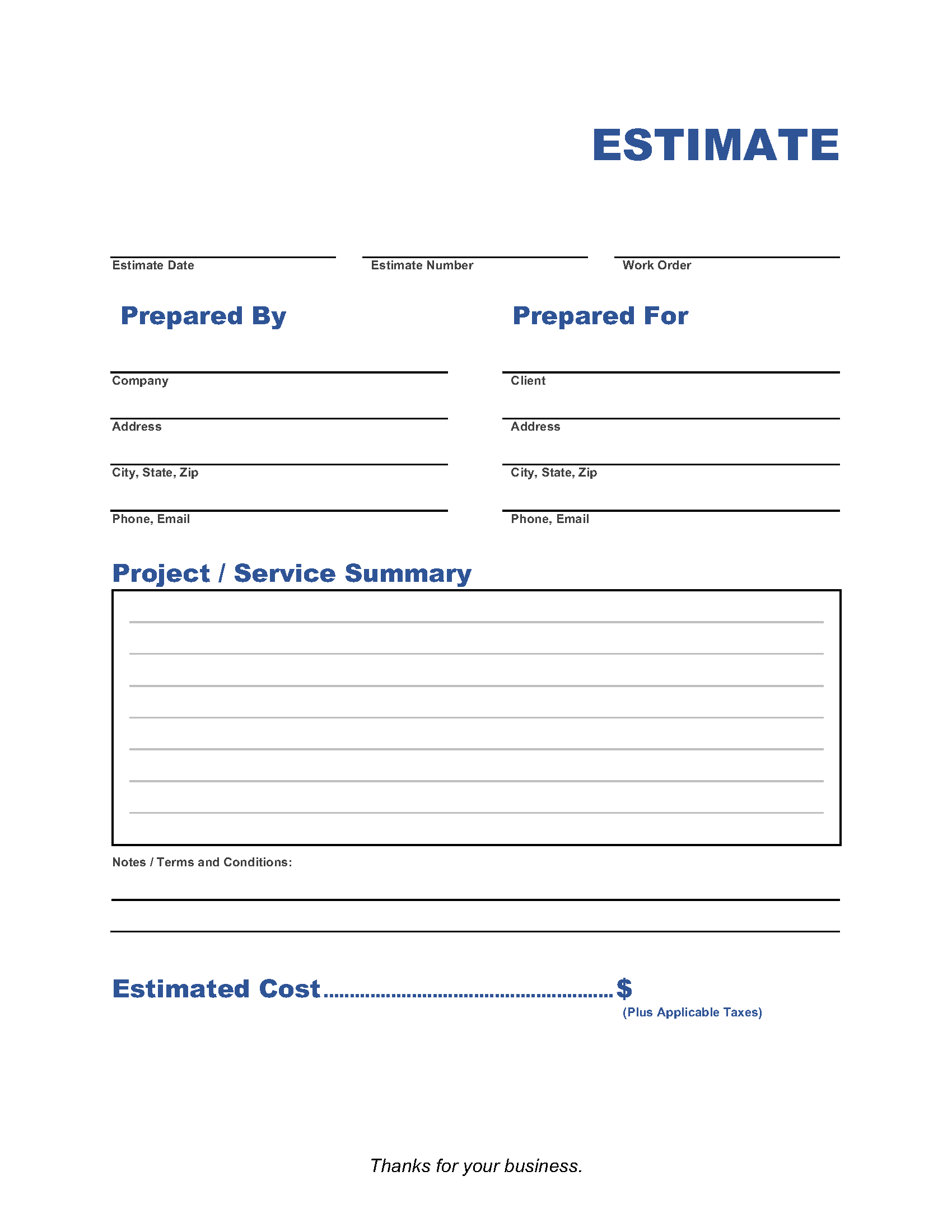

Independent Contractor Estimate Template

An independent contractor estimate is a document contractors use to communicate the estimated cost of a project to a potential client. The client can use the document to decide whether or not to go ahead with booking the job.

Employee vs. Independent Contractor

Generally, an independent contractor is someone who owns their own business and charges per job or service, rather than receiving a regular paycheck from an employer. Independent contractors supply their own equipment and cover their own benefits and overhead costs. They also pay their own taxes. The Internal Revenue Service defines an independent contractor as someone who is self-employed.

How to Price Your Work as an Independent Contractor

Probably the best way to price your work is to sit down and create a budget. Consider such expenses as:

- Accounting charges

- Software subscriptions

- Travel costs if work requires travel (i.e. auto insurance, car lease, gas, vehicle maintenance)

- Uniforms if required

- Tools and equipment (e.g. laptop, camera, ladder, pressure washer)

- Marketing (e.g. website hosting, Google Ads, print ads)

- Business Insurance

- Rent (if applicable to home office or office)

- Health insurance

- Retirement contributions

Next, consider how much you’d like to get paid annually. It’s important to remember that your rates will increase with time and as you gain experience. Think also about how many hours you want to work per week, per month, and per year. How many holidays do you want to build into your annual salary? This will help you to determine what hourly rate will allow you to work the number of hours you want to work and get paid the amount you want to get paid. Make sure to research the rates that other independent contractors in your field are charging.

Do Independent Contractors Need a License?

In some industries, independent contractors don’t need a business license to operate. Getting licensed as a small business carries benefits, such as more organized books for accounting purposes and protection of personal assets from lawsuits the business might incur. However, it’s not required to be licensed as a business in order to operate as a contractor. Some industries do require other types of licensing. For example, electrical and plumbing contractors need industry-specific licenses in order to operate. Anyone working in the food industry or cosmetic industry does, too.

What is a Self-Employment Tax?

Independent contractors are required by law to pay a self-employment tax. This amounts to 12.4% for social security and 2.9% for Medicare. This can be computed using Form 1040.

What Should an Independent Contractor Estimate Include?

An independent contractor estimate should include:

- Contractor’s contact information (phone number, email address, address)

- Client’s contact information

- Estimate number

- Job description

- Estimated cost of labor

- Estimated cost of materials

- Applicable taxes

- Date on which estimate expires

- Payment terms and conditions