Receipt Templates

A receipt acts as an official record of an exchange of payment. Receipts are crucial for consumer transactions and business accounting. The IRS recommends that small business owners and self-employed individuals keep receipts on hand for a minimum of three years.

By Type (6)

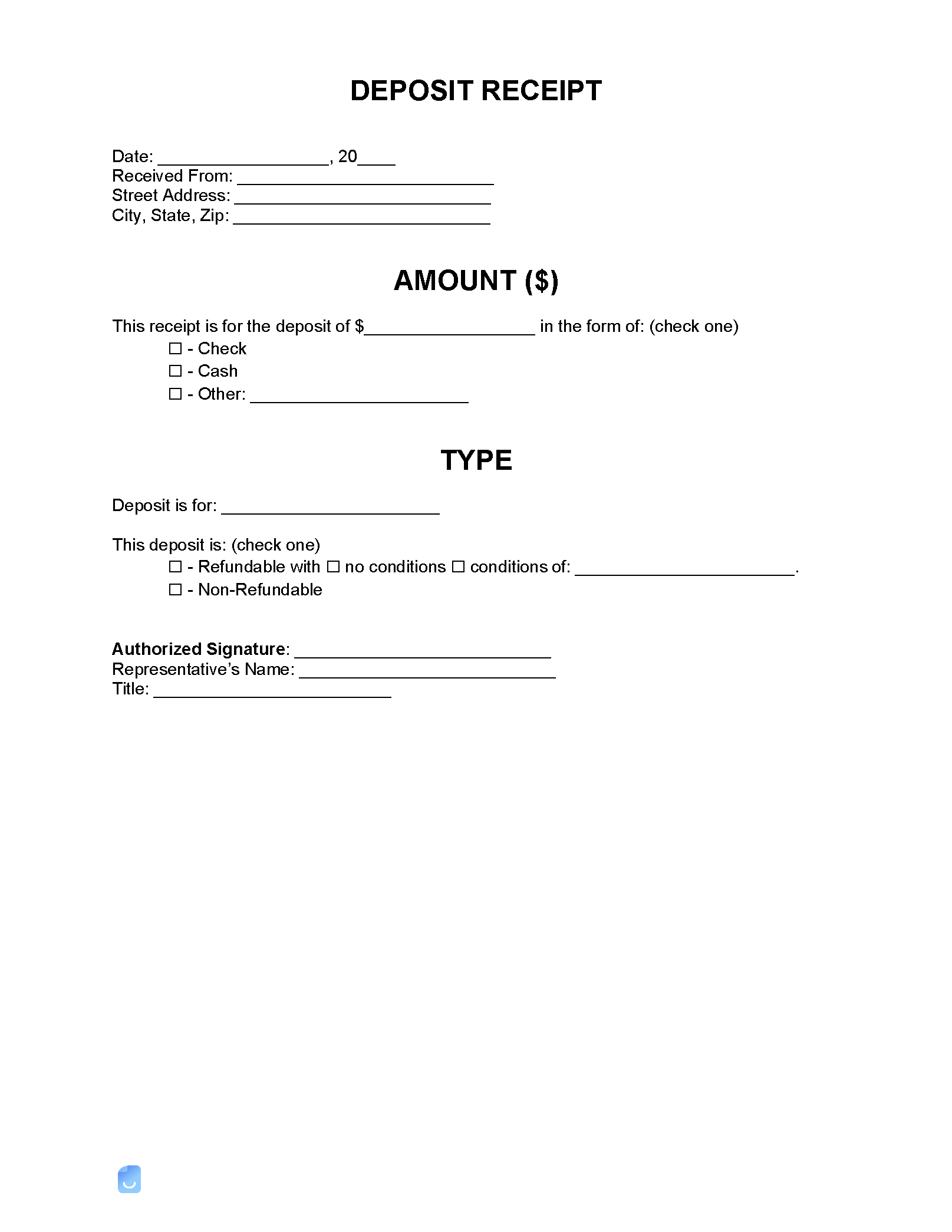

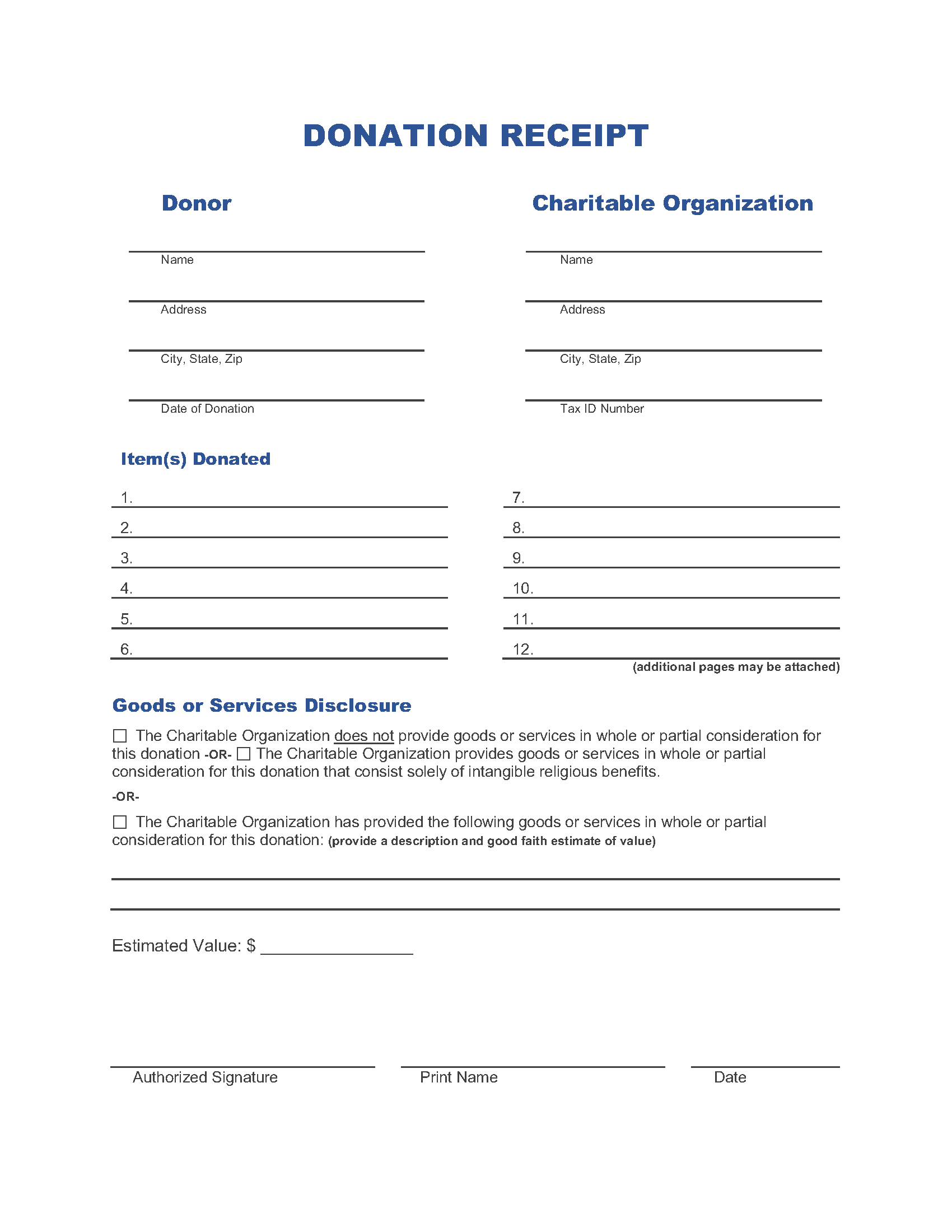

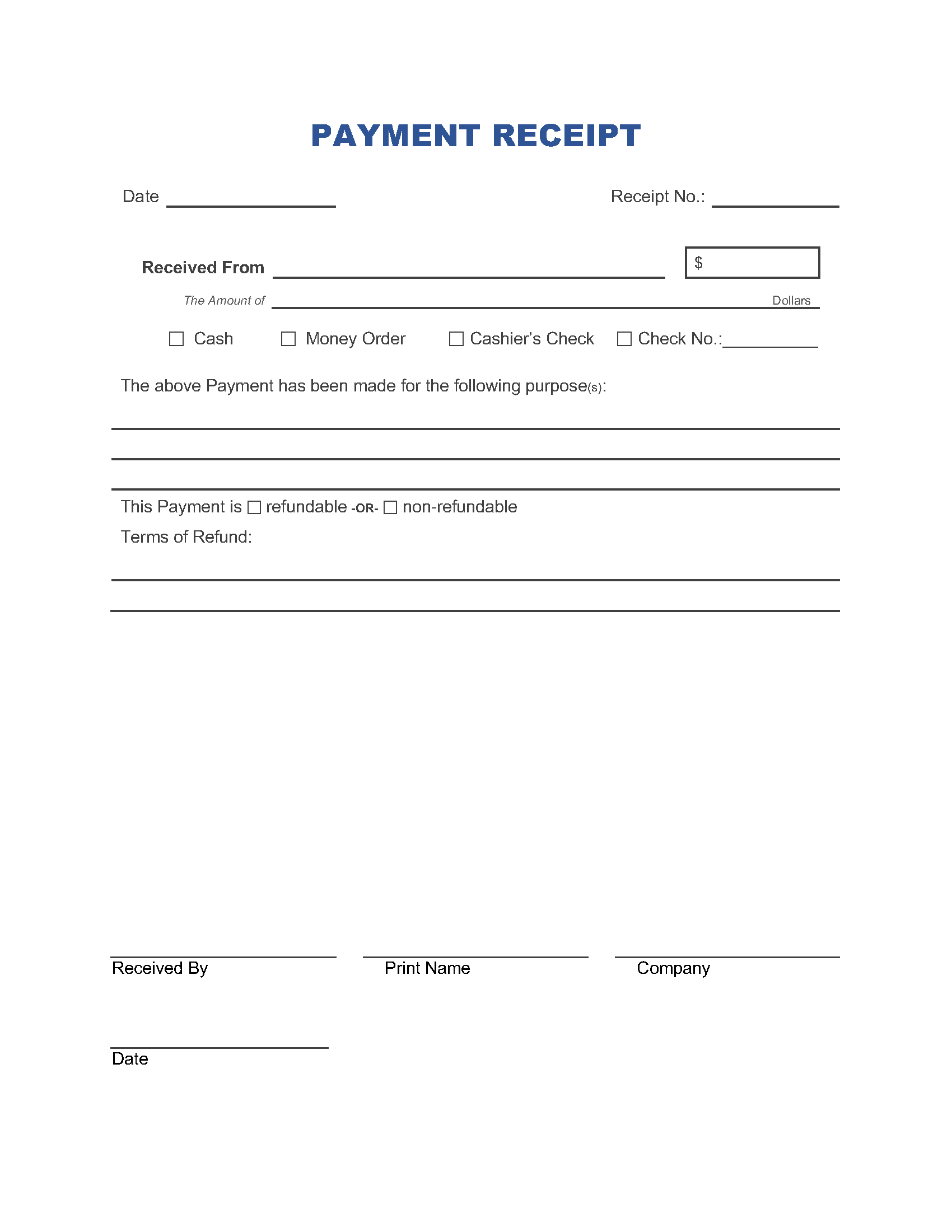

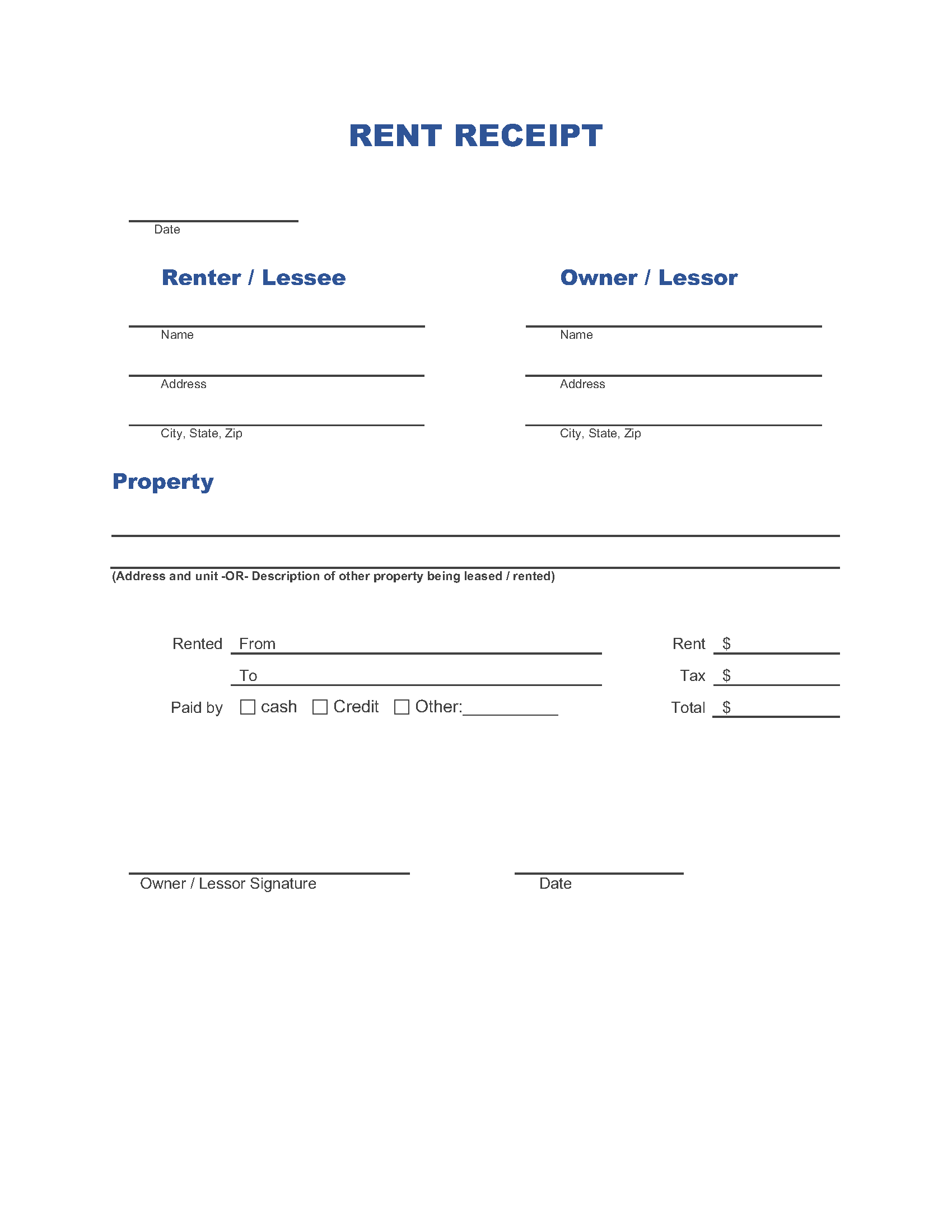

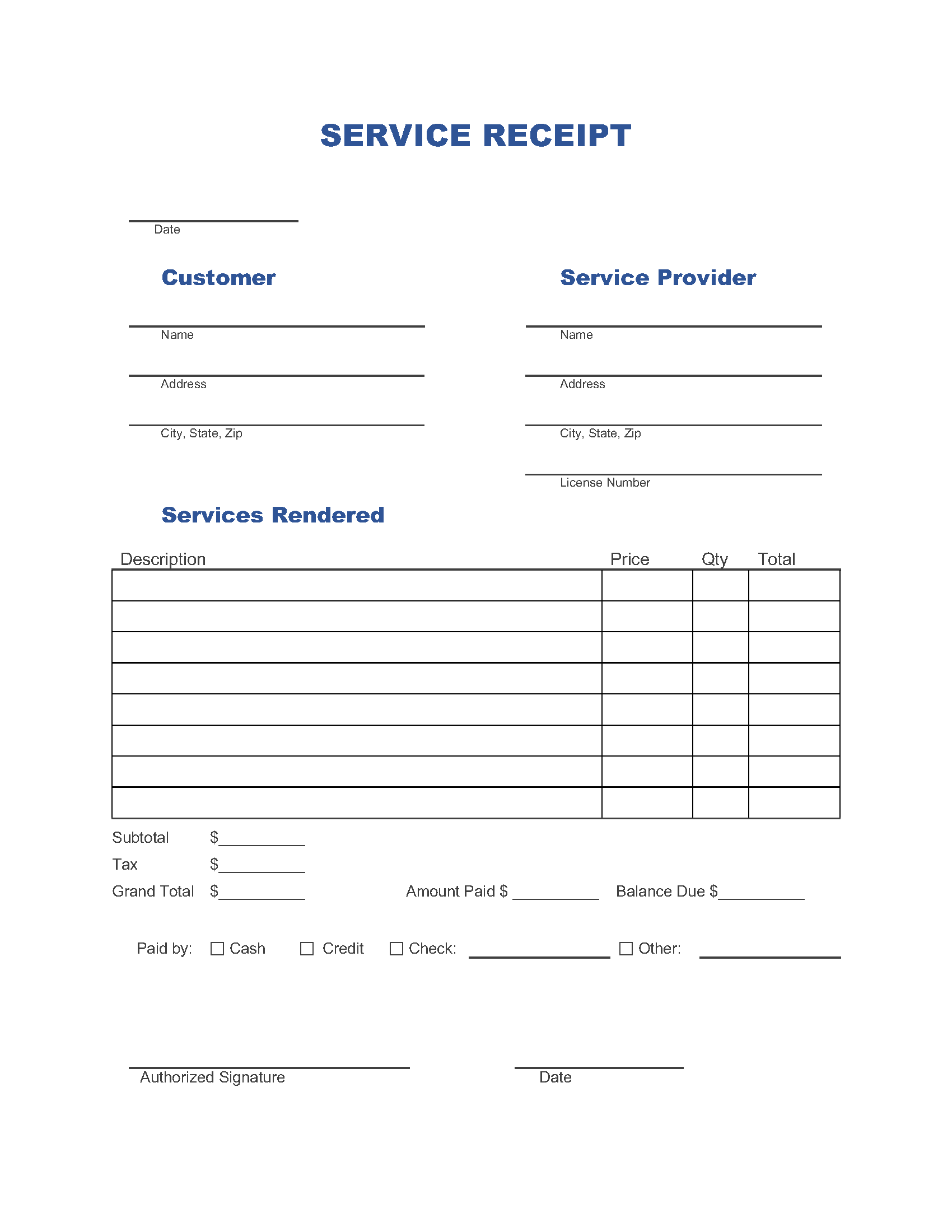

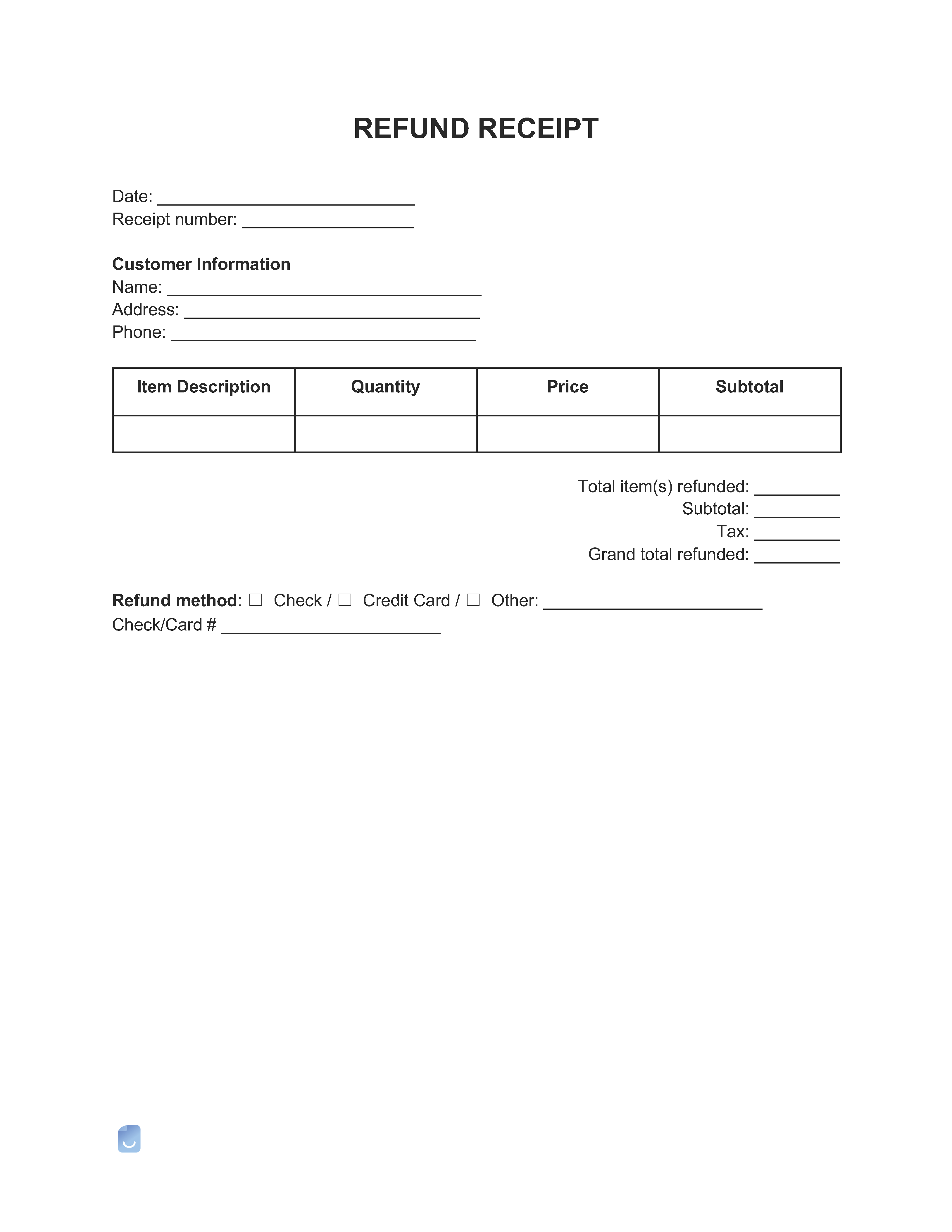

What to Include In a Receipt

Receipts should always include the transaction date, the seller’s information, an itemized list of goods or services sold (if applicable), the amount of money exchanged, and any taxes, fees, or discounts applied.

