Hourly Rate ($/hr) Invoice Template

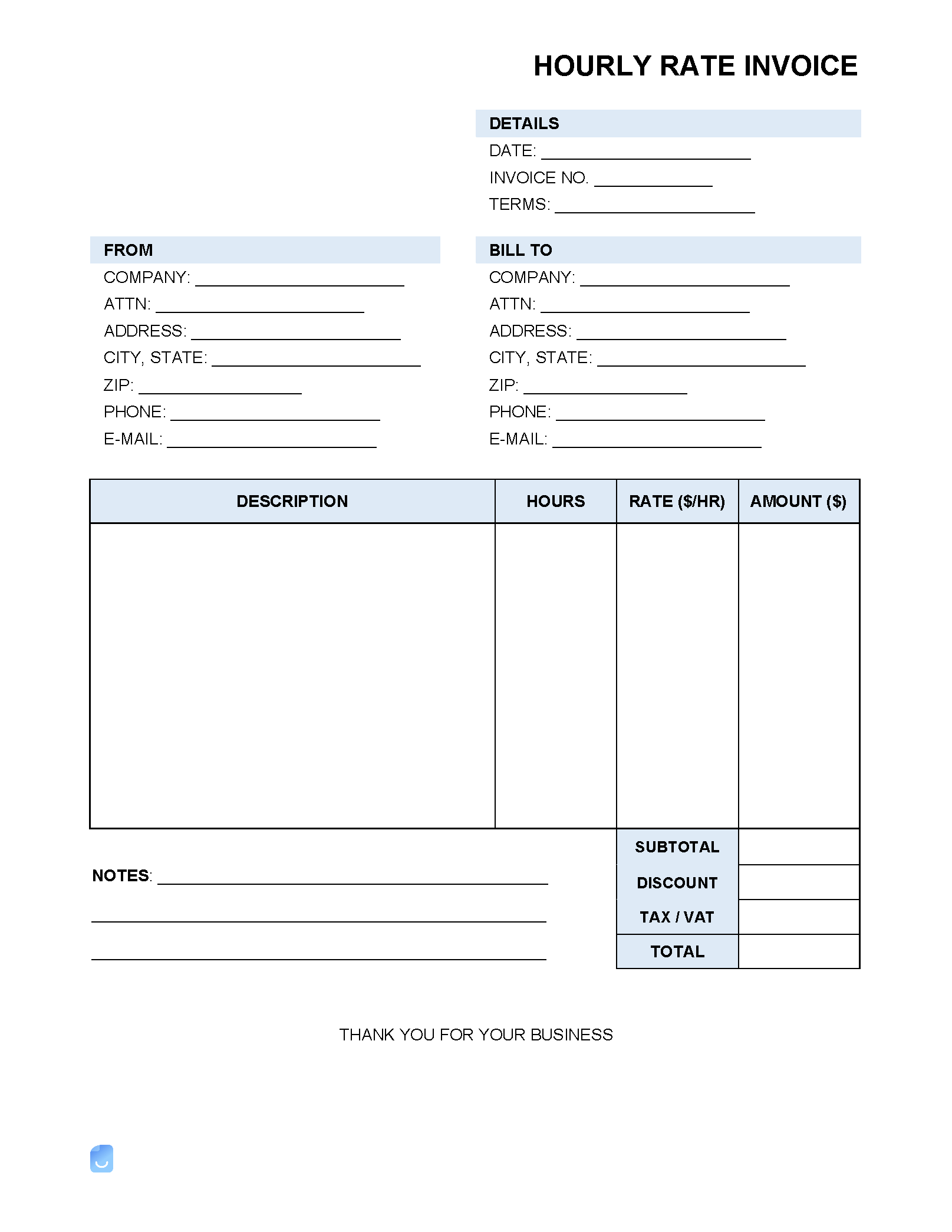

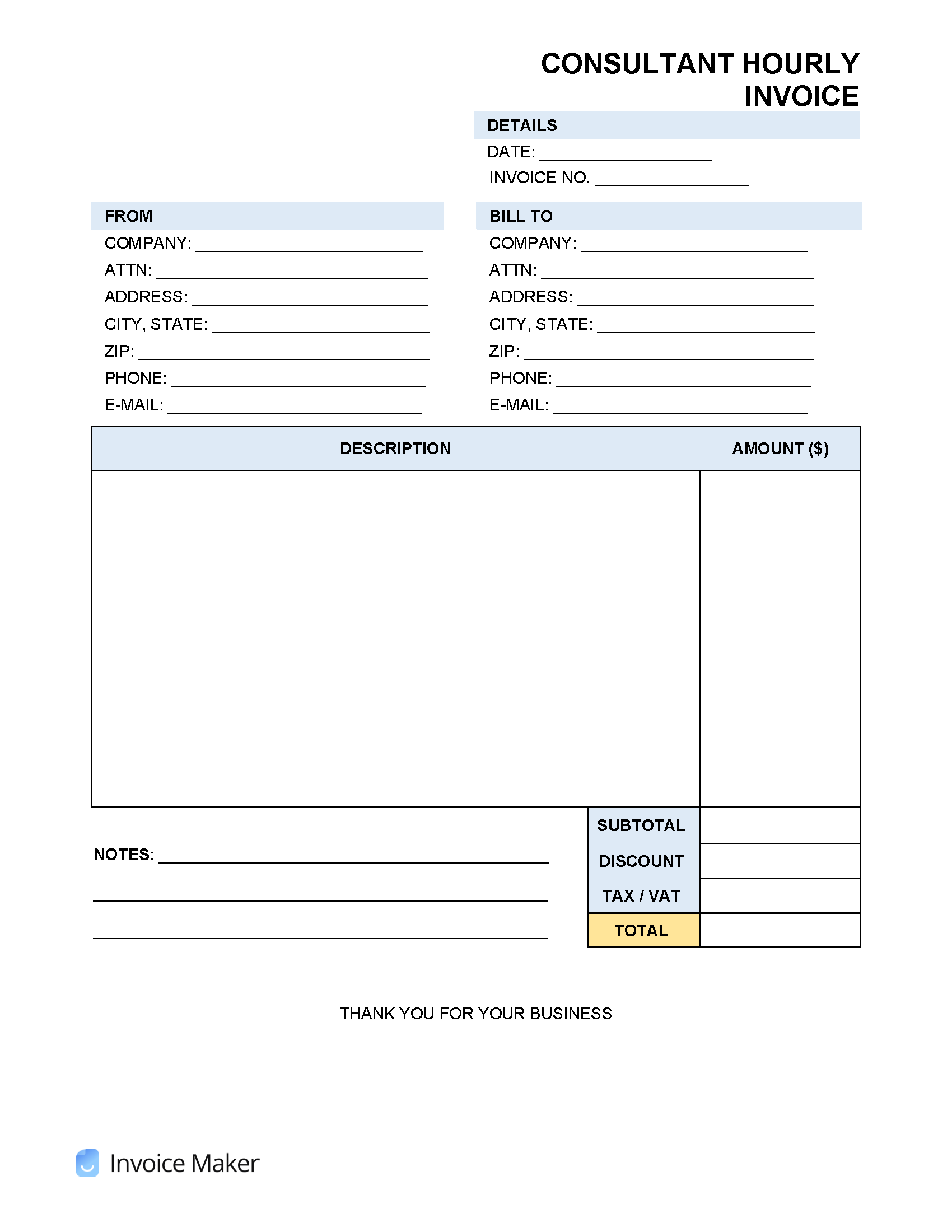

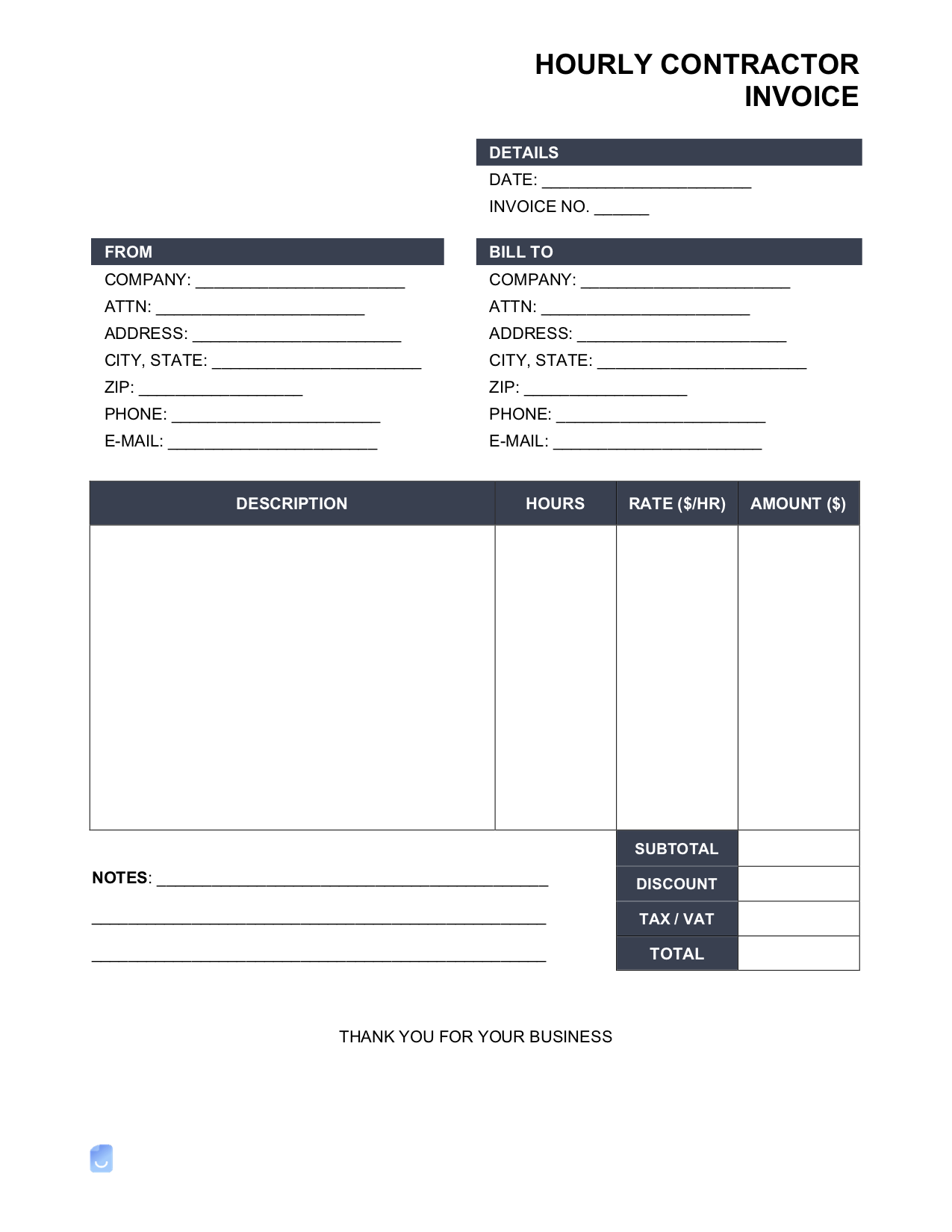

An hourly rate invoice provides service businesses, freelancers, and contractors a means of giving clients a detailed breakdown of the hours dedicated to a particular task or project. To provide sufficient information for the client, hourly-based invoices must contain three (3) pivotal pieces of information, which include 1) the amount charged, 2) forms of acceptable payment, and 3) the payment deadline.

By Type (9)

How to Create an Hourly Rate Invoice That Will Get You Paid on Time, Every Time

Many professionals charge by the hour for services rendered. Identifying an hourly rate is important for both the employed and employers. Freelancers and contractors, for example, need to have a solid understanding of their finances to charge a rate that allows them to cover living expenses while remaining an attractive option for prospective clients. Individuals who choose to charge by the hour should implement an efficient, effective, and meticulous invoicing system that allows them to track hours, get paid for hours worked, and stay on top of cash flow.

