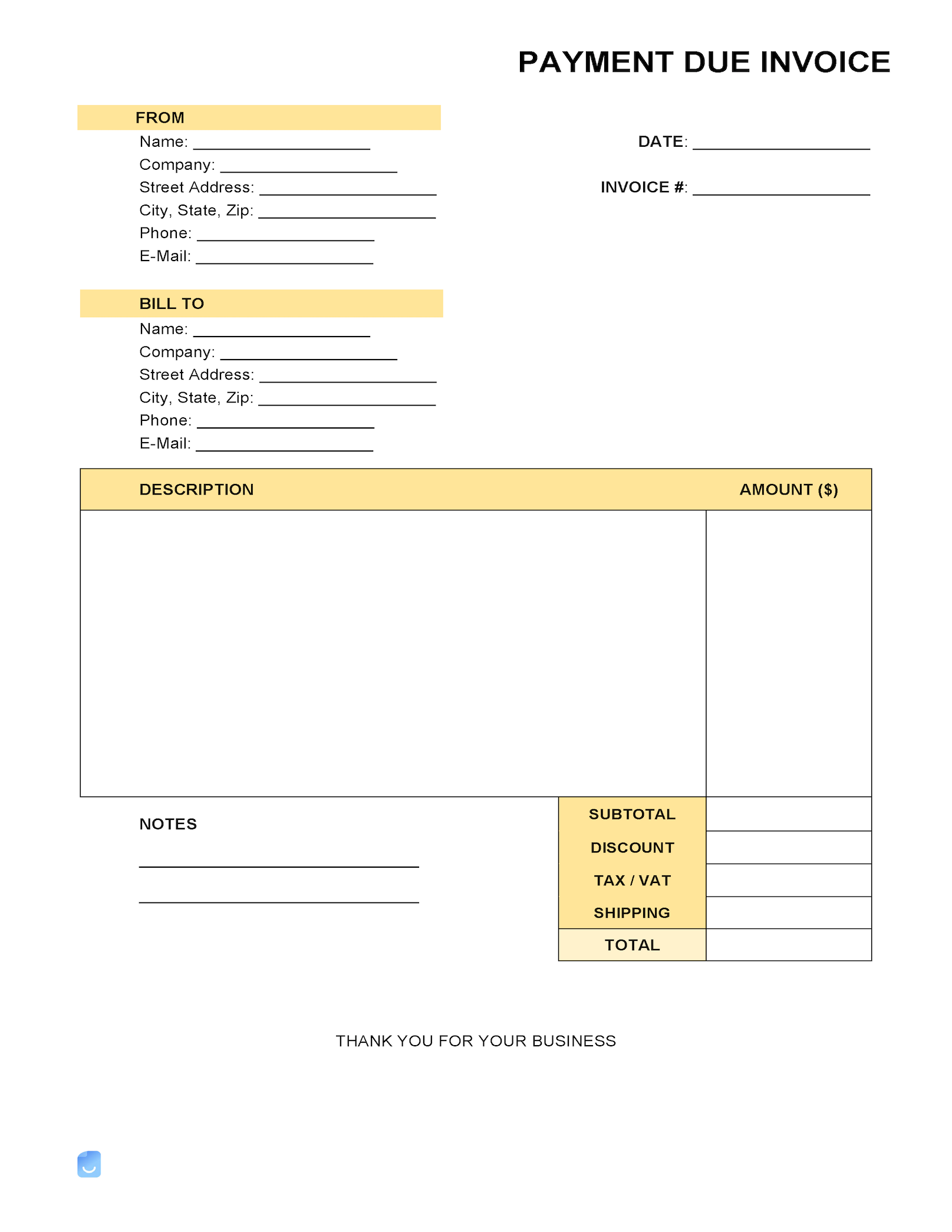

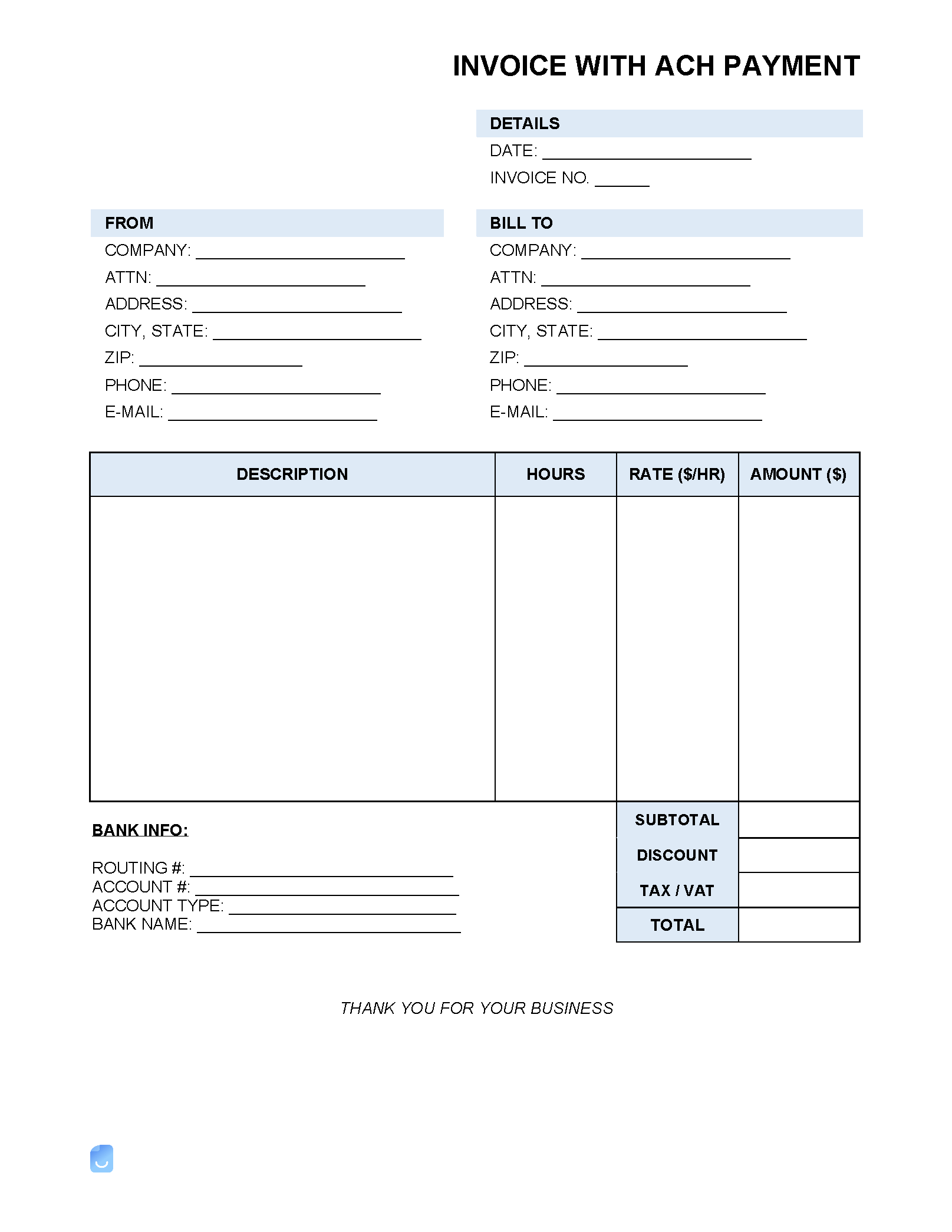

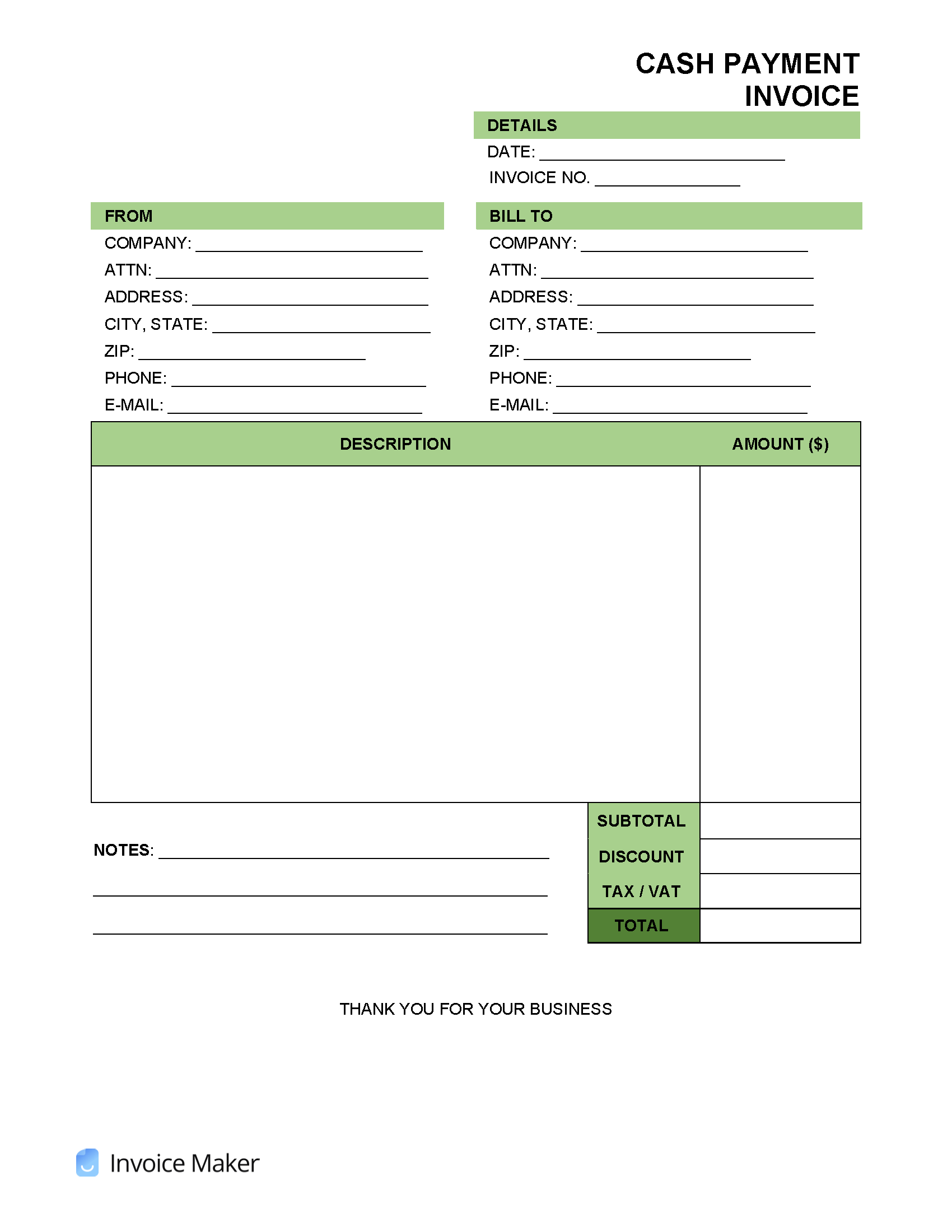

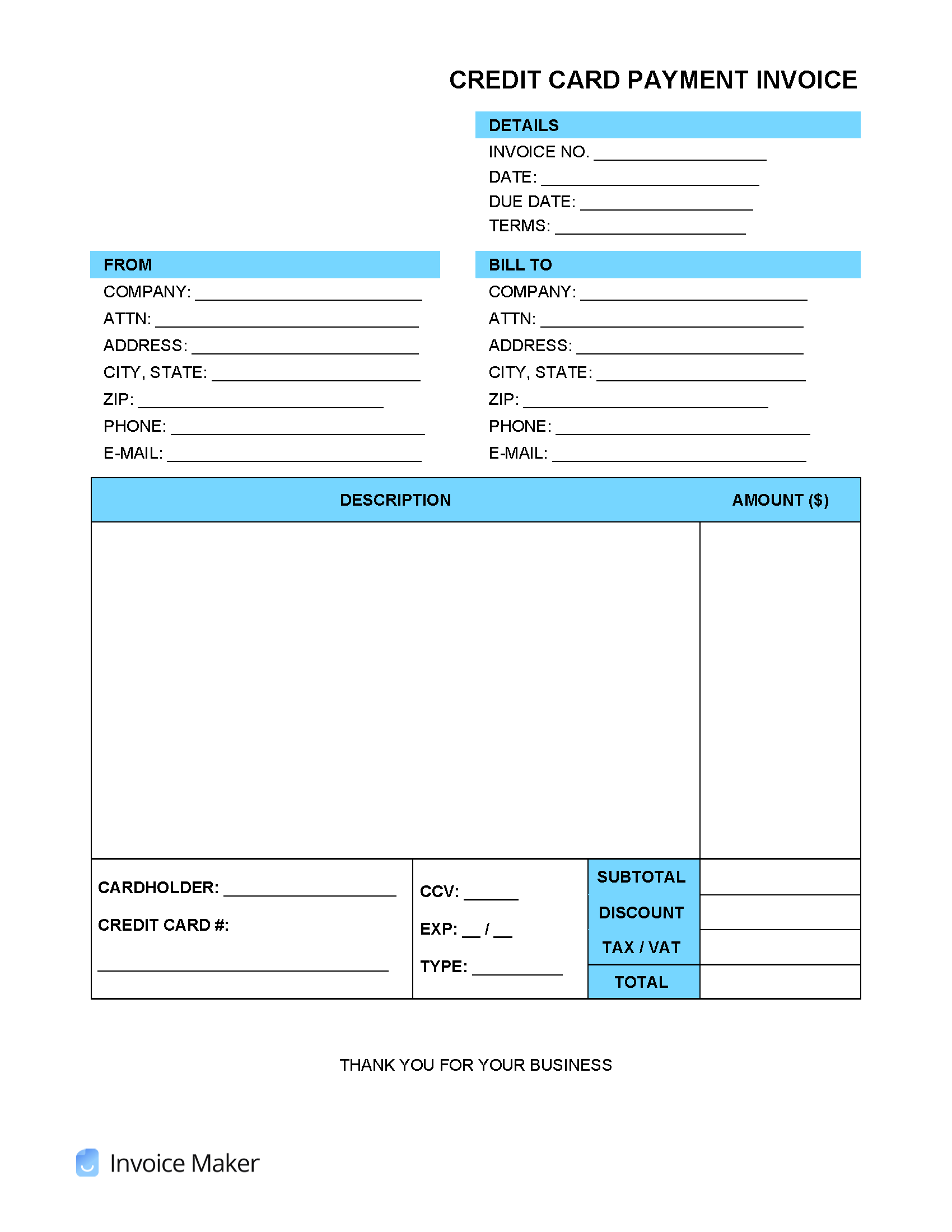

