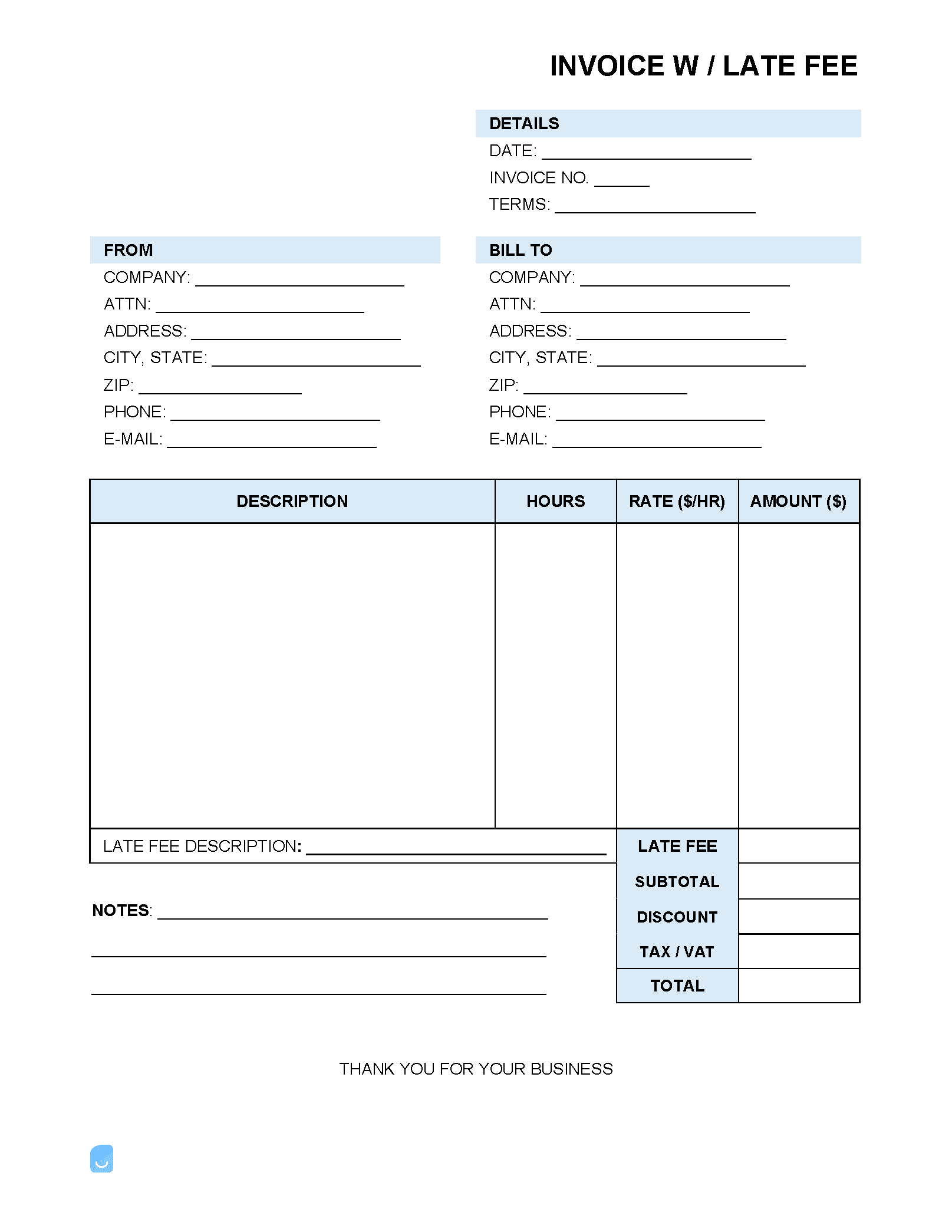

Invoice Template with a Late Fee

An invoice template with a late fee can be used to notify an individual or business that a payment is past due and their account is beginning to accrue late fees. Late fees can be structured as a single, standard amount per week or month (e.g., “$10”), a percentage based on the total invoice (e.g “1% per month”), or a combination of the two.

How to Get Paid on Time: The Ultimate Guide to Late Invoices

A late invoice is an invoice sent to clients with outstanding balances. Ensuring on-time payments, however, begins with the initial invoice sent to a client for goods or services rendered. Let’s talk about getting paid on time.

