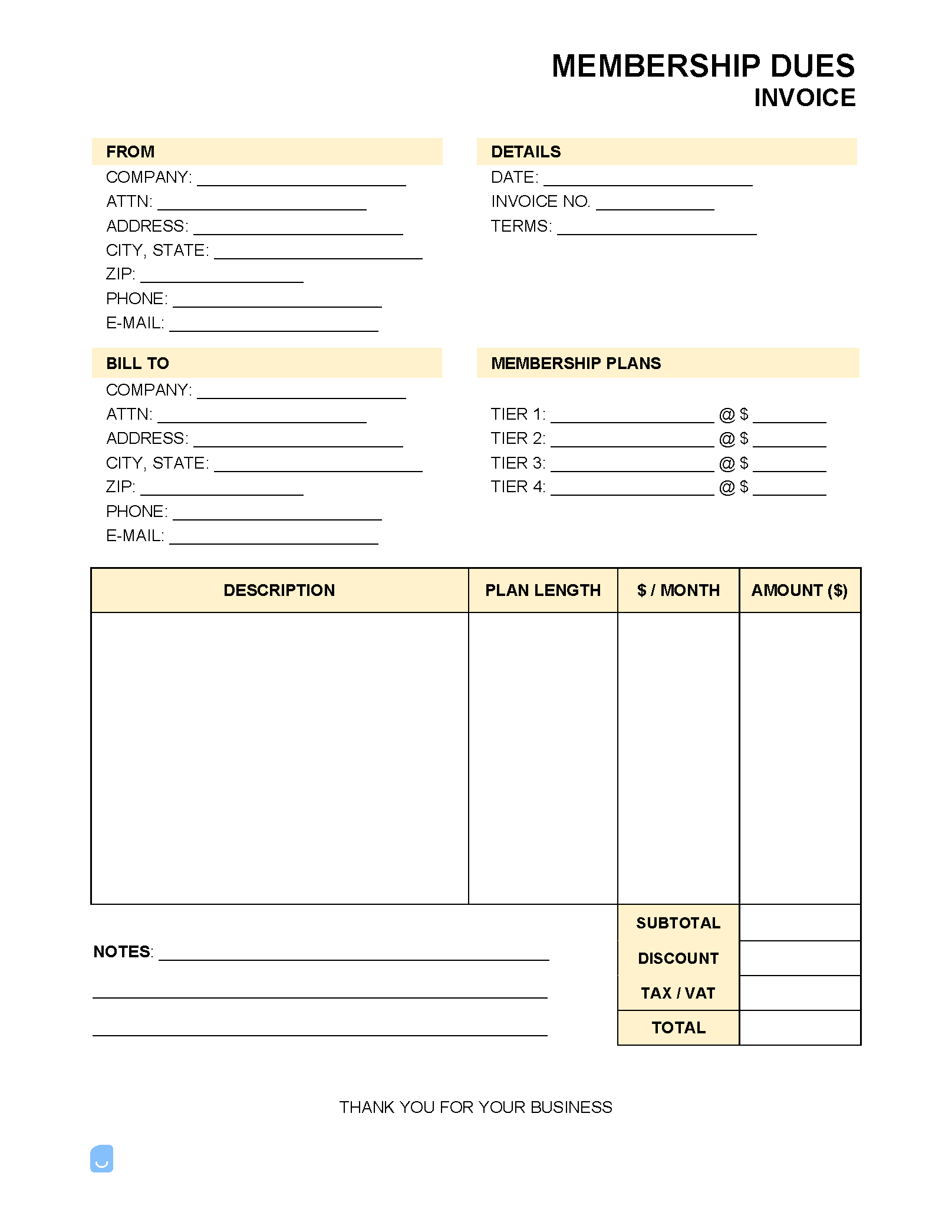

Membership Dues Invoice Template

A membership dues invoice is used for renewing a yearly or monthly membership for an organization, club, or professional group. Pricing is often dependent on membership level, the time spent with the organization, and billing intervals. In exchange for dues, membership organizations provide professionals with strong networking opportunities, a means of recognition, and discount perks, to name a few.

Are Membership Dues Tax-Deductible?

According to IRS Publication 535, it states the average business club membership dues cannot be deducted from an individual or business taxes. However, the publication provides a list of organization types that are exceptions to the rule. According to the publication, the exceptions are the following:

- Trade boards

- Trade associations

- Professional organizations (medical / bar associations)

- Chambers of commerce

- Civic / public service organizations

Whether membership dues are tax-deductible is mainly based on whether the activities within the club are considered “leisurely” or for entertainment purposes. To report membership dues as a sole proprietor or single-member LLC, form IRS 1040 Schedule C should be filed.

What to Include on a Membership Dues Invoice

Unlike a standard invoice, a membership dues invoice should contain an attachment that specifies the different membership types, the cost of each kind of membership, what benefits accompany each type, and an area to state both accepted the payment types and the mailing address checks should be made out to. In addition to being sent to individuals, membership dues are often sent to small businesses and corporations signing up multiple employees for memberships. Allowing fields for at least five (5) members is recommended. Further, making the invoice informative and straightforward is highly recommended to avoid confusing or upsetting the customer.