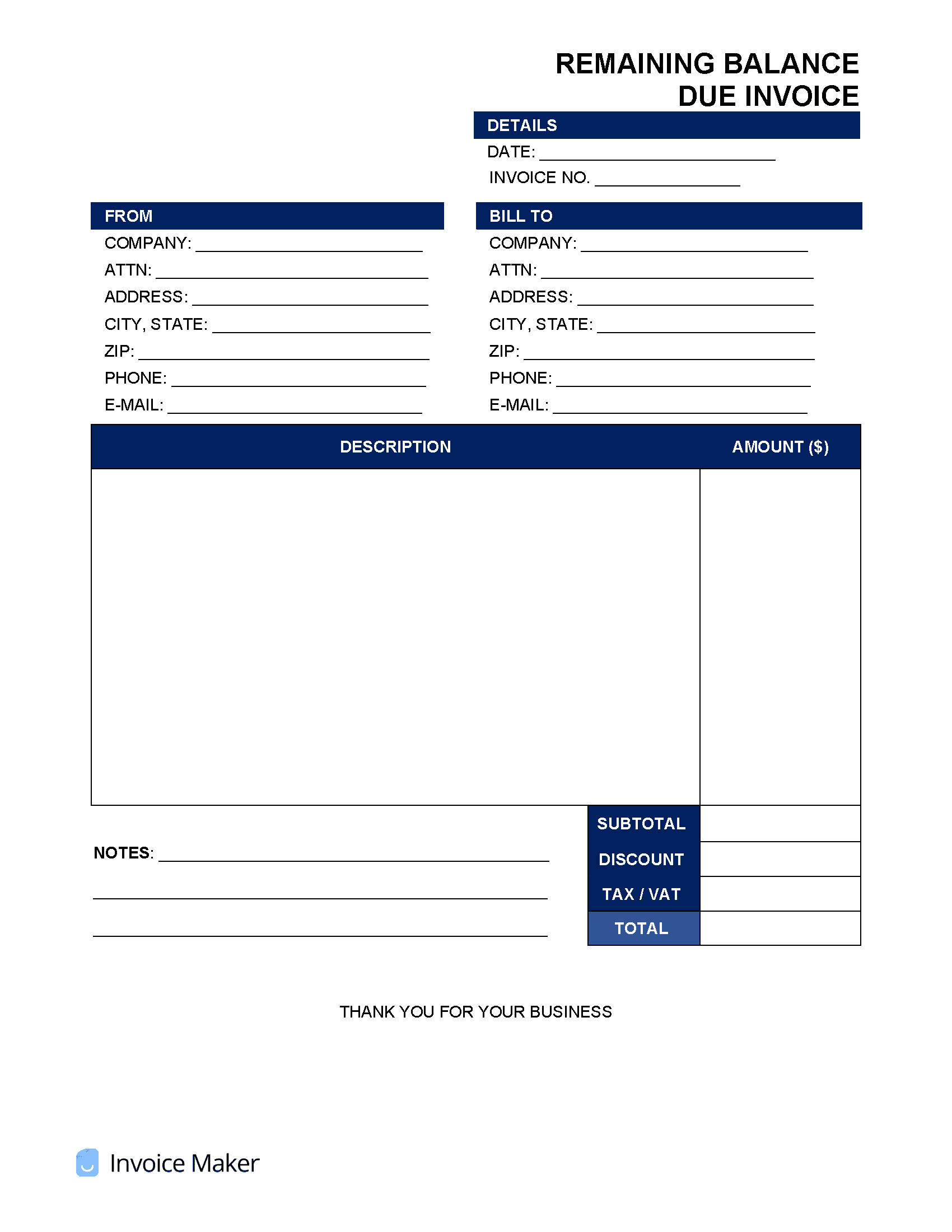

Remaining Balance Due Invoice Template

The remaining balance due invoice is to clear an outstanding balance between a debtor and creditor. It can also be used as a letter to notify a customer of a remaining balance.

What is a Remaining Balance?

A remaining balance is an amount of money (debt) that needs to be paid. Debtors should not panic nor be afraid when they see a remaining balance, as it does not suggest that a payment is late or in default. However, a remaining balance should be watched with a close eye. If not taken care of before the due date, the balance could fall into default which would most likely bring unwanted fees, penalties, and interest. A remaining balance due always occurs at the end of a billing cycle, typically every month. A remaining balance due for credit holders is a serious matter. If a credit holder is late on a balance due, all three credit bureaus will be notified, and the debtor’s credit score will be negatively affected. Being late on a credit card payment is the biggest factor that can negatively affect a person’s credit. Once an individual’s credit is negatively hit by being late on a remaining balance, it takes 7 years to go away. The remaining balances are mostly associated with the following:

- Credit card, bank, loan statements

- Customer Accounts

Helpful Tip: Debtors should beware of pending transactions on their statements. Debtors may think that a balance has been paid in full but do not realize a pending transaction within their account that has yet to hit their balance due statement. If forgotten about, the balance will fall into default if automatic payments are not turned on.

Remaining Balance Calculator

A remaining balance calculator is a great help to determine the amount left to be paid on a debt with a payback schedule (typically monthly). Using a remaining balance calculator, a debtor can calculate the number of loan payments that remain to be paid by entering the following:

- Original borrowed principal

- Interest rate (annual)

- Monthly payment amount

- Loan start date (month and year)

- Months gone by

Remaining Balance Calculators: Calculate.me, FinancialCalculators.com