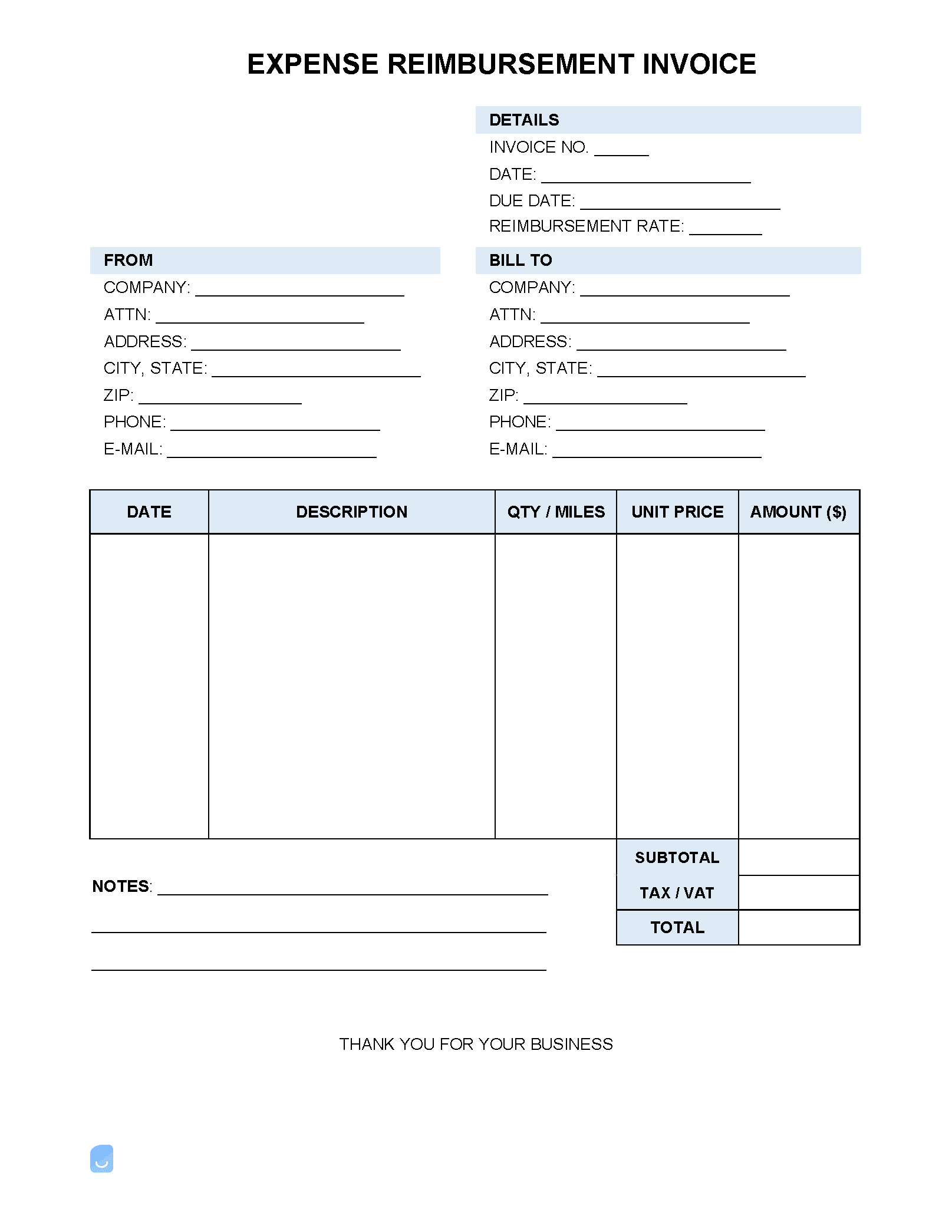

Expense Reimbursement Invoice Template

An expense reimbursement invoice provides both employees and companies a means of recuperating business-related expenses that were paid for out-of-pocket. Examples include an employee paying for software that is strictly for business use, or a business that requested a client to cover the cost of an item or service that wasn’t included in the agreed-upon price, such as the installation of an additional part. Mileage Reimbursement Invoice – For being repaid for vehicle-travel based on the IRS Mileage Rate.

What are Reimbursable Expenses?

Reimbursable expenses are purchases that were made by an employee (or business) that are strictly for the benefit of the business or the business’ clients. The reimbursement invoice provides a layout for breaking down the expense(s) paid for, the total cost of each, and any receipt numbers or other identifying fields used to prove the expense was paid for.

Are Expense Reimbursements Taxable?

In short, the taxes from expense reimbursements should not be paid for by the employee. In order for employee reimbursements to not be considered as income (and thus not taxable), the company should have a system (called an “accountable plan”) in place that outlines how reimbursements are to be distributed. Additionally, IRS 535 states that personal, family, and living expenses are not tax-deductible. However, employees should understand they are equally responsible for ensuring reimbursements are taxed. They have to strictly follow the accountable plan’s rules, invoice their employer as soon as possible after paying for an expense, and ensure all excessive reimbursement is returned to the employer.

Can an Employer Refuse to Reimburse Expenses?

With the exception of California, who have laws that require expense reimbursement, an employer can refuse to pay for an expense paid for by an employee that was for a business purpose. However, there are exceptions:

- If the employee has a salary that is close to minimum wage and they are required to pay for a business-related expense that brings their wage below the minimum rate, they are entitled to receive reimbursement.

- In the event that the employer guaranteed the employee will receive compensation for work expenses, they are legally upheld to abide by their said promises according to promissory estoppel.

- If the non-reimbursement of expenses is deemed as discrimination (other employees receive reimbursements or it is because of the employee’s race, age, gender, disability, or religion).