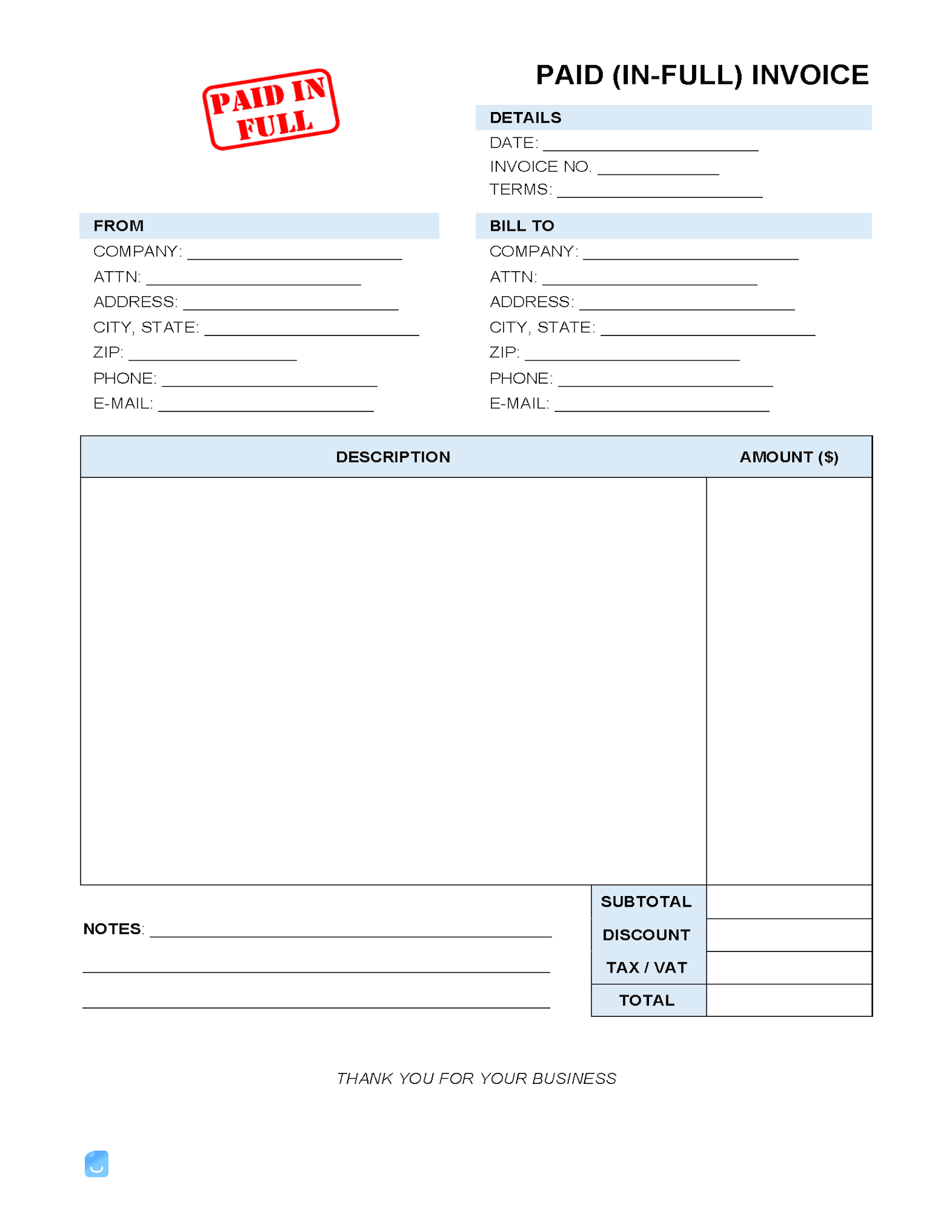

Paid (in-full) Invoice Template

A paid-in-full invoice is a form that records a full, upfront payment for a product or service rendered. Typically the invoice will clearly state the words “in full” in order to clearly communicate that the entire balance has been paid.

How to Create a Paid-in-Full Invoice for Your Business

A paid-in-full invoice is generally presented to a client after a balance has already been paid. In this way, it functions like a receipt. Both the seller and the buyer are advised to retain a copy of the paid-in-full invoice as proof of payment for record-keeping purposes.

Formatting a Paid-in-Full Invoice

A paid-in-full invoice should include the following components:

- The words “paid in full”

- Name and address of supplier

- Contact information for supplier

- Name and address of buyer

- Contact information for buyer

- Invoice number

- Unit price of goods or services purchased

- Qty (quantity) of goods or services purchased

- Total amount paid

- Any applicable taxes

- Any applicable shipping costs

The invoice can be generated using a word processing program, Google Docs, Microsoft Excel, or an online invoice generator like Invoice Maker.

Pros & Cons of Requiring Full Payment

Whether a business requires customers to pay invoices in full instead of paying in installments over a week, month, or another timeframe depends on the type of company and the goods/services being sold. In general, more expensive items or services are rarely associated with paid-in-full invoices. Requiring full payment for these would likely turn customers away. However, smaller businesses and freelancers offering more affordable products often demand full payment. Here are some pros and cons of requiring customers to pay in full:

Pros

- Simplifies a company’s accounting

- Limits a company’s accounts receivables

- Increases the likelihood of clients paying on time

Cons

- Can be unaffordable for clients

- No revenue from late fees and interest

From a client’s perspective, paying debts on time and in full is helpful because it can improve a credit score. This is because one of the key factors influencing a credit score is the “credit utilization ratio,” which is the amount of revolving credit a person is using divided by the total amount of revolving credit available to that person.

Tips on Upfront Payment

Requiring full payment is different than requiring upfront payment, but often businesses will demand both. Upfront payment, which is a transaction in which a client pays for something before receiving it or before the work is completed, is not a mutually preferred payment method in every situation. Businesses and vendors interested in asking clients to pay upfront might consider that this request could make some customers bristle. Here are some questions to consider before implementing this payment system.

Does the client have a clean payment history?

Clients that have proven their trust over years of business should not be required to pay their invoices upfront. Requiring them to do so can cause them to feel like “any other customer” and that their long-term business isn’t appreciated.

Is the company well-known and established?

Companies that have proven themselves over years of being in business are likely to be trusted with paying a bill after the product or service has been delivered.

Are the services or products inexpensive?

Cheaper items or projects should not be required to be paid upfront, as the risk to the provider/seller is minimal if the invoice is paid late. Note that this is different than requiring the client to pay the invoice in full.