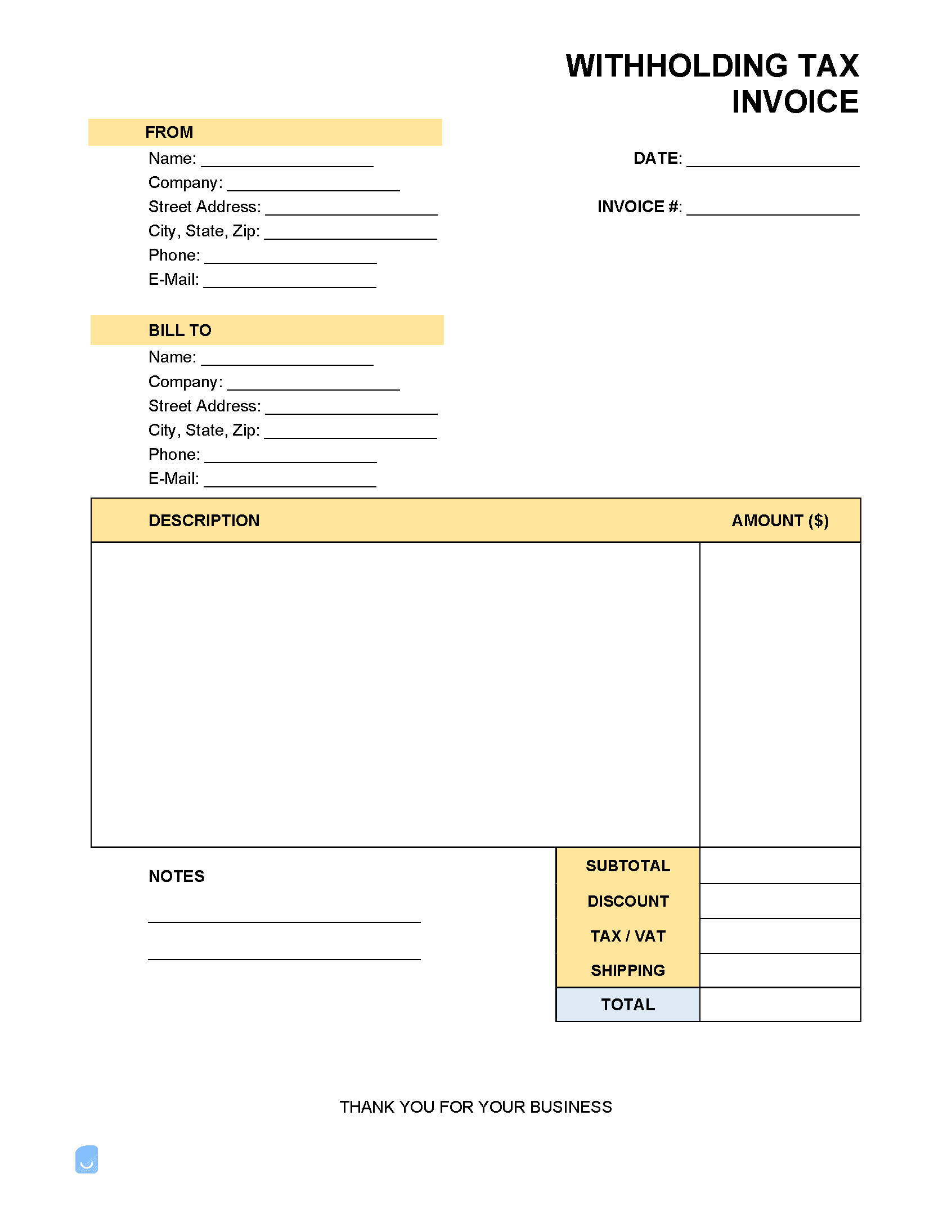

Withholding Tax Invoice Template

A withholding tax invoice is a billing form sent by a tax accountant (CPA) to a business owner after providing services that include calculating the withholding taxes for their employees on payroll.

What is Withholding Tax?

Withholding tax is most commonly referred to as the amount taken out of an employee’s paycheck to pay local, state, and federal taxes. Employers need to calculate the amount to be taken out of each employee’s paycheck when running payroll. The withholding amount will vary depending on the state, marital status, employee’s taxable gross wages, and the allowances claimed. Payroll services, such as Gusto, can automatically calculate and file withholding taxes to the proper government agency each time payroll is run without the hassle of doing the calculations.

Types

Federal Tax Withholding – To know how much federal income tax must be withheld from an employee’s wages, Form W-4 should be signed immediately upon hiring. Payroll Tax Withholding – Thee total amount of taxes held from an employee’s paycheck. Social Security Tax Withholding – The social security tax rate is currently 6.2% for both the employee and the employer, for a total of 12.4% that must be paid to the government. Therefore, 6.2% must be withheld each time from an employee’s paycheck when payroll is run. State Withholding Tax – Most states charge their own state withholding tax that must be withheld from an employee’s paycheck. However, some states like Florida charge zero state withholding tax while other states like California charge the highest.

Tax Withholding Form

An employer’s first action upon hiring an employee is to give that person a W-4 form to fill out. A rather simple form, it helps the employer calculate the employee’s withholding taxes. Employers should consider having their employees sign a new W-4 at the beginning of each new tax year.

How Much Tax Should I Withhold?

To calculate and estimate the amount of your tax withholding, use the IRS Tax Withholding Estimator. The goal is not to have too much or too little federal income tax withheld. Withholding estimates will be calculated off the following information provided:

1. Filing status

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widower

2. Dependents

Dependents are children, young adults, or family relatives that you care for (dependent on you). Claim as dependents if they meet the following criteria:

- Under the age of 19;

- Students under the age of 23 that still live in the house

- Relatives still living in the house

3. Income

If employed by a regular job, withholding taxes will be drawn out. If self-employed, you will need to calculate your withholding taxes at the end of the year. It’s important that you plan ahead and not spend your withholding taxes.

4. Pension

Any time of retirement payment or pension plan may be taxable, and taxes could be withheld. If you are taking in a pension, disclose how many pensions you have.

5. All Sources of Income

You will be asked to disclose all other sources of income, including if you are old enough and taking social security.