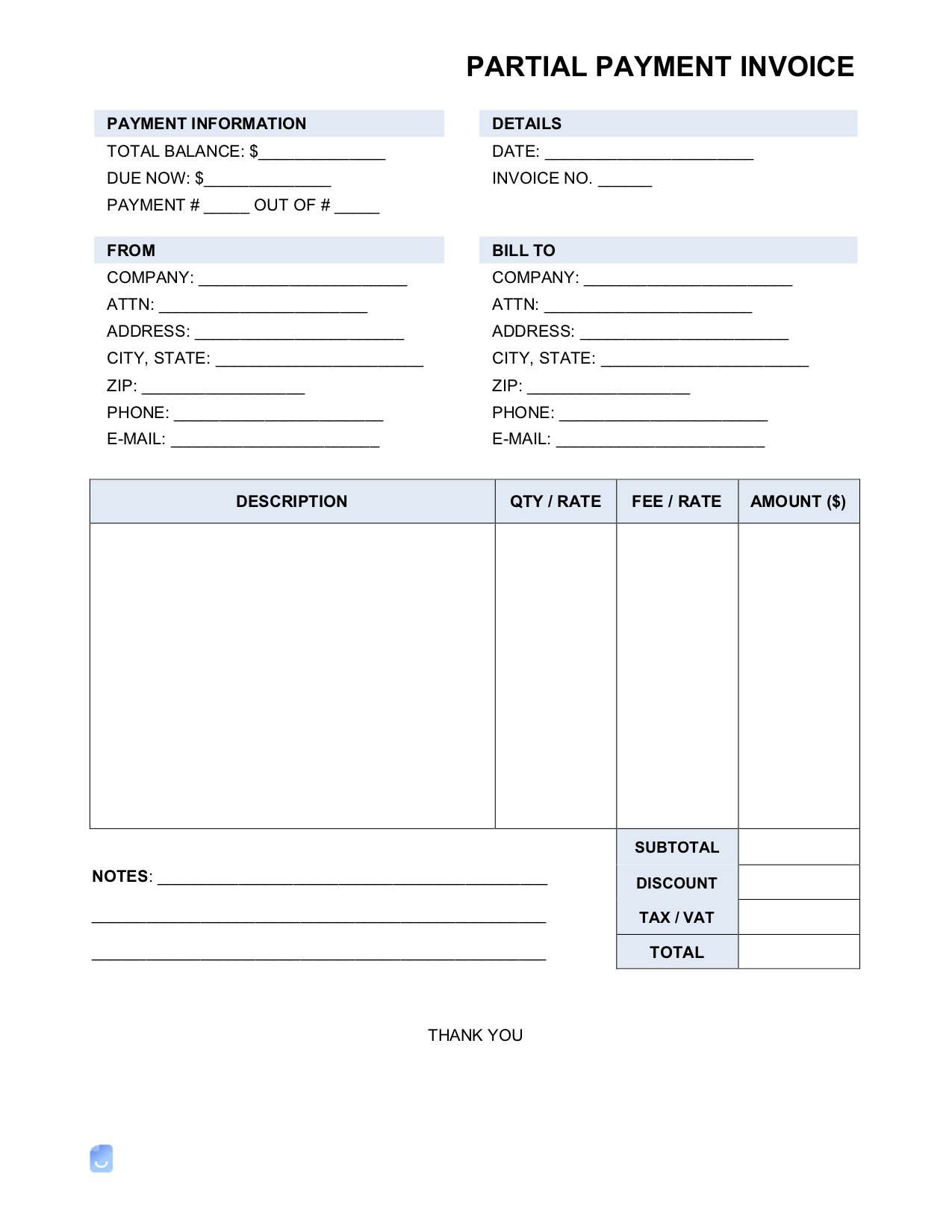

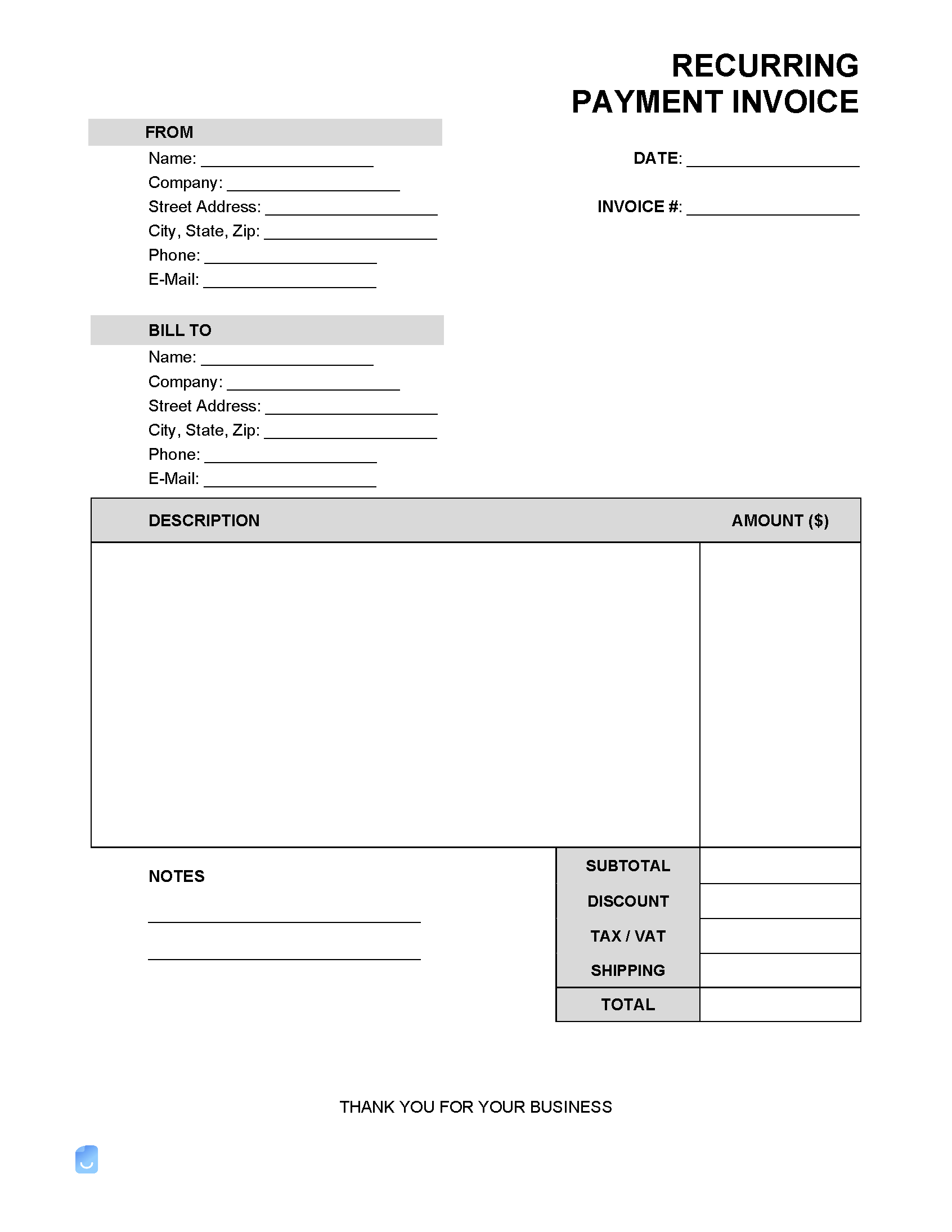

Payment Due Invoice Templates

A payment due invoice requests a form of payment for a balance owed. This may be for any type of purchase of goods or services made by a client. When a payment is due, it should be paid as soon as possible or else late fees and penalties may occur after 30 days.

