How Do Financial Advisors Invoice Clients?

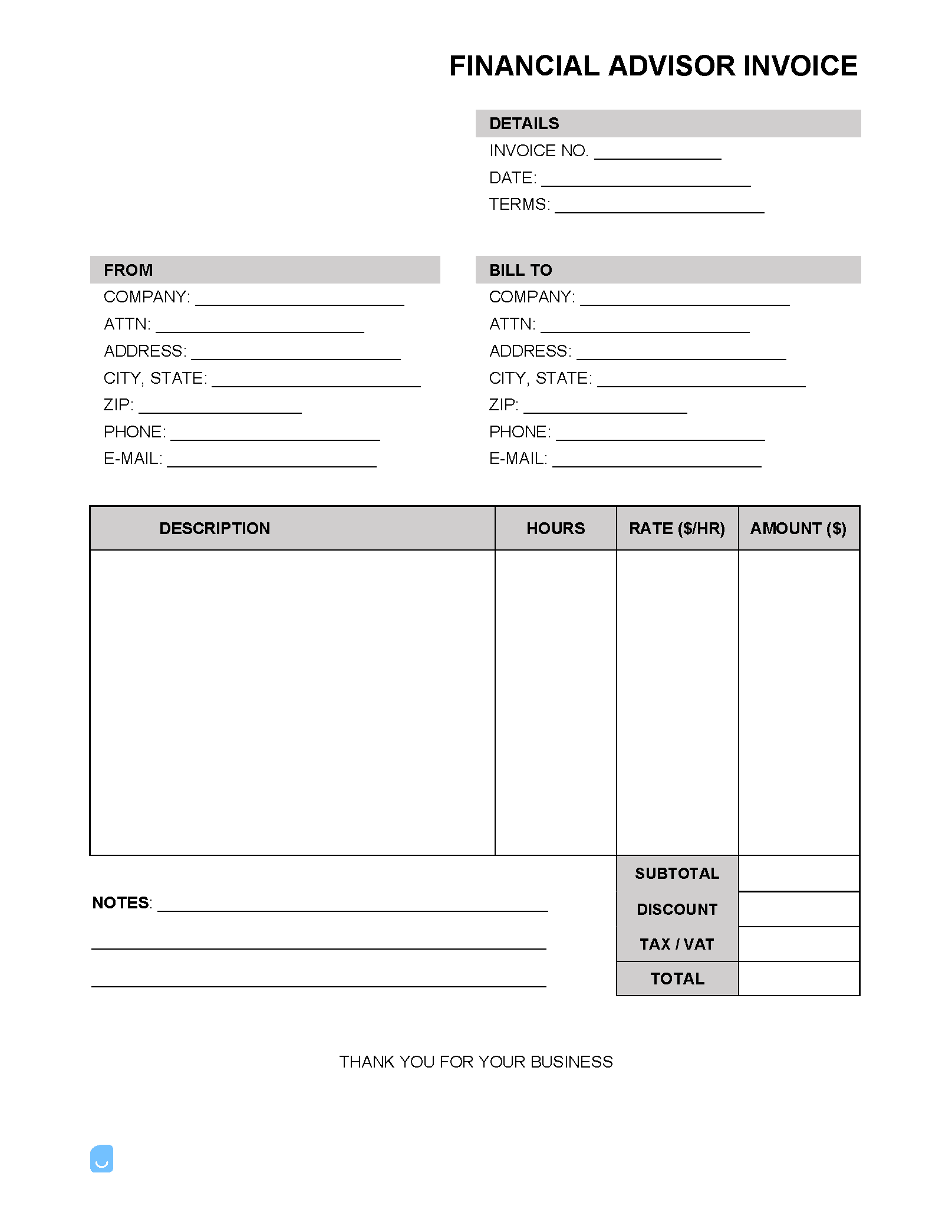

A financial advisor invoice should include the name and contact information of the financial advisor, as well as the name and contact information of the client. The invoice should also include a detailed description of the services rendered, the date the services were rendered, and the total amount due. The client should receive a copy of the invoice and should make payment within the timeframe stated on the document. If the client does not make payment within the specified timeframe, the financial advisor may charge a late fee. The financial advisor should keep a copy of the invoice for record-keeping purposes.

What Do Financial Advisors Do?

A financial advisor helps clients plan for retirement and unforeseen life events. Financial advisors are adept at analyzing the current conditions of the market, making wise investment decisions, and counseling their clients on suitable courses of action for long-term financial health. The advisor will make recommendations pertaining to estate planning, stocks, bonds, mutual funds, annuities, IRAs, 401ks, taxes, and other financial matters that affect families. Often the financial advisor will take a commission on investments. Financial advisors and planners can work independently or with companies and firms of varying sizes and specifications. According to the United States Bureau of Labor and Statistics, some of the typical duties and responsibilities of financial planners and advisors include:

- Explaining the types of financial services they provide to potential clients;

- Educating clients and answering questions about investment options and potential risks;

- Recommending investments to clients or selecting investments on their behalf;

- Researching investment opportunities; and

- Monitoring client accounts and making changes as necessary to maximize the return from their investments.

Becoming a Financial Advisor

Becoming a full-time, certified financial advisor requires earning a bachelor’s degree in an economic field, working an internship, and potentially earning advanced degrees. The recommended steps are outlined below.

College Education

Any person desiring to be a financial advisor should earn a degree. Regardless of whether the individual desires to be a sole practitioner or work for a large or small financial firm, earning a degree opens the door to internships, further education, certifications, and higher pay grades. There is no single degree required for a career as an advisor. However, it is best for a student to study business and economics.

- Recommended bachelor’s degree: Finance, Business, Statistics, Accounting, or Economics

- Length: Four (4) years

Internship

Completing an internship gives current students or recent graduates their first taste of the profession and the day-to-day lifestyle of those who work in the field. Additionally, an internship can open the door to employment with the interned firm and enhance a person’s resume, which can increase future employment opportunities. Internships can be found through college career services via online postings and word-of-mouth.

Entry-Level Job

A person can start applying to entry-level financial positions with a degree in hand and some experience in the industry. With a strong resume and consistent networking, hopeful candidates can land a job in the industry.

Certifications

To legally offer financial advice and follow standard fiduciary duty, a person must pass several registration exams. These include:

Series 6 “Investment Company and Variable Contracts Products Representative Exam”

- Questions: Fifty (50)

- Type: Multiple choice

- Duration (Length): Ninety (90) minutes

- Cost: $90

- Minimum passing score: 70%

Series 7 “General Securities Representative Exam”

- Questions: One-hundred twenty-five (125)

- Type: Multiple choice

- Duration (Length): Two-hundred twenty-five (225) minutes

- Cost: $245

- Minimum passing score: 72%

Series 63 “Uniform Securities Agent State Law Exam”

- Questions: Sixty (60)

- Type: Multiple choice

- Duration (Length): Seventy-five (75) minutes

- Cost: $135

- Minimum passing score: 43/60 (~ 71.7%)

Certified Financial Planner (CFP)

This is a highly distinguished credential that allows financial advisors and planners to guarantee that they will treat their fiduciaries and clients with integrity and professionalism.

Certified Financial Analyst (CFA)

This is one of the most critical designations a financial advisor can earn. Passing all three (3) levels of the CFA program demonstrates a mastery-level understanding of the most advanced investment skills pertaining to the analysis of investments and portfolio construction and management.