Hourly Rate vs. Flat Fee

The two (2) most common charging methods are via an hourly rate ($/hr) or by a single flat fee that is paid upfront or after work has been completed. The two options have advantages and disadvantages.

- Hourly rate – A specific dollar amount that is multiplied by the number of hours dedicated to a certain project or task. Although this option is simple, it can result in workers being less motivated and in a client over-paying.

- Flat fee – Charging a single amount for a job is, like an hourly rate, relatively easy to conceptualize. However, those looking to charge a single fee for their work need to have completed a job several times to ensure they know the amount of time it takes and any pitfalls to avoid being underpaid for a job that takes longer than expected.

How to Calculate an Hourly Rate

To determine an unadjusted rough value, one can take the yearly salary value (let’s say $50,000) and divide it by 2, and then 1,000 (or divide it by 2,000 if a calculator is handy). So $50,000 divided by two (2) equals $25,000, then, to divide by 1,000, move the decimal place to the left by three (3) places, resulting in an hourly wage of $25/hr. To allow for vacation days and other factors, first determine the number of weeks that will be worked in a year (the average is about 50, allowing for two (2) weeks of vacation). Then, identify the number of hours worked in a single week (the average is 40 hrs/week). Multiply the two (2) values. In this case, it would be (50 weeks x 40 hrs/week = 2,080 hours a year). Now, take the yearly wage and divide it by the value found before. With an annual salary of $50,000, the worker’s hourly rate would be 50,000/2,080 = $24.04/hr.

Hourly Rate Calculator

Those that need to calculate an hourly rate fast and don’t want to rely on math to get it right should make use of Calculator.net’s Salary Calculator. It allows the user to input a weekly, bi-weekly, monthly, quarterly, or yearly salary, the number of holidays/vacation days a worker is allotted in a year, and the number of days and hours worked in a week to determine the individual’s hourly rate.