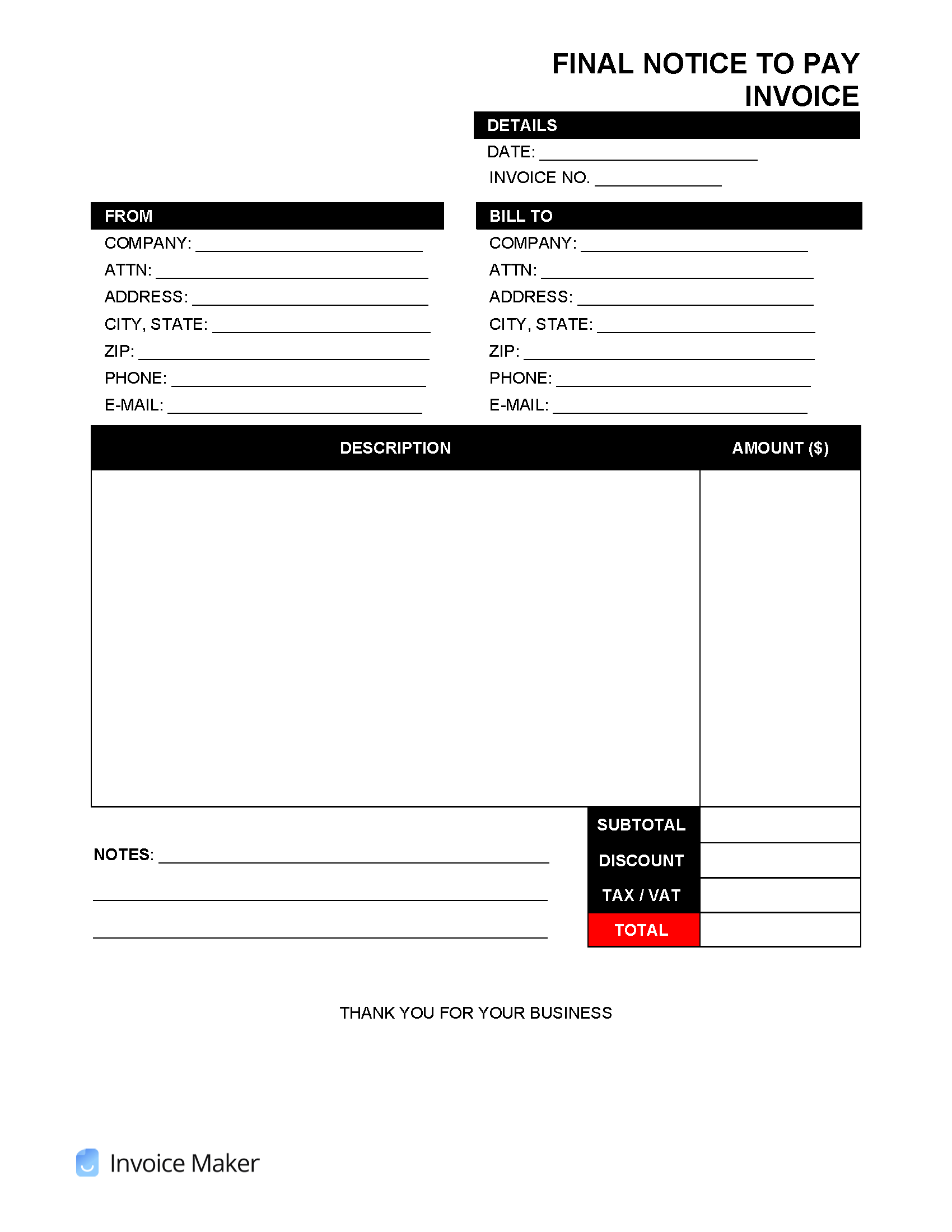

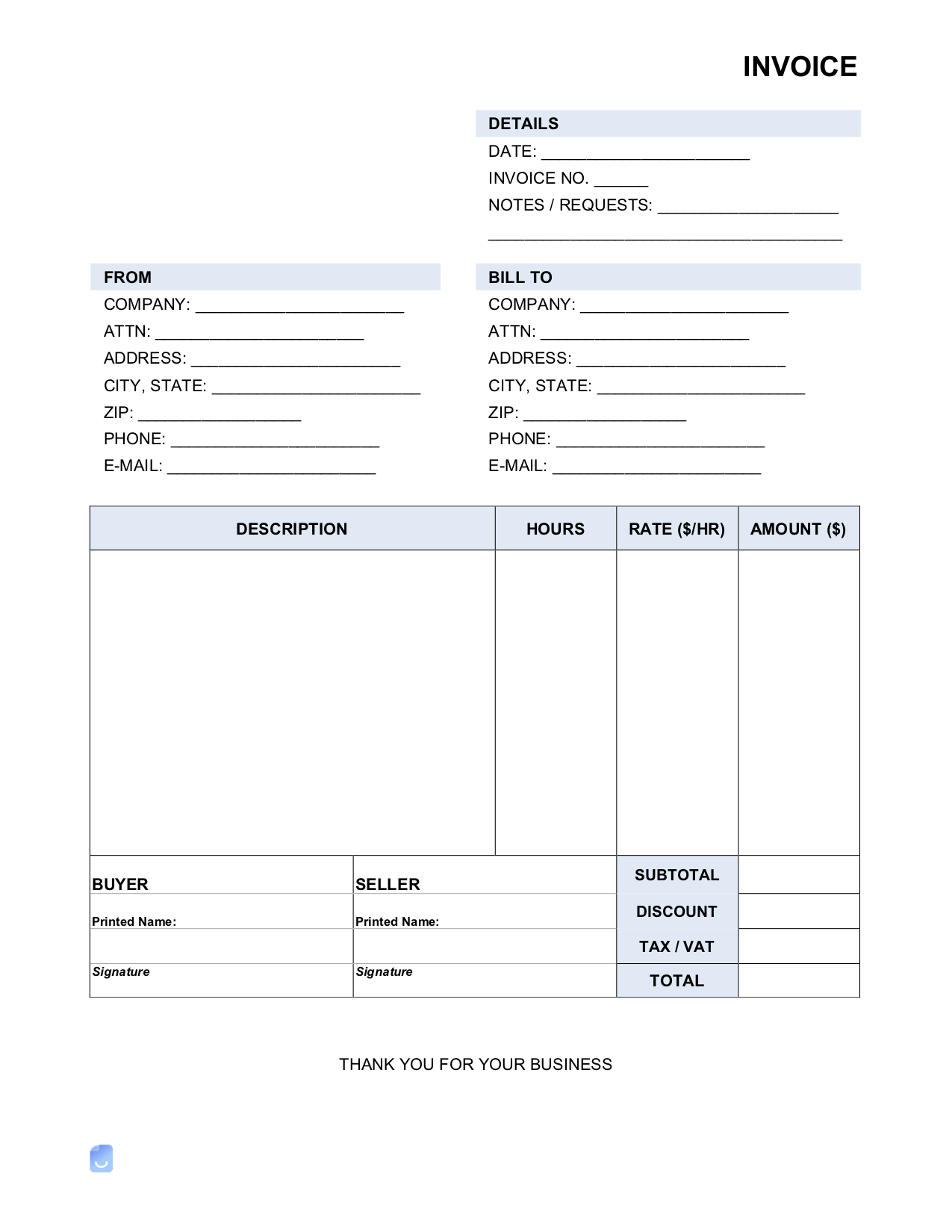

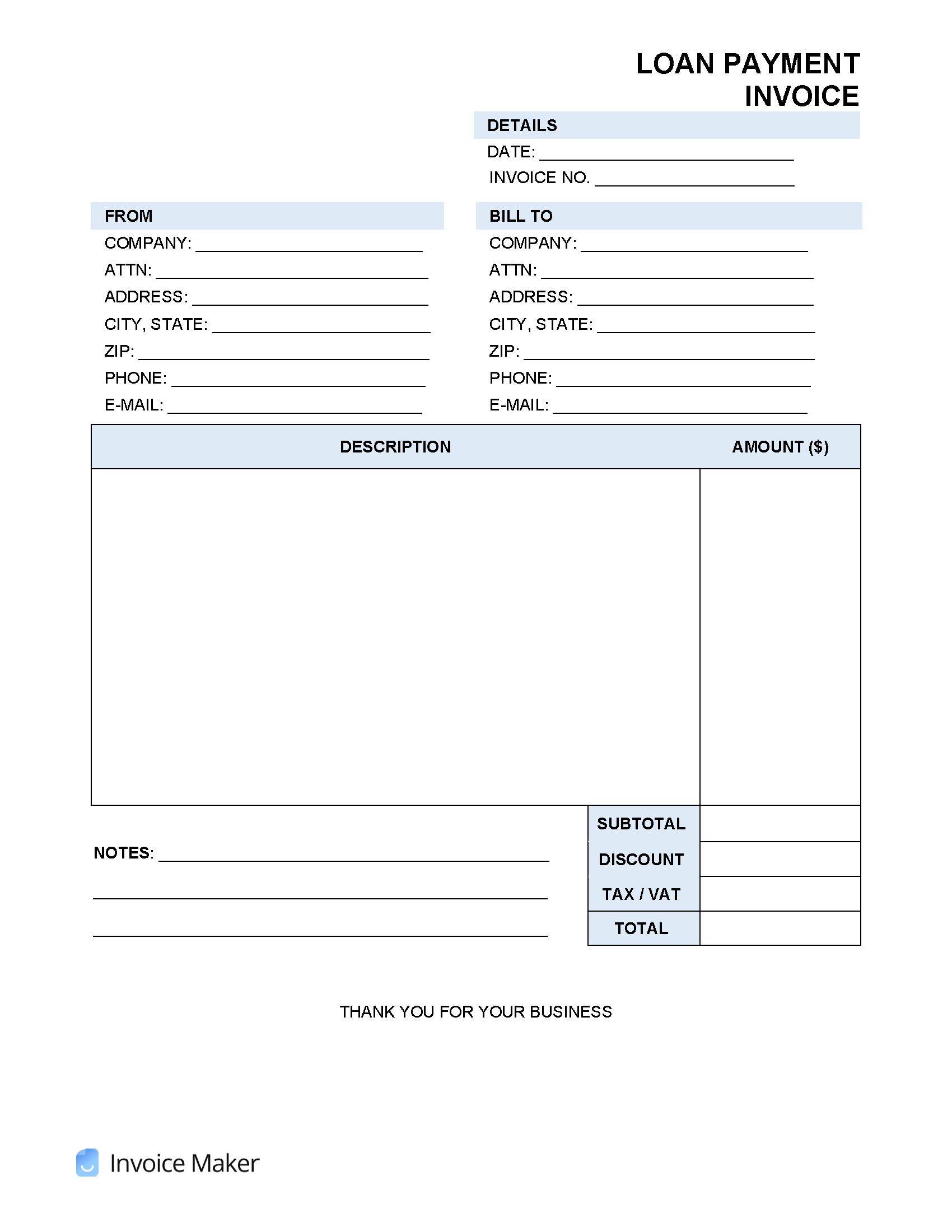

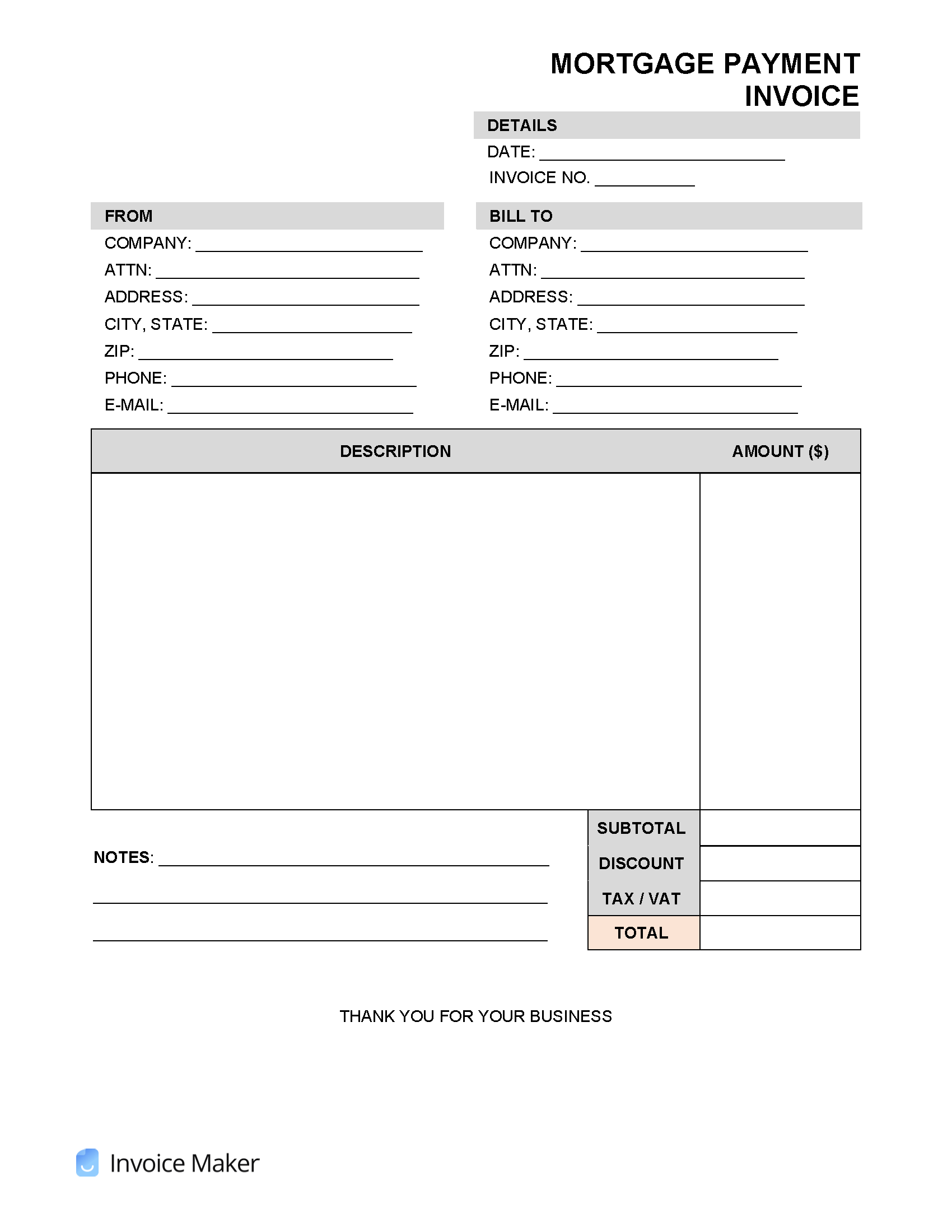

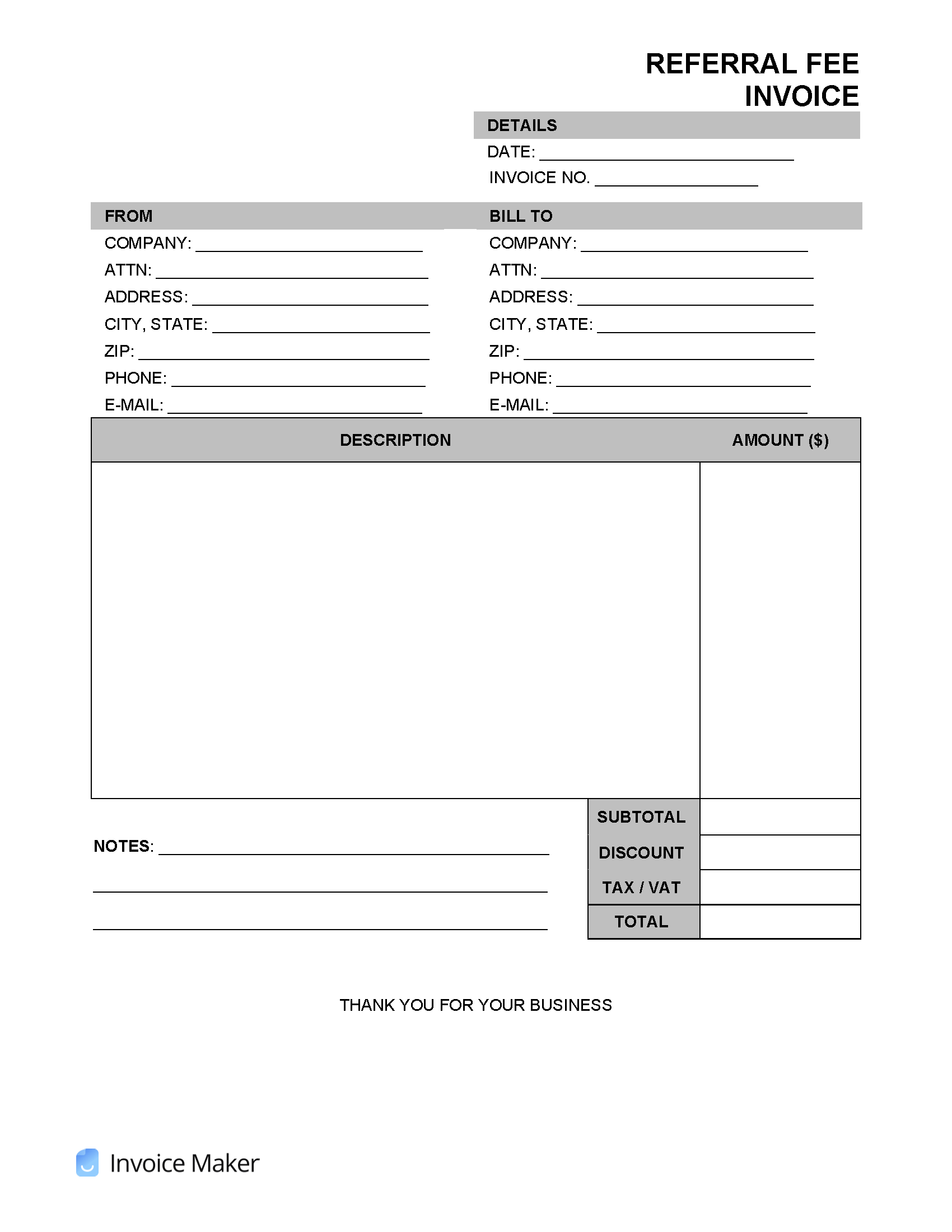

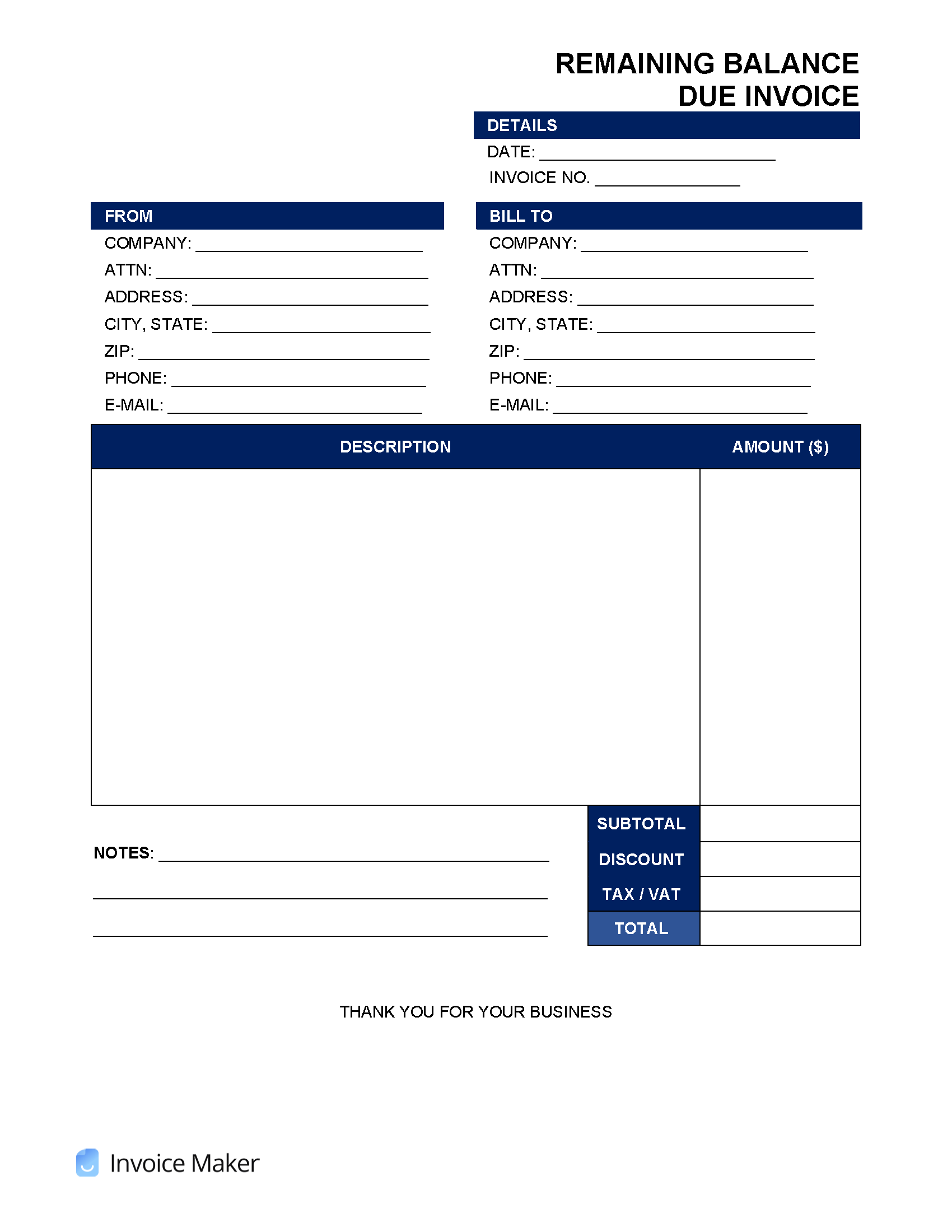

