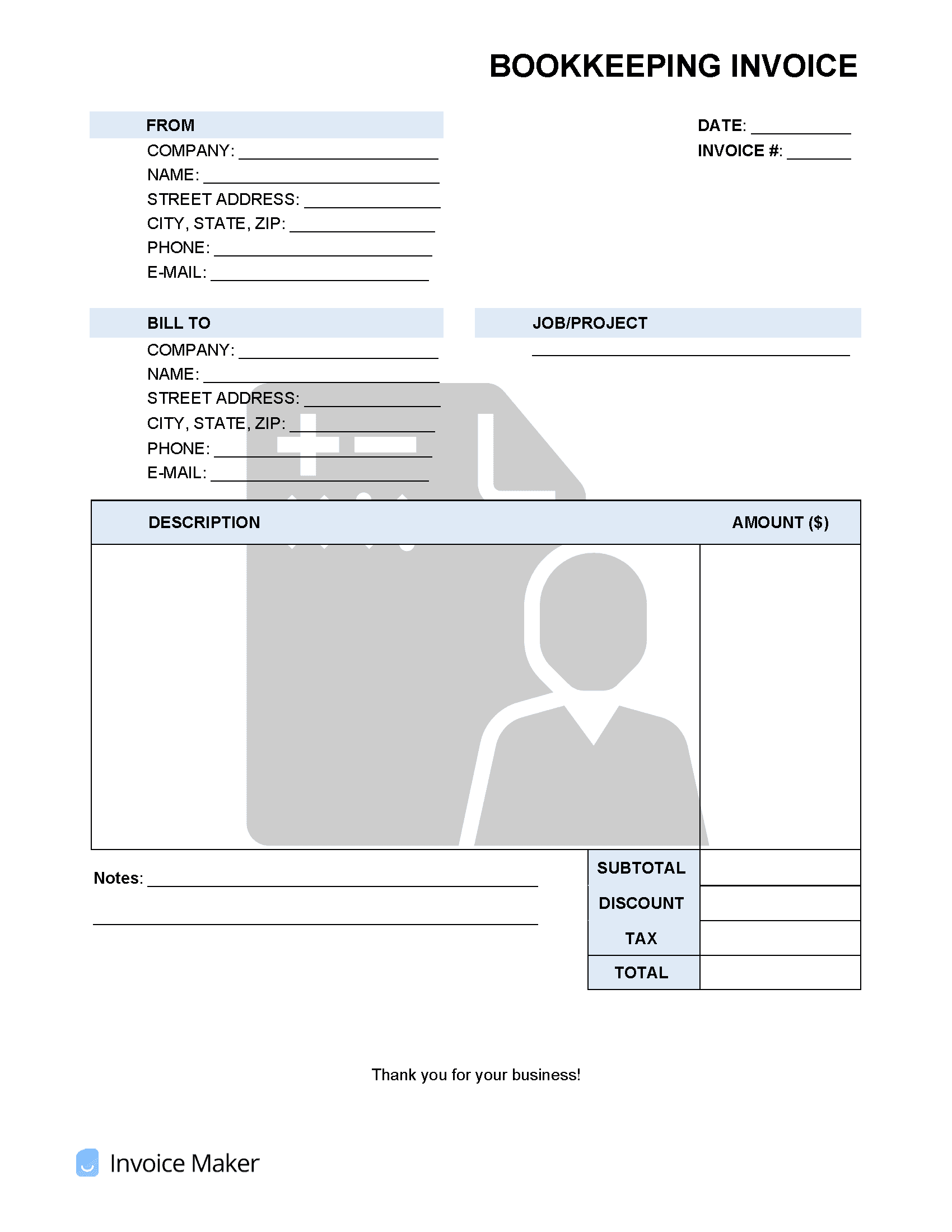

Bookkeeping Service Invoice Template

The bookkeeping service invoice allows a bookkeeper to be paid for organizing financial statements on behalf of a business or individual. The services are commonly charged on a per hour basis with the bookkeeper providing the invoice after a set of hours or a major project is completed. A bookkeeper does not have to be licensed in order to perform their duties, although, if they are certified or licensed as a certified public accountant they may be able to get paid more by clients.

What Does a Bookkeeper Do?

A bookkeeper is an unlicensed professional that provides accounting services as an employee or independent contractor. A bookkeeper’s primary duties consist of the following:

- Balance checkbooks;

- Provide financial statements (ex. profit and loss statements, expense reports, etc.);

- Oversee financials (e.g. general ledgers, bank statements, etc.);

- Enter physical bills and receipts into accounting software;

- Provide budget estimates;

- Mileage Reimbursement;

- Payroll responsibilities; and

- Any other related accounting task that is requested by the client.

All of the above duties are to be completed in accordance with standard accounting procedures.

Related Invoices

Accounting Invoice – For licensed accountants (CPA’s). Expense Reimbursement Invoice – To be given to an employer to refund an employee for paying company expenses out-of-pocket.

Bookkeeper vs. Accountant

The average person may determine that an accountant and a bookkeeper provide the same roles and duties. They both can record financial transactions into a ledger and prepare financial statements for tax purposes. Although, there are significant differences between the two (2) titles:

Bookkeeper

- No license required. Certifications are available but are nothing more than a standard test in proper accounting methods.

- No analysis required. The job of a bookkeeper is to enter and export financial statements.

- No Financial Planning Advice. A traditional bookkeeper has not undergone the education required to provide financial planning advice to an individual or business.

- May NOT Conduct a Formal Audit.

Accountant

- State license required.

- Analysis required. An accountant may be asked to produce advanced accounting reports based on accounting records.

- Financial Planning Advice. An accountant is able to provide advice based on tax laws and other metrics to make recommendations to a business or individual.

- May Conduct a Formal Audit.

Bookkeeper Certifications

There are two (2) national organizations that exist for an individual to become certified:

American Institution of Professional Bookkeepers (AIPB)

- Requirements: At least two (2) years experience.

- Cost: $574 (members is $479)

- Exam: Four (4) parts covering adjusting entries, error correction, payroll, depreciation, inventory, and fraud detection.

- Passing Score: 70% (open-book portion) and 75% (prometric).

- Renewal: Must complete sixty (60) hours over a three (3) year period (fees not mentioned).

National Association of Certified Public Bookkeepers (NACPB)

- Requirements: Take the Training Course or provide documentation of similar courses taken elsewhere.

- Cost: Varies by Course Selection

- Exam: 50 multiple choice questions, minimum 75% correct, 2-hour time limit (Schedule an Exam)

- Passing Score: 75%

Bookkeeper Salary & Hourly Rate ($/hr)

Salary: $41,818/yr (source: Glassdoor) Hourly Rate: $18.29/hr (source: Payscale)