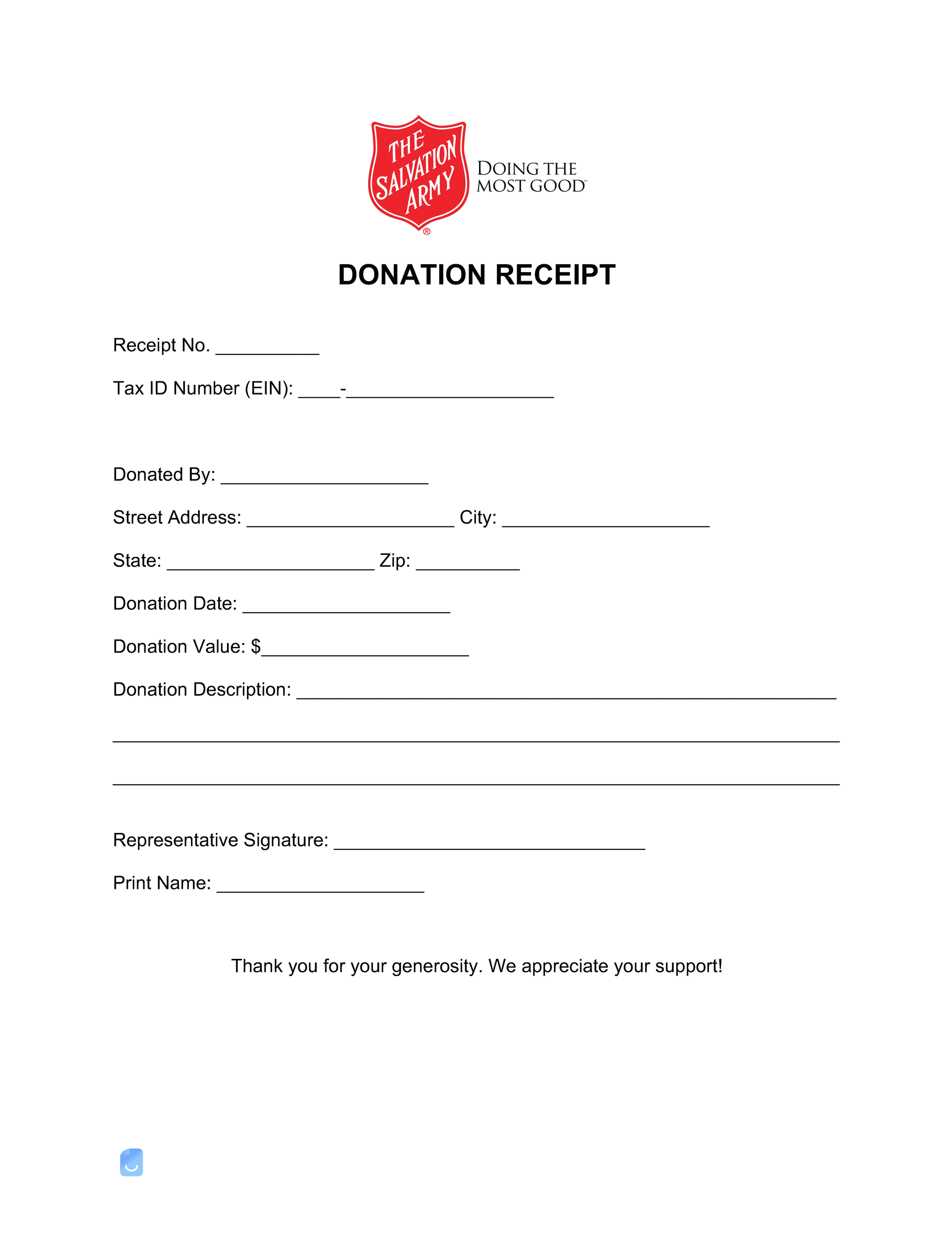

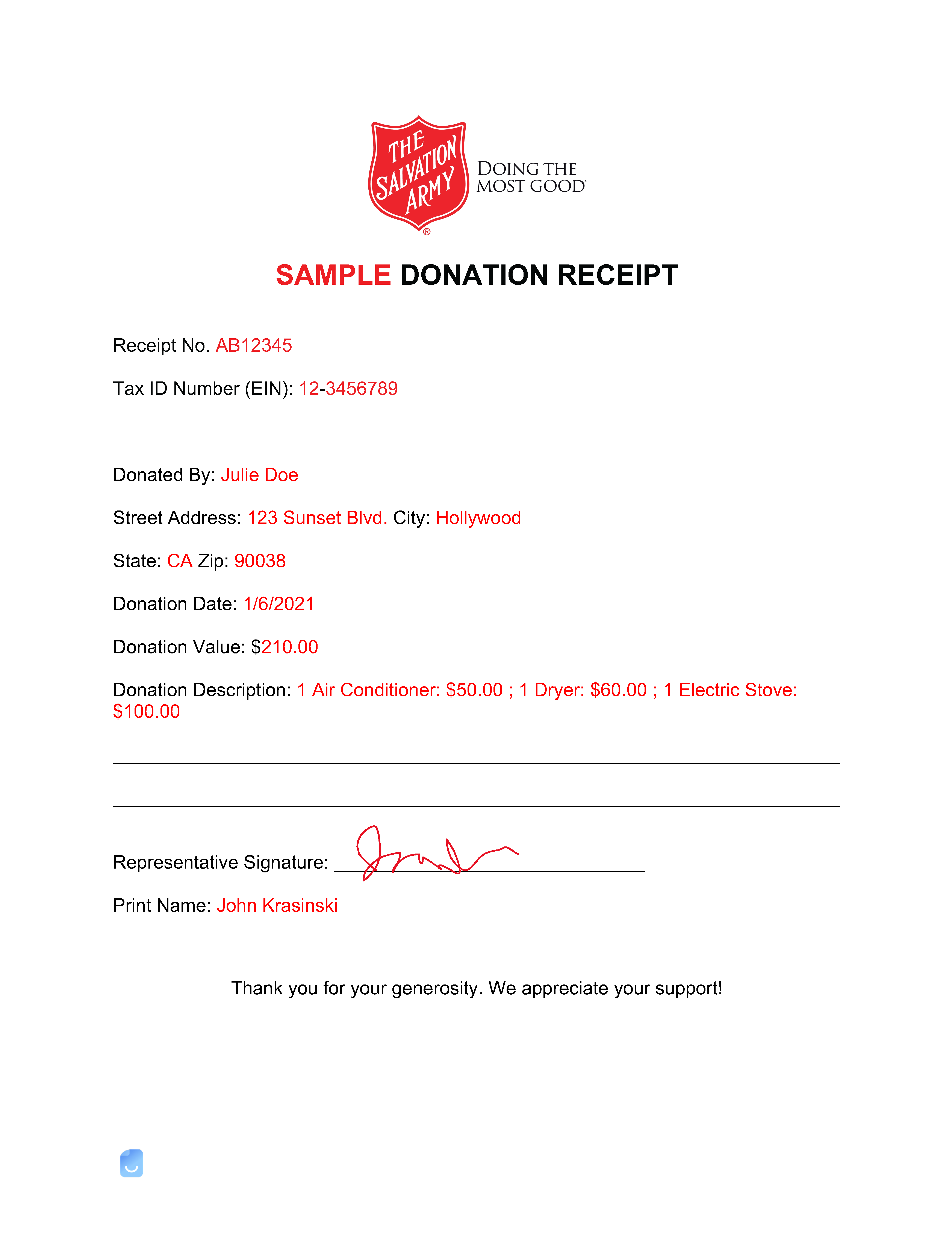

Salvation Army Donation Receipt Template

A Salvation Army donation receipt is used to claim a tax deduction for items donated to Salvation Army. The Salvation Army, which has hundreds of locations across the country, is a 501(c)(3) organization and accepts almost anything of value, even unused airline miles. To determine the value of your donated items, see the Salvation Army’s Donation Value Guide.

Receipt Request

For items donated to Salvation Army, donors fill out their own receipts by downloading the template on this page. After completing the lines on the form, including a list of donated items and their estimated value, present the receipt to a Salvation Army employee receiving your donation so that they can provide a signature at the bottom.

Donate

Find a Salvation Army donation center using this location finder to make a donation of clothing, household items, or any other item of value. To schedule a free pickup, visit this link or call 1-800-SA-TRUCK (1-800-728-7825) for more information. Salvation Army also accepts contributions of the following: Donate Money – You can make a one-time or a monthly contribution via PayPal, credit card, or a direct bank deposit. Donate a Vehicle – To donate a vehicle, you will need to have a clear title and the owner’s information, including the VIN number. Donate Bonds, Funds, Stocks, and IRA Rollover – The Salvation Army has four territories covering all 50 states to handle complex financial donations. Planned Giving, Wills, and Gift Annuities – Planned donations are a good alternative when deciding what to do with end-of-life assets. Donate Airline Miles – Accepts airline mile donations from your United Airlines or Delta account.