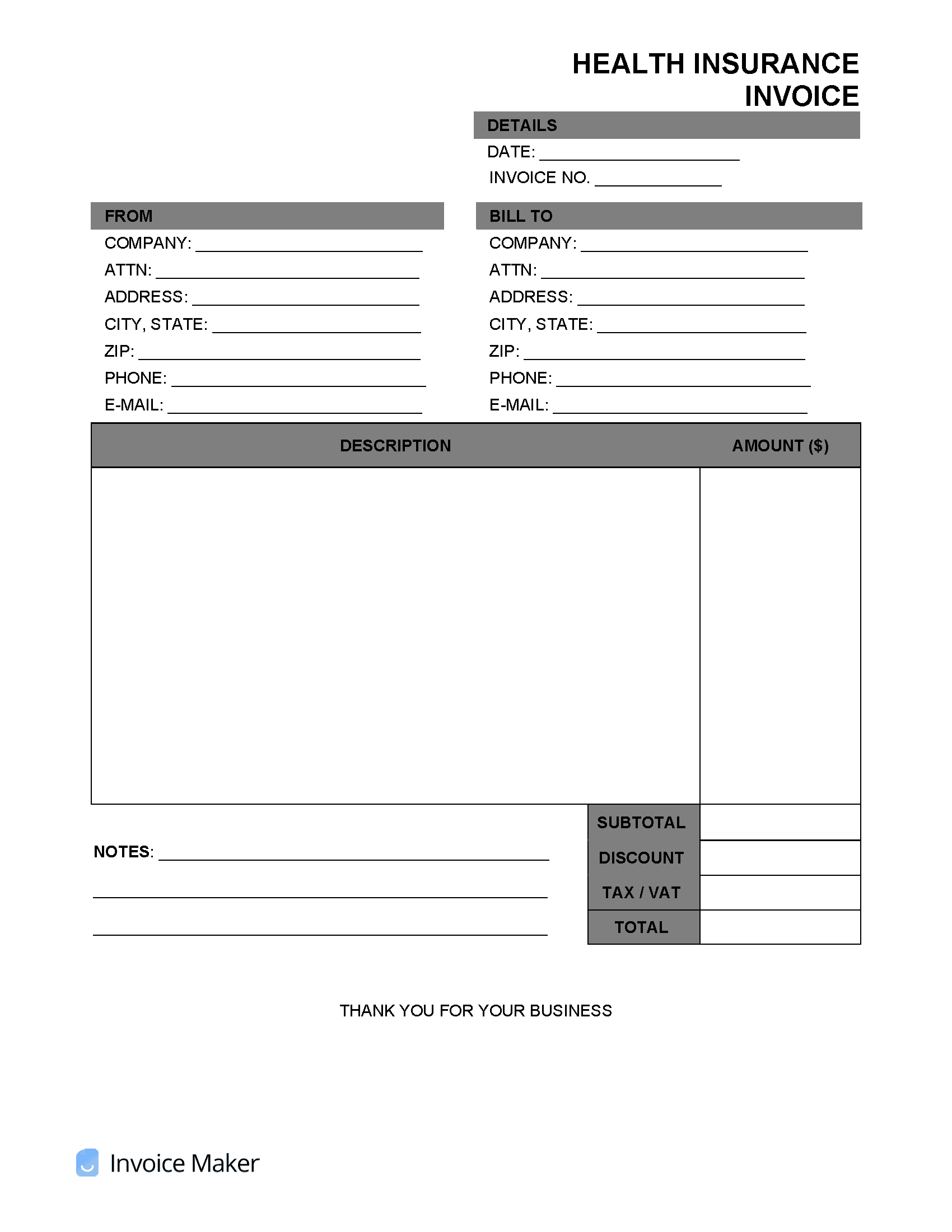

Health Insurance Invoice Template

A health insurance invoice is used by health insurance providers to bill patients for premiums and coinsurance payments that are due. Invoices are also a useful source of information for members when it comes time to file an annual federal tax return.

What is Health Insurance?

Health insurance gives a person the comfort to know that medical and surgical expenses are covered in the event something unfortunate occurs in their life. By paying a monthly rate, or a premium, an individual can be covered up to a certain amount. The higher the monthly premium, the more coverage an individual can obtain. An individual can compare plans through the health insurance marketplace to see which compliments their situation and life best. (Source: Census.gov)

How Much is Health Insurance?

The majority of the population has private health insurance (67.2%) obtained through their employer. Many others obtain their health insurance through the government (37.7%) or what is called the Marketplace. Health insurance must be purchased during the open enrollment period when using the Marketplace, which typically occurs from November 1st to December 15th. Health insurance can still be purchased after the deadline, but it will be much more difficult. Health insurance rates are often defined by how well the economy is doing, as rates tend to go with the flow of economic trends. The cost of health insurance comes down to three major questions: 1. What is the size of your family? – Single, non-married people pay the most. The larger the family, the greater the chance of qualifying for a subsidy to lower the overall cost. 2. What is your household income – A household with low income can qualify for more credit through a subsidy, and a household with high income should have no problems finding and paying for health insurance. 3. What is the average price per plan in your State? – Depending on what state you live in, prices for plans will vary. Other factors that decide how much a person pays depends on the coinsurance and co-pay, which are out-of-pocket expenses related to your health insurance plan. Coinsurance – Amount that you share with your health insurance company when paying for medical expenses after your deductible has been reached. For example, if a patient gets a bill for $100,000 and has agreed to pay a 20% coinsurance rate, the patient would be responsible for paying $20,000 while the insurance company would be $80,000. Copay – A set fee amount for every time a medical expense is rendered.

How Do Health Insurance Deductibles Work?

The higher the deductible, the lower the monthly premium payment. The lower the deductible, the higher your monthly premium will be. A deductible is the amount a member must pay before their health insurance will pay for the remaining cost. Healthy people tend to have higher deductibles and lower premiums as they do not expect to encounter medical issues. These types of plans are seen as emergency plans. Due to the greater chance of medical problems, older people pay higher monthly premiums to mitigate the large out-of-pocket expenses after a major surgery or operation.

Example

If a member receives a medical bill for $20,000 and has a deductible of $4,000, the member must pay the first $4,000 of that bill before the insurance company pays for the remaining $16,000. The good news: once a deductible has been paid, the insurance company is responsible for paying all future medical bills within that year.