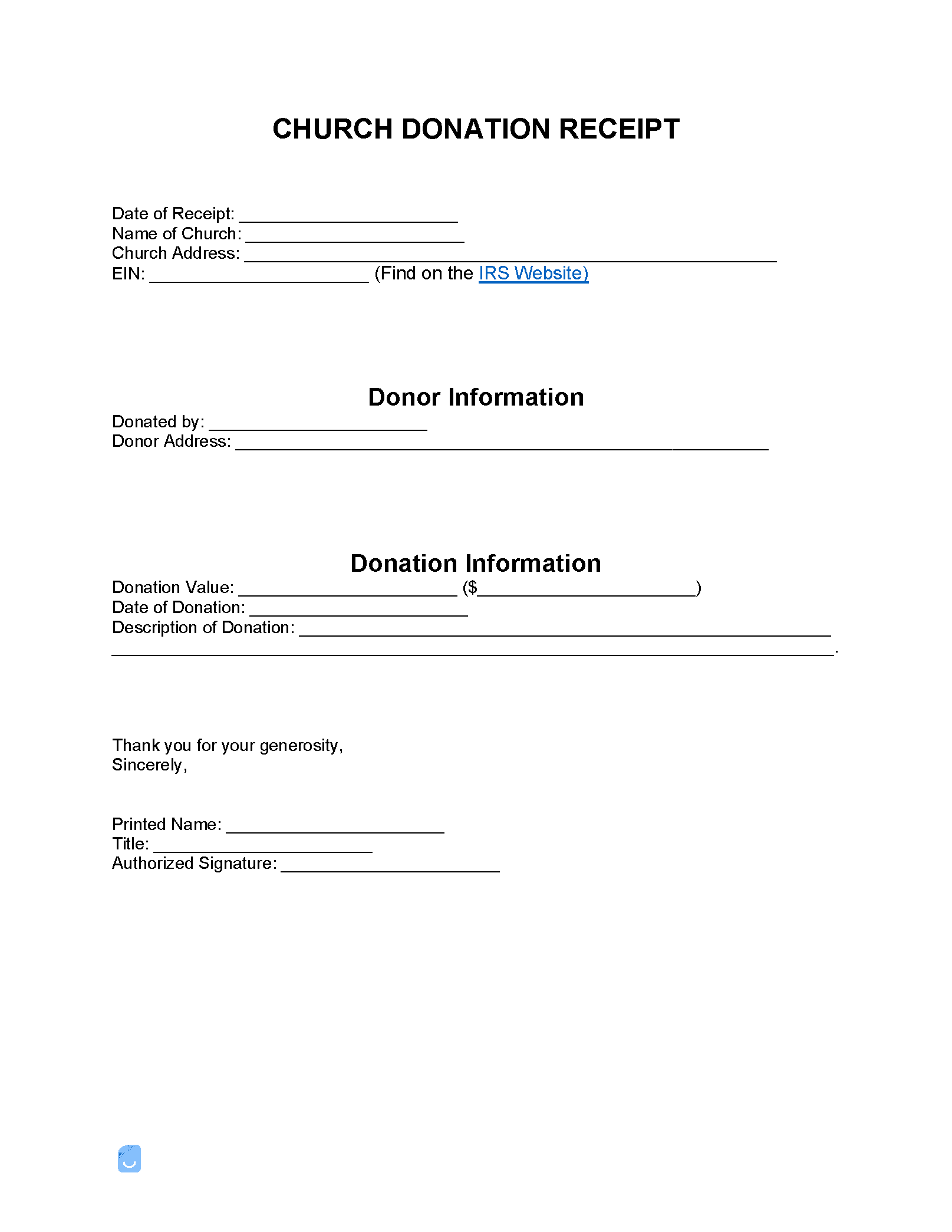

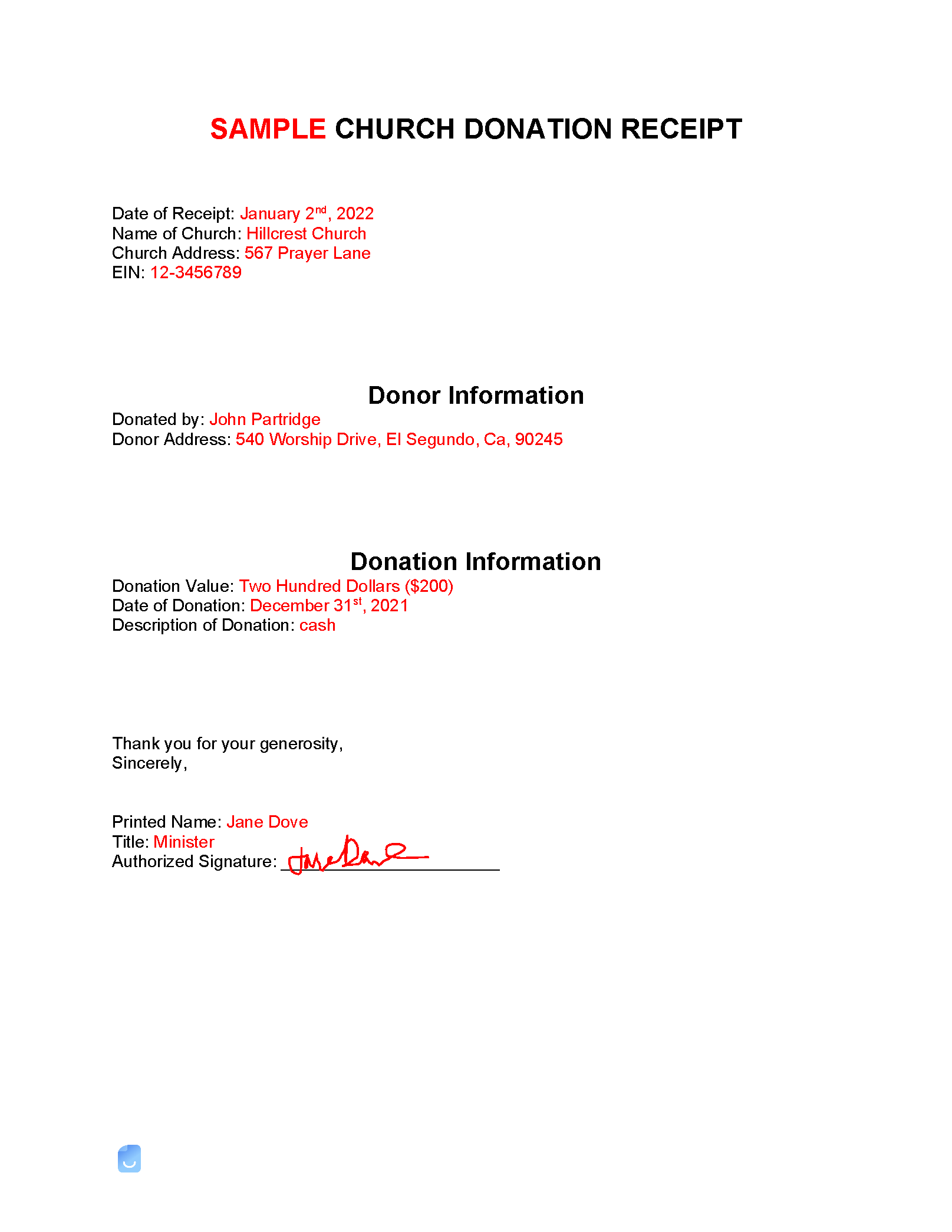

Church Donation Receipt Template

A church donation receipt is a record of proof that a charitable donation or cash, goods or services has been made to a church. Receipts are kept by donors to compound at tax time so contributions can be deducted from an individual’s taxes.