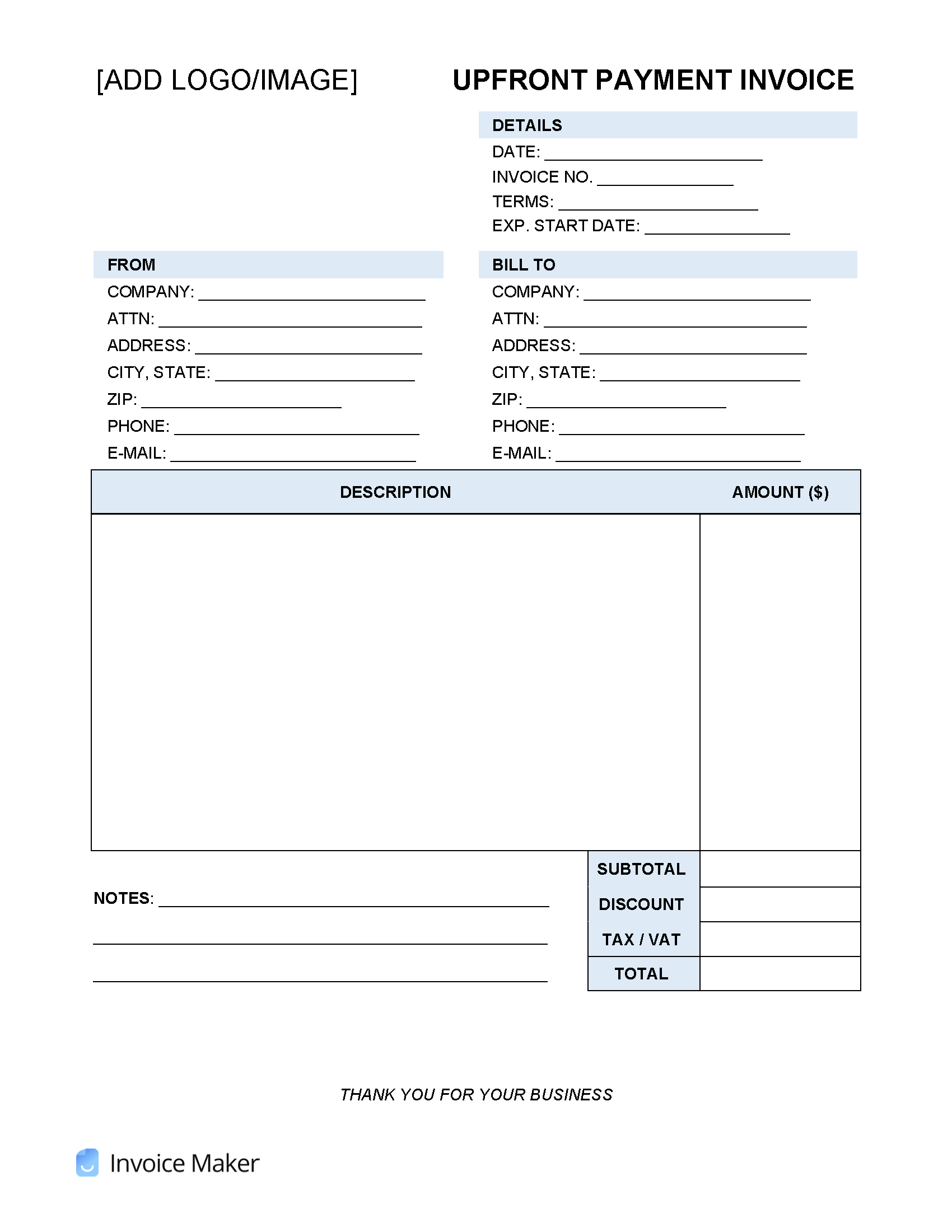

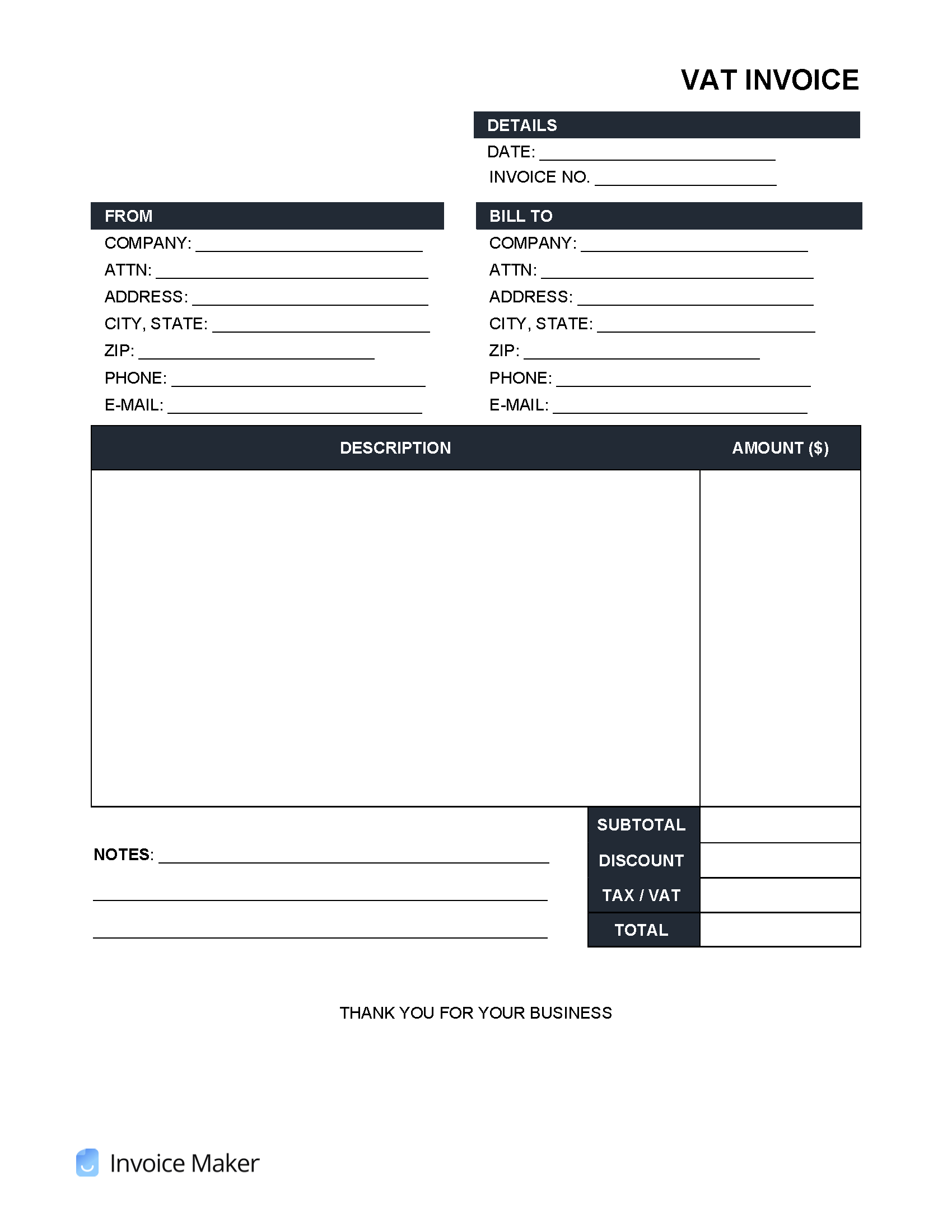

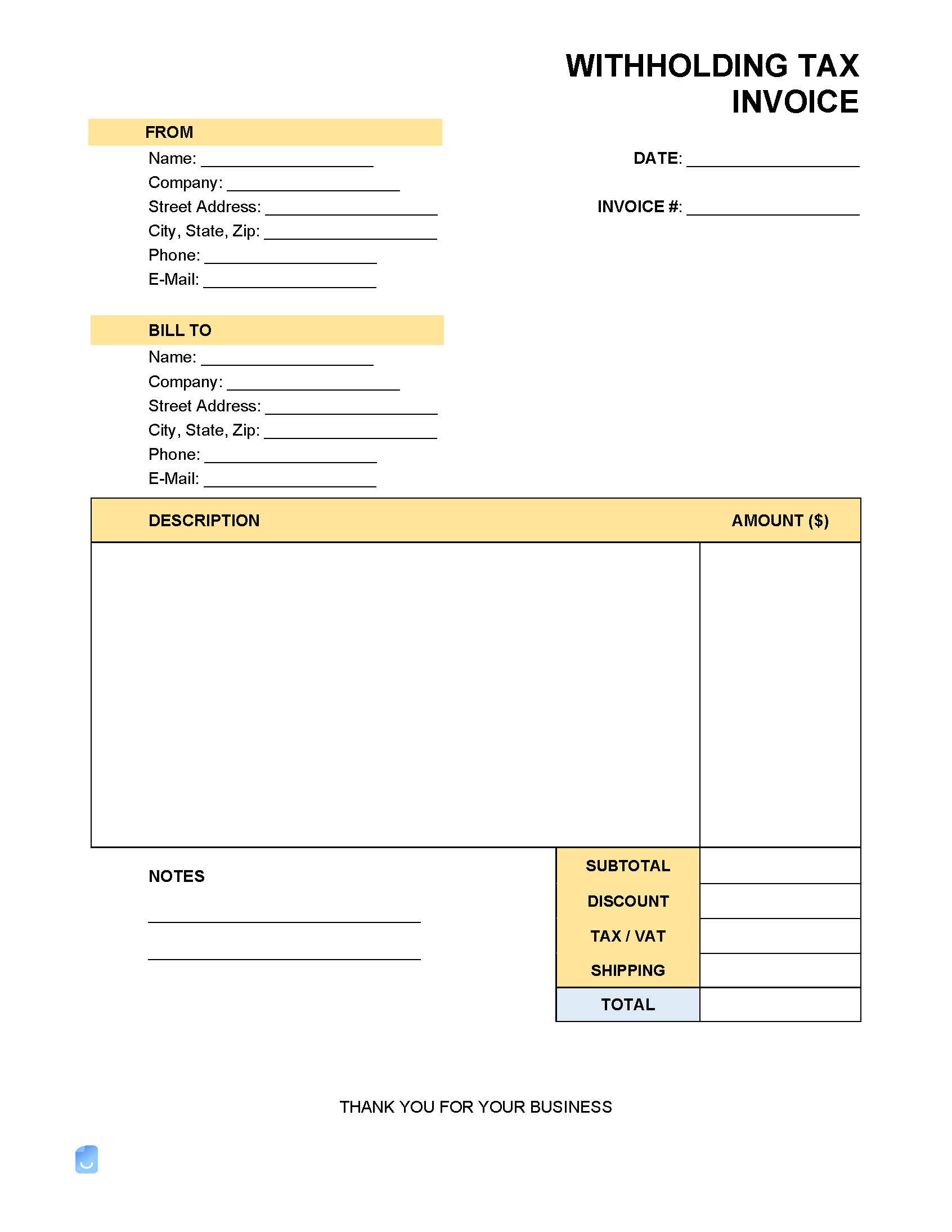

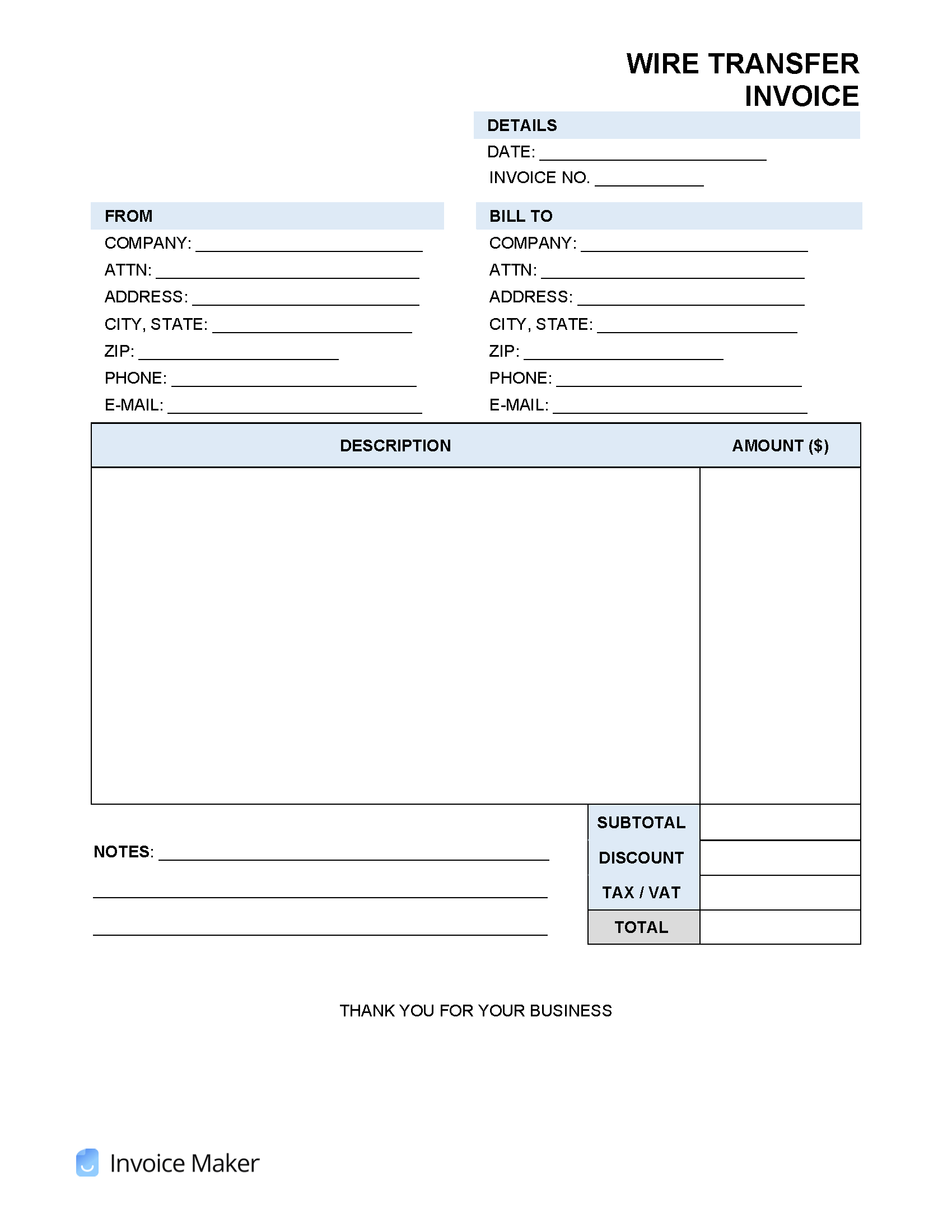

By Type (17)

Payment Due Meaning

An invoice or a letter stating “payment due” is a declaration by a creditor to a debtor that a debt (payment) is owed on a certain date. When it comes to credit cards, a letter or statement claiming a payment due must be taken very seriously. Defaulting on a payment can affect a person’s credit negatively. As for all other types of accounts claiming a payment due, there is typically more flexibility when paying a payment due requested via an invoice. Types of documents that are common to have a payment due:

- Bills sent out monthly (utility, water, heat, etc.)

