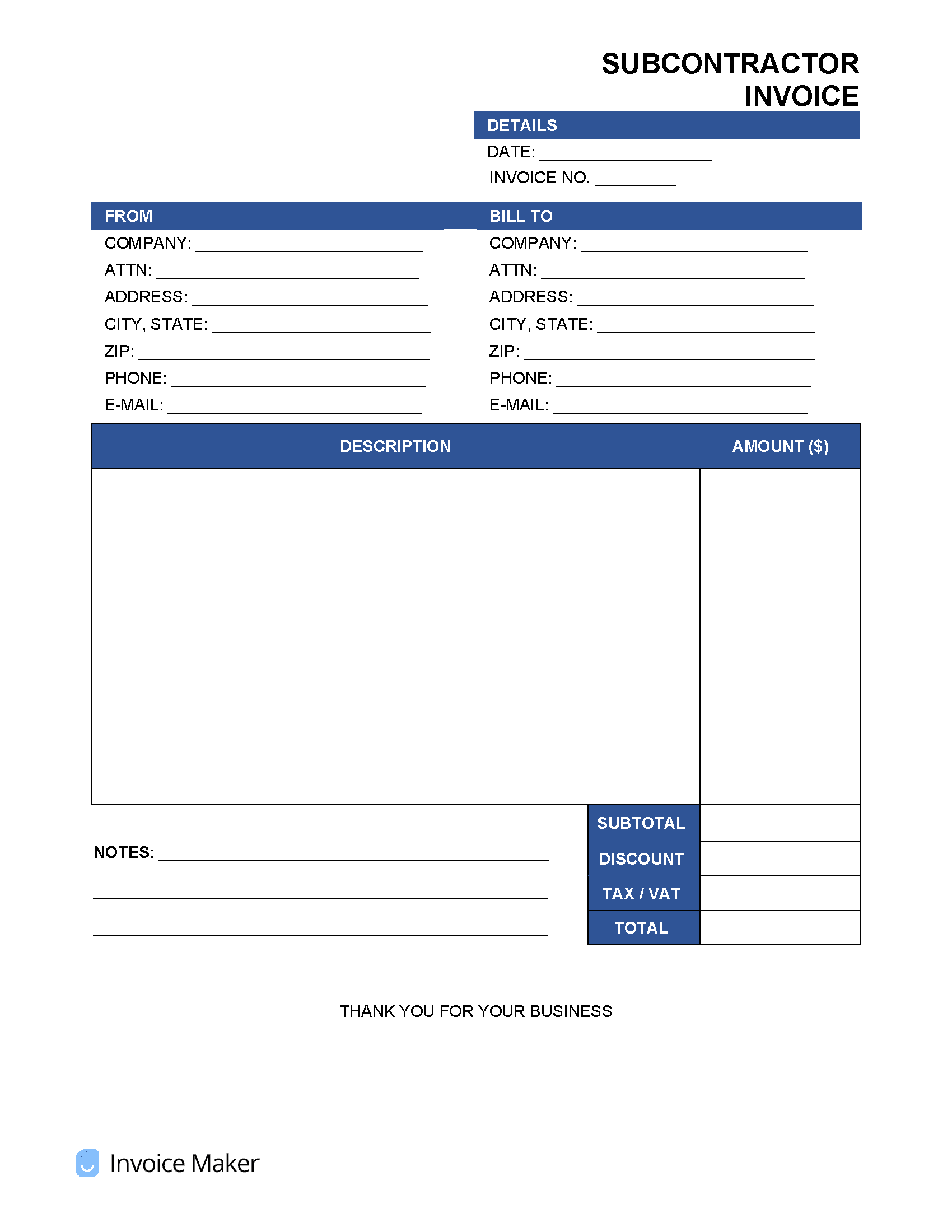

Subcontractor Invoice Template

A subcontractor invoice is a form used by contractors to pay subcontractors for their services after a job is complete. This invoice also serves a double purpose by keeping an accurate account of all items and services completed by the subcontractor. If a subcontractor earns more than $600, the contractor must file an IRS Form 1099-MISC when paying the invoice.

What is a Subcontractor?

A subcontractor is an individual or company hired by another company (the general contractor) to complete a job or a side job. Because hiring employees can be painstaking and more expensive, it’s much easier for a general contractor to hire another individual or company to do the work as a subcontractor. This mitigates expenses and risk while allowing both the contractor and subcontractor to make more money on the project.

Contractor vs. Subcontractor

To look at it simply, the contractor is the main boss, and the subcontractor is their own boss working under the contractor. One big difference between subcontractors and employees is that subcontractors are responsible for paying their own taxes. After a job is complete, the only thing a contractor needs to worry about is paying the subcontractor what they’re owed. Contractors and subcontractors are able to work well together because of an agreement they sign beforehand—called the subcontractor agreement.

Subcontractor Agreement

A subcontractor agreement is the backbone of the relationship between both parties: the subcontractor and the contractor. The agreement prevents any disputes from arising because it lists every detail about the job and the services each party brings to the table. Within the agreement, the subcontractor will state the costs of their services. The contractor, in return, can use the subcontractor agreement as a reference when allocating work to the project.