Sample Receipt Fields

- From

- Business Name

- Address

- Phone

- Item Description

- Product / Service Name

- Quantity (#)

- Price ($)

- Amount Paid

- Subtotal

- Sales Tax

- Other

- Payment

- Type (credit card, cash, etc.)

- Date of Sale

Benefits of Providing Receipts

As a business owner or service provider, your customers rely on you to provide accurate records for each transaction. Providing receipts to customers is beneficial to both parties for several reasons:

- Receipts can be used as proof of purchase with important details like the date and time of the transaction and the amount paid.

- Receipts are necessary for expense tracking and may be required for tax or accounting purposes.

- Providing receipts shows your customers that you value their business and can help you foster trust as a professional.

While providing receipts may not always be a requirement, it is a simple yet effective way to improve customer satisfaction, streamline transactions, and maintain good business practices.

Legal Requirements for Issuing Receipts

Some jurisdictions require by law that certain types of sellers issue receipts to all customers. See below for the requirements in your state.

State Laws

| State | Receipt Required? | Statute |

| Alabama | Only for payments made to insurance premiums. | Section 482-1-072-.04 |

| Alaska | — | — |

| Arizona | Only for county treasurers for payments made other than by check. | ARS 11-494 |

| Arkansas | — | — |

| California | Yes | Regulation 1686, CIV 1747.09 |

| Colorado | Only for landlords. | Section 38-12-802 |

| Connecticut | Only for pistol and revolver sales. | §29-36m-6 |

| Delaware | — | N/A |

| Florida | — | N/A |

| Georgia | Yes | Ga. Code § 7-3-15 |

| Hawaii | — | — |

| Idaho | Yes | §28-43-204 |

| Illinois | — | — |

| Indiana | — | — |

| Iowa | — | — |

| Kansas | Only for landlords. | §50-687 |

| Kentucky | — | — |

| Louisiana | — | — |

| Maine | Only for landlords. | §11-116 |

| Maryland | Yes | §12–617 |

| Massachusetts | Yes | 255D § 12 |

| Michigan | — | — |

| Minnesota | — | — |

| Mississippi | — | — |

