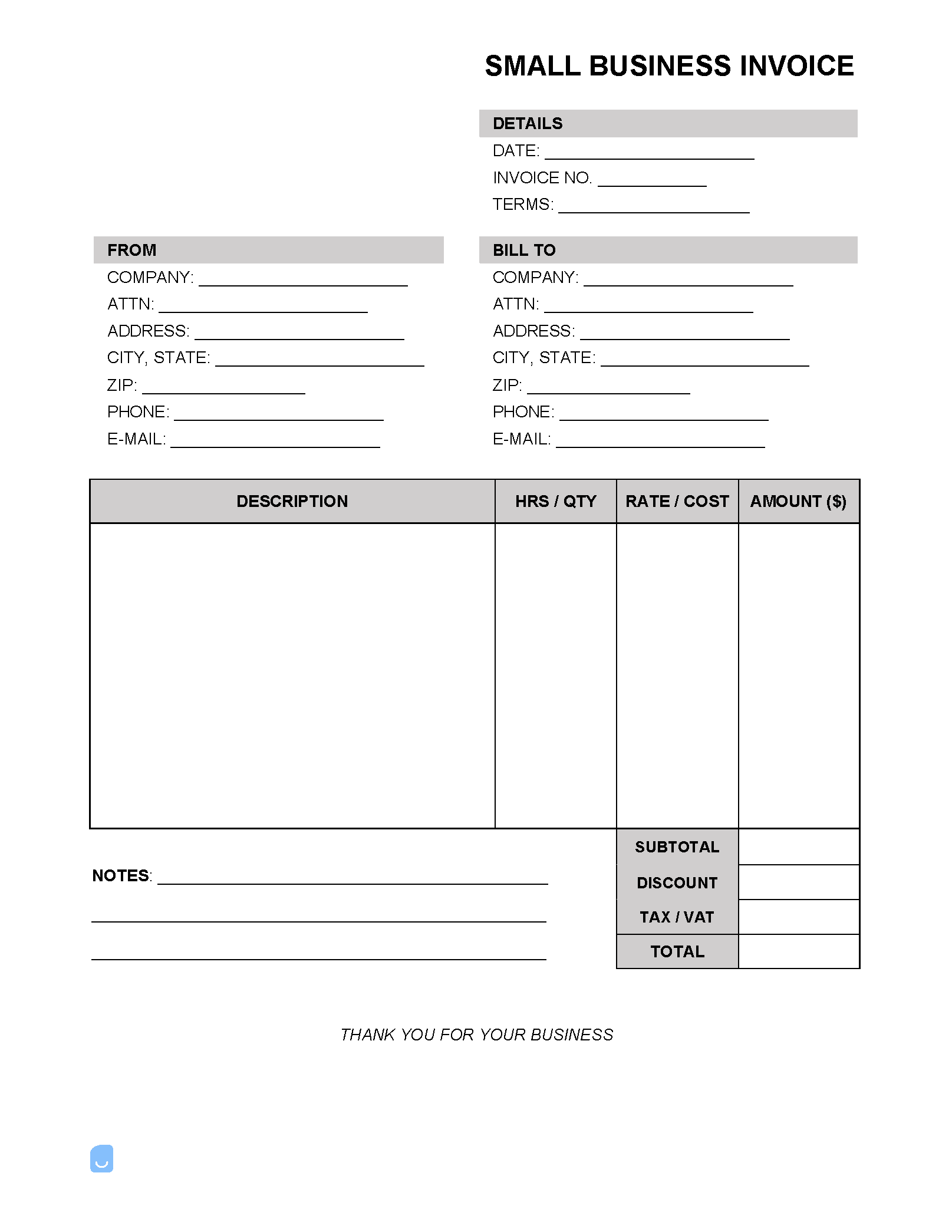

A small business invoice is a billing document sent to consumers or business customers to establish a formal payment obligation for goods and/or services already delivered. At the most basic level, an invoice sent by a small business should contain an area for one (1) or more line items (which serve to describe each service or object sold), fields for listing any additional fees (tax, shipping, etc.), an area for the issuing company to display their contact information, any notes regarding the offering, the amount of time the customer has to pay the invoice, and the method(s) in which the invoice can be paid. Timesheet Invoice – Use when paying employees, specifically by the hour ($/hr), in a “clock-in” and “clock-out” format.

