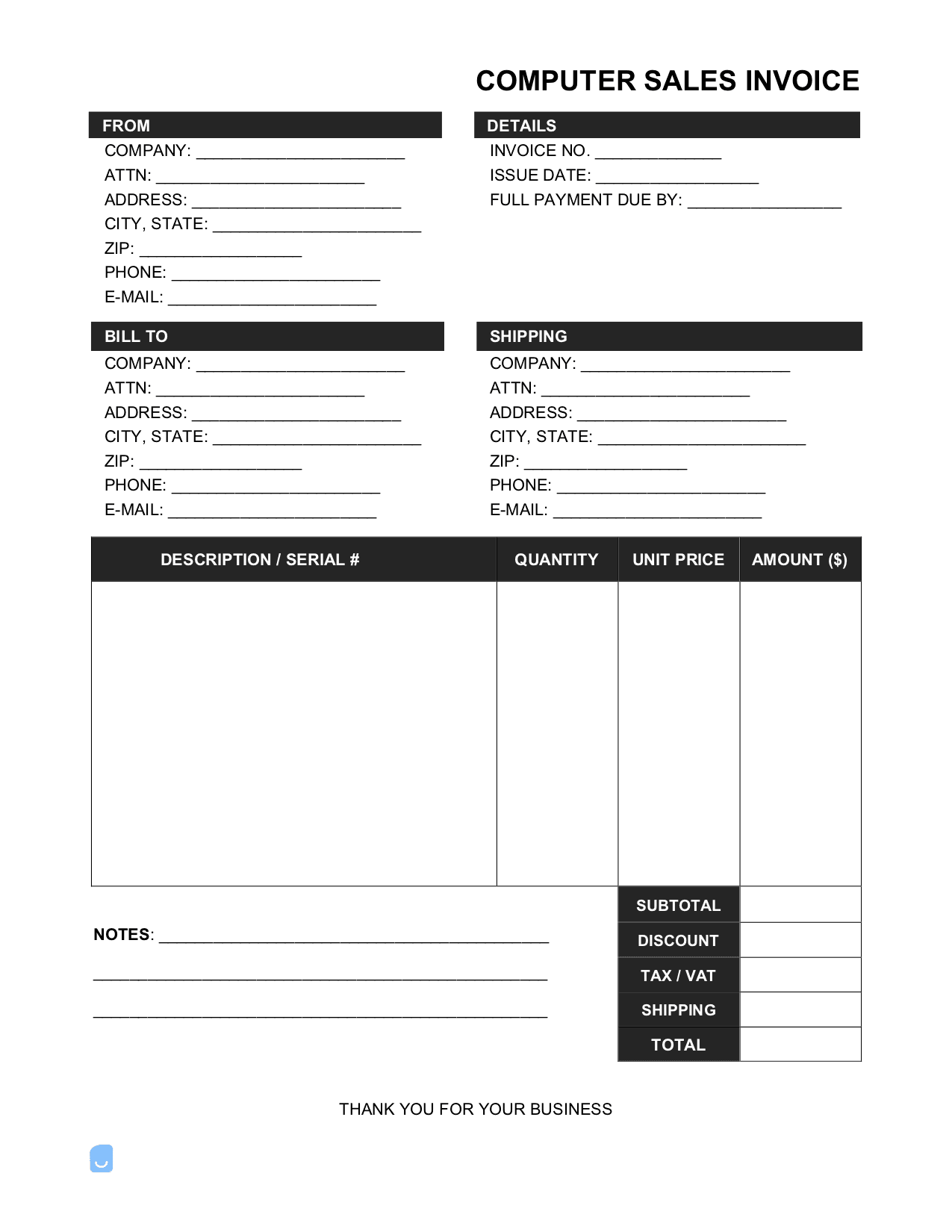

Computer Sales Invoice Template

A computer sales invoice is a billing document listing the computer(s) or accessories sold, the unit cost and quantities of each, taxes, and any applicable discounts or offers. The invoice can be issued as a receipt for documentation or as an invoice requiring immediate or delayed payment. If a computer or part needs to be shipped to the customer, an option on the invoice can be checked, allowing for a shipping address and charge to be applied to the invoice.

Computer Parts Invoice – For the selling of specific computer parts.

How to Calculate Sales Tax

Charging clients the correct sales tax, regardless of online or in-person transactions, is essential. To find the correct sales tax to charge a customer, follow the steps below, which were created with the reference of TaxJar.com. (Note: Check that the items that are being sold are indeed taxable – for reference, items that are sold B2B (Business to Business) are typically not taxed).

Step 1 – Sales Tax Nexus

Determine if there is a sales tax “nexus” in the state that products are being sold. A nexus can exist if there is a physical location in the state, employees, affiliates, inventory, or (in certain circumstances) if there is an exceptional amount of annual sales (either the number of transactions or total dollar amount) to the state. If the seller determines no nexus in the state, a sales tax does not need to be applied to the invoice. If the seller does determine that a nexus exists with one (1) or more states in which they are shipping to, they need to determine if the state has an origin or destination-based sales tax. For a full list of origin and non-origin-based states, check out the TaxJar page here.

Step 2 – Receive a Sales Tax Permit

A sales tax permit is required in every state that the company will be collecting sales tax. For a comprehensive list of each state’s application process and guidelines, check out the TaxJar’s state-by-state tax guide.

Step 3 – Calculate the Tax and Add It to the Invoice

To add on the required sales tax to purchased items, find the state’s local tax rate. Tax Foundation has created an updated list of all fifty states’ tax rates, which can be used to identify the correct tax to charge. As stated in Step 1, the required tax will either be the current state or the destination state, depending on if the computer company is in an origin-tax state or not. Upon finding out the tax rate, multiply all applicable items by the rate, and add the sum to the total invoice amount.

Computer Salesperson Salary

- Salary: $44,888/yr (source: Glassdoor)

- Hourly rate: $19/hr (source: ZipRecruiter)