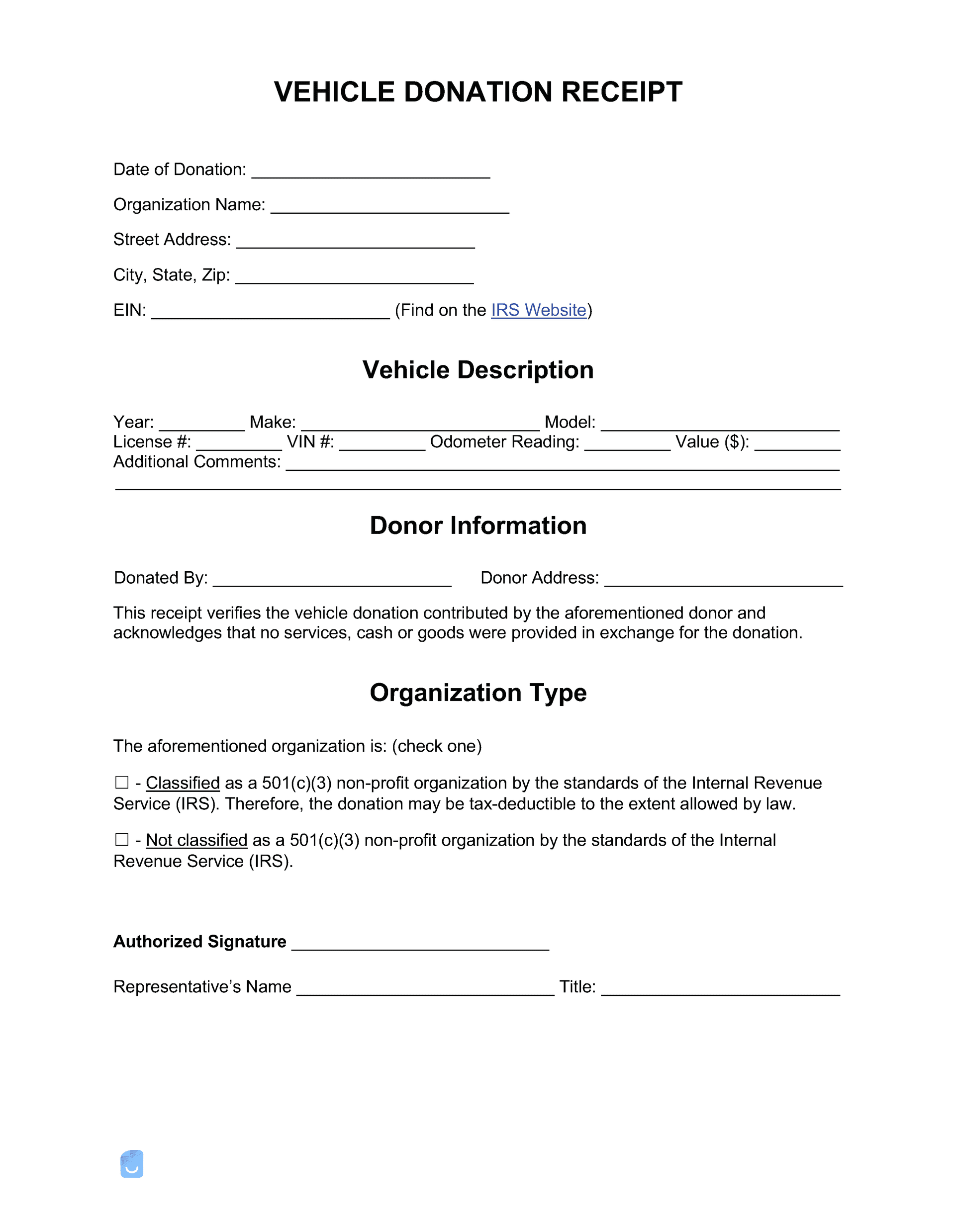

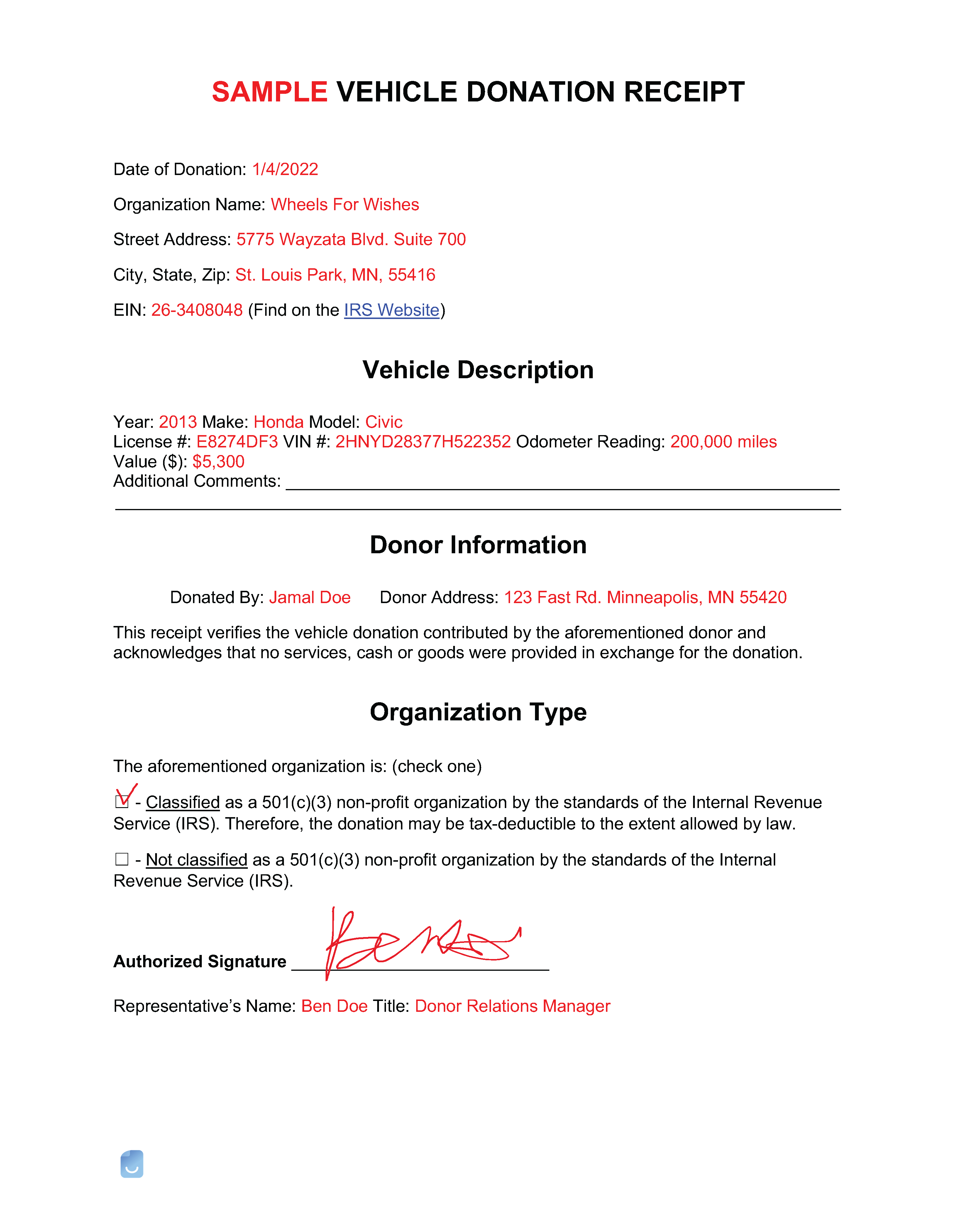

Vehicle Donation Receipt Template

A vehicle donation receipt is formal documentation that records the charitable gift of an automobile. Also known as a “vehicle donation bill of sale,” this paperwork must be provided to all vehicle donors in order for them to receive a deduction from their income tax.

How to Donate a Vehicle

Step 1 – Select a Charity to Donate the Vehicle to Many large-scale charity organizations provide a seamless process for vehicle donation by providing a pick-up of the vehicle from your residence and taking care of most paperwork. Recommended charities include Make-a-Wish Foundation, Goodwill, and Salvation Army. Step 2 – Ensure the Donation is Tax Deductible To ensure that a vehicle donation is tax-deductible, the charity you are donating to must be a qualified organization. This can be confirmed using the IRS’ 501(c)(3) Verification Tool. Keep in mind that certain organizations are not required to file exemption applications and yearly returns, including churches, mosques, synagogues, and temples. Therefore, these organizations may not be listed in the organization search database. Step 3 – Verify the Value of the Vehicle There are mainly two scenarios that will determine the value of a vehicle when donated.

- If the charity sells the donated vehicle, the donor’s tax deduction is based on the gross proceeds from the sale, which is detailed in the written acknowledgment/receipt from the charity.

- If the charity plans to make significant use of the vehicle (not sell), the donor is eligible to deduct the vehicle’s fair market value. A written appraisal from a qualified appraiser is required if the deduction is over $5,000. The appraisal must be made within 60 days prior to donating a vehicle.

Step 4 – Transfer Title to the Charity of Choice The Certificate of Title is the only document required to donate the car, and only the current legal owner as listed on the Title has the authority to donate the vehicle. Step 5 – Obtain a Receipt Charities are legally required to provide a written acknowledgement (receipt) of the vehicle donation. If the deduction exceeds $500, the donor is required to keep the following records:

- Name/address of charity;

- Date of donation;

- Place where you donated the vehicle (the location where the vehicle was dropped off or picked up;

- Description of the vehicle; and

- A statement that no goods or services were provided in return for the donation.