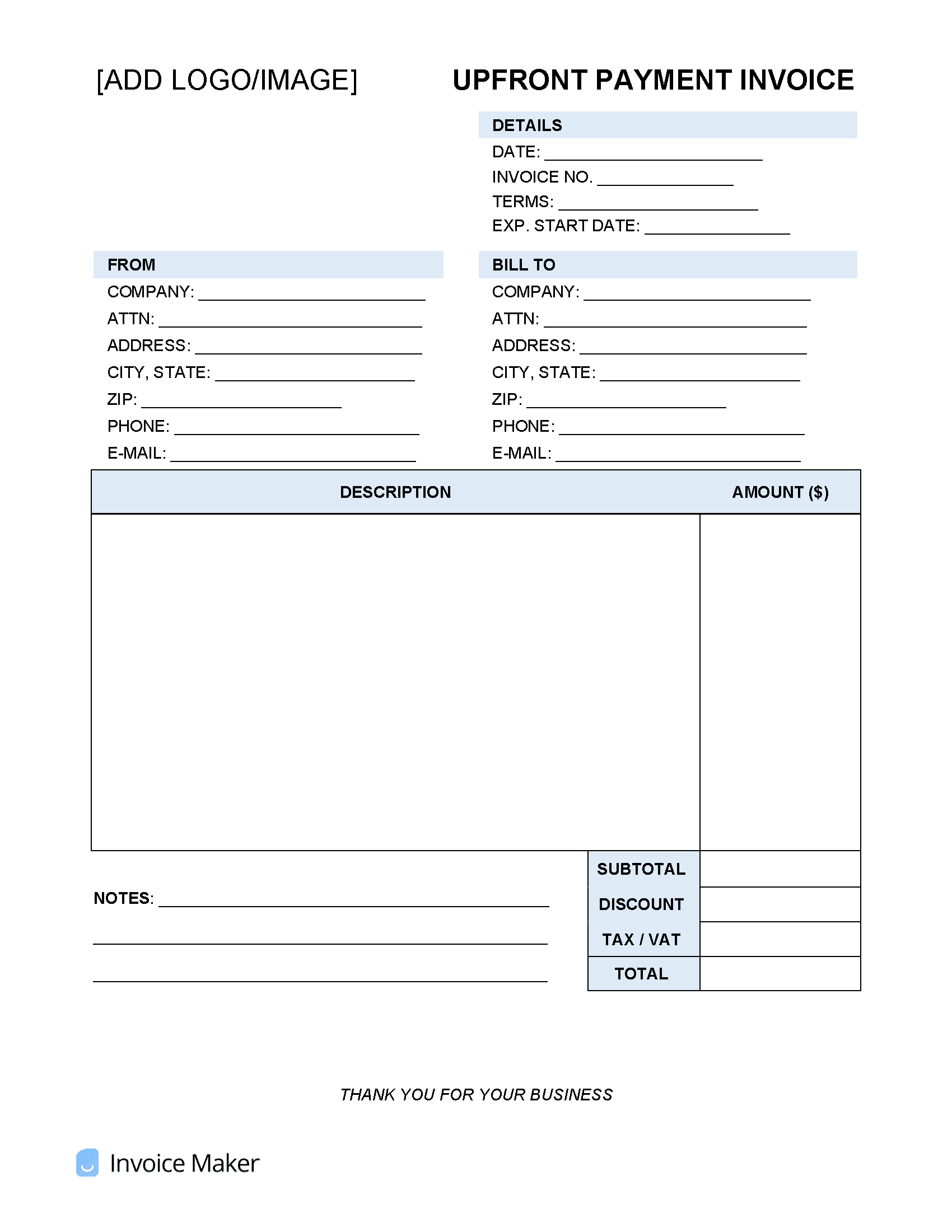

Upfront Payment Invoice Template

An upfront payment invoice allows a company or freelance contractor to charge their clients a portion or all of the bill before the service or product has been rendered or delivered. Commonly used for B2C (Business-to-Consumer) transactions, the payment method is often required for exceptionally large projects or large product orders.

When to Ask for Payment Upfront

An important question that both freelancers and business owners often ask themselves during their careers is whether or not they should ask their clients to pay upfront. The best way of answering this question is by asking, “what options do I have for collecting payment if the client doesn’t follow through?” For example, if the business or freelancer is a provider of prescription glasses, they can simply refuse to provide the new glasses for the customer if payment is received. In this scenario, requiring upfront payment isn’t necessary as the eyeglass seller can keep the merchandise. However, a freelance writer may want to request payment upfront as they have no means of ensuring payment is received after digitally submitting their work. While suing may seem like an option, it is rarely worth both the time and legal fees involved. Another example is those about to engage in a lengthy, high-cost project (building contractors, for example). While asking for the entire project sum upfront may be a stretch, requesting a partial payment upfront is highly recommended to ensure the client is a) serious and b) can afford the job. In short, a client should be required to pay at least a portion of the total cost upfront if one of the following holds true:

- The sold product(s) are exceptionally expensive, or the project is time-consuming (and costly)

- If the provider or seller cannot force the client to pay by withholding the finished product

Exceptions: If the company is well-known and has a positive history with the seller or service provider.

Pros and Cons of Upfront Payment

Pros

- Eliminates the risk of receiving no (or late) payment from clients.

- Removes the burden of keeping up with missing payments and issuing late fees.

- Looks very professional, as it infers that the company or freelancer takes their work seriously.

- Allows the seller to do a “pre-screen” of clients. If they are hesitant to pay a portion (or all of) the invoice amount, this should alert the provider to a possibly non-paying customer.

Cons

- Can scare off potential customers. For those that have never seen the finished product, the idea of committing money may be off-putting.

- Is impersonal. Can make clients feel untrusted.

- Clients may not have the upfront capital to pay for said goods or services.