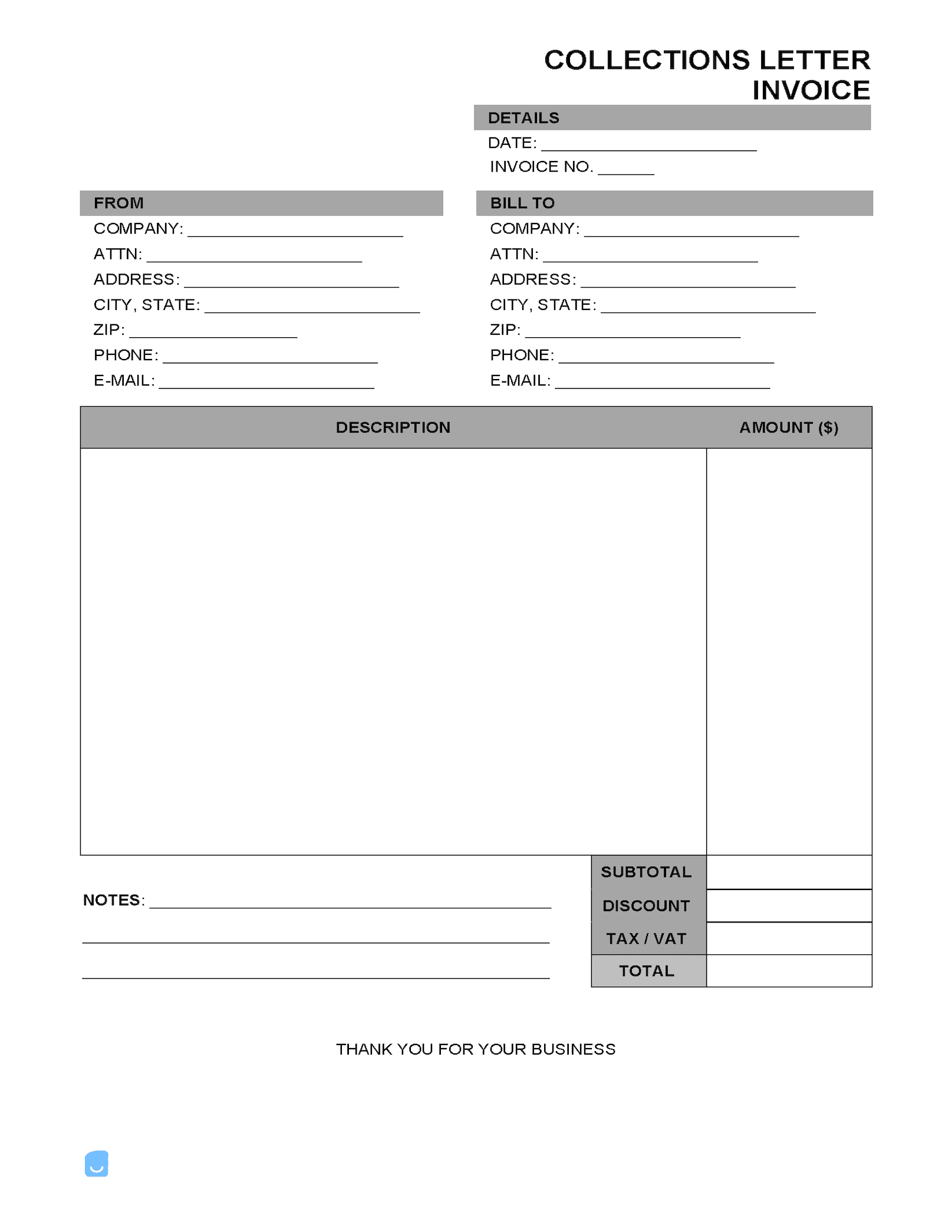

Collections / Demand Letter Invoice Template

A collections letter invoice is used by creditors and owners of delinquent accounts to notify consumers about paying and the ramifications if the account isn’t rectified. The invoice should detail the total amount owed, due date, minimum payment (if any), and the consequences if not paid.

What is a Collection Letter?

A collection letter, also referred to as a debt collection letter, acts as a last reminder to someone who owes money on a past-due account before notifying a credit agency or summoning the debtor in a small claims court. It is typical for a collections letter to detail the outstanding amount and the minimum amount due for the current period. A collections letter is used to warn (no threats!) the debtor that the grace period is about to end.

Sample Collection Letter

Dear ____________, On behalf of ____________ [Name of Creditor], we have sent multiple requests for payment in the amount of $___________ that remains unpaid and due by __/__/____ (Due Date). Please call __________ (Phone Number) to schedule payment or make payment payable to ________________ and send to this address: _____________________________. Please contact us so we can help you resolve this issue at your earliest connivance as this is an urgent matter. If payment is not made by the due date, your account will be closed and sent to a collection agency. If you feel that this letter is a mistake or in the event that you decide to dispute the claim, you must do so within 30 days from receiving this letter. Sincerely, [Name of Creditor] [Creditor Phone] [Creditor E-Mail]

When to Send a Collection Letter?

As soon as possible. Creditors with past due accounts can’t wait forever to be paid. Due to the Statute of Limitations (different for each State), a debt is only valid for a certain length of time. For example, in the state of California, a creditor has 4 years to collect a debt once an account becomes delinquent.