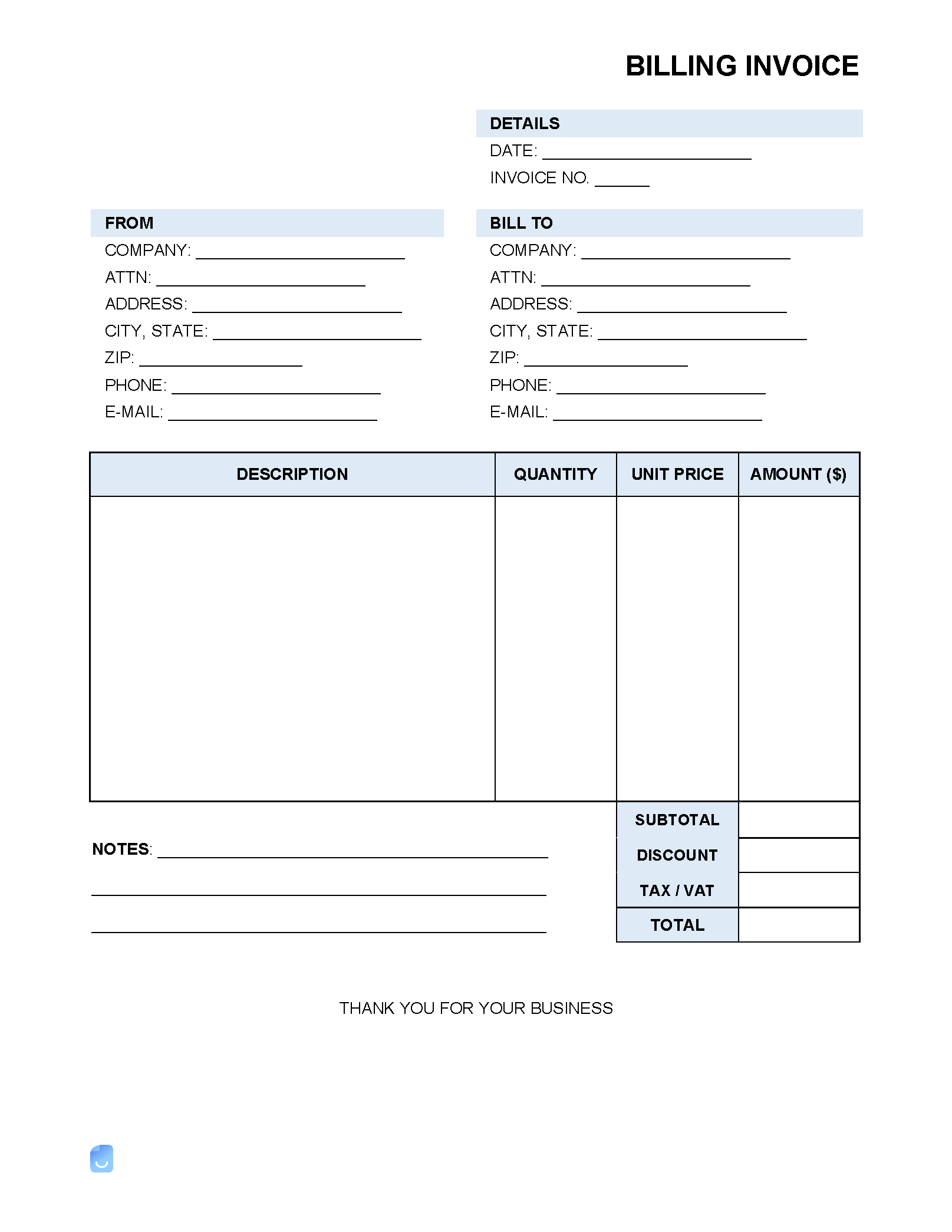

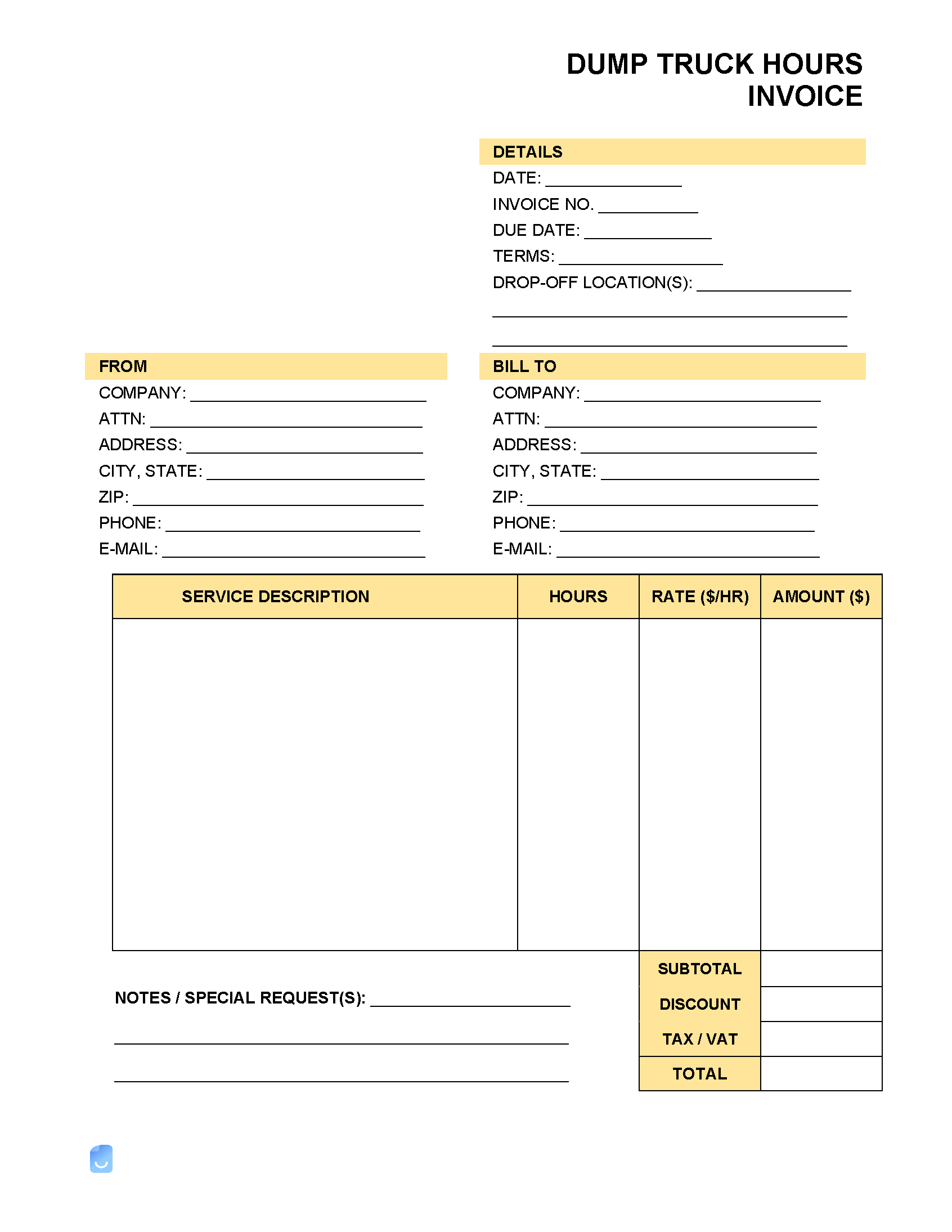

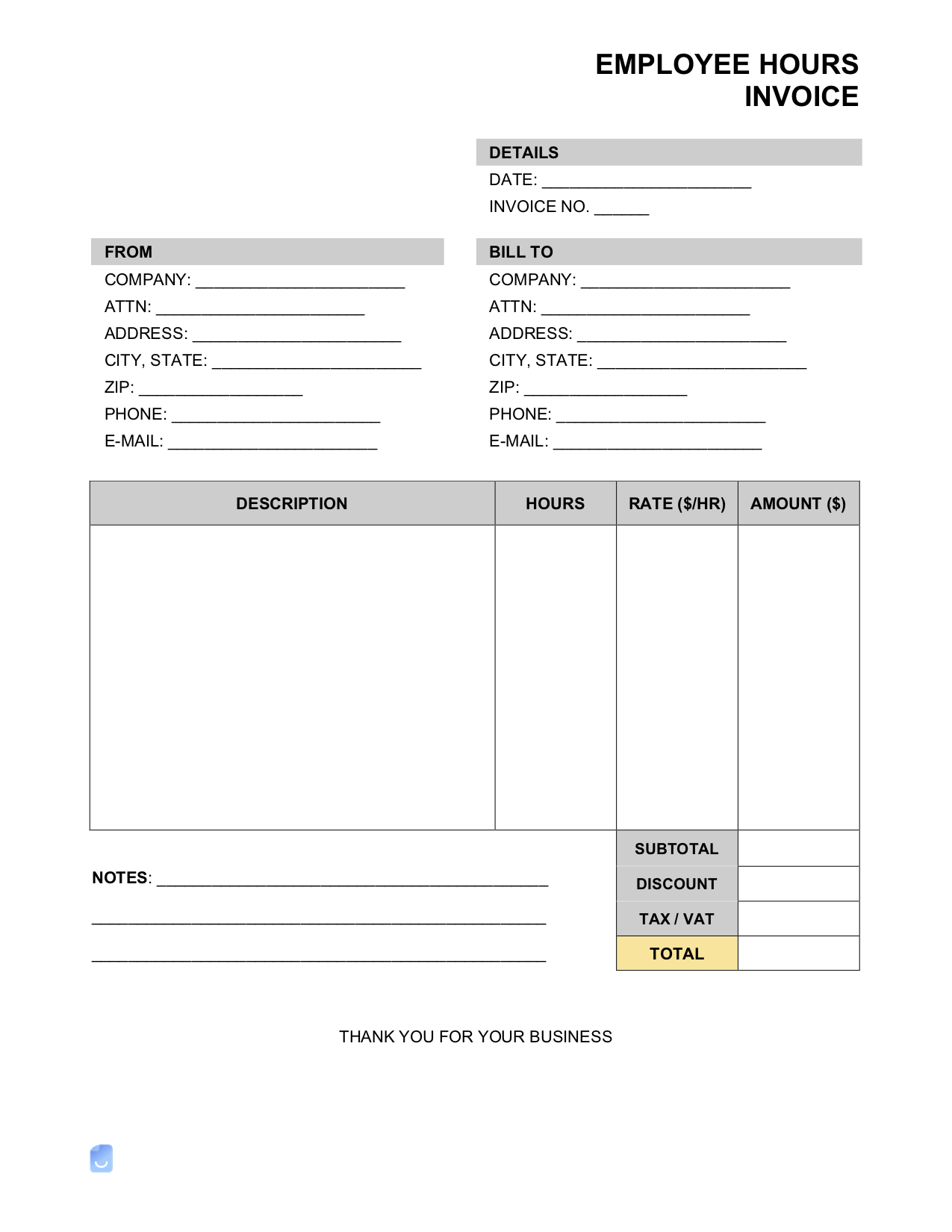

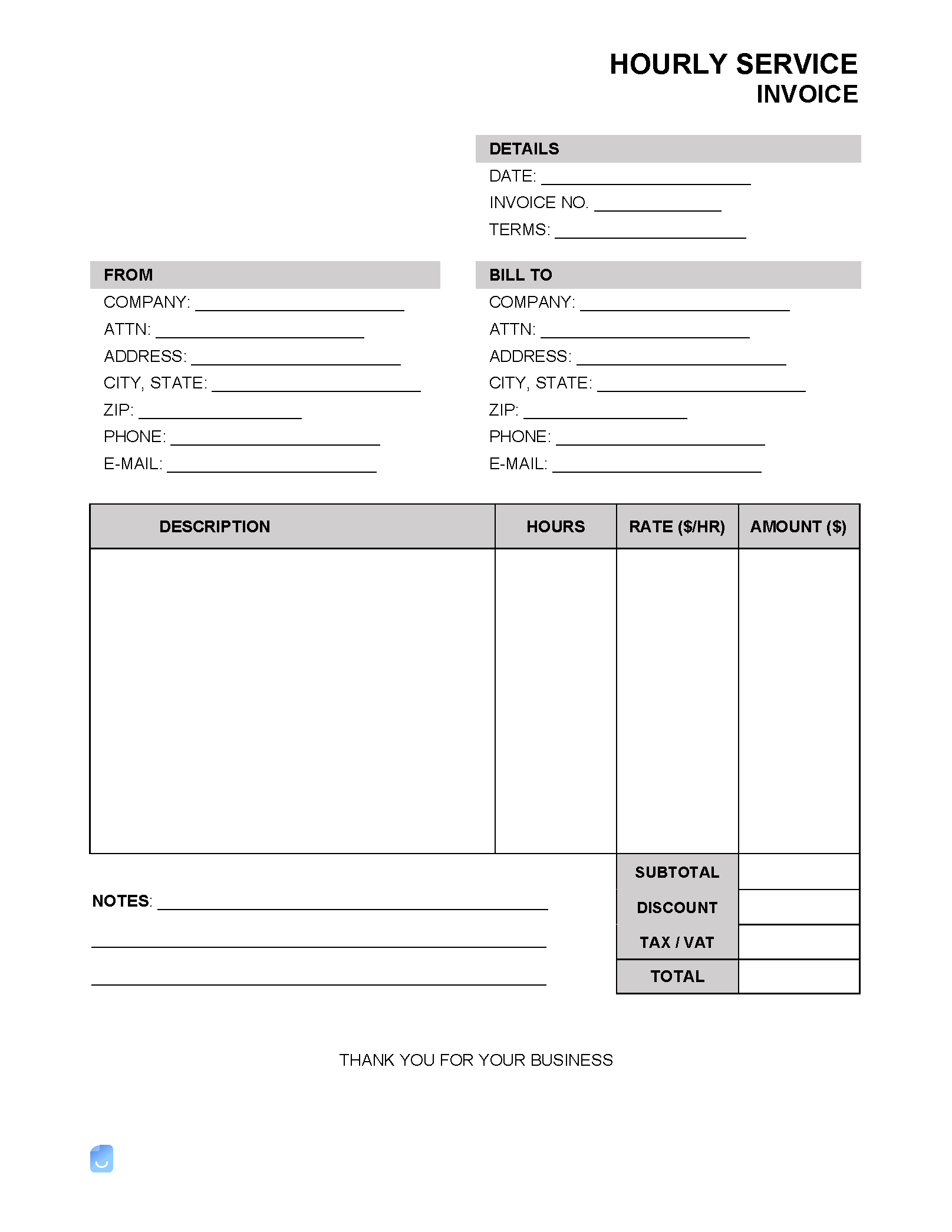

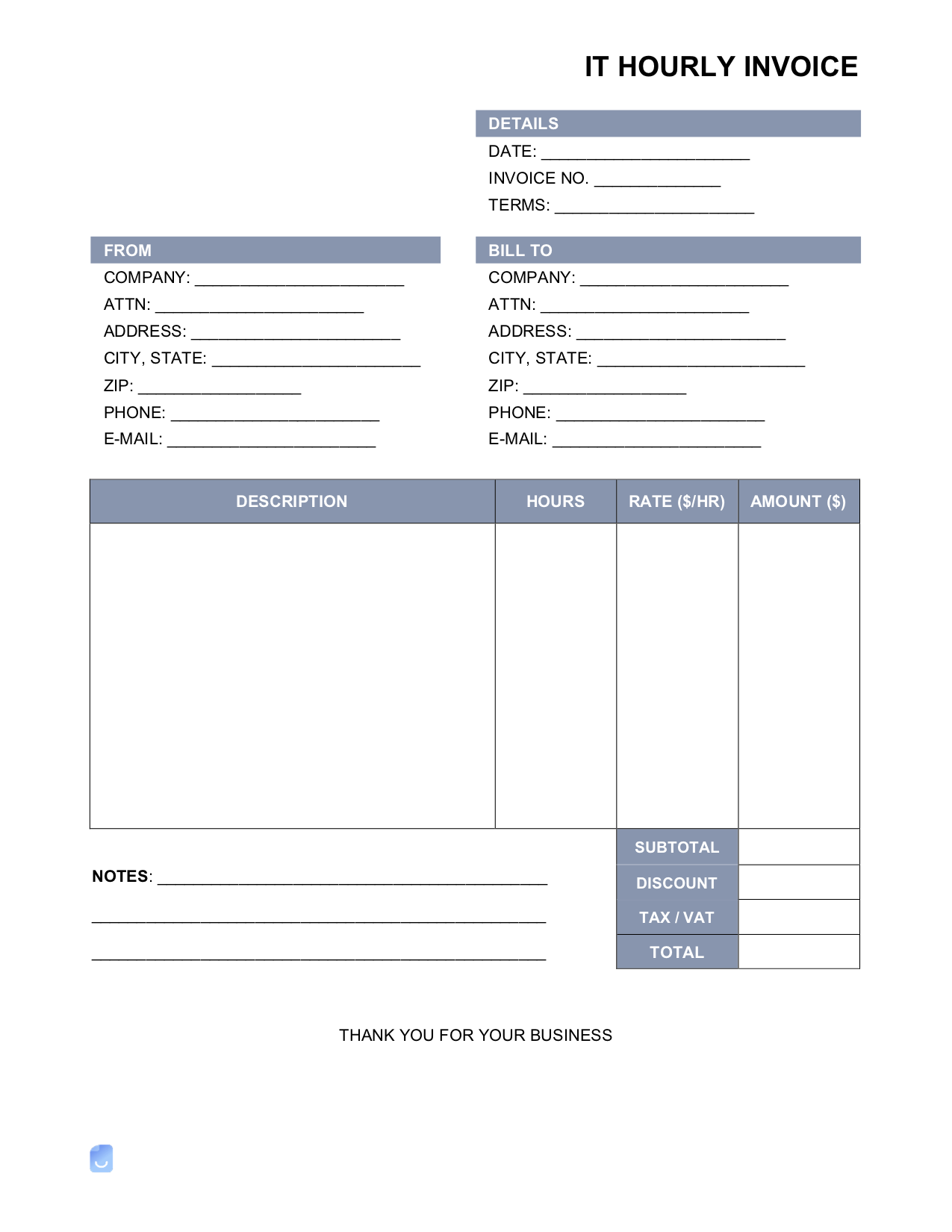

Key Elements of an Hourly Rate Invoice

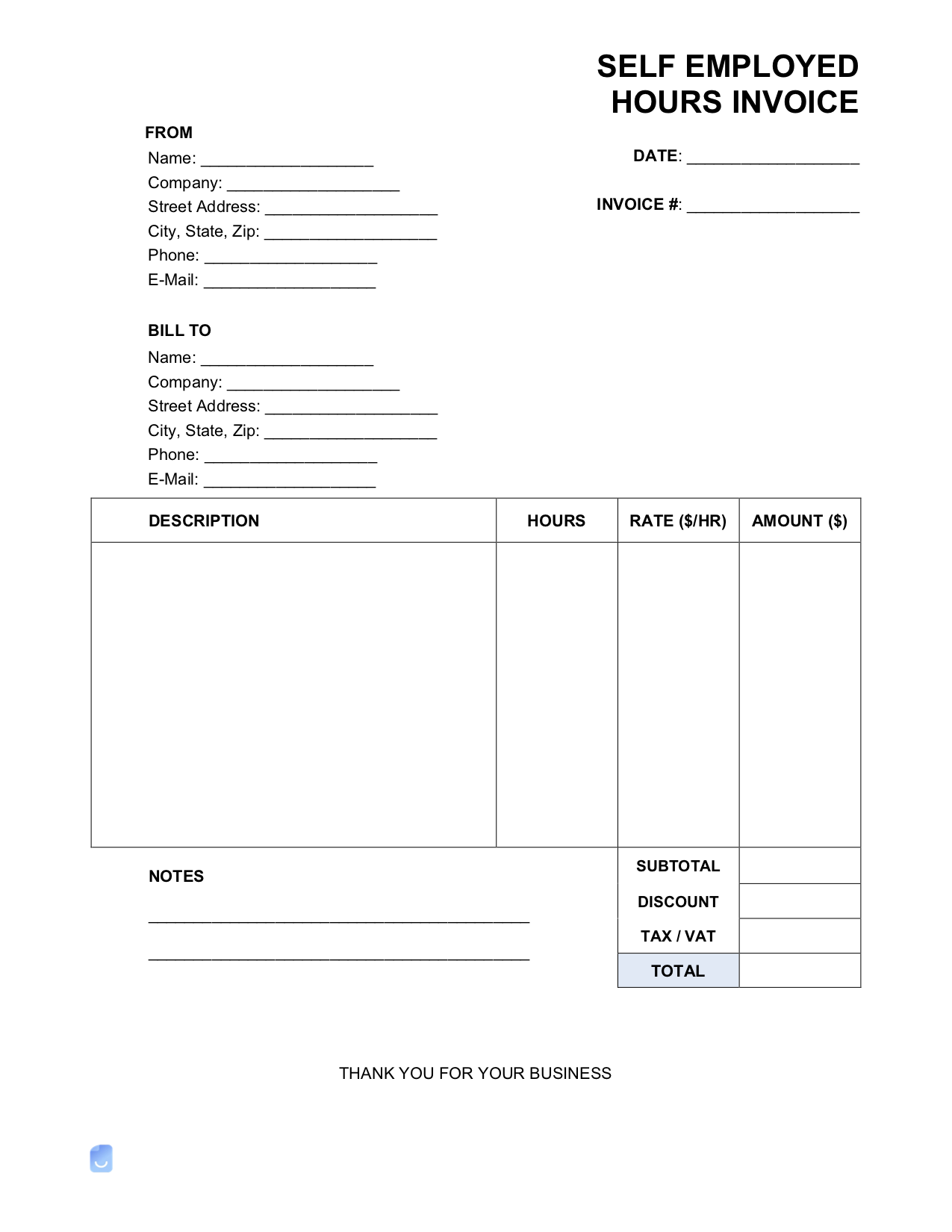

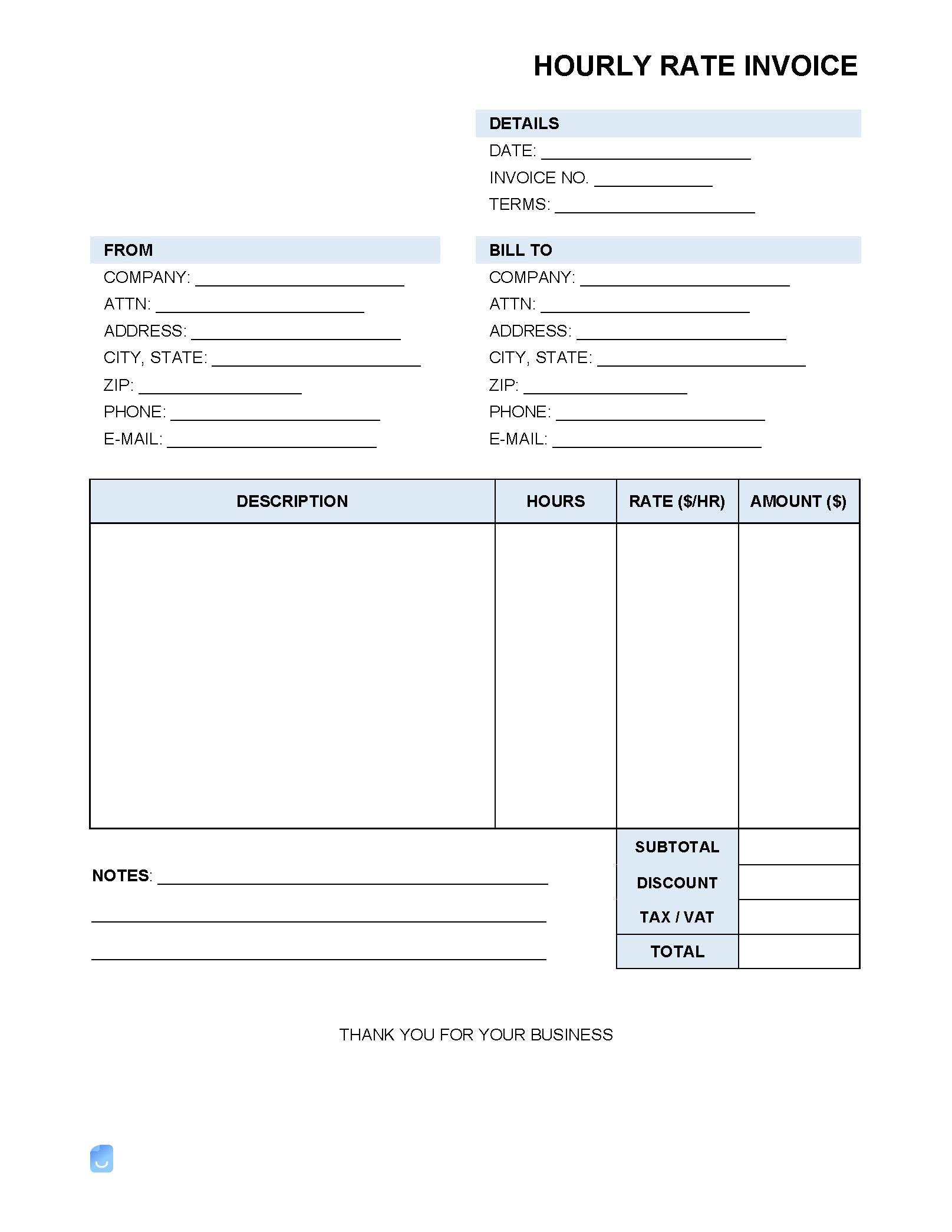

An hourly rate invoice should include the following elements:

