How to Create a Tax Consultant Invoice That Will Get You Paid Fast

A tax consultant is responsible for preparing and filing the tax return for the client and advising clients on tax matters. Typically these services are billed by the project or by the hour. The charges and fees for the services are provided in an invoicing document issued by the consultant after the work has been completed.

What is a Tax Consultant?

There is no official license that authorizes a person to work as a tax consultant. However, typically a tax consultant will be a certified public accountant (CPA), which requires a license. Also known as a tax advisor, the tax consultant has training and deep knowledge of tax law. Tax consulting can cater to a wide range of services such as:

- Preparing and filing tax returns

- Providing tax planning advice

- Representing clients in audits and other tax-related proceedings

- Financial oversight

- Property (real estate) oversight

A tax consultant may provide a variety of services to their clients, such as preparing and filing tax returns, providing tax planning advice, and representing clients in audits or other tax-related proceedings. A tax consultant is generally someone who works for or has worked for a large consulting firm, as all tax consultants need years of experience before they can set up shop on their own. Tax consulting is divided into two categories: personal tax services and corporate tax services. Many of the largest companies in the world use the same four accounting firms, also known as the “Big 4” (KPMG, EY, Deloitte, and PwC), to handle all their tax-related issues. As for personal tax consulting, there are thousands of small private businesses all over the United States employing tax consultants.

Tax Consultant Salary

Do I Need a Tax Consultant?

There is no definitive answer to this question. You may need a tax consultant if you are facing a complex tax situation, if you are self-employed or have a small business, if you have income from investments or rental property, or if you are subject to an audit by the IRS. A tax consultant can help you determine what deductions and credits you are eligible for, prepare and file your tax return, and represent you in an audit.

Where Do I Find a Tax Consultant?

1. Check with your local Chamber of Commerce or Better Business Bureau. They may have information on tax consultants in your area. 2. Ask family and friends if they know of any reputable tax consultants. 3. Do an online search for tax consultants in your area. Make sure to find out if the tax consultant is a Certified Public Accountant (CPA), which requires passing a rigorous exam and meeting other requirements.

When are Taxes Due?

Taxes for all individuals and companies are due on April 15th of each year. Service members and diplomats are given a two-month extension to file their taxes. Even if a person does not have the money to pay their taxes come April 15th, they still must file their taxes, as not filing and not paying are two completely separate issues. Harsh penalties can arise for not filing your tax return, including jail time. If you need more time to pay taxes, you can call the IRS to work out an arrangement to pay owed taxes (for example, paying with monthly installments). Estimated taxes need to be reported quarterly for company owners and the self-employed who make over $1,000 per year. Typical employees automatically have their taxes withdrawn from their paycheck, which is why they only need to report annually (April 15th). Taxes are not withheld from the self-employed, and therefore the IRS holds them accountable to a higher degree, making the self-employed pay taxes four (4) times per year (April, June, September, and January). However, many business owners decide to make themselves employees of their own company and pay themselves a steady paycheck, therefore avoiding paying quarterly taxes.

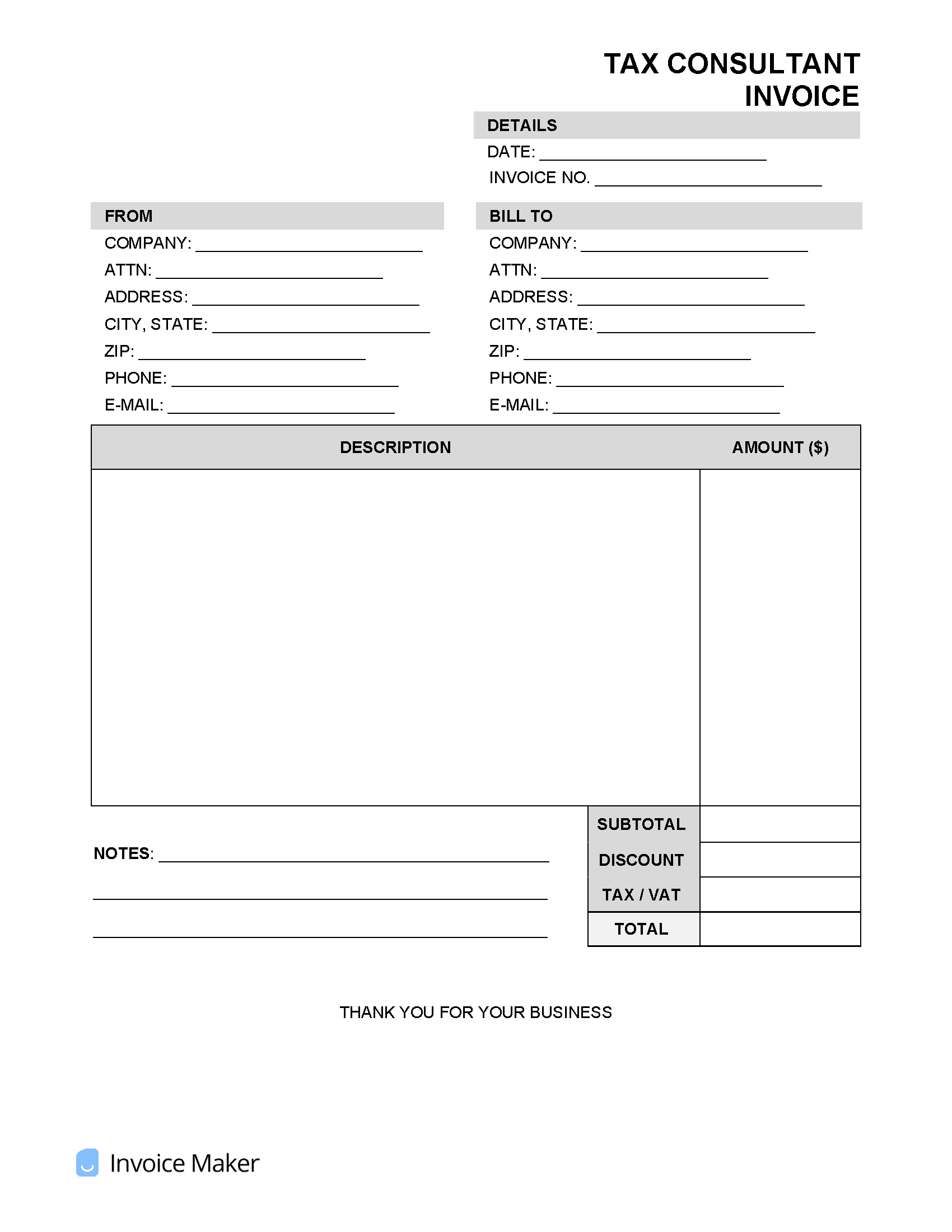

Key Elements of a Tax Consultant Invoice

A tax consultant invoice should include the following key features:

- The name and contact information of the tax consultant

- The name and contact information of the client

- The client’s tax ID number

- A clear description of the services provided

- The dates of service

- The total amount due for the services rendered

- The payment terms (e.g. due upon receipt, etc.)

- The tax consultant’s signature

A tax consultant invoice should also indicate what will happen if the client fails to pay by the due date (i.e. whether a penalty will apply or interest will accrue).