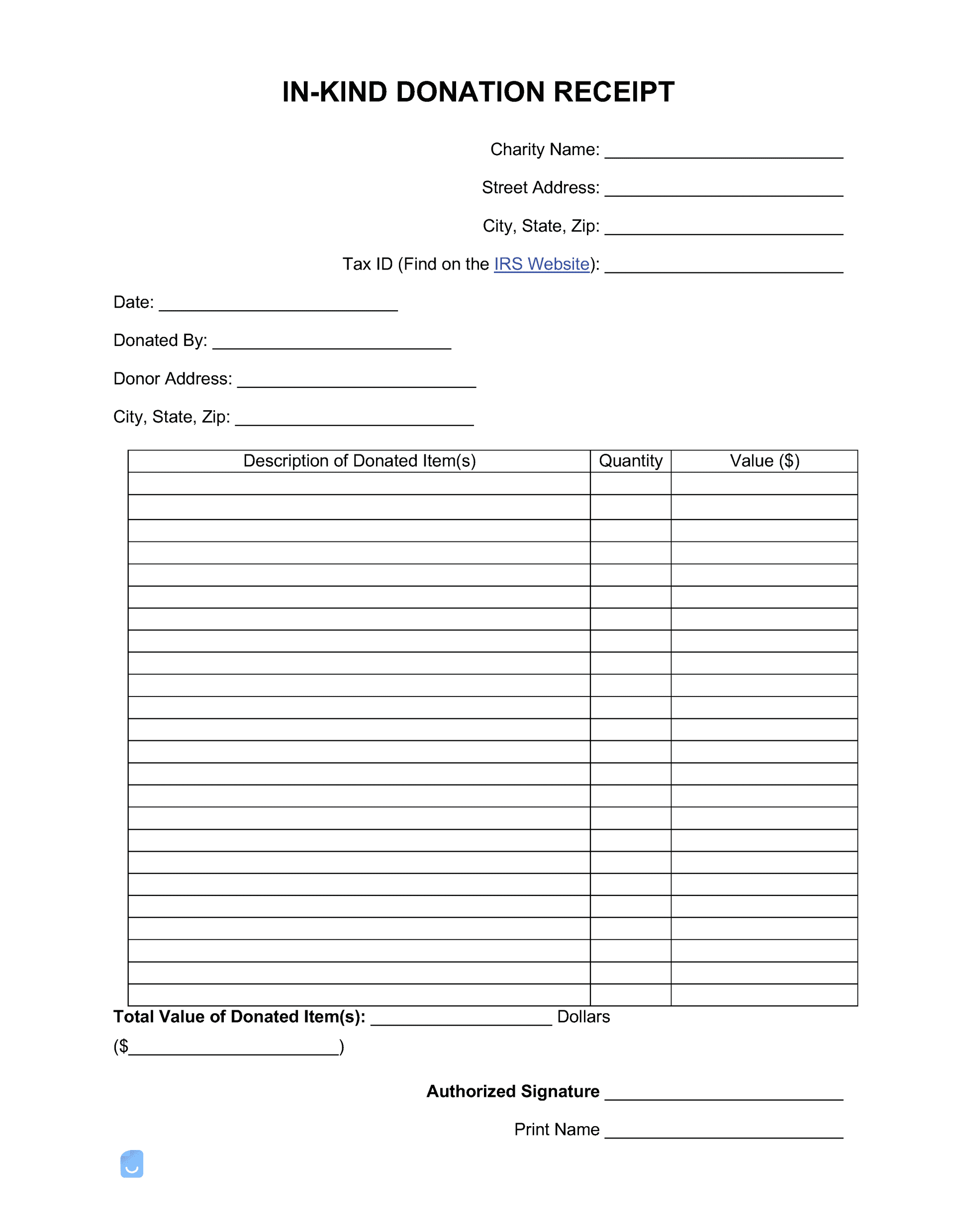

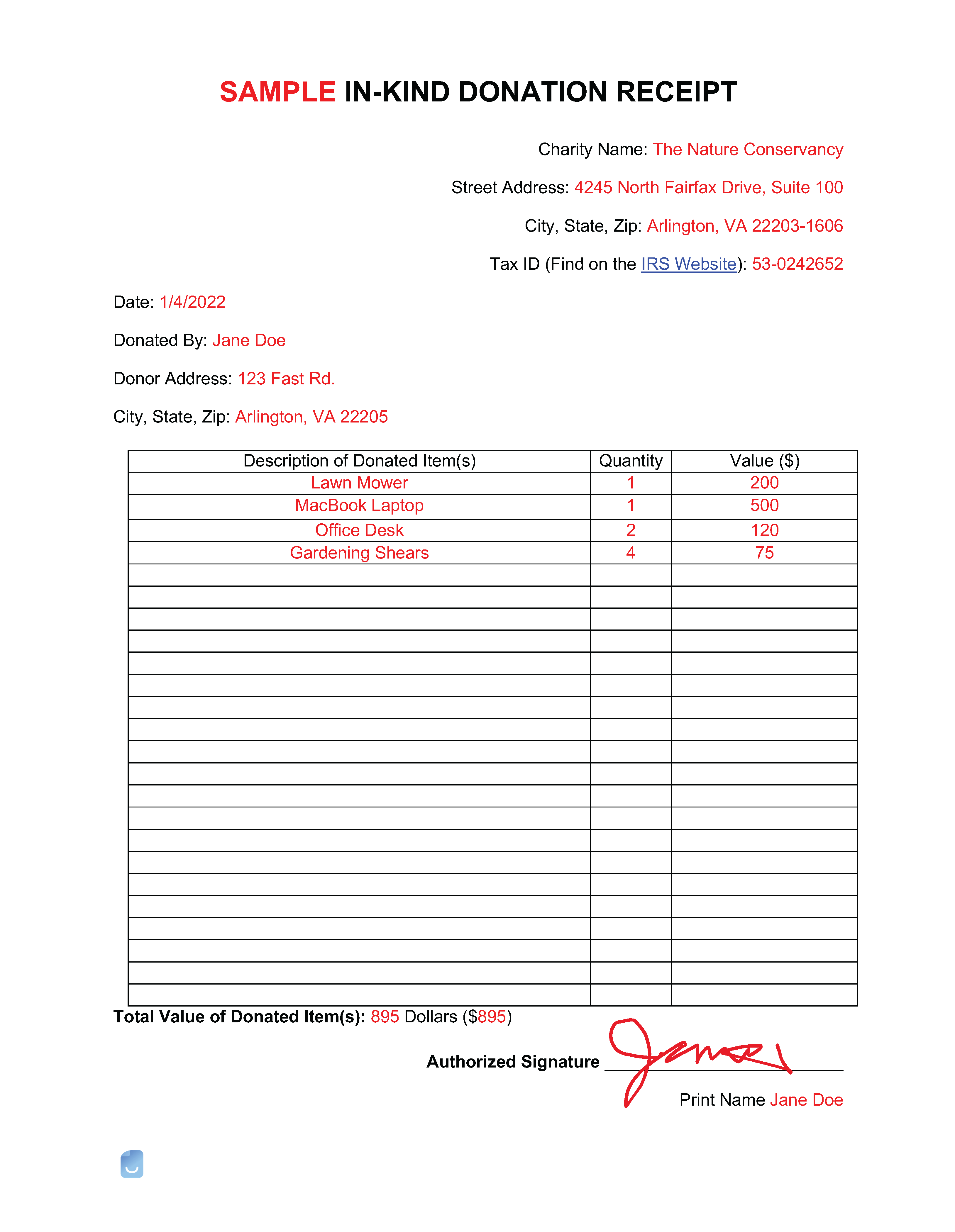

In-Kind Donation Receipt Template

An in-kind donation receipt is used when non-cash goods—such as equipment, furniture, or services—are made as charitable contributions to an organization. For the donor to receive a tax deduction for the donation, they must obtain a receipt detailing the specifics and value of their in-kind donation.