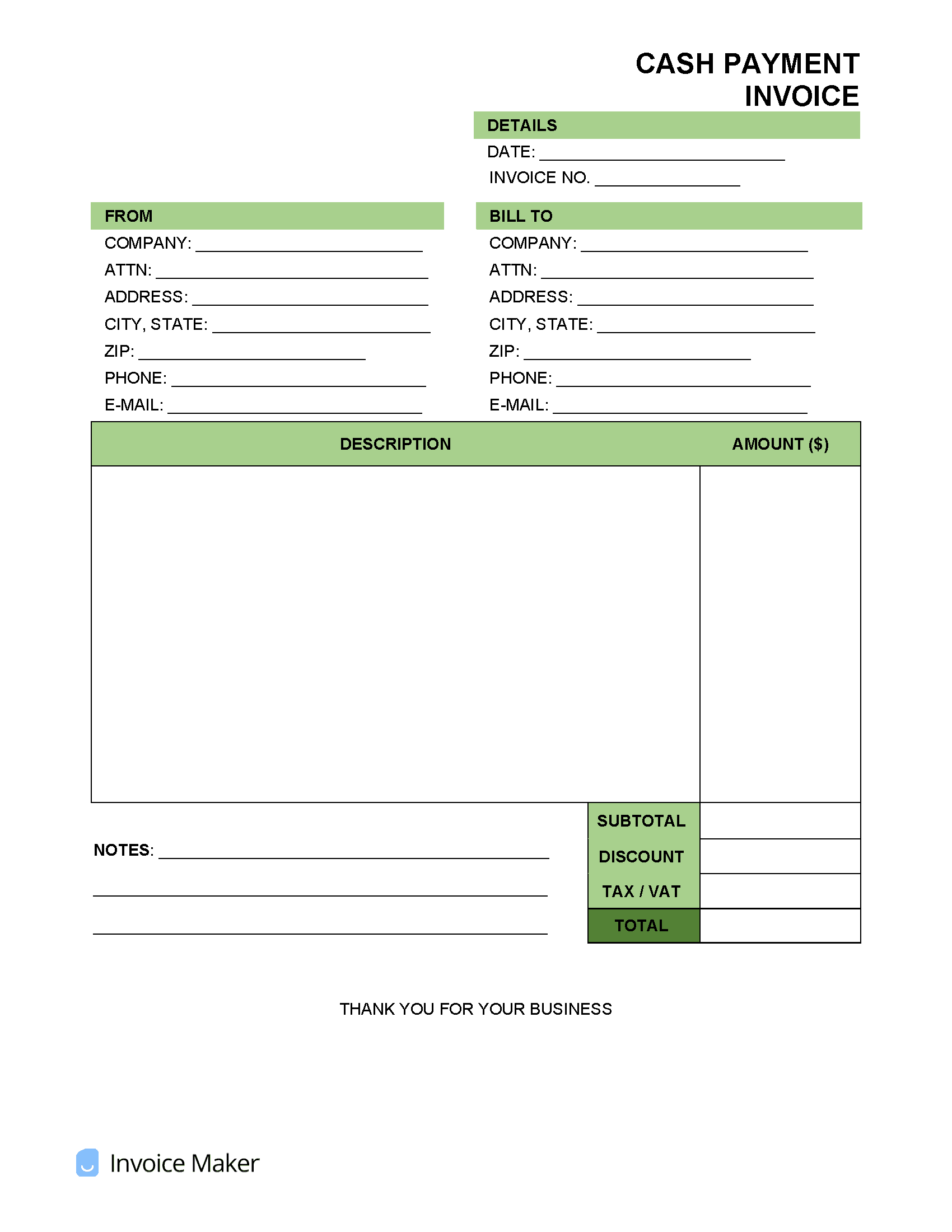

Cash Payment Invoice Template

A cash payment invoice is used to record a payment made with physical cash. The use of a cash payment invoice is necessary as cash cannot be tracked like other forms of payment. Cash payments are always made in the currency of the country where the transaction takes place. A cash payment invoice should include the total amount paid in cash, the country of the currency, and the products/services paid for in cash.

Cash Payment

From a buyer’s standpoint, cash payments should be limited as much as possible. The only way to prove that a cash payment was made is by having a receipt or invoice, which, if lost – can cause a problem for buyers showing proof of purchase. Also, buyers are losing out on points and advantages that they would otherwise receive by using a credit card instead of cash. Most businesses prefer cash because it eliminates the possibility of a chargeback or fraudulent charge. Cash payments should only be used in the following situations:

- For customers who do not have a bank account and access to a debit/credit card.

- Paying a tip (at a restaurant, hotel, etc.).

Petty Cash Transactions

Petty cash is referred to the amount of money (cash) set aside for employees of a company to pay for miscellaneous expenses on behalf of the company. The amount is small enough that the loss wouldn’t hurt the company if an employee were to steal. Sometimes instead of using petty cash, companies will issue business credit cards to employees to pay for company expenses. The benefit to using a credit card as a replacement for petty cash is that transactions can be better tracked. When spending petty cash, there must be a system in place to make recordings of all transactions. It’s also important to obtain a petty cash receipt after each purchase.