Self-Billing Invoice Template

A self-billing invoice is an invoice form given by a buyer to a seller, in contrast to a standard invoice that a seller or service provider issues to a buyer. Self-billing is a practice that only occurs when the buyer and seller have entered into a mutual agreement to use it and is generally only used in specific professions and situations.

How to Create a Self-Billing Invoice for Your Business

Typically, a seller sends an invoice to a buyer after delivering goods or services. However, if a buyer is a regular customer of the seller and their orders vary in amount, it’s sometimes better for them to issue the invoice to the seller. For example, let’s look at how a self-billing invoice would work for a restaurant business. As restaurants can be inconsistent with purchase orders, produce suppliers can’t know what to deliver on every delivery. The restaurant, therefore, will provide an invoice detailing the amounts of produce they need in their next order. By writing up their own self-billing invoice, the restaurant can fill in the order without delay. The customer and vendor must enter into a self-billing agreement before they can utilize self-billing invoices. This arrangement should be regularly reviewed. Both suppliers and customers should keep careful self-billing records.

Formatting a Self-Billing Invoice

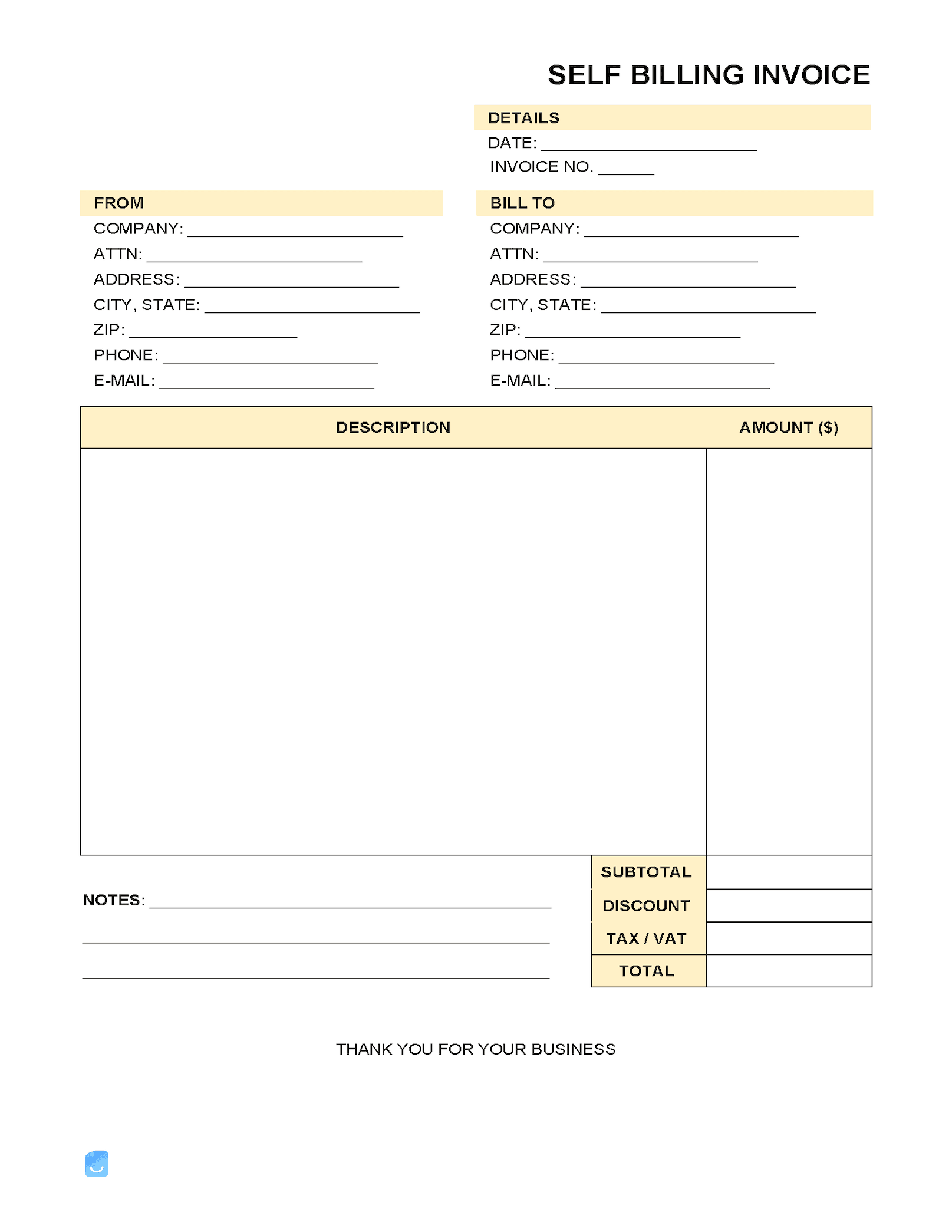

The format of a self-billing invoice doesn’t change much from the standard format of an invoice. A self-billing invoice should include:

- Seller’s company name

- Seller’s contact information

- Buyer’s company name

- Buyer’s contact information

- Tax ID/VAT numbers

- Details and price of all items purchased

- Any attachments, such as purchase orders, if applicable

The invoice can be generated manually in a word processing or spreadsheet program or with accounting or invoicing software that streamlines and accelerates the process.

VAT on a Self-Billing Invoice

In some countries, such as the United Kingdom, a customer is required to self-assess and self-report their own VAT, or value-added tax. This means the customer has to account for VAT on the purchase of goods from states that use this system. So if, for example, there is VAT on shipped goods, the purchaser must account for that VAT. This is one reason it is important for a buyer and seller to enter into a self-billing arrangement before using self-billing so that these sorts of matters can be clarified in anticipation of an audit occurring.

Pros of Using a Self-Billing Invoice

Perhaps the most obvious benefit of self-billed invoices is that they save the vendor or supplier time and money usually spent on accounting and invoicing. For businesses with many customers, the savings can be considerable. Since the invoices are already created in a format that the customer is familiar with and since the customer is likely to get all their tax information and payment terms right, self-billing can accelerate and simplify the transaction.

Cons of Using a Self-Billing Invoice

The most prominent risk of using self-billing is the likelihood of errors and audit trail weaknesses. Keeping careful records and copies of agreements between buyers and suppliers is one way to mitigate this risk.