- Credit card statements

- Gym memberships

- Mortgage loan payments

- Insurance premiums

Minimum Payment Due

A debtor will only see a statement offering the ability to pay a minimum payment on a credit card statement. Banks that issue credit cards to cardholders, believe it or not, actually want the cardholder to only pay the minimum payment so that the bank can collect interest on the remaining balance. Most people are unaware of the consequences of only paying the minimum payment, which should be avoided if the cardholder has the funds to pay off the entire amount.

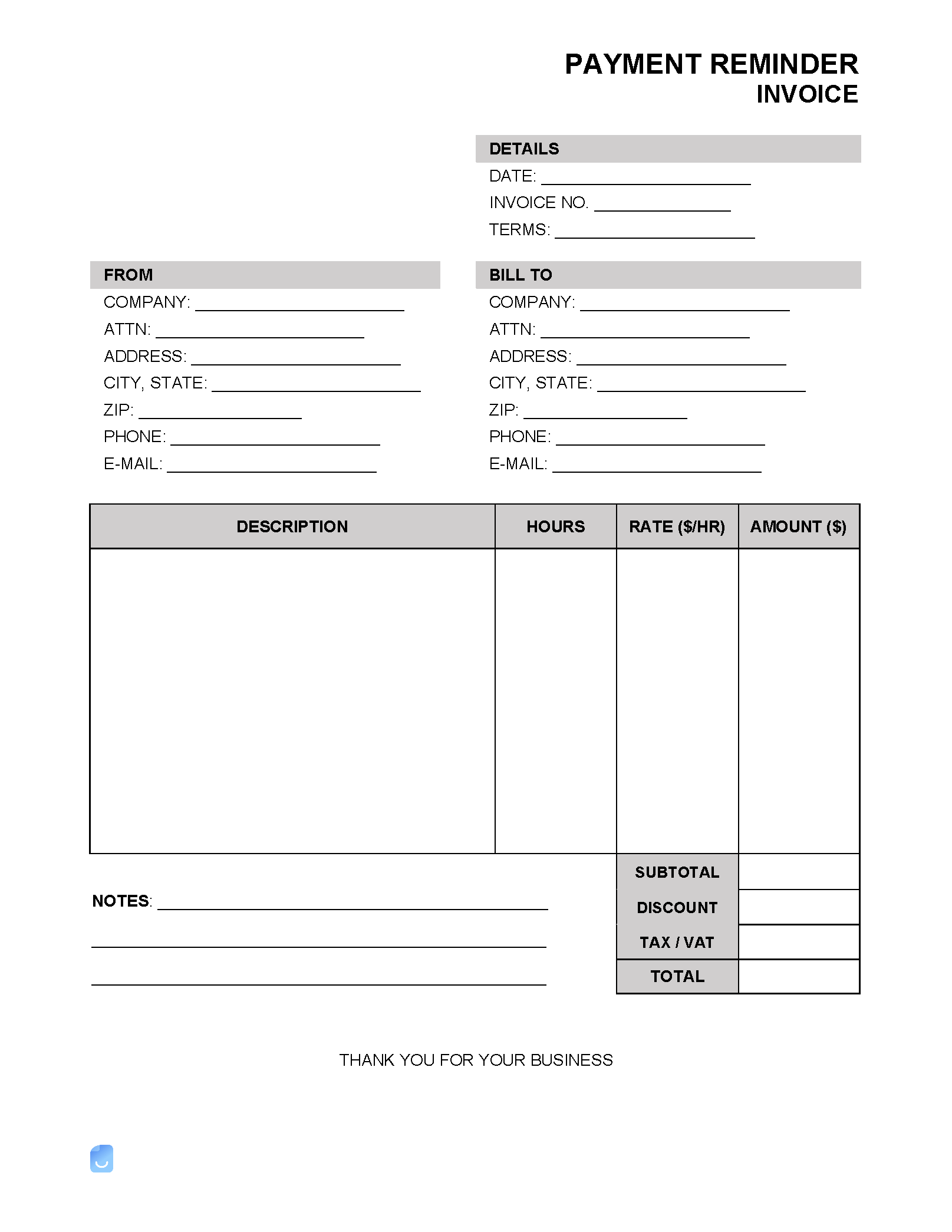

Payment Due Date

When a payment is due, there will always be a due date “demanding” the money to be paid. In some cases, there are penalties for not paying on the due date. For example, with credit cards, there are harsh penalties when the debt is not paid by the due date. Debtors are allowed to make payments owed before the due date if they wish. This rule may not apply in some situations when an individual will incur a prepayment penalty on loan. Therefore it’s always best to check with your credit/bank provider before making a payment before the due date.

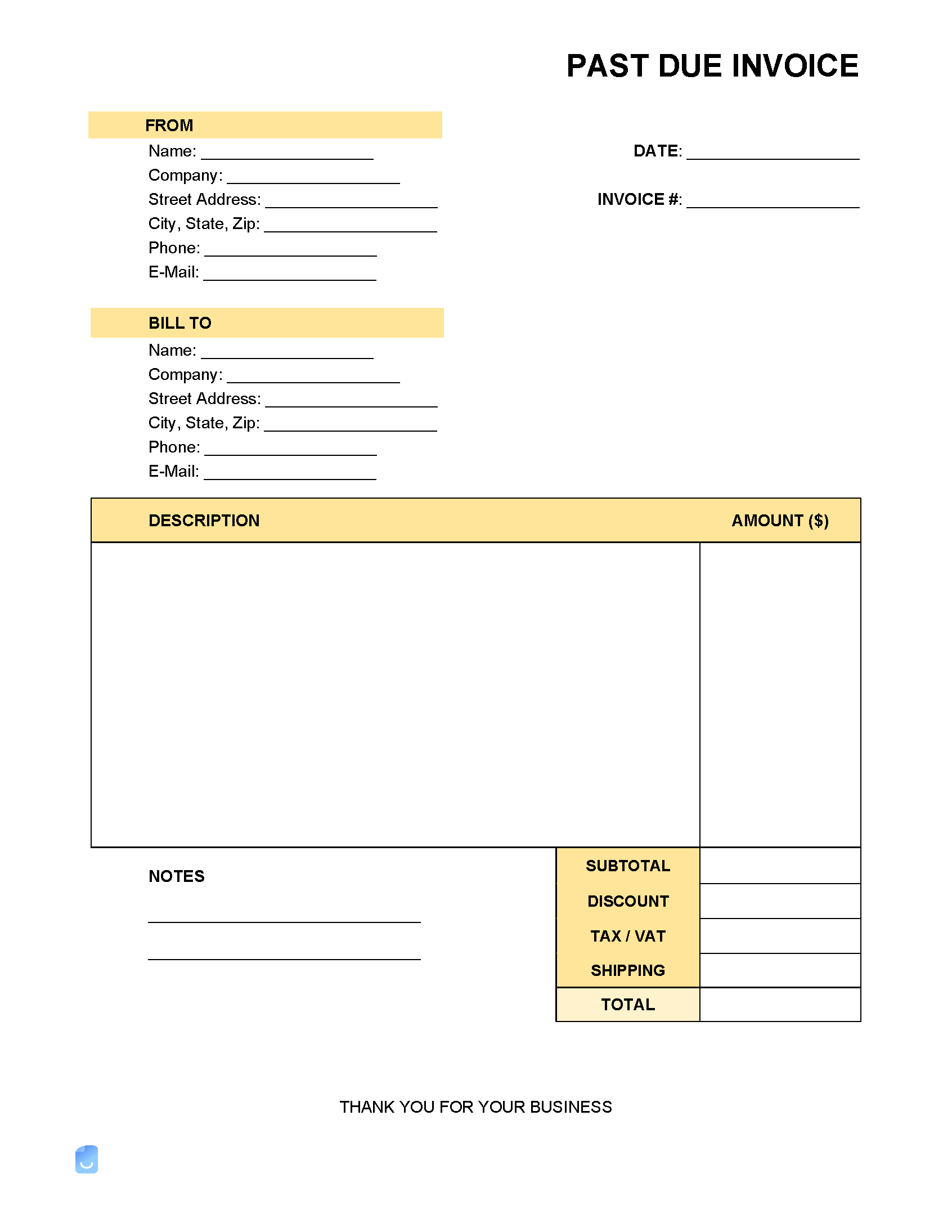

Past Due Payment

A past-due payment is an outstanding balance by a debtor that must be paid. Typically, a past due payment will have incurred charges (late fees, penalties) added on to the original balance, which must be paid as well. A past-due payment will have a new payment due date, which if late again – more serious penalties and fees will be racked up. Ultimately, if a past due payment goes without being paid, the lender will send the debt to collections which will hurt the debtor’s credit score until it is cured.