501(c)(3) Organization Donation Receipts (6)

A 501(c)(3) organization donation receipt is given to a donor for tax purposes. According to the IRS, any deductions claimed of $250 or more for donations must have a physical or electronic receipt from the organization it was made. Verify a 501(c)(3) Organization – Use the IRS Website to make sure an organization is a non-profit.

What Should it Include?

According to the IRS, donation receipts of $250 or more must include:

- Organization’s name;

- Amount of contribution ($);

- Description of estimate (for non-cash donations);

- Description of value (i.e. cash, clothing, etc.); and

- Statement that no goods or services were provided by the organization.

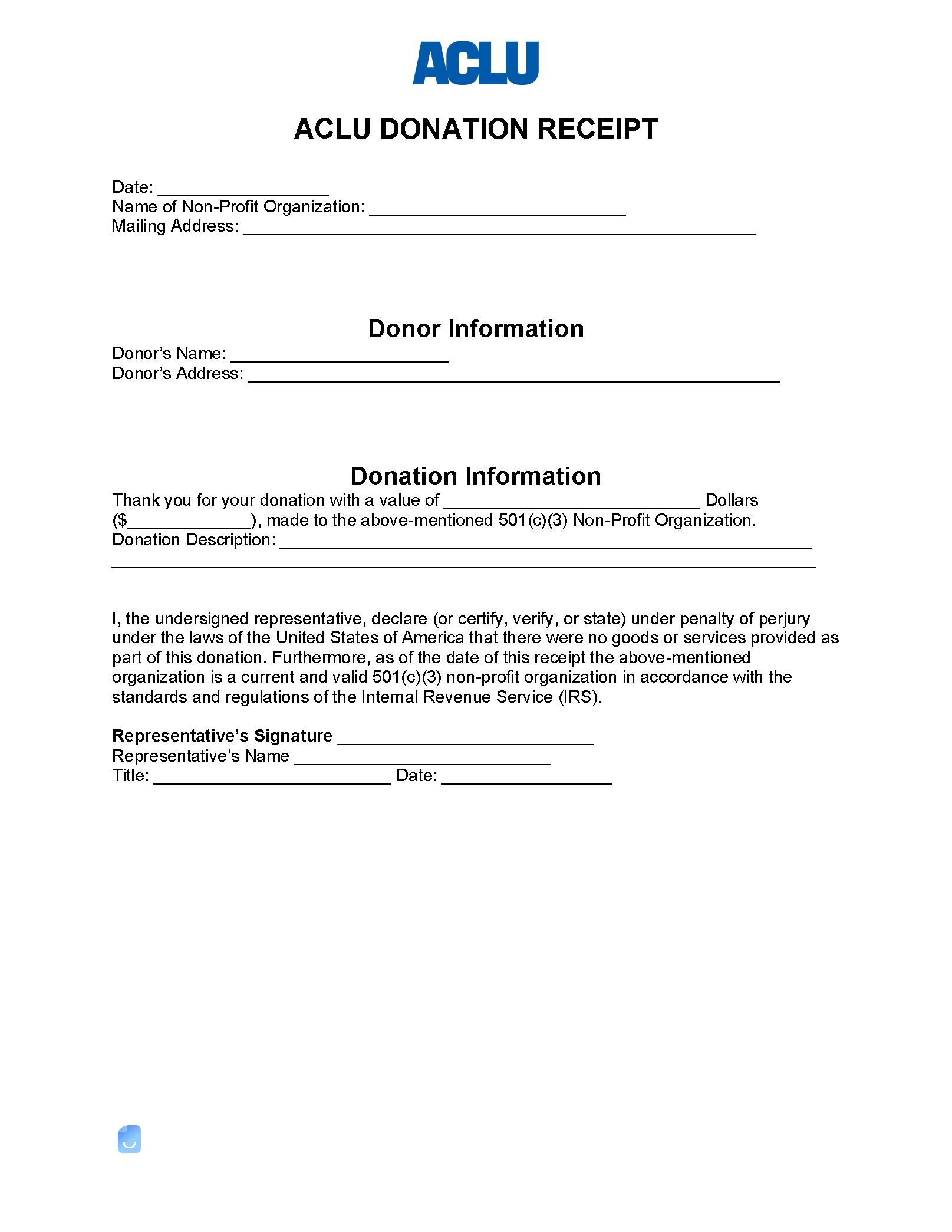

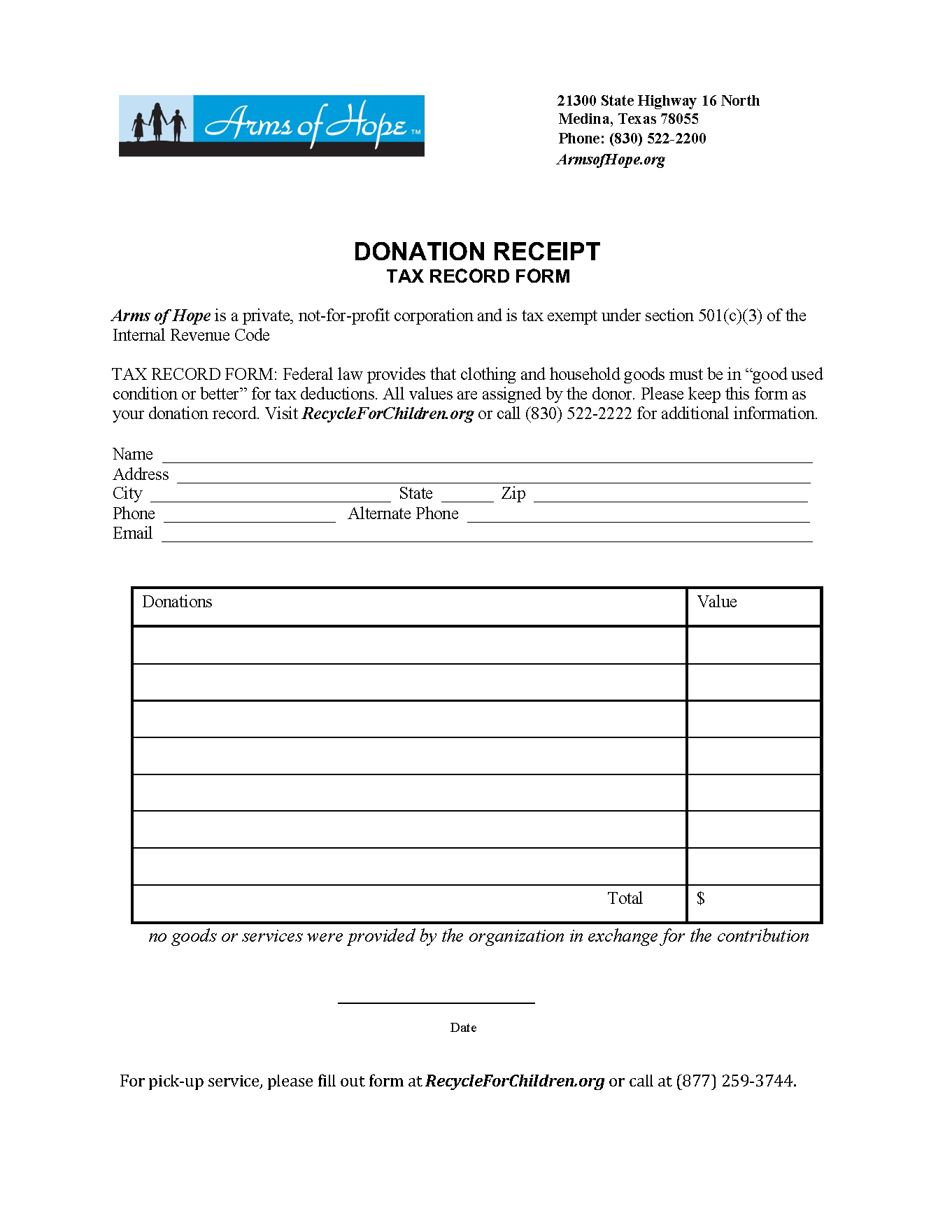

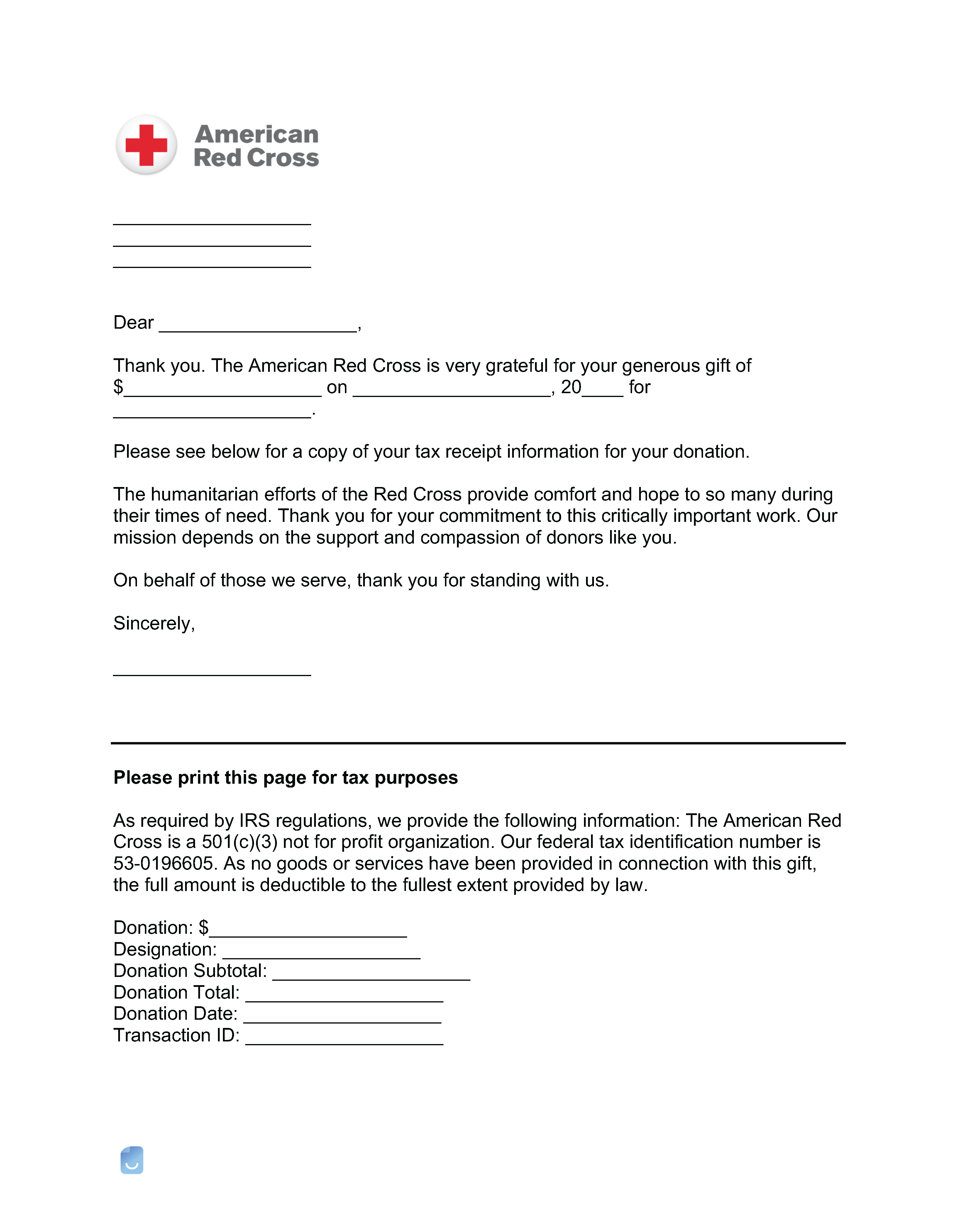

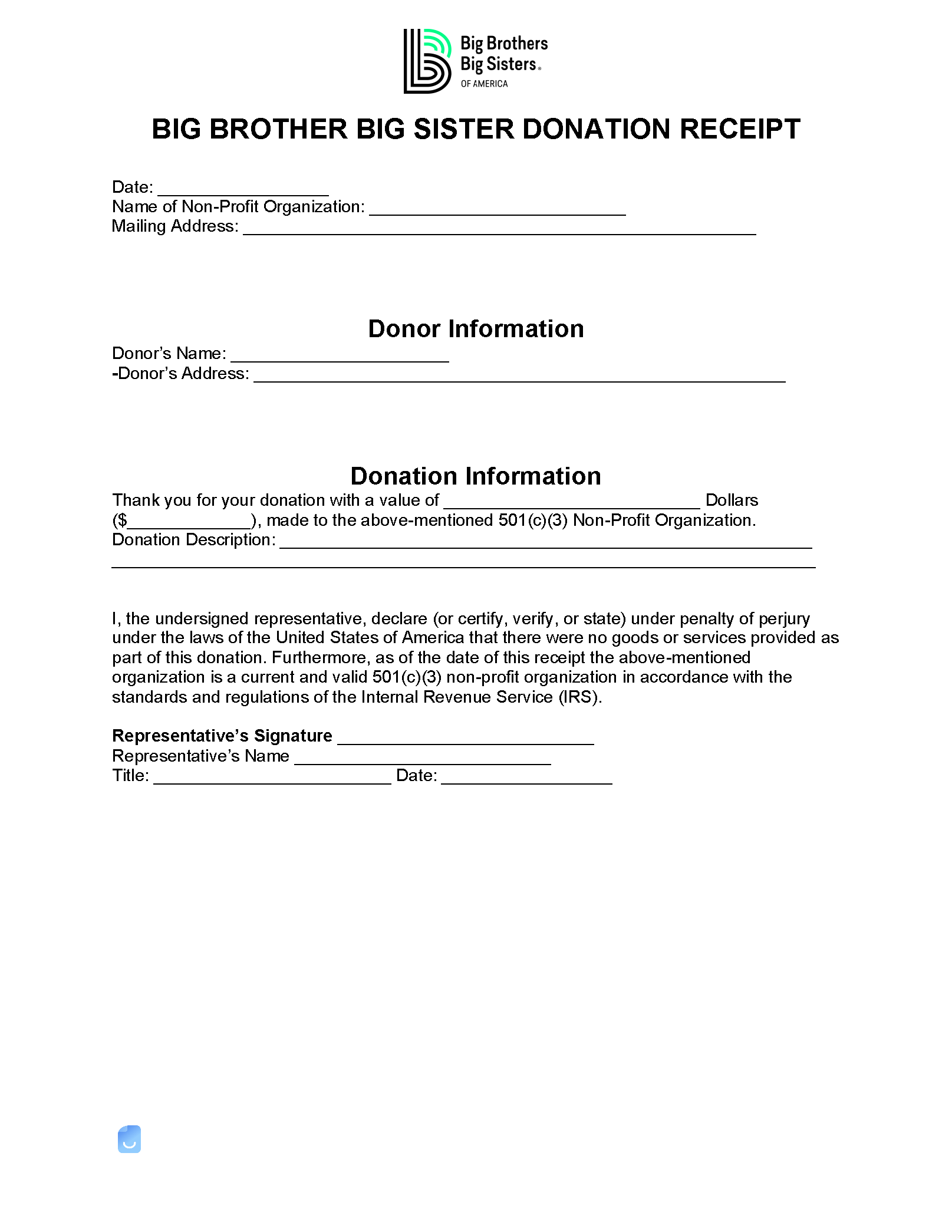

