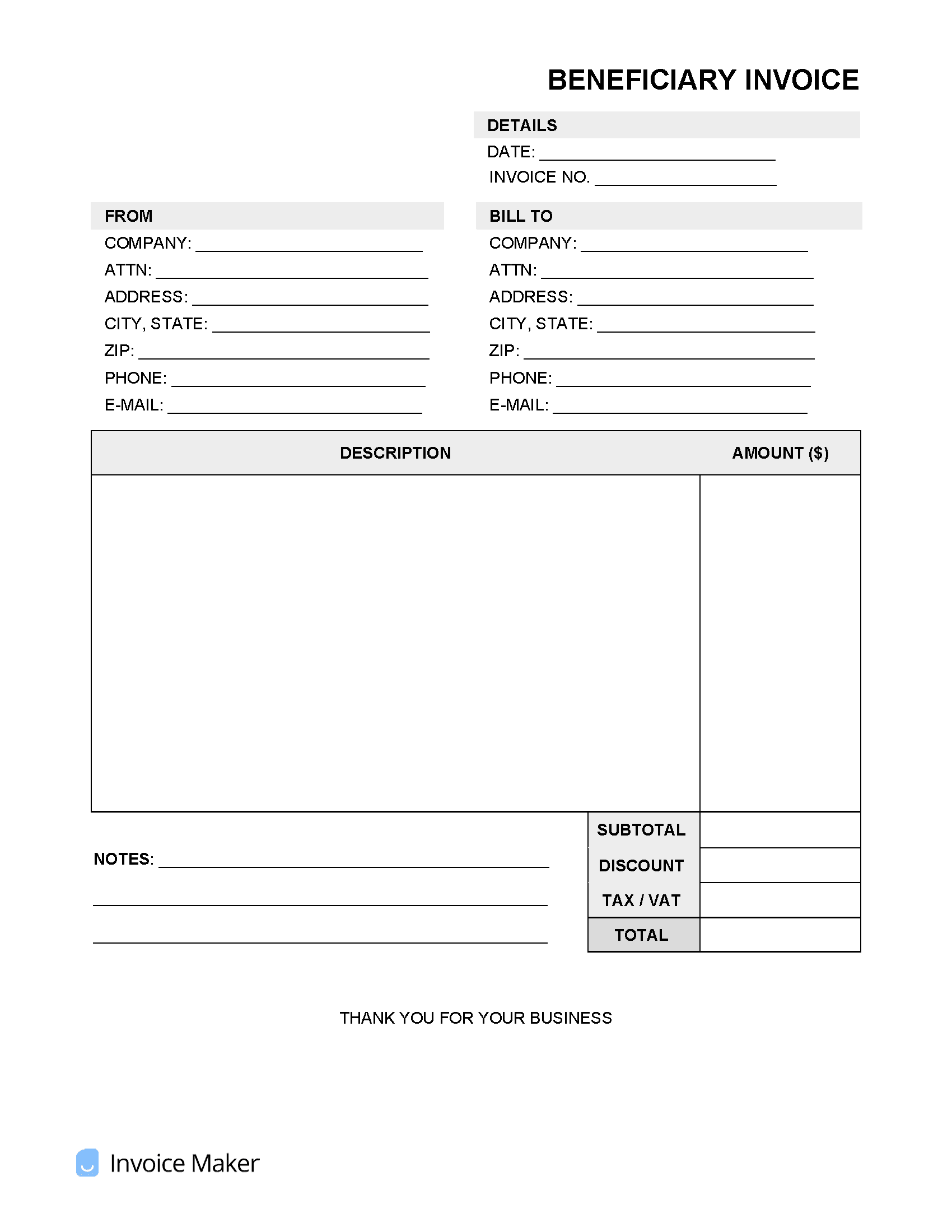

Beneficiary Invoice Template

A beneficiary invoice is used as documentation when transferring a person’s account to their intended (primary) beneficiaries.

What is a Beneficiary Invoice?

When an individual dies, there needs to be documentation that details where their cash, investments, and property will go. There are many methods in which a person can designate their assets to beneficiaries, the most popular method being a Will. To make transferring assets from a person’s financial account to beneficiaries, it may be necessary to notify the financial institution of the instructions. A beneficiary invoice can be used to facilitate the transfer of the following from a person’s account to a beneficiary:

- IRA

- Will

- Annuity

- Irrevocable Trust

- Mutual Fund

- Life Insurance

- Bank Account (funds)

Transfer on Death

Signing a Transfer on Death agreement is the most secure option for any person when it comes to securing their financial accounts after their death. The beneficiaries listed in a transfer on death agreement/deed will override a Will or any other type estate document. Furthermore, by having a transfer on death agreement, the account holders’ assets will not go to probate as they normally would. Financial institutions, such as TD Ameritrade, allow their clients to opt into a Transfer on Death Agreement. In such an agreement, a person can designate a multitude of beneficiaries while also allocating a percentage share to each beneficiary. If there is only one beneficiary, the percentage share to that person would be 100%, as the total percentage shares given out must sum to 100%. Due to the Uniform Transfer to Minors Act, if a beneficiary is a minor (under 18 years of age), the person must designate a custodian.