- Name and contact details (e.g. address, phone number, business name, etc.) of service provider

- Service provider’s logo (if applicable)

- Name and contact information for client

- Invoice number

- Date

- Description of services rendered or tasks completed

- Charges associated

- Applicable taxes

- Methods for accepting payments (e.g. PayPal, credit card, app-based methods)

- The due date for payment

An invoice can be generated manually using a program such as Google Docs or Microsoft Word, but for greater ease and simplicity, check out online invoice generators or invoicing software.

Benefits of Using an Hourly Rate Invoice

There are many benefits of using an hourly rate invoice when billing for services. Perhaps the most obvious benefit is that it allows you to more accurately track the time you spend working on a project. This can be helpful in ensuring you are fairly compensated for your time and effort. Additionally, it can help to avoid misunderstandings or disagreements about the scope of work to be completed, as the hourly rate invoice provides a clear and concise breakdown of the time spent on the project.

Drawbacks of Using an Hourly Rate Invoice

The main drawback of using an hourly rate invoice is that it can be difficult to estimate the total cost of a project in advance. This can lead to cost overruns and frustration on the part of both the client and the service provider. In addition, hourly billing can create a perception that the service provider is “working the clock” rather than focusing on delivering value. Finally, hourly billing can incentivize service providers to work slowly in order to increase their billable hours.