Freelance Accountant Rates

As a freelance accountant, you get to set your own rates. That’s one of the perks of freelancing—but it can also be one of the pitfalls. Knowing your worth while simultaneously reading the market is a skill, and you can grow it as you grow your business, but it’s important to have a sense of where to start when it comes to pricing your services. Read on to learn more about the going rate for various markets, factors that may affect your rate, and how to get the rate you deserve.

Make a Free Invoice NowProject-Based vs. Hourly Rates

How to charge is a question every freelancer should think carefully about. Your two main choices are charging by the hour and charging by the project, and each one represents a different philosophy of valuation. Hourly pricing pegs your value to your labor, which can be helpful when you’re young in your career. Project-based pricing, on the other hand, allows you to price according to the value your work brings to the table, regardless of how long it takes you to complete the scope of work.

Average Hourly Rates for Freelance Accountants

The national average hourly rate for freelance accountants is $29, according to recent data from ZipRecruiter. Included in that average is a high end of $52 per hour and a low end of $10 per hour. Accountants in certain markets (including New York City and Boston, as well as parts of Nebraska, California, and Washington) typically charge more than the average.

There are many specialties within the accounting field, some of which command a higher rate. Freelance clinical project managers, systems engineers, internal auditors, and project managers all charge, on average, more than $46 per hour, making them excellent specialty choices when you’re considering how to guide your career toward top earnings.

You’ll also be able to charge more if you carry a CPA credential—the national average hourly rate for CPAs is $40, with some freelance accountants charging well into the hundreds.

Average Project-Based Accountant Rates

If you choose to charge by the project, it will be harder to make apples-to-apples comparisons with your competitor’s rates, as no two projects are exactly the same. That said, there are some common projects that are useful benchmarks for assessing and setting your price point.

For example, the National Society of Accountants publishes average rates for jobs such as preparing a Schedule C tax return ($184). They also offer regional averages that will help you understand where your geographical market falls in terms of typical price points.

Charging by Experience

As you build experience and expertise, your rates should grow along with you. Starting with a junior rate is expected, and as you develop a specialty and a client roster, your rates should climb.

Beginner (1-3 years of experience)

When you’re first starting out, it’s a good idea to do some research into what other junior accountants with a similar education to yours are charging in your area. If you hold an MBA and practice out of New York City, you’ll be able to set your junior rate much higher than someone with a bachelor’s degree in a rural area.

Accountants on Upwork start at just $12 per hour, but that number represents the lowest end of the pay scale, and isn’t typically one you want to shoot for (unless you’re entering the field with zero experience or have some other rate-mitigating factors to consider).

Working from the average hourly rate of $29, you’ll want to set your rate in relation to that number—ask yourself, do you have more or less education than the average accountant? Is your geographical area above or below the national average in terms of pricing? Your answers will help you set your initial rate, and then you’ll work up from that for your first few years in business.

Intermediate (3-10 years of experience)

Once you have some solid experience under your belt, it’s time to make sure your rates reflect your value. Perhaps you’ll want to start charging per project at this point, which can be much more lucrative, as it removes the direct relationship of value and labor and allows you to charge according to how much value you offer your client. For example, if you’re known as a tax prep wizard who can get the highest (legal) deductions for your clients, you’ll be able to charge a premium for that talent and service.

Expert (10+ years of experience)

Once you’re a tried-and-true expert in the field, your rates should be on the high end of the scale. Depending on where you are and what you specialize in, that can mean landing on the high side of average at just north of $50 an hour, or specializing or marketing yourself in a way that commands premium pricing.

