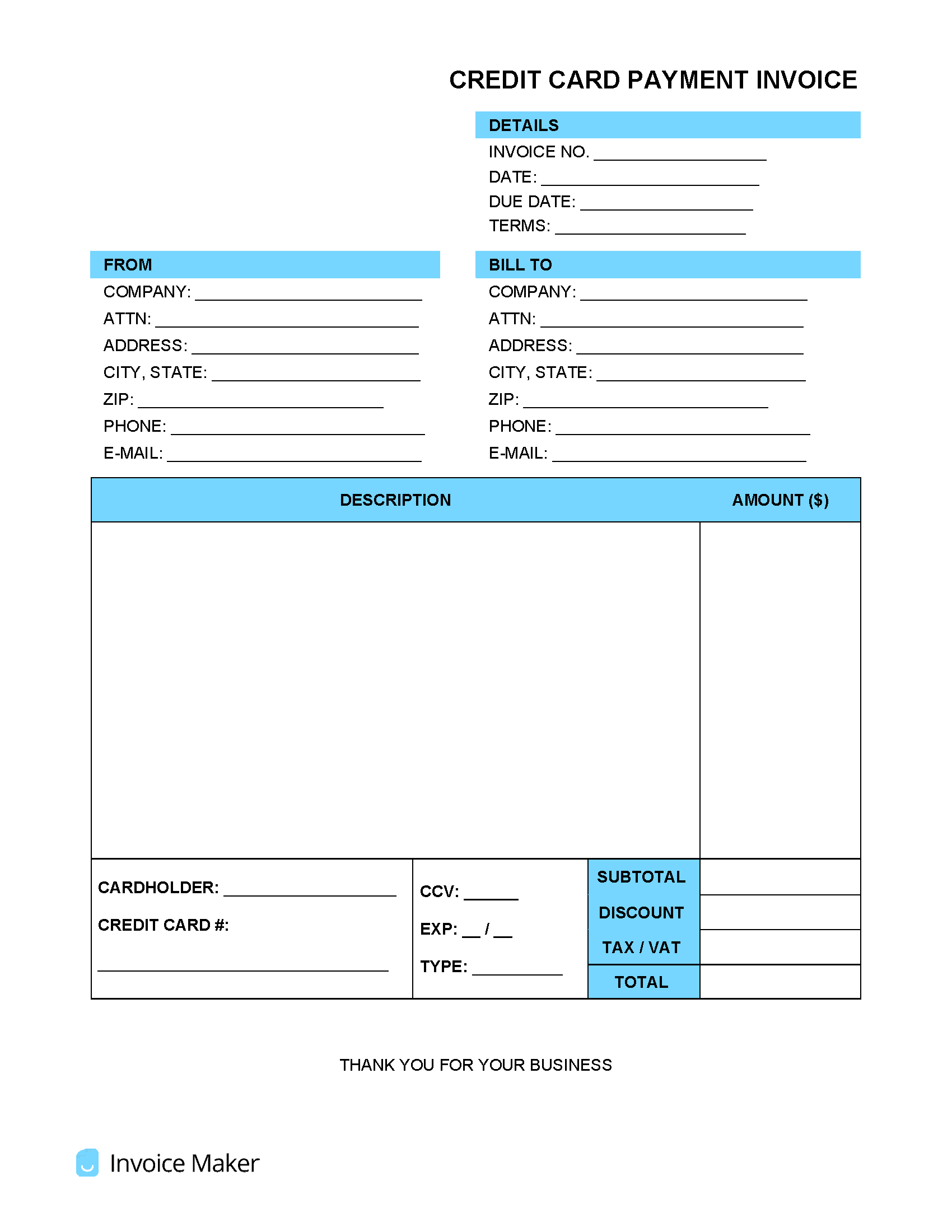

Credit Card (CC) Payment Invoice Template

A credit card invoice is an official billing statement that is mailed to clients for the purpose of collecting payment solely via a credit or debit card. The document can be used for billing services rendered, materials sold or used, or a combination of the two. An invoice designed for accepting credit cards as a means of payment should contain a field for credit card fees, the card and CCV number, the expiration date, and the full cardholder’s name.

Pros & Cons of Accepting Credit Cards

Due to the increasing preference for using debit and credit cards compared to cash, many small businesses weigh the benefits and drawbacks of offering such a payment method. The following are notable pros and cons of each:

Pros

- Highly convenient – Drawers don’t have to be counted, and the transaction is almost fully customer-controlled (depending on the exact payment system).

- Increases customer pool – For customers that only carry a credit card, the likelihood of purchasing an item at a small business that only accepts cash is unlikely. This is especially the case if an ATM is not accessible nearby. Accepting card payments greatly opens up the potential pool of customers, aiding customer satisfaction and an upsurge in revenue.

Cons

- Chargebacks – A customer-induced claim that the service or product ordered did not live up to expectations. Once a chargeback is issued, the merchant’s bank removes the money from their account while investigating if the chargeback was legitimate.

- Fees – Processing and other card fees are the costs businesses incur for having the ability to accept card payments. They typically cost merchants around 2% of the total sale.

Average Credit Card Processing Fees

Depending on the card issuer and other factors, a small business may pay anywhere from 1.4% to 4% in processing fees. The following are the average processing fees per card network according to ValuePenguin:

- Visa: 1.43% – 2.4%

- Discover: 1.56% – 2.3%

- American Express: 2.5% – 3.5%

- MasterCard: 1.55% – 2.6%