| Missouri | — | — |

| Montana | Yes | 42.26.248 |

| Nebraska | — | — |

| Nevada | Only for landlords. | NV Rev Stat § 597.080 |

| New Hampshire | Only for door-to-door & home solicitation sales. | § 361-B:2 |

| New Jersey | Yes | § 17:16C-49 |

| New Mexico | — | — |

| New York | Yes | § 5-32 |

| North Carolina | Yes | § 25A-22 |

| North Dakota | — | — |

| Ohio | Only for deposits. | 109:4-3-07 |

| Oklahoma | — | — |

| Oregon | Yes | ORS 81.030 |

| Pennsylvania | Yes | 1968 Act 387 |

| Rhode Island | Yes | 280-RICR-20-70-25.12 |

| South Carolina | Yes | 37-2-302 |

| South Dakota | — | — |

| Tennessee | Only for landlords. | § 47-18-608 |

| Texas | Yes | 601.052 |

| Utah | — | — |

| Vermont | — | — |

| Virginia | For home solicitation sales. | 59.1-21.4 |

| Washington | Only for certain fees. | § 36.18.090 |

| Washington D.C. | — | — |

| West Virginia | Yes | §46B-5-2 |

| Wisconsin | Yes | 422.306 |

| Wyoming | — | — |

Are Digital Receipts Legal?

With many companies and service providers doing business partly or entirely online, traditional paper receipts are becoming a thing of the past. Electronic receipts are widely accepted as legally valid alternatives.

The IRS recognizes digital receipts as legally valid records, and digital receipts are increasingly being offered as the default even by traditional brick-and-mortar businesses. However, the rules and regulations may vary depending on the industry and location.