Other Considerations in Setting Your Rates

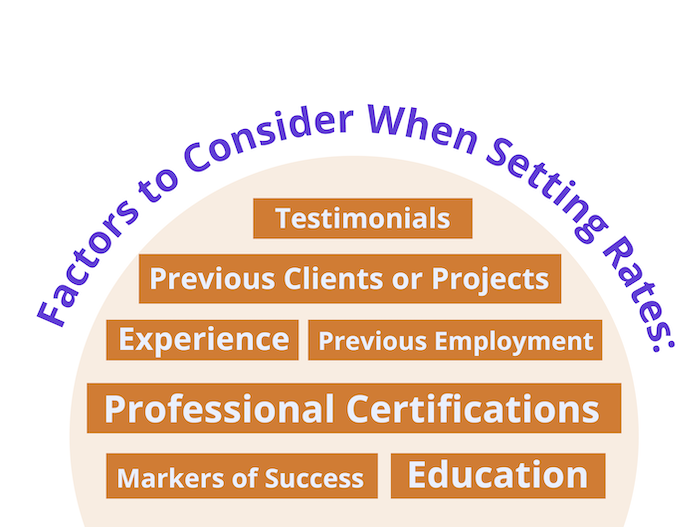

In every field, there is a price range. Your choices around how to charge, along with your experience, will be the most defining factors in your pricing, but other nuances should come into play as well. If you decide to price your services on the premium end, emphasizing some of the following factors in your marketing and client-facing materials can help a new client feel like you deserve the rate you’re asking for.

Education

Did you go to an Ivy League or otherwise prestigious school? Do you have an advanced degree, like an MBA or a master’s of science in accounting? What about specialty qualifications, like a Certified Public Accountant credential? Don’t be shy about it—this is the time to brag.

Previous Employment

Do you have an extensive work history that predates your freelance work? To the degree that you are permitted by non-disclosure agreements, provide those bona fides, particularly if you have experience working for the government (everyone wants an accountant who knows how the sausage is made).

Previous Clients or Projects

Have you worked for high-profile, challenging, or otherwise impressive clients? Again, respecting any legal or ethical obligations to their privacy, capitalize on that experience and make it clear why you command the rate you are charging.

You can also stress KPIs or other markers of success that you achieved with previous or existing clients, and you might consider soliciting testimonials from your happy clients as well.

How to Negotiate the Right Price

You can decide on and set your rate anywhere you want it, from exorbitant to bargain-basement, but the real test of the viability of your pricing is whether you can get clients to go for it. Part of that equation is setting your rate well, but the other part is a soft skill: negotiating.

Negotiation skills are critical for successful freelancers because there’s no one to pass the buck to. Uncomfortable client conversation? That’s your department. Unpaid invoice? That’s you, too. Strong negotiating chops will be necessary for setting initial contract terms and defining scopes of work, as well as for securing rate increases.

How to Approach Rate Increases

There are several scenarios in which you deserve a rate increase. An annual cost of living increase of five or ten percent isn’t so much a raise as it is the prevention of a pay cut, as the cost of your overhead and living expenses increase over time with inflation.

Beyond that cost of living increase, however, you’ll also need and deserve rate increases as you grow your expertise and efficiency. If you maintain long-term client relationships (which is very possible in the accounting field, as no one outgrows their need to pay taxes), that means negotiating for a raise within existing contracts.

To successfully negotiate for more money, here are a few pointers.

- Give notice. Let your clients know from your initial contract that you regularly bump your rates up x% a year. Then, raising your rates isn’t a surprise. When you’re approaching a more substantial global rate increase, don’t drop it on them as you’re invoicing—give them plenty of advance notice.

- Demonstrate your increased value. Have you gotten way better at your job? Along with your rate increase, provide your clients with a rundown of the additional value you’re bringing to the table, whether it’s mastery of a new software, a newly minted CPA license, or growing efficiency that allows you to turn their projects around more quickly.

- Tell, don’t ask. Obviously, you want to be delicate in your delivery, but “I’d like to let you know that my rates for audit services are going up by ten percent as of January first” lands much more assertively than “Would you be okay with paying me more?”

Your Career, Your Rates

Accounting can be a steady source of well-paid work, with the potential for career-length clients and the ability to work remotely from anywhere with an internet connection. As you build your reputation and roster as a freelancer, remember that regularly checking in with yourself about your rate is part of being a good businessperson.