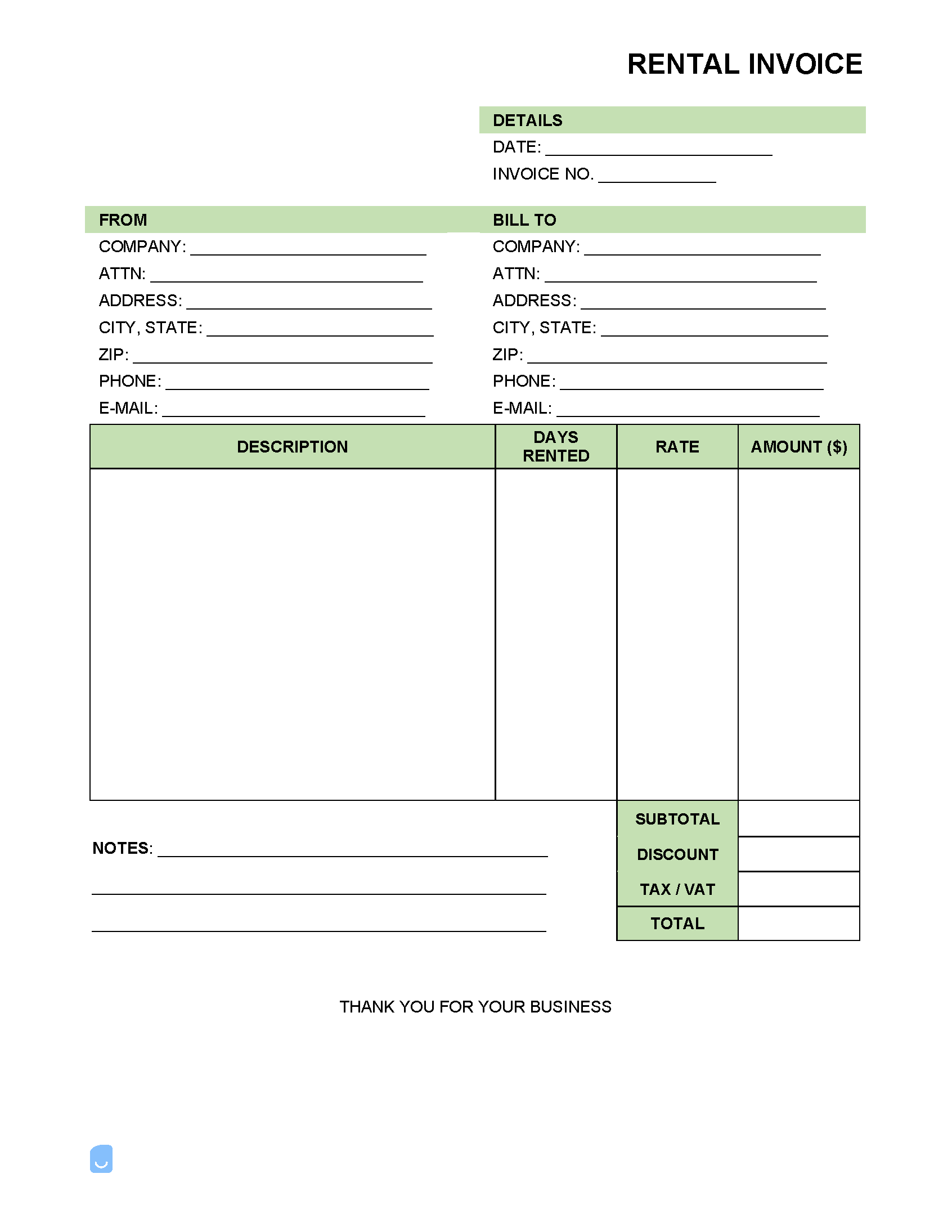

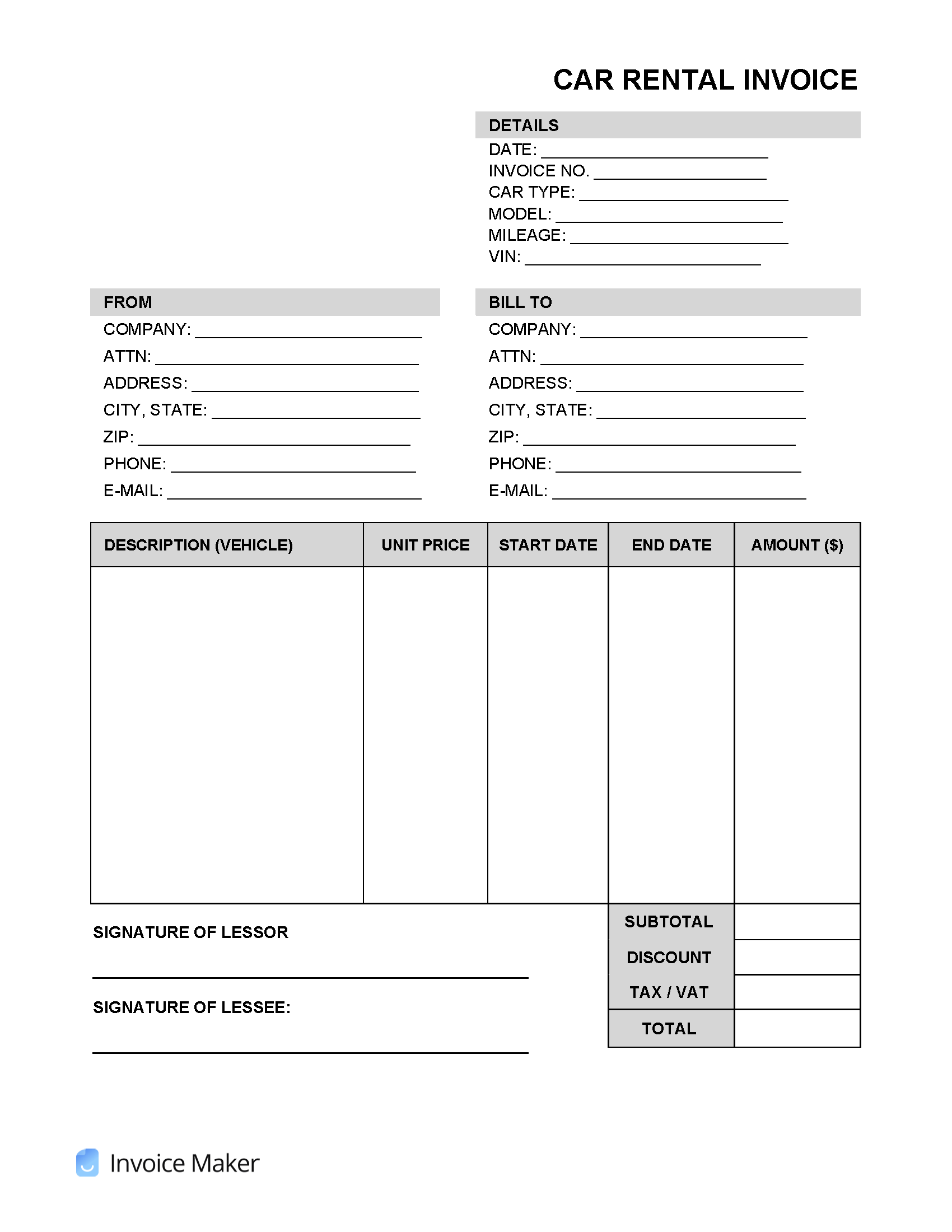

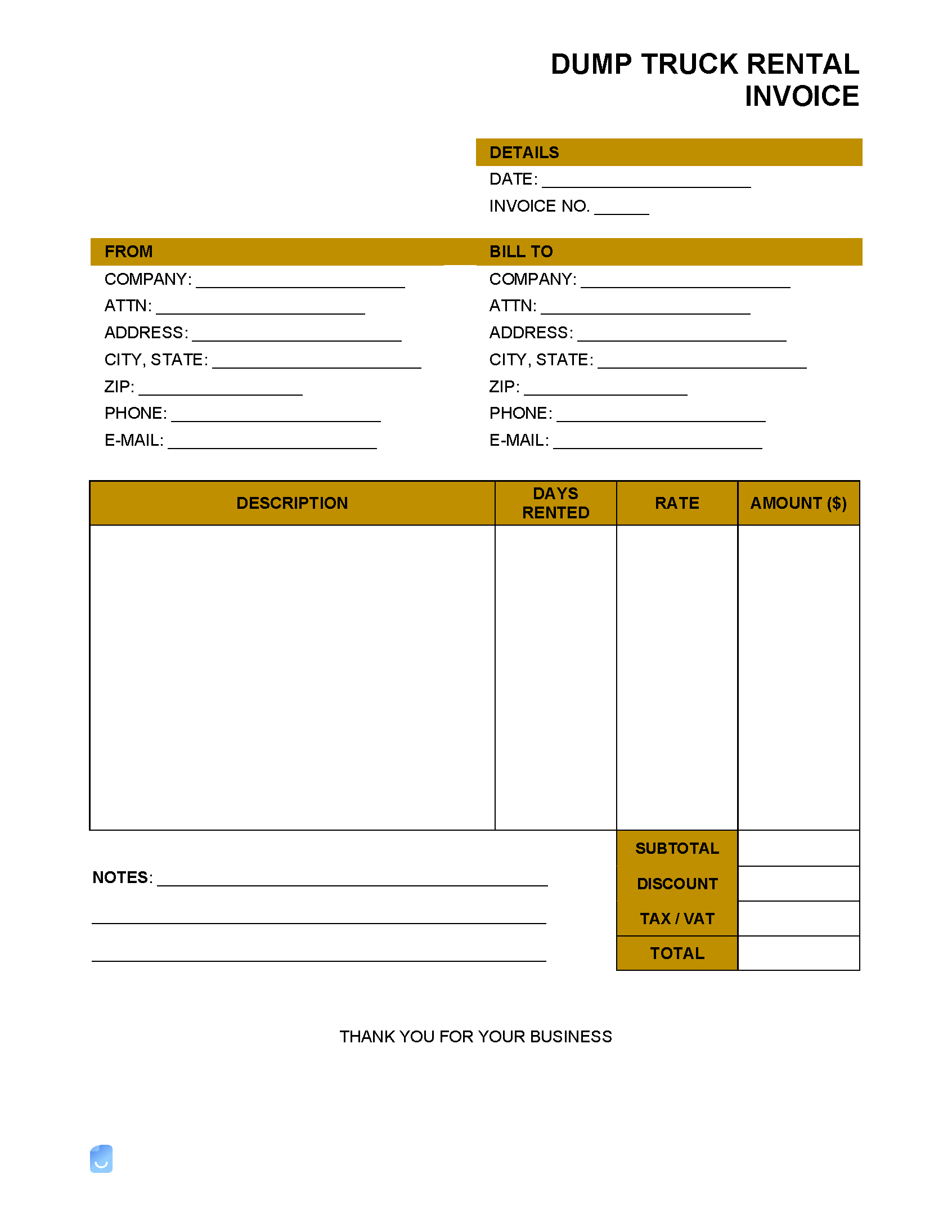

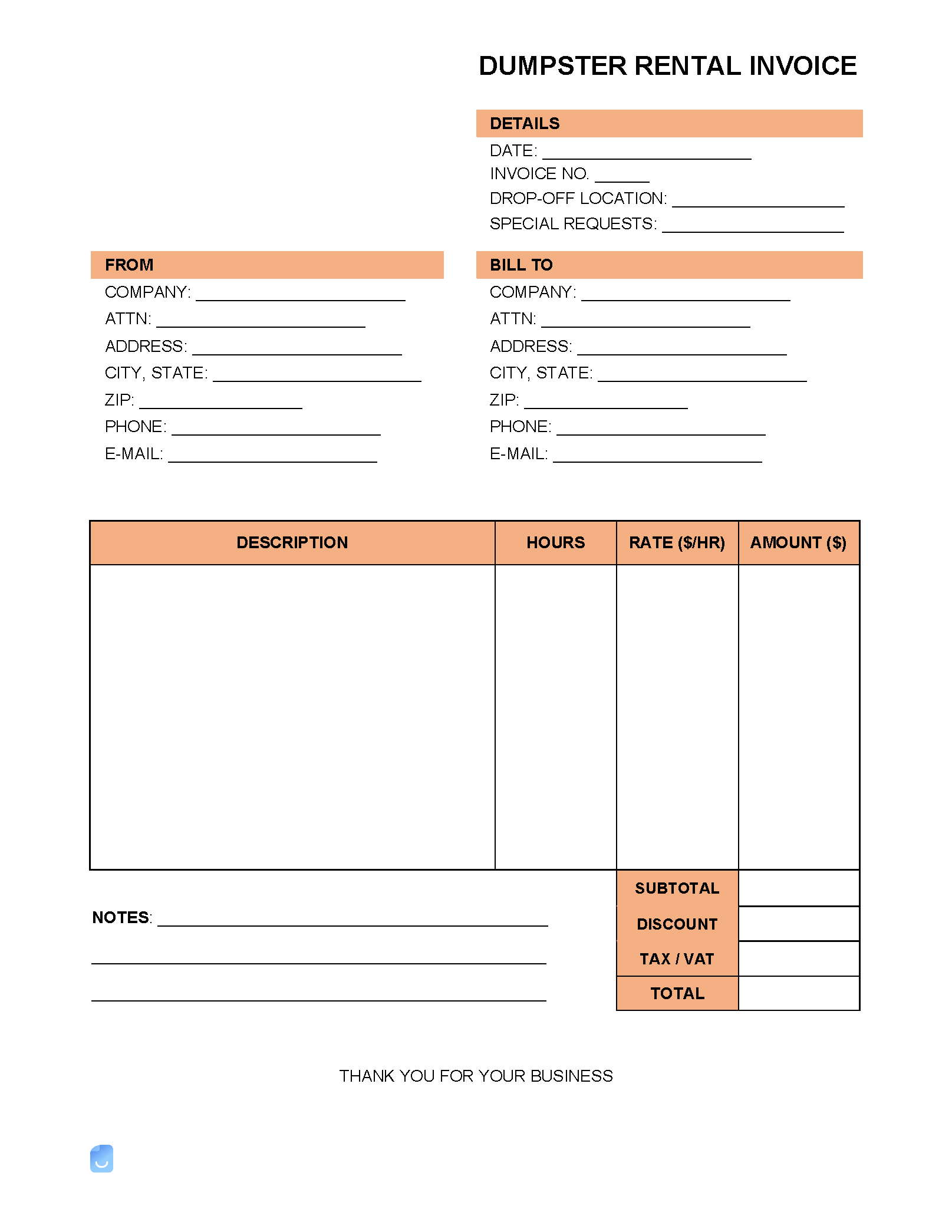

Rental Invoice Template

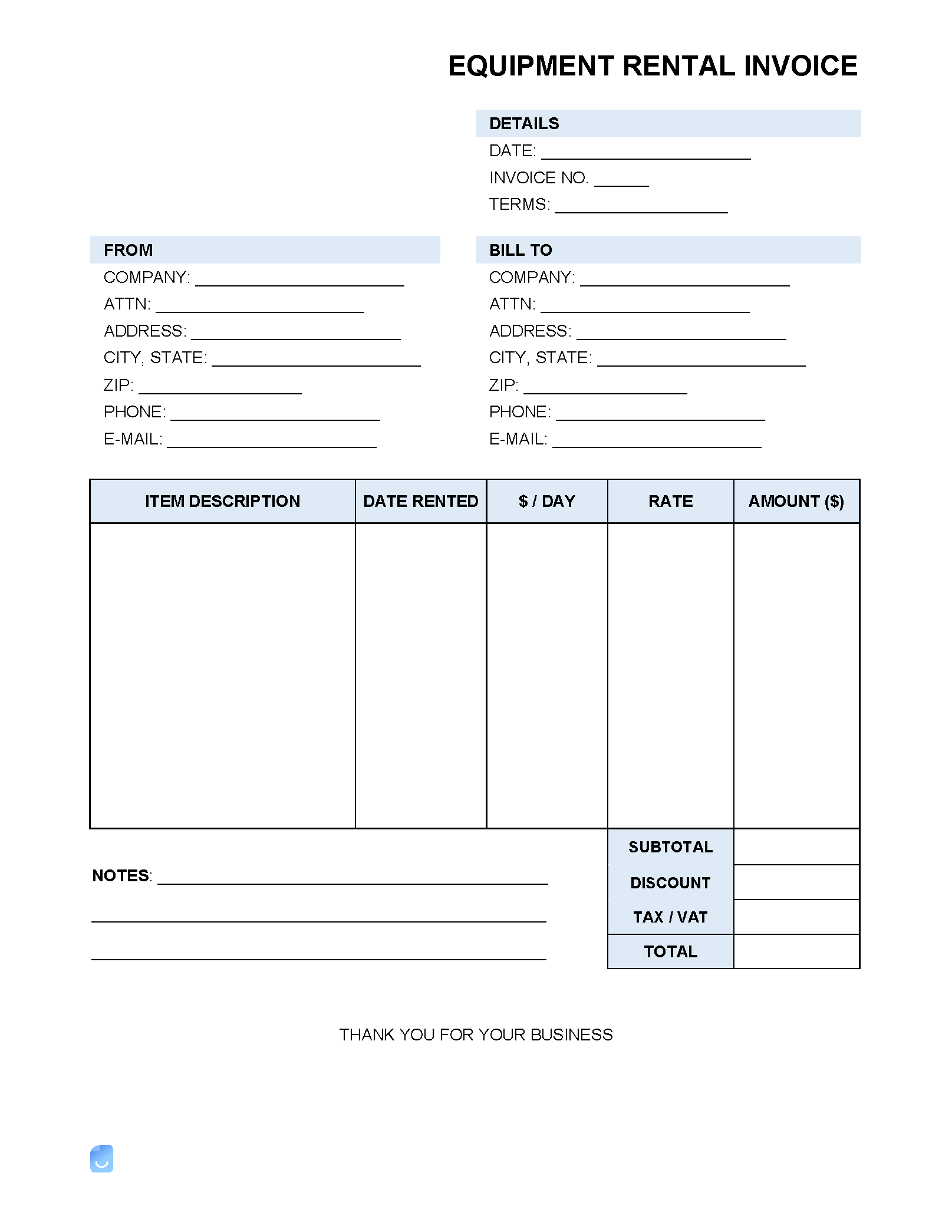

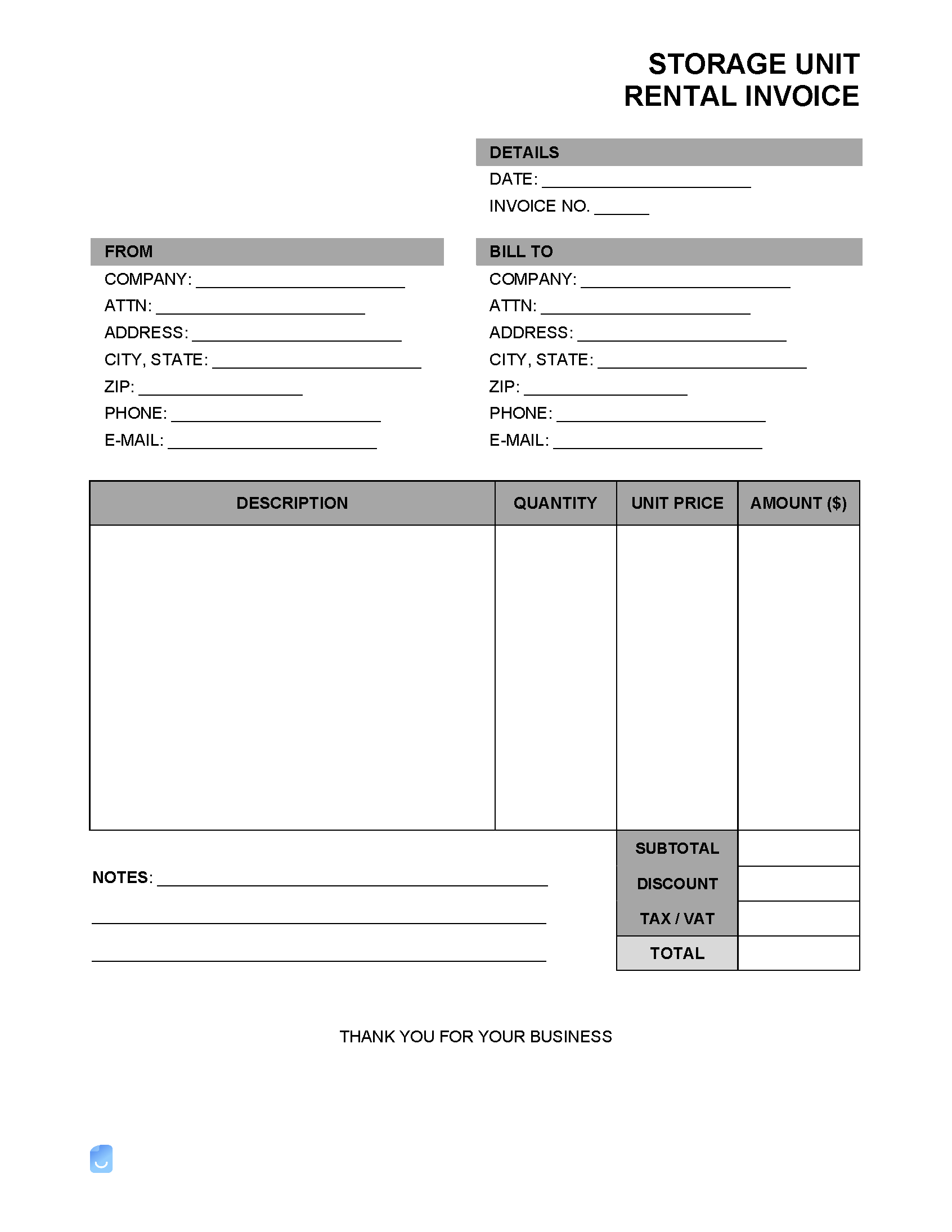

A rental invoice is a form used to bill a customer for the final amount owed after renting