What is a Small Business?

A small business is a privately-owned company with less than five hundred (500) employees. The term “small business” may sound like it is referring to a minor subset of today’s workforce, but the truth could not be any farther from reality, as according to the SBA, small businesses account for 99.9% of employer firms. Small businesses can be structured as: sole proprietorships (a single owner), partnerships (two owners – often friends or family), LLCs (limited liability companies), or corporations (includes several different types, including b corps, s corps, c corps, and non-profits).

How to Start a Small Business

Starting a business can be the most rewarding life decision an individual can make. Unlike standard “9-5” jobs, the financial potential is massive, and the business owner will be in complete control of how they spend their day. However, with such great potential comes the very real possibility of failure. The small business owner may be free in concept, but can be completely dependent on their customers and those that keep them in business. Those looking to start a business also need to understand that they will be working far harder than the average employee to get their business off the ground. For the individual that has a grasp of the risk involved and is ready to commit every ounce of their free time to their goal, the first step toward business ownership can be taken.

Step 1 – Research & Planning

As great as an individual’s idea may appear (to them), blindly jumping into the market is a surefire mistake. Research the market, take the time to analyze competitors in-depth, and write it all down. Ask: What are they doing right? What are they doing wrong? What is their strategy (cost leadership, differentiation, industry focus)? Going in with a strong game plan will not only increase the new business’ chances of surviving in the long term, but it will make it easier to obtain SBA loans and receive funding from other avenues. It’s worth noting that too much planning can be equally disastrous, as the more nitpicking an individual does, the more likely that individual is to get “cold feet” – too afraid of failure to even begin their small business dreams. Additionally, the owner must be ready to forego plans that are made if they are discovered to likely result in failure. A quote to highlight this comes from Winston Churchill, who once said:

“Plans are of little importance, but planning is essential.”

Step 2 – The Business Plan

The business plan is undoubtedly the heart of a business, both large and small. It should contain a pain-staking amount of detail, from the color of the employees’ uniforms to the business’ strategy for capturing their portion of the market. It should capture the research and planning conducted above into an organized, step-by-step process for how the business will be formulated. The following sections should be included in a business plan (not necessarily written in this order):

- Executive Summary (the business’ pitch)

- A detailed description of the company (purpose, strategy, etc.)

- Breakdown of the products and/or services offered

- Competitor, market, and customer analysis

- Business structure (LLC, corporation, partnership, etc.)

- Organizational style (horizontal or vertical management structure, CEO, CFO, etc.)

- Marketing Plan

- Financing (expenses, required profit, employee salaries, and mock financial statements)

Step 3 – Finding a Location

For companies that will be offering products or services to consumers (in the B2B world, the location is often not as essential), the location can make or break the business’ success. For example, a restaurant on the corner of a busy city will be exposed to thousands of potential customers, increasing the rate of walk-ins. Whereas a restaurant situated in a dead area of town will be challenged to acquire nearby foot traffic.

Step 4 – EIN, Filing the Name, & Registration

An EIN (Employer Identification Number) is a federally-issued, nine (9) digit number given to corporations, LLCs, and partnerships for the purpose of paying taxes. Because sole proprietorships are taxed on a personal level, they typically do not need to apply for an EIN. For more information on receiving an EIN, check out the SBA’s page regarding state and federal ID numbers. To ensure the desired name of the company is not already in use as well as to lock-in the business name to ensure it can’t be used by another entity, the soon-to-be business owner will need to file the name with the state. Simply registering the business name with the state may be enough for the company to open shop and begin conducting business. For others, certain licenses will need to be acquired. The SBA’s “Apply for licensure and permits” article contains a full list of required licensure based upon the industry of the small business.