Bank Details (ACH) Invoice Template

A bank details (ACH) invoice is a form used for formally requesting one-time or recurring payments from a client through their banking institution. ACH (Automated Clearing House) payments facilitate bank-to-bank transactions, allowing customers to pay providers without using credit cards, checks, or cash. Bank transfers, often called “eChecks,” benefit a product or service-based business in several ways compared to more standard billing methods. Advantages include:

- Faster payment processing

- Decreased payment turnaround

- Increased security

- Low transaction costs

- Highly convenient for both parties

In addition to the above points, bank transfers are preferable due to the more definite nature of payments. Unlike credit cards, ACH payments are very difficult to reverse. For an ACH deposit to be disputed and reversed, the transaction would have to have been unauthorized, initiated on the wrong date, or be for an incorrect amount.

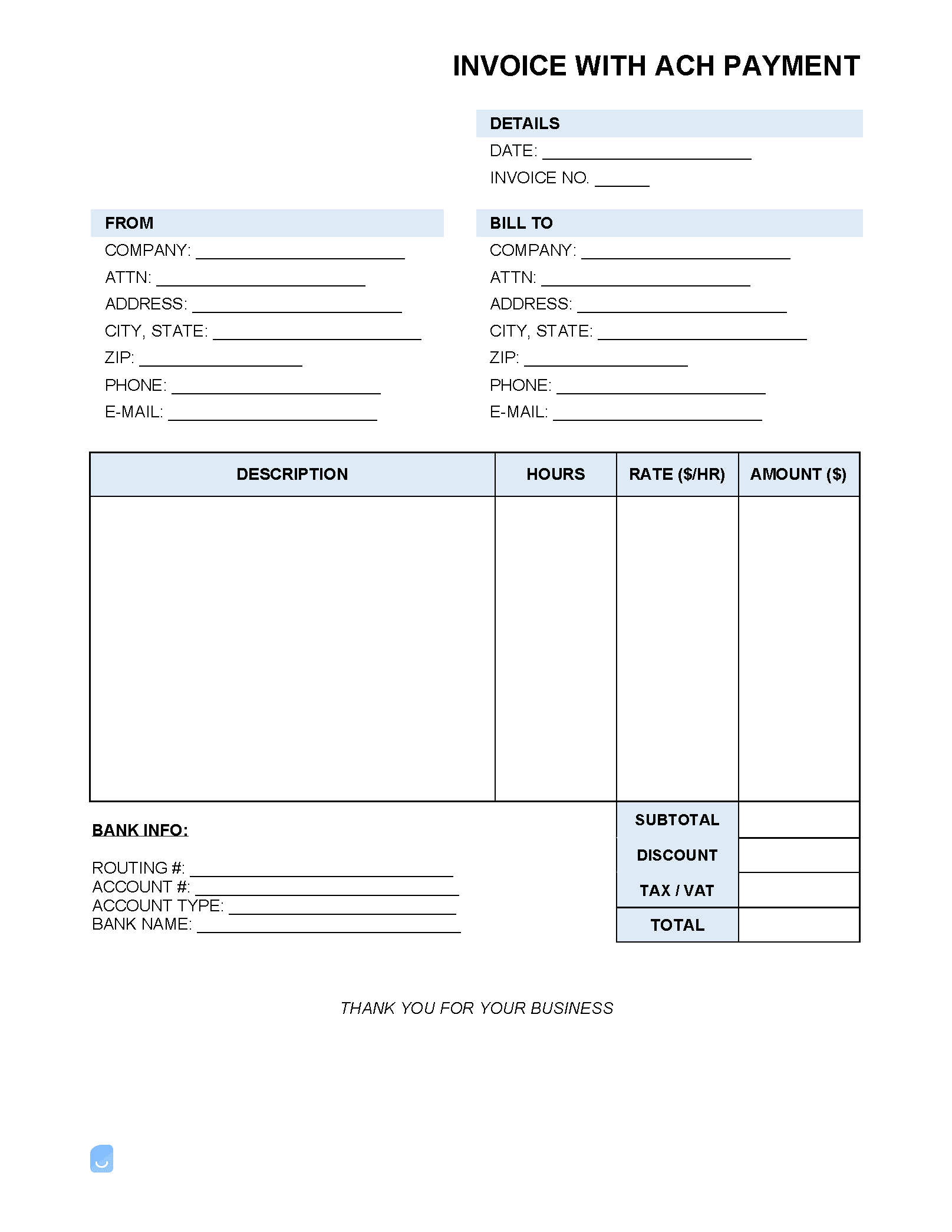

Required Information (ACH Deposit)

To complete an ACH transfer, the issuing company will need to collect the following information from the customer:

- Bank account type (credit/savings)

- ABA routing number (nine-digit code for identifying the bank)

- Customer’s account number

- Full bank/credit union name

Due to the sensitive nature of banking information, companies will need to ensure all invoice documents are kept in a secured location for future accounting purposes.

How Long Does an ACH Deposit Take?

Depending on the financial institution and the time the transfer was initiated, transfers can take anywhere from one (1) to five (5) days. With the more standard time frame consisting of three (3) to five (5) days.

Difference Between a Bank Wire and ACH Transfers

With both wire transfers and ACH transfers being electronic means of moving money from one location to another, confusing the payment methods with each other is an easy mistake to make. Although many minute differences separate the payment types, the following are the major separating features:

- Cost – The average cost of an ACH transfer is between $1 and $3. On the other hand, wire transfers cost between $10-$45 depending on if the transfer is domestic or international as well as the transferring institution.

- Transfer speed – Wire transfers are almost always same day (unless after 5pm local time). ACH deposits, however, can take up to five (5) days to arrive in the recipient’s account.

- Security – Both transfer methods are very secure. However, wires are often preferred by the recipient due to them being impossible to retract. In comparison, bank transfers can be reversed in certain situations.