the invoice. Invoices can be generated manually or using invoice generating software. To start, create a header for the invoice. This should include the business name and contact information, the date, and the recipient’s name and contact information. Below the header, on the left side of the page, list the services and deliverables provided and the corresponding hours worked. Here’s a simple example:

- Web design: 10 hours

- Graphic design: 5 hours

Include the date, information about the client, the hourly rate, and the amount due. Also include applicable taxes.

Examples of Hourly Billing

Two of the most common professions in which people bill by the hour are accounting and law. Both CPAs and lawyers offer expensive services. Thus, to limit and control costs, most customers prefer to pay for these services on an hourly basis.

CPA

A certified public accountant is someone who helps others with calculating their taxes. Knowledge of tax codes and the ability to navigate complex IRS and state requirements allow CPAs to charge high rates. CPAs are generally busiest around April 15, the annual deadline for taxpayers to file tax returns. Most charge by the hour.

- Hourly Rate: $40.37/hour (source: BLS)

Attorney

Because attorneys fight for their clients in cases that can sometimes have high stakes, they are able to charge high rates. Attorneys often charge a retainer fee also, or a deposit that ensures the client will make payments. Many charge by the hour for consultations and all activities related to case preparation, including research, sending emails to client, and meeting with witnesses. Others charge on a contingency basis, meaning they only get paid if the client wins the case.

- Hourly Rate: $71.17/hour (source: BLS)

How to Calculate Hourly Rates

There are a few different ways to calculate an hourly rate. The first way is to take a desired annual salary and divide it by the number of hours worked in a year in order to determine an annual rate. This figure can be used to determine a desired hourly rate.

Hourly Pay Calculators

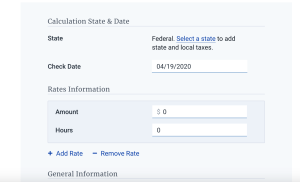

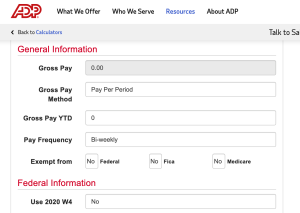

An hourly pay calculator can be handy when calculating hourly pay multiplied by the number of hours worked. PayCheckCity Hourly Pay Calculator  ADP Hourly Paycheck Calculator

ADP Hourly Paycheck Calculator

Benefits and Drawbacks of Hourly Billing

In flat-fee billing, services are billed at a set price regardless of how much time the provider actually spends on the service. This can often lead to providers feeling like they are not being fairly compensated for the amount of time they devote to a project. Hourly billing, on the other hand, allows providers to control the amount of time they spend on providing the service. Hourly billing also gives clients more control over the total cost, as they can choose to use the services of the provider for a shorter or longer period of time, depending on their needs and budget. The risk of hourly billing is that it can incentivize service providers to take longer to complete tasks in order to increase their billable hours. This can be frustrating for clients.

The best way to minimize disputes or conflicts is to be clear and transparent about billable hours and billing systems at the outset of a client-provider relationship.