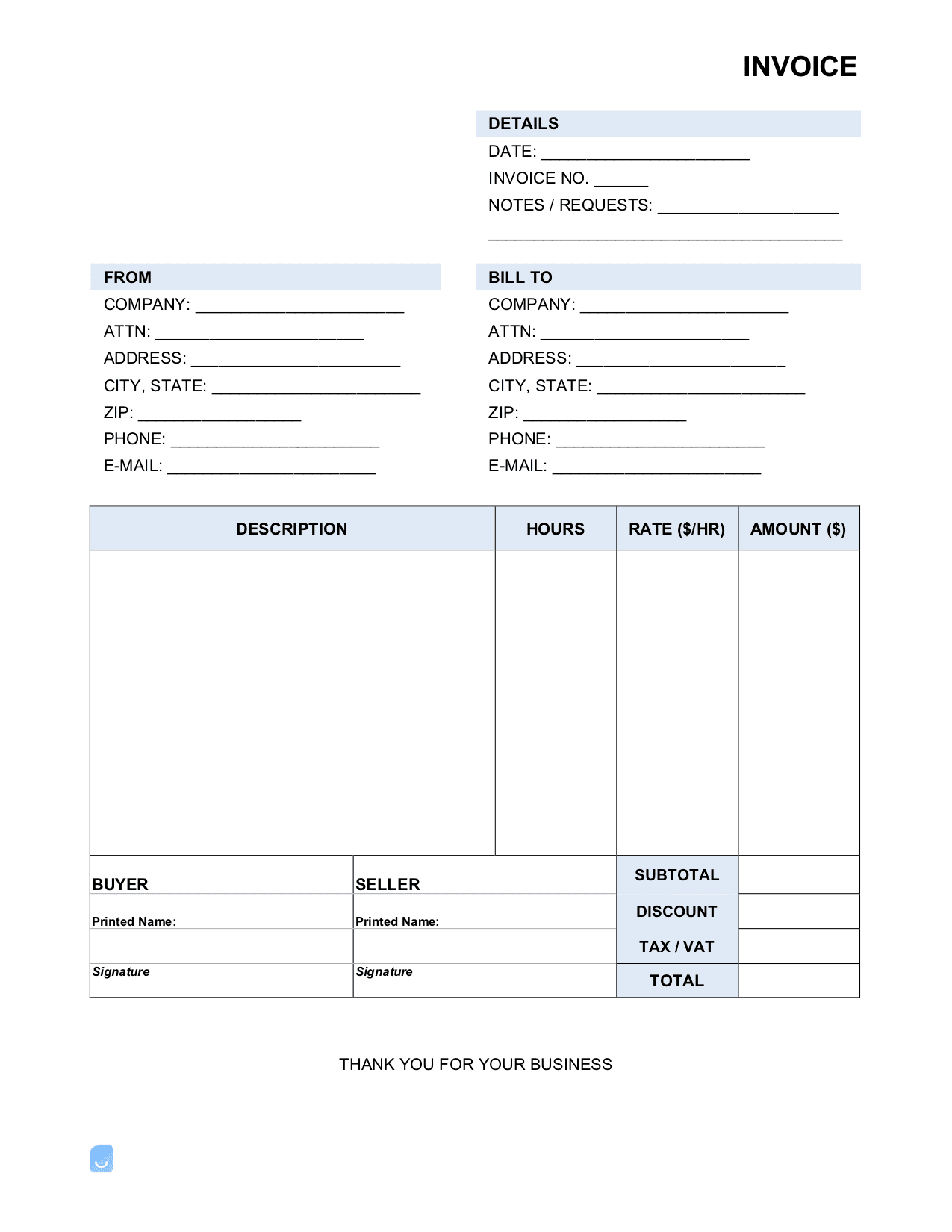

Invoice with Signature Template

An invoice with a signature allows a person or company to provide electronic or handwritten authorization to add a personal effect. Alternatively, an invoice requiring the client to sign ensures the client complies with the charges issued. While not a requirement, including a handwritten signature on an invoice can comfort the client or customer in that the bill they received is legitimate. This is especially important for invoices charging a relatively high amount.

When to Include a Signature

When to sign an invoice personally

Businesses and contractors should write their signature on an invoice anytime they wish to convey a private, personalized vibe to their clients. Situations in which the provider conducted a significant amount of work, has known the client for a long time or wants to make the client understand the importance of the invoice. In places where fraudulent invoices are common, signatures are used to tell real and fake invoices apart. If this is the case, signing an invoice should not be considered optional.

When to require a signature

Requiring a client to write their signature onto an invoice is recommended for documents that contain terms that need to be “agreed to” on behalf of the client receiving the invoice. Additionally, having clients sign their names onto the bill maintains that they understand what they are being charged and accept their obligation to make timely payments to the issuer. A signature must be requested for invoices issued before work has begun, as it adds another level of security in the event the customer does not pay the invoice.