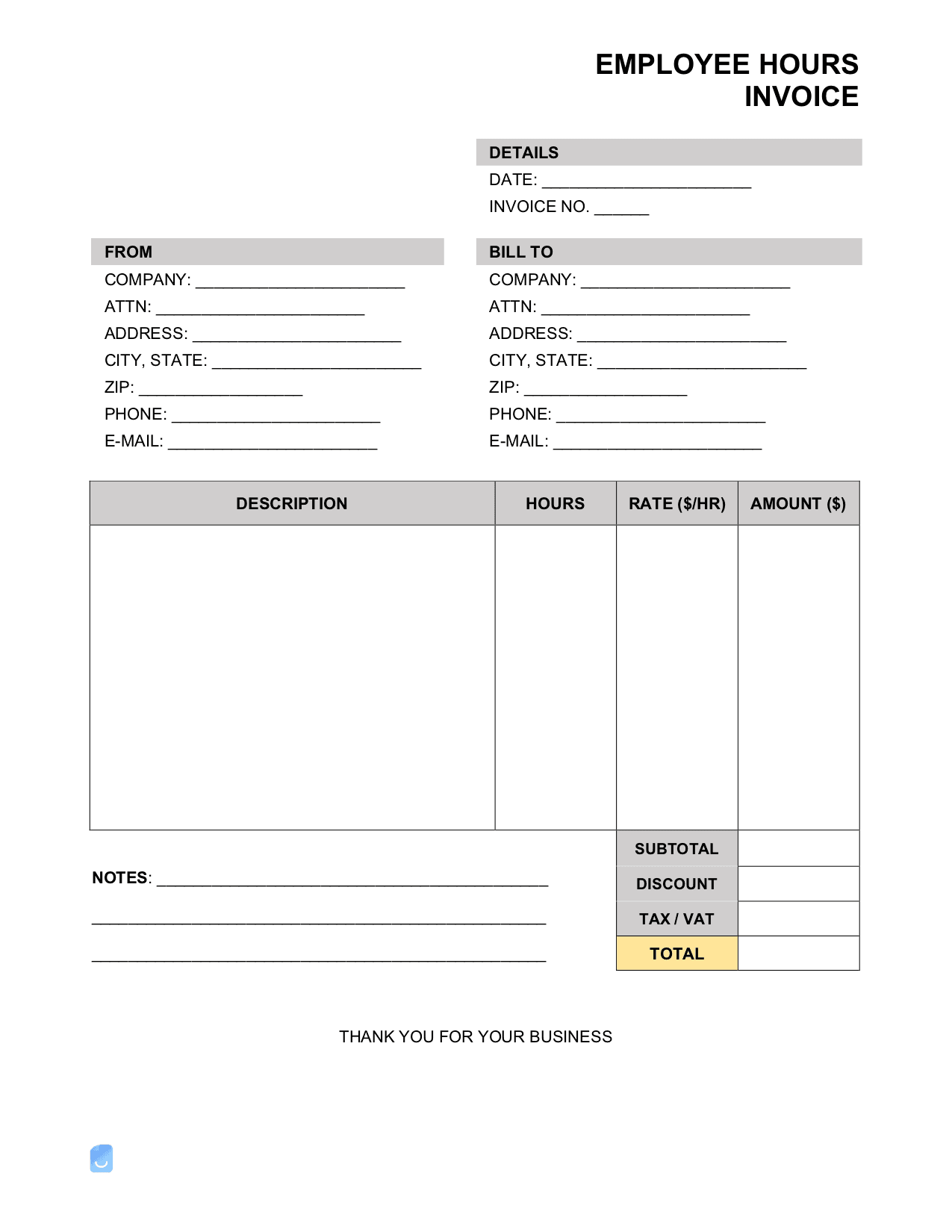

Employee Hours Invoice Template

An employee hours invoice is a billing document used by part-time and full-time employees to track the number of hours they worked and request payment for those hours. This invoice is often used by a non-exempt employee who needs to track and bill weekly wage fluctuations, overtime pay, and hourly wages.

How to Create an Employee Hours Invoice

The employee hours invoice is used to calculate the employee’s pay for a given pay period. This type of invoice is typically used by businesses that pay their employees on an hourly basis. The invoice should include the employee’s hourly rate as well as hours worked that are considered overtime or double time and, if applicable, the holiday, vacation, bereavement, and sick leave to which the employee is entitled. The employee hours invoice must be approved by a supervisor or manager before it can be submitted for payment. The supervisor or manager will review the invoice to ensure that all hours worked are accounted for and that the correct hourly rate is being paid. If there are any discrepancies, the supervisor or manager will make the necessary corrections and then approve the invoice.

Salary vs. Hourly

An employee is deemed to be on salary if they are guaranteed a minimum amount of money to be received during any workweek, regardless of the amount or type of work they put in. Most employees on salary have an employment contract with their employer that governs the working relationship between both parties and the payment structure. An employee paid hourly gets paid based on the number of hours tracked and worked. This type of employee is generally entitled to overtime pay for hours worked beyond 40 hours a workweek.

How Many Hours Can An Hourly Employee Work Without a Break?

In most states, after five (5) hours of consecutive work, employees are entitled to a 30-minute break. The laws vary by state, which can be seen in the US Department of Labor’s Table of Meal Period Requirements.

How Many Hours Does a Part-Time Employee Work?

