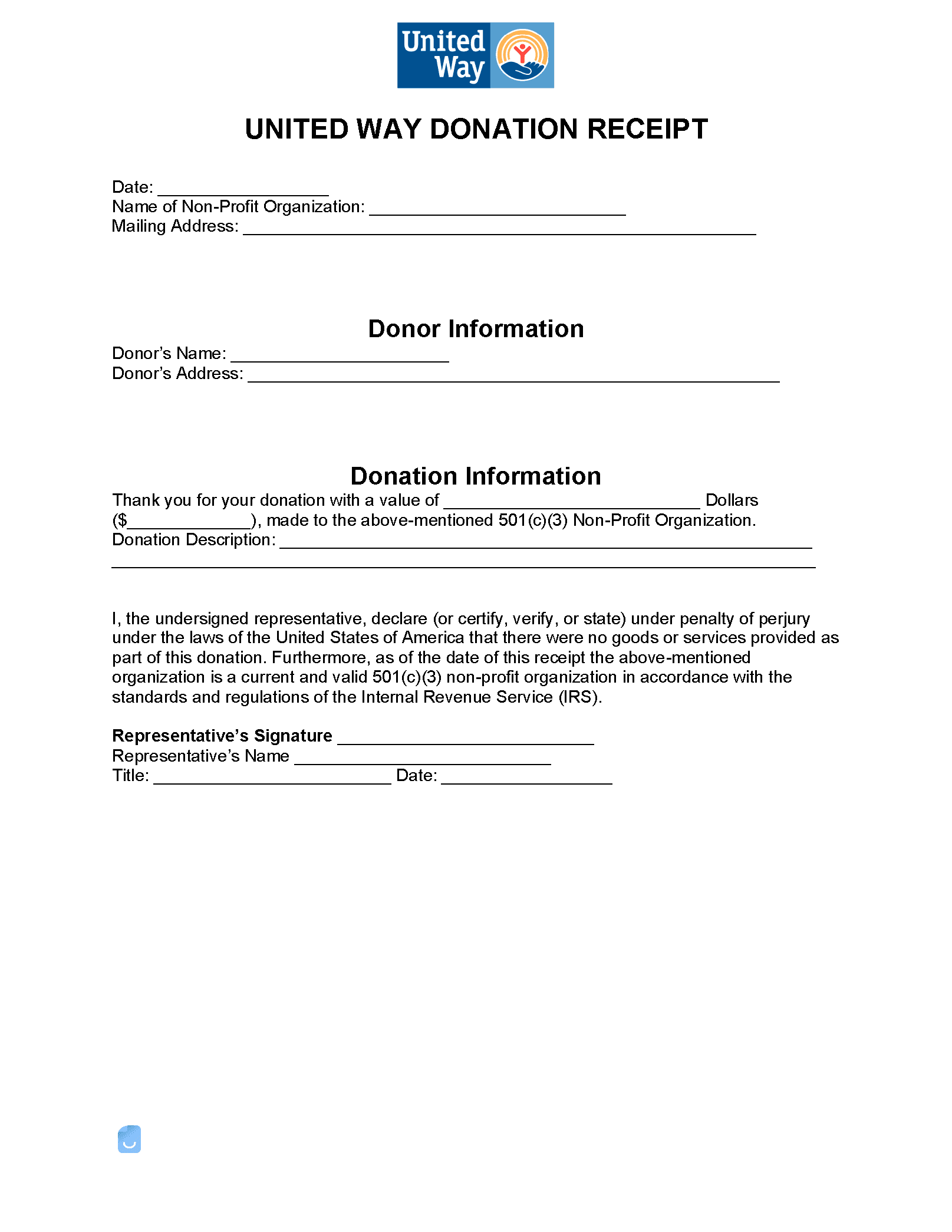

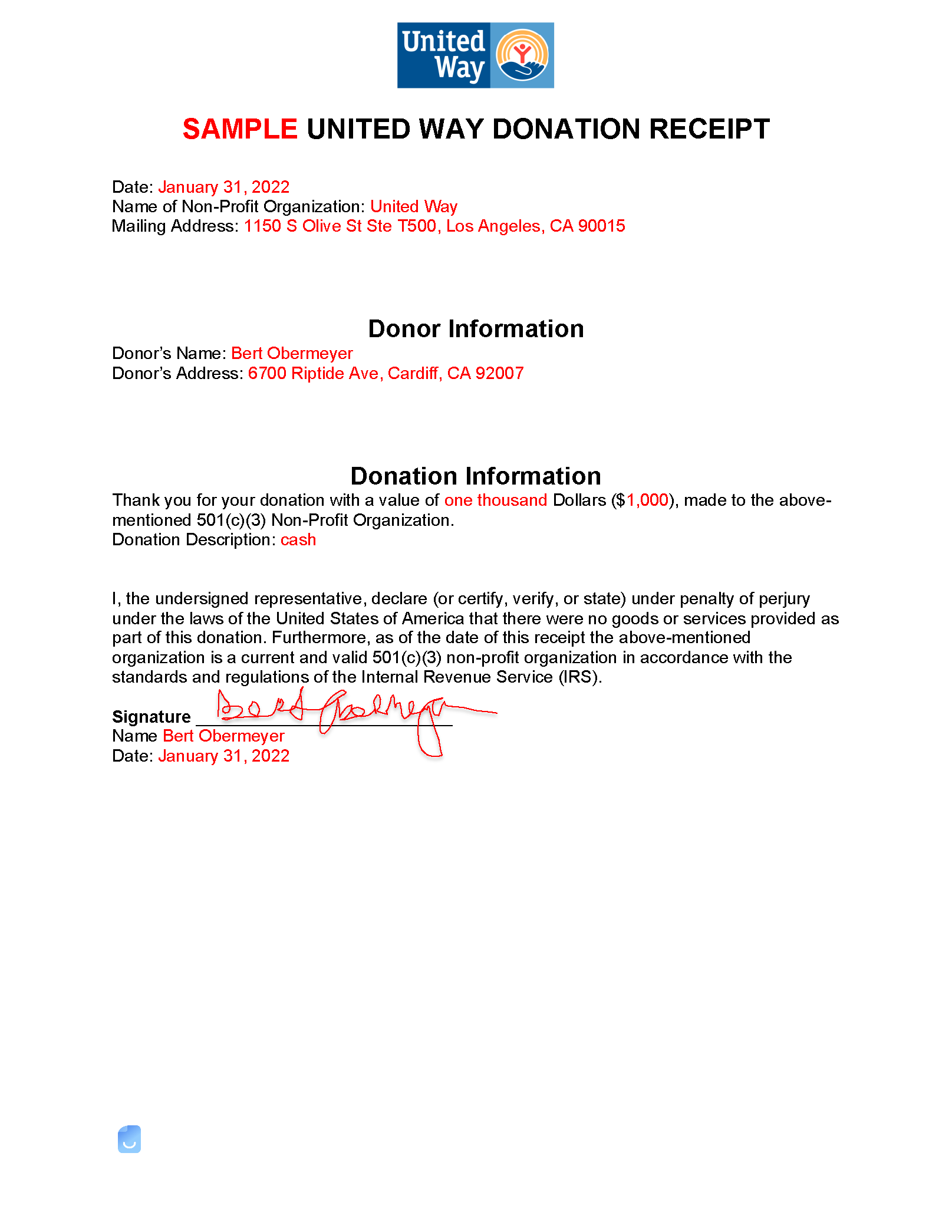

United Way Donation Receipt Template

A United Way donation receipt is proof of a donation submitted to United Way, a charitable organization focusing on health and education for low-income persons. In order for offerings to be considered tax-deductible, a valid receipt must be kept by donors.

Receipt Request

Donations larger than $250 require a receipt in order to be valid for deduction purposes (26 U.S. Code § 175(f)(8)(A)). Contact United Way to request a receipt.

Donate

United Way accepts single or recurring monthly donations. Make a donation to United Way and keep the receipt as proof of a tax-deductible contribution. United Way’s Federal Tax ID number is 13-1635294.