How to Become a Freelance Accountant

Everyone needs an accountant. That’s why working as a freelance accountant can be a flexible, lucrative, and self-directed career for those with the skills and the motivation.

Make a Free Invoice NowPeople become freelance accountants in one of two ways. The first way is to begin your accounting career as an employee, working for a service that contracts you out or as part of an in-house team that handles accounting for a large company, and then shifting to freelance work once you’ve gotten the experience and reputation that you want to build. The second way is to start from the ground up as a freelancer, building your professional expertise and your business at the same time.

What is a Freelance Accountant?

A freelance accountant is just like a regular accountant — they handle financial records, compiling, analyzing, verifying, and prepping them on behalf of their clients for everything from in-house strategizing to the IRS. The difference between a staff or in-house accountant and a freelance one is that a freelance accountant is self-employed, choosing what kind and what volume of work to take on, defining their own workflow, and generally shaping their business practices around their own values and desires.

If you’ve been working as an in-house accountant, one big difference in the freelance life is that instead of one client for whom you do many tasks at scale, you’ll probably have a roster of smaller clients.

The upsides of freelancing is that your financial success is not tied to the success of any one entity, and you get some breathing room from the same tasks and personalities. On the other hand, the downsides are that you are far more affected by ebbs and flows in work, and you won’t have easy access to the kind of professional mentorship and community that comes with working for a big firm.

Industry Outlook: Traditional vs. Freelance Accounting

Accounting as a profession is projected by the Bureau of Labor Statistics to grow 6% by 2031 (which is an average rate of growth as compared to other occupations). Currently, only 4% of accountants are self-employed, which means there is plenty of room in the field for both newcomers and folks who are coming over from staff positions.

Social factors including the rise of remote work during the pandemic and the freelance/gig economy’s appeal to younger workers mean that more and more people are considering the freelance life. That means that the idea of hiring a freelance accountant will eventually become normalized even to potential clients who wouldn’t have considered it in past eras.

Freelance Accounting Roles and Responsibilities

As an accountant, your broadly defined role is working with financial data. But there are a lot of specifics that fall under that umbrella, and as a freelancer, you won’t be receiving marching orders from a boss or manager. You’ll have to self-start, often telling your clients what services they need from you rather than the other way around. Depending on the industry you serve and any particular niche of your practice, your daily responsibilities might include any of the following:

- Reviewing financial documents for accuracy and compliance

- Preparing, maintaining, and double-checking financial reports

- Preparing your clients’ tax returns and making sure they are paid correctly and on time

- Creating projections like income forecasts and risk analyses

- Strategizing solutions for financial issues

- Creating recommendations for improved efficiency

- Guiding your clients on how to sharpen the financial success of their operation, using approaches like increasing sales/income, reducing overhead/costs, and maximizing profit on goods or services sold

- Examining your clients’ business practices to provide recommendations on best practices and to identify existing or potential problem areas

To do these jobs, you’ll use a combination of accounting software, data analysis skills, math, and the kind of tactical know-how that comes from experience. (If you’re still working on that last part, that’s okay — that’s a skill set that takes a while to build.)

Qualifications to Become a Freelance Accountant

To be a freelance accountant, you need specific skills, education, certifications, and training.

Skills

The best accountants have excellent math and logic skills and exceptional attention to detail, as well as strong communication skills and the ability to shift gears from granular focus to big-picture systems thinking.

Education

Most accountants have a bachelor’s degree in accounting or business — at a minimum. However, there are some folks who enter the field as bookkeepers without a degree and work their way into an accounting role.

Certifications/Licenses

Some accountants further their education by earning a Certified Public Accountant license. To become a CPA, you must hold a bachelor’s degree in finance, accounting, or business, accomplish the required training, and pass the rigorous Uniform CPA Exam.

Training

To sit for the Uniform CPA Exam, an accountant must accumulate two years of professional experience as a public accountant. Continuing education is an important part of accounting as well, so no matter what your education level is, keeping your skills sharp through workshops, seminars, and conferences is especially important for freelancers.

Tools and Programs for Freelance Accountants

As the head of the office, you’re in charge of deciding which software and other accounting tools to use. The market is full of options, so you want to shop for one or several that serves your specific needs and goals.

Excel

Known as the OG spreadsheet software, Excel manages everything from simple expense reporting to complex financial projections.

