Self-Employed Hours Invoice Template

A self-employed hours invoice is a billing document used by professionals, such as freelancers, who charge their clients on an hourly basis for their services. The invoice notifies the client about how many hours were spent completing a project or job and what payments are due.

How to Create a Self-Employed Hours Invoice

Self-employed individuals need to keep track of hours worked and generate invoices for clients detailing the hours worked and the rate charged. They are responsible for paying their own taxes and social security contributions, as well as for their own health insurance and other benefits. It’s important for people who are self-employed to keep a careful record of work completed and income earned. The self-employed hours invoice is a document that is used by individuals who are self-employed to bill for the hours that they have worked. This document can be used for a variety of different purposes, such as billing a client for hours worked, or for tracking the hours worked by an individual for their own records.

Tracking Self-Employed Hours

There is nothing new about professionals charging for their services by the hour. Attorneys and lawyers have been doing it for years and continue to use this method. Until recently, tracking the number of hours worked by self-employed persons hired for a job was no easy task. However, there are now plenty of digital tools that can help clients and freelancers track hours worked.

Helpful tip for clients: Tracking hours of a self-employed person can only be done for those who work on their computer. For other self-employed professionals, such as carpenters and painters that work in the physical world, it’s typically only possible to track hours if they are working on-site or at a location that can be observed.

Software for Tracking Work Hours

Freelance websites such as Upwork offer freelancers the ability to toggle work logging on and off time while completing tasks for clients. When logging is turned on, the software takes six (6) screen captures per hour, allowing clients to see the freelancer in action working. Clockify, an app, allows self-employed professionals to earn trust with clients by showing them a detailed breakdown of their work and the time spent on individual tasks.

Self-Employed Hourly Rate and Taxes

A self-employed person’s hourly rate is calculated based on their area of expertise, experience, and the market’s demand. For freelancers, the amount and quality of reviews received will allow them to charge more for their services as time goes on. Self-employed professionals can charge as much as the people in the market are willing to pay. After receiving payment from a client, the self-employed professional is responsible for paying their own taxes. The self-employment tax rate is 15.3%, which is a result of Social Security and Medicare taxes. Wages up to $128,400 are subject to this tax rate. Depending on the state where the self-employed individual works, additional taxes may apply. Self-employed professionals must pay self-employment tax and file Schedule SE (Form 1040) with the IRS.

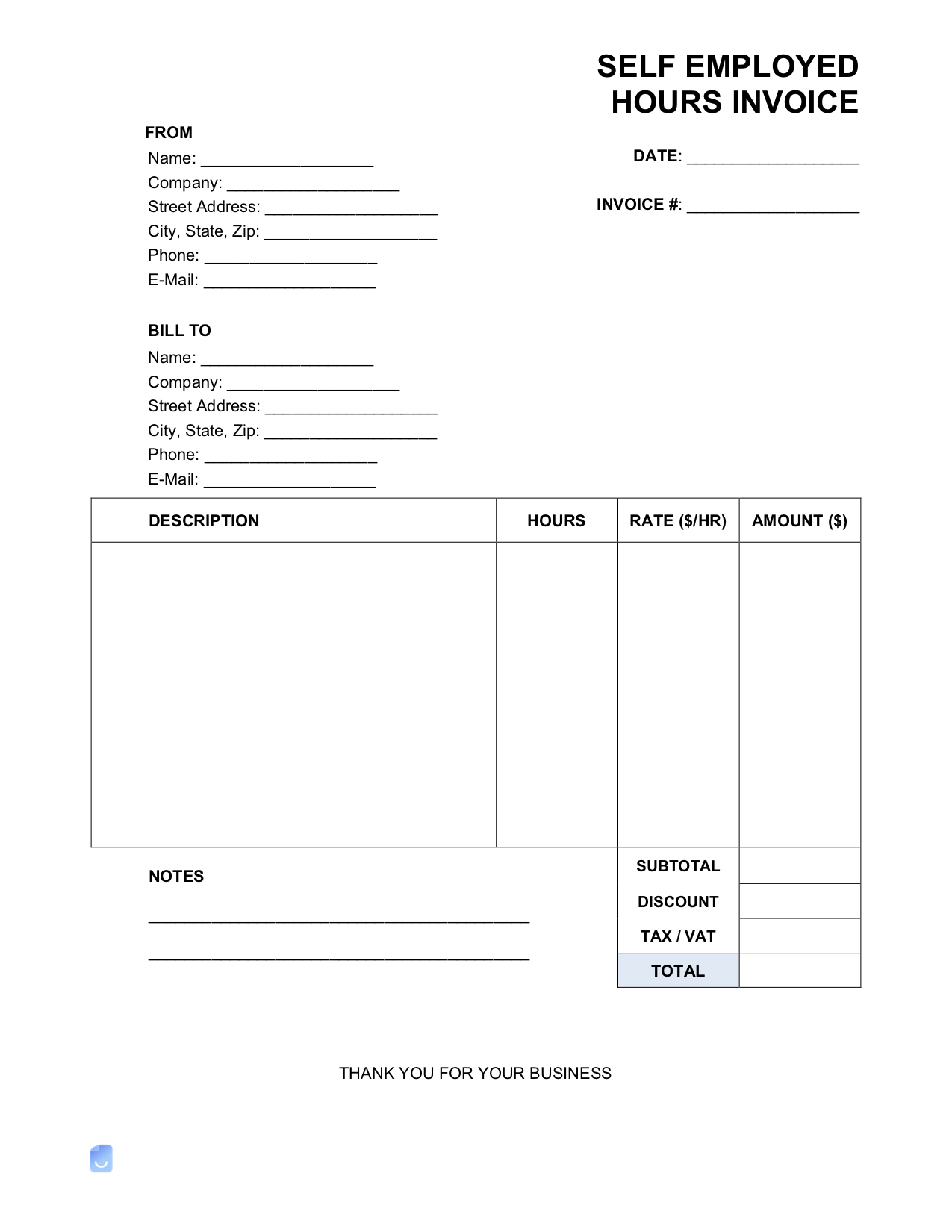

Information to Include on a Self-Employed Hours Invoice

The self-employed hours invoice should include the following information:

- The name, address, and telephone number of the person or business who performed the work

- The name and address of the person or business who commissioned the work

- The date the work was performed or project was completed

- A description of the work performed

- The number of billable hours spent performing the work

- The total balance due

- Applicable taxes and discounts

- Payment methods accepted (e.g. PayPal, credit card, check, etc.)

- Payment terms (including whether a late payment will accrue a penalty fee or interest)

Benefits of Using a Self-Employed Hours Invoice

There are many benefits of using the self-employed hours invoice template. Perhaps the most obvious benefit is that the document allows you to keep track of the hours you work. This can be extremely helpful in ensuring that you are paid for all the hours you work and that you do not end up working more hours than you are contracted for.

Tips for Using a Self-Employed Hours Invoice

There are a number of business expenses that are tax-deductible, including: 1. Advertising and marketing expenses: These can include the cost of designing and producing marketing materials, as well as the cost of placing ads in newspapers, magazines, online, or on television or radio. 2. Business travel expenses: If you travel for business purposes, you can deduct the cost of your airfare, hotel, rental car, and other travel-related expenses. The process for filing taxes as a self-employed individual can be a bit more complicated than if you were employed by someone else. Here are the basics of what you need to do: 1. Keep good records throughout the year. This means tracking your income and expenses related to your business. 2. When it comes time to file your taxes, you will need to file a Schedule C to report your business income and expenses.