If an employee is not on salary and is not guaranteed a minimum amount of pay each week, that individual would be considered a part-time employee. There is no law restricting the number of hours a part-time employee can work. Therefore, it is possible for an employee to work 40 hours per week and still be considered a part-time employee. What defines whether an employee is working part-time or full-time is up to the employee and employer.

Fair Labor Standards Act (FLSA)

All employees that work by the hour are covered under the Fair Labor Standards Act (FLSA). This federal department establishes the rules on how employees are paid, whether hourly, tipped, or on salary. In addition, local and state governments have their own departments that ensure labor laws are enforced.

Use this Handy Reference Guide for clarification on rules and laws.

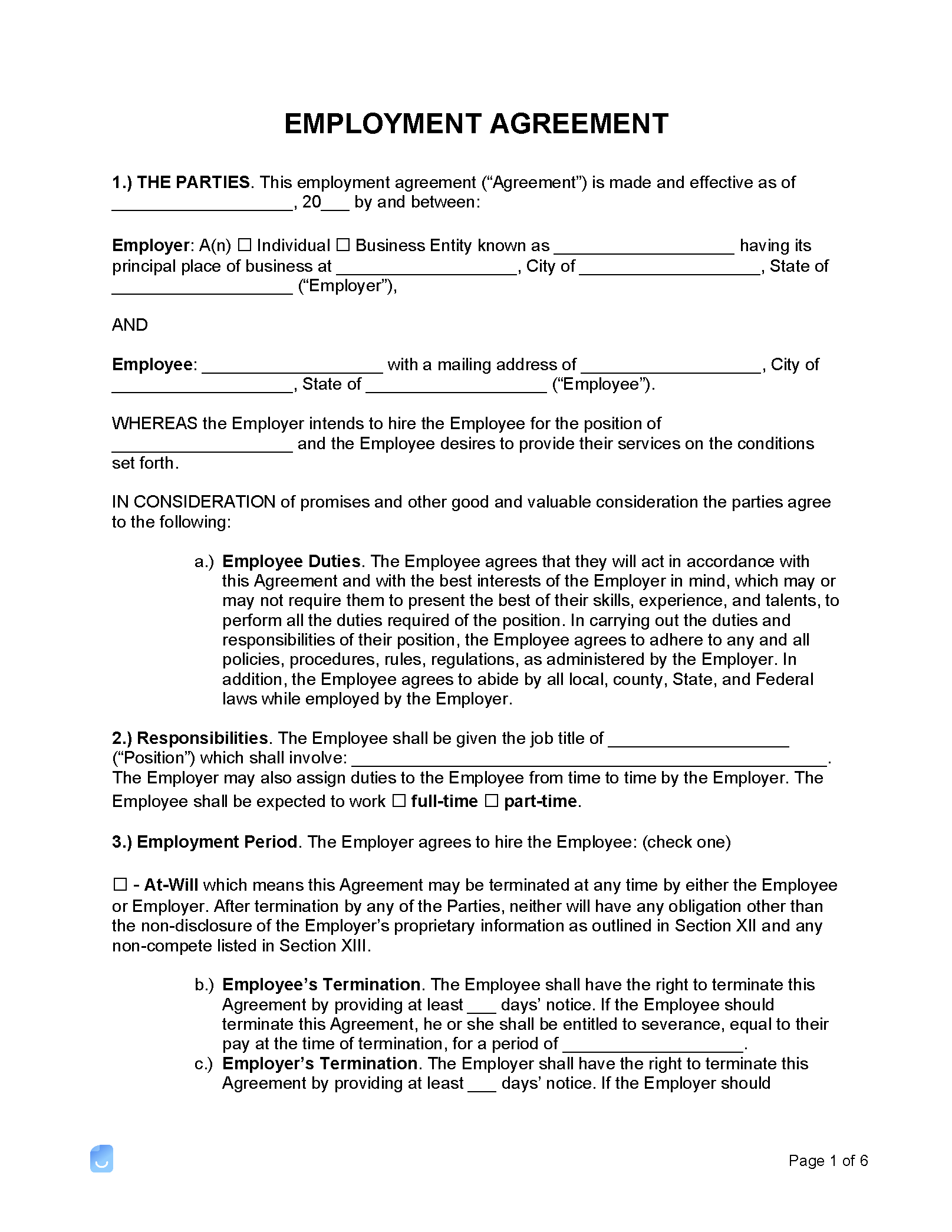

Employee Contract Template

Use when hiring an employee either on a per hour ($/hr) or salary ($/yr) basis. Download: Adobe PDF, MS Word, OpenDocument

Tracking Hours as an Hourly Employee

The first step in creating an hourly invoice is to convert your hourly rates into an invoice for work done. You can do so by tracking the hours by either writing down everything or using an Excel spreadsheet. You can also use time-tracking software to monitor the number of hours worked.

What to Include on an Employee Hours Invoice

An employee hours invoice typically includes the employee’s name, the number of hours worked, the hourly rate, and the total amount due. Here’s a list of elements to include:

- Employee’s name and contact information (e.g. address, phone number)

- Business name and contact information

- Business logo (if applicable)

- Invoice number

- Date

- Description of work

- Hours worked

- Hourly rates

- Charges accrued

- Total amount owing

- Applicable taxes

- Payment methods accepted (e.g. PayPal, credit card, app-based payments)