Be Clear in the First Invoice

The first step to charging late fees is to ensure the client knows ahead of time that there will be penalties payable if payment is not received by the due date. The first invoice sent to clients should clearly state the terms of late payment. Simple phrasing is best; for example, the invoice might say “Due in ___ days. 1.5% interest will be added for each week an invoice is late.”

Issuing an Invoice with a Late Fee

Assuming the initial invoice contains late payment terms, the issuer can and should send an invoice with a late fee as soon as the due date for payment passes. The updated invoice will include the late fee on top of the charges listed on the first invoice. In the description area, the issuer should explain exactly how the late fee amount was calculated. If the late fee is charged as a percentage of the entire invoice, for example, it might look like: “$2,000 x 1.5% (.015) = $30” A new invoice should be created and delivered to the client for each month that passes without payment. The previous month’s added interest should be used in the calculation of the new fee as well. For example, the new invoice calculation might look like: “$2,030 x 1.5% (.015) = $30.45” The issuer should repeat this process until the client has paid the invoice (and late fees) in full.

Consequences of a Late Invoice for a Business

For businesses, and especially for small businesses and freelancers, late or unpaid invoices can have a considerable impact on cash flow. Expenses do not wait for a client to pay. Unpaid invoices can even, in the worst cases, shut down businesses. Unfortunately, late payments are common, particularly in the construction and manufacturing fields. According to a study by Xero, the average small business is owed more than $6,000 in late payments. Even for businesses that are financially stable enough to weather some late payments, late invoices have consequences. They can endanger a relationship with a vendor or supplier that took time and effort to develop and cultivate. Many businesses are reluctant to extend credit to companies that have a history of paying late. All of these reasons explain why it’s important to make clients aware that non-payment or late payment will bear consequences and to then follow through on those consequences.

Consequences of a Late Invoice for a Client

The ultimate consequence of not paying an invoice and then not paying invoices with late fees is being sued. Businesses can take legal action if they’ve sent invoices with late fees, followed up by phone and email, and still not been paid. The process of suing involves sending a demand letter, which can serve as evidence admissible in court that a final attempt was made to receive payment from the client. Businesses will often engage a lawyer to send this letter. A client who loses this suit in small claims court is responsible for paying not only the outstanding balance on their account, but also the filing fees and court costs associated with initiating the lawsuit.

Maximum Late Fees

Some states cap the late fees a service provider can charge, so consult local laws before setting up a late payment system. It’s generally advisable to cap late fees at 10%.

Sample Late Fee Message

Hi Gary, My records show that I haven’t yet received payment of $1,000 for Invoice #0001. The payment is overdue by one week. If the payment has already been sent, please disregard this notice. And if you’ve lost the invoice, please let me know, and I’d be happy to send you another copy. I’ve attached an updated invoice that lists the initial charges, as well as a late fee. I’m sure you’re busy and I really appreciate you looking into this. Thanks, Rachel

Tips for Getting Paid on Time

While some late payments are unavoidable, there are also steps businesses can take to increase the likelihood of goods and services being paid for in a timely manner.

Lay out Payment Terms

Sometimes payments are late because invoices lack accurate or complete information. Make sure to avoid this by being clear about payment terms in advance and throughout the invoicing process. This ensures everyone is on the same page and all parties are aware of both the due date and the way overdue invoices will be handled.

Set up Reminders

Businesses can avoid late invoices by ensuring that their invoicing process is efficient. Digital tools can help to keep an accounting system on track, particularly for small businesses that lack a large accounting staff. Accounting software and invoicing software can send reminders to clients who are late on payments.

Quickly Issue Invoice with Late Fee

If a client is told that a late fee will be charged a week after the due date, the charge should be applied exactly a week after the due date has passed. This is because the company or contractor needs to establish the importance of making the payment in a timely fashion. The risk of not enforcing the consequence or taking action is convincing the client that the situation is not urgent.

Be Polite

Customers will typically be unhappy to receive a late fee, so it’s a good idea not to compound the problem by being rude. Using words and phrases such as “Please,” “Thank you,” and “If you have any questions, don’t hesitate to reach out” may seem inconsequential, but can be an important strategy.