an item from a company or individual. The rental agreement should also be attached to the invoice after a transaction is final and closed.

By Type (5)

What is a Rental?

Any product or service, or the combination of both, bought by a customer for temporary use is known as a rental. Whether it be a car or a house, all rentals have to be agreed upon in writing within an agreement. Because the ownership of the rented item is not being transferred, there needs to be an agreement stating the owner of the rented item is renting the item to the lessee at an agreed-upon price. Depending on the item, service, or product – there may be regulatory laws involved that need to be followed. Laws are put in place mainly for safety, consumer protection, and fairness. When either party defaults on a rental agreement, there are fees or penalties involved that are expressed within the agreement. The price, length of time borrowed, number of lessees, and the signatures of all parties should be clearly stated in a rental agreement.

Is Rental Income Taxable?

Like any business in which money is profited, there are taxes to be paid. However, because there is depreciation involved when talking about real estate property and expenses incurred with most rented items, businesses can find a lot more deductibles and loopholes than a standard cookie-cutter business. All profits generated by rental income are taxable and must be properly reported to the IRS.

Property

When renting out a home or apartment, you can deduct the upkeep expenses needed to keep the rental in good shape. If a tenant were to rent a property for $10,000 per year and it cost $1,500 in expenses/repairs, the owner would need to report a profit of $8,500 on that property. Property owners need to report supplemental income and loss on Schedule E Form 1040 when filing.