Charities to Donate to

Below is a list of the top donation categories that people and businesses make donations to every year. Even if a charity is tax-exempt, you still need to check with the IRS to see if the item donated is tax-deductible. For example, the Red Cross is a 501(c)(3) tax-exempt organization; however, donors can not deduct the value of blood given to a blood bank. For more information, see the IRS Publication on Charitable Contributions.

- Blood (plasma) Donations (Not Tax Deductible) – How often can blood donations be given? Every 8 weeks. Where: Red Cross.

- Egg Donation (Not Tax-Deductible) – The process of a woman donating a reproductive egg.

- Car Donation (Tax-Deductible) – Used cars that are hard to sell can be discarded by giving to a charity. Almost all charities accept car donations. Use the Car Donation Wizard to find a car donation center.

- Clothes Donation (Tax-Deductible) – Clothes are the biggest donated items that people give, which is why some of the largest charities in the world happen to be Goodwill and the Salvation Army.

- Hair Donation (Not Tax-Deductible) – The IRS views donations associated with the human body as not tax-deductible.

- Furniture Donation (Tax-Deductible) – With any furniture of worth, it’s always possible to find a charity to come to pick it up. Use the Salvation Army Pickup service to schedule a time.

How to Donate Clothing

As an example, say a person has a box full of clothes sitting in their closet. April 15th (tax day) is approaching, and they want to unload these clothes to receive a tax break. The following is the process for doing so:

Step 1 – Itemize the Clothing

Empty the box of clothing in a space where they can be easily sorted. Each item of clothing needs to be valued at fair market value. This can be done by eyeballing the clothes, although it’s important to consider that the clothes are old and used into consideration. Valuing the clothing should be assessed on the lower end. Use this clothing valuation guide as a reference. Use IRS Form 8283 when itemizing the list of clothing.

Empty the box of clothing in a space where they can be easily sorted. Each item of clothing needs to be valued at fair market value. This can be done by eyeballing the clothes, although it’s important to consider that the clothes are old and used into consideration. Valuing the clothing should be assessed on the lower end. Use this clothing valuation guide as a reference. Use IRS Form 8283 when itemizing the list of clothing.

Step 2 – Select a Charity

You can’t give your donated clothes to a random charity. The charitable organization must be deemed 501(c)(3) tax-exempt, which usually means that the charity is a nonprofit corporation. For clothing, a popular option is Goodwill. Look online to see where the closest store is located near you.

You can’t give your donated clothes to a random charity. The charitable organization must be deemed 501(c)(3) tax-exempt, which usually means that the charity is a nonprofit corporation. For clothing, a popular option is Goodwill. Look online to see where the closest store is located near you.

Step 3 – Donate

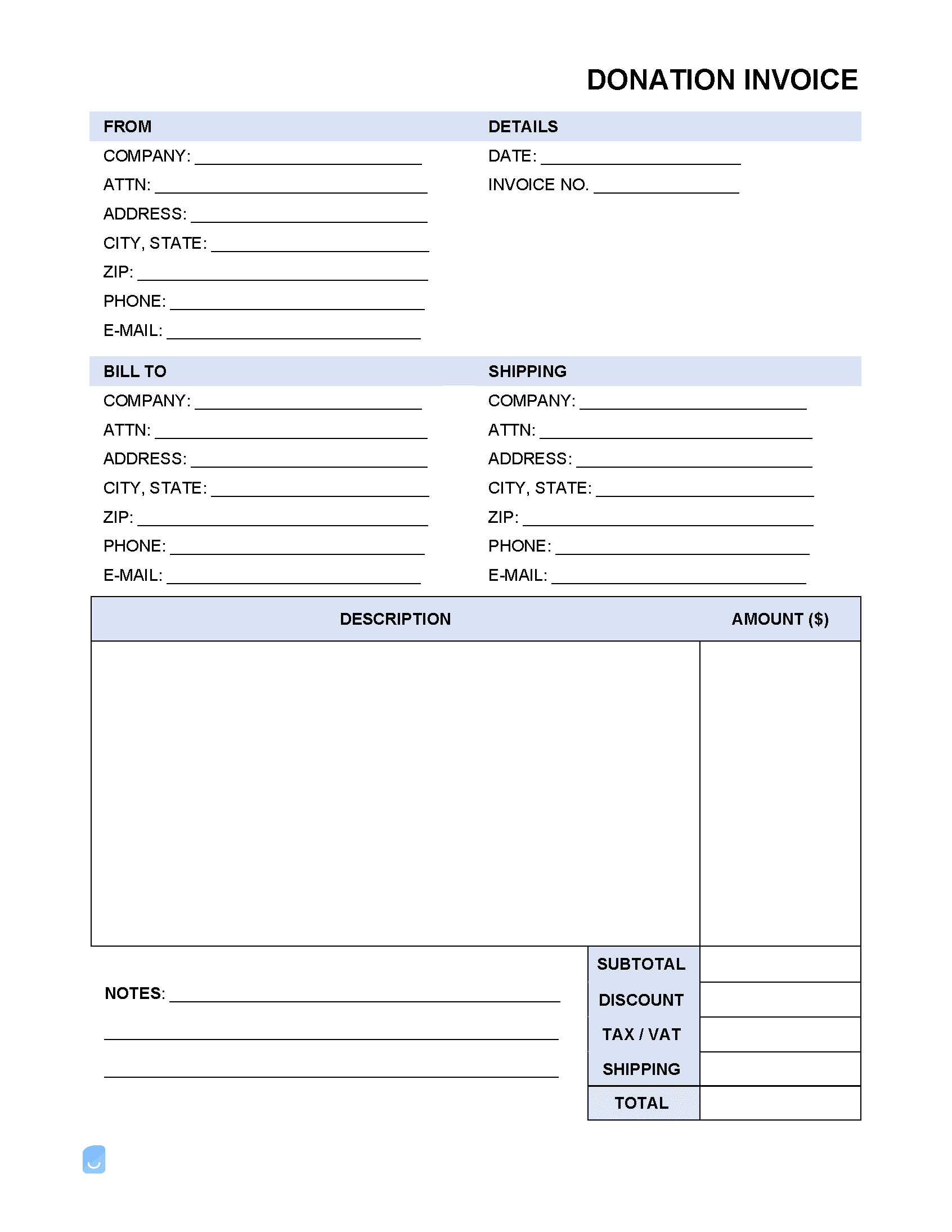

According to the IRS, a pledge to donate doesn’t count until you actually donate. Once the clothes are donated, the charity should give you an invoice or a receipt showing that you made a donation. The invoice should be kept for record-keeping, and the information from the invoice should be used to fill out Schedule A of Form 1040 come tax time.

According to the IRS, a pledge to donate doesn’t count until you actually donate. Once the clothes are donated, the charity should give you an invoice or a receipt showing that you made a donation. The invoice should be kept for record-keeping, and the information from the invoice should be used to fill out Schedule A of Form 1040 come tax time.