QuickBooks

With functionality for invoicing, billing, inventory management, and payroll, QuickBooks is an excellent bridge between you and your client, who can simply send you their data within the software, saving you tons of hassle and improving clarity and communication.

AuditFile

A professional CPA software, AuditFile is a cloud-based audit tool that integrates with accounting systems to run internal audits and prepare for external audits.

BizPayO

Make payments manually or set up automated transactions on behalf of a client, all in the time it takes to click a button.

Canopy

For workflow and relationship management, Canopy’s Practice Management Suite offers efficiency, automation, and a central location for timelines on all the jobs you’re running for your entire roster of clients.

DocuSign

Never chase or wait for a signature again with instant, verified e-signing from DocuSign.

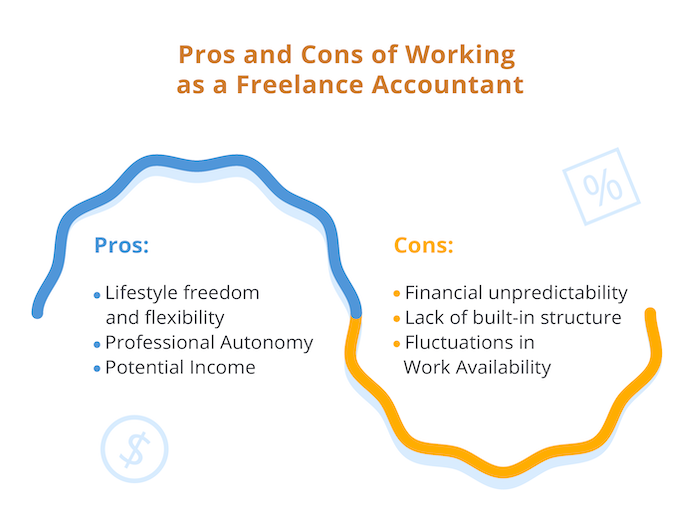

Pros and Cons of Freelancing as an Accountant

There are some great perks to freelancing — and also some real drawbacks. Being clear about which ones make a big difference to you will allow you to make a smart choice that fits your professional and lifestyle goals.

Pros

- Lifestyle freedom and flexibility

Work when you want, where you want, in the clothes you want to wear.

- Professional autonomy

Choose the work that you prefer, define your own workflow, and enjoy full autonomy when it comes to selecting your partners and employees.

- Potential income

As we’ll detail below, most freelance and salaried accountants make comparable incomes, but the income ceiling is significantly higher for top earners.

Cons

- Financial precarity

With freelancing, income can come and go. Weathering the fluctuations and downturns mentally and financially can be tough.

- Lack of leadership and collegial community

If you love coworkers and flourish under the mentorship of a boss, the solopreneur life might leave you feeling a bit out in the wind.

- Shifting work scope

As a freelancer, sometimes you have to take whatever work is available. If you prefer to hone your skills on a particular niche over time, the constant shifting of gears may be less than ideal for you.

Freelance & Salary Rates

The median salary for all accountants and auditors was about $77k in 2021, with a range stretching from almost $48k all the way up to nearly $129k.

Accounting is a field with high seasons (specifically, at the end of every quarter and during tax season), but as a salaried worker, your paycheck will be the same throughout the year (not allowing for any bonuses you might earn). As a freelancer, on the other hand, there’s a bit of a feast or famine dynamic. It’s fairly common to have periods of time where you have to turn down work for lack of time to complete it, followed by slower seasons where work is a bit scarce.

Freelance

ZipRecruiter (which looks specifically at accountants and doesn’t include auditors in their statistics) places the average freelance accountant salary at about $60k per year, with a range starting at $21k and going up to $109k.

Salary

Salaried accountants average out at $57k on ZipRecruiter, starting at $25k and going up to $85.5k.

The takeaway from those numbers is that there isn’t a huge difference in annual salary for most freelance and salaried accountants. There is, however, greater potential on the high end for freelancers, which is great news if corporate accounting isn’t a great fit for you, or if you have the desire to work for yourself.

Free Agents

As a freelance accountant, you have a transferable skill set that you can use in many geographic markets. It’s a great career choice for someone who has to (or wants to) move frequently, like military and academic spouses, and it can offer you a large measure of financial consistency within the freedom of the freelancing life.