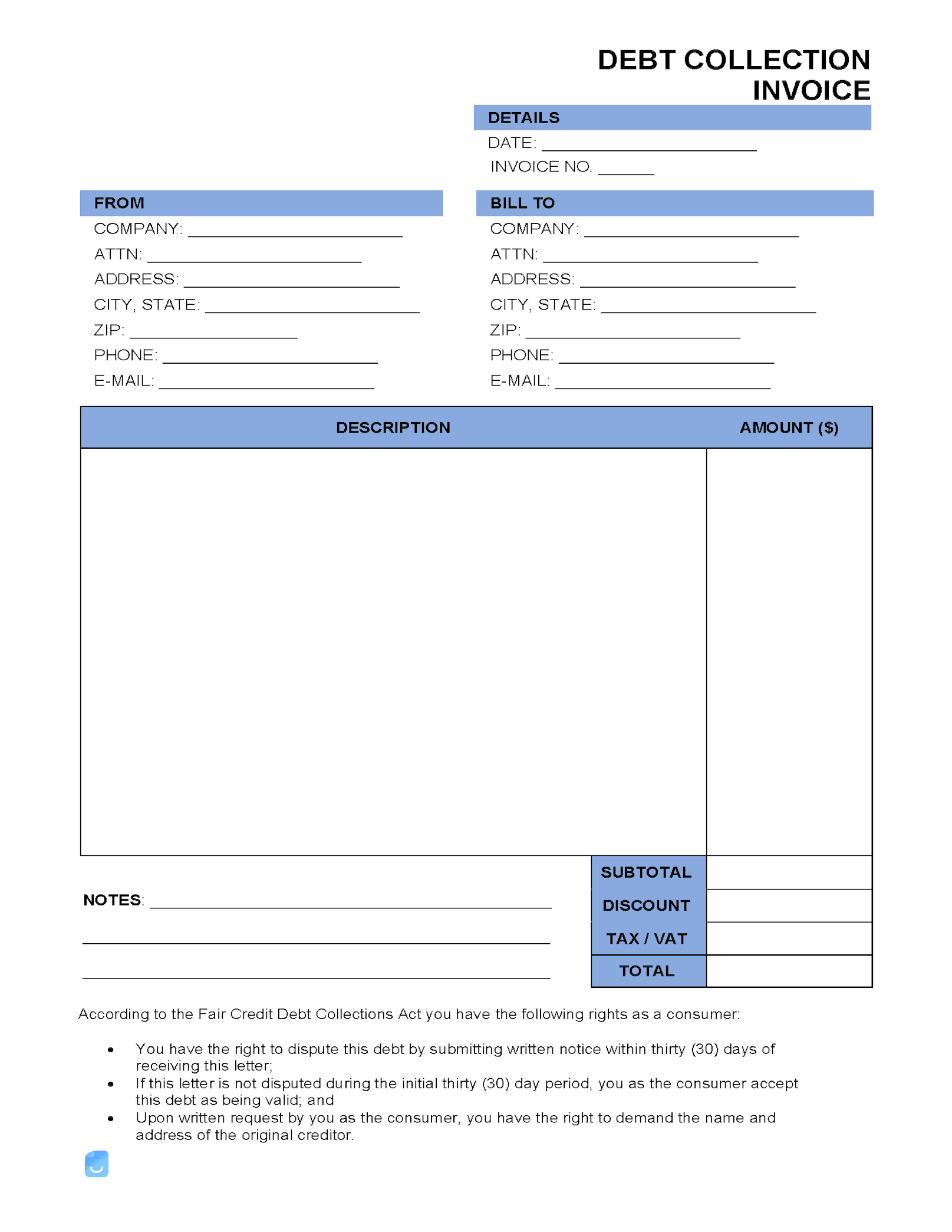

Debt Collection Invoice Template

A debt collection invoice allows an agency (collector) to request payment from a debtor that owes money for a past due balance. The invoice must follow federal laws under Debt Collection Practices (§ 1692) that grants the debtor access to information on how the debt originated. If the debt is not disputed within the initial 30-day period, the debt will be acknowledged as owed and may affect the debtor’s credit report.

What to Include?

According to 15 U.S. Code § 1692g, the following must be included in the invoice or collections letter:

- Amount ($) of debt owed;

- Creditor’s name;

- A statement detailing that unless the debtor disputes the validity of the debt, within thirty (30) days, that it will be considered valid by the debtor;

- A statement that if the debt is disputed within the thirty (30) day period, that a judgment or proof will be provided by the creditor that the debt is legitimate; and

- A statement that within a thirty (30) day period the debtor may request who the original creditor was to the money owed.

Fair Debt Collection Practices Act

The Fair Debt Collection Practices Act, which was set into law in 1977 and has been revised many times over since then, exists to protect the consumer (debtor) from abusive, deceptive, and unfair practices from collection agencies. The act also sets a standard that collection agencies must abide by, which include the following:

- Hours of Contact – Agencies may only call debtors from 8 am to 9 pm local time.

- Communication – If a debtor asks not to be called again, the agency must respect their wish. The agency is also prohibited from calling a debtor at their job.

- Abuse – Debtors are prohibited from threatening to go to the police or from publishing the debtor’s information publicly.

Statute of Limitations

Debt does not last forever. Most debts (except for college loans, child support, etc.) expire after a certain amount of years. Each state differs, but most debts expire between 5-12 years. When a debt outlasts a state’s statute of limitations, a person can create a motion to have the debt removed from their credit report. If the debt is a tax lien, the debtor will need to file with their local registry of deeds to remove the lien.

Did you know?

The statute of limitations does not apply to a college loan. Therefore, trying to wait out the statute of limitations on a college loan will not work. The individual with college debt will only rack up more interest and be left more in debt.