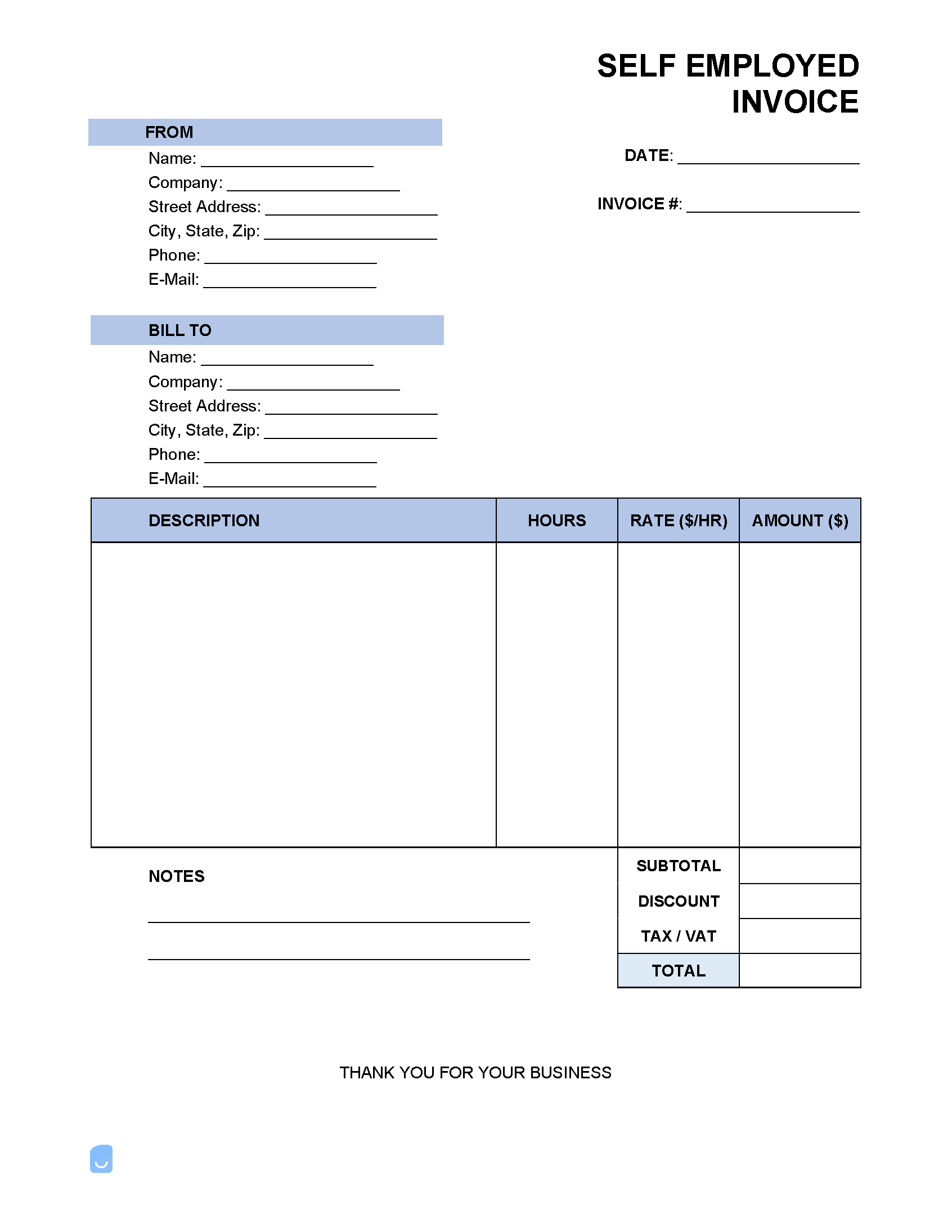

Self-Employed Invoice Template

The self-employment invoice is for any freelancer, entrepreneur, or contractor who is considered a “1099 employee.” When self-employed, the individual will be responsible for the payment of their own withholding taxes. The amount paid in taxes must match what the employer enters on IRS Form 1099 that is submitted at the end of the fiscal year (if the amount is over $600 per Internal Revenue Code § 6041(a)).

What Does It Mean to Be Self-Employed?

A self-employed person is their own boss, much like that of an independent contractor. However, some business owners will subject themselves to a payroll paid by their own company, which may give off the impression that they are employed, but in fact, they are still self-employed. How an individual pays taxes is the clearest indicating factor in determining their employment status. A person is self-employed if any of the following are true:

- An individual owns a business as a sole proprietor or works for themselves as an independent contractor.

- An individual that is a member of a partnership that’s involved in a trade or business.

- An individual that is in business for themselves (however that might be).

Self-Employment Tax

There is no specific self-employment tax—that is, an individual is not taxed as an extra or special tax simply because they are self-employed. Typically, the more money a person makes, the more they will pay in taxes depending on the tax bracket they fall into and in what state they reside. Self-employed individuals have the responsibility to pay an annual tax return while also paying estimated quarterly taxes.

- Self Employment Tax Form – Those that own a business are required to file Schedule C (Form 1040) to report profit and losses for a sole proprietorship. Businesses with expenses not exceeding $5,000 may file Schedule C-EZ instead. Lastly, a self-employed individual must file Schedule SE (Form 1040) and Self-Employment Tax to report Social Security and Medicare taxes. This might seem like a lot of work, which is why many companies hire a tax consultant or CPA to stay on top of these issues related to taxes.

- Tax Deductions – Deductions are calculated by deducting business expenses from the gross income of your company.

Self-Employed Health Insurance

There is insurance available to those who are self-employed (could be a freelancer, consultant, independent contractor, or another self-employed worker) that do not have any employees. If a self-employed person has even one employee, they will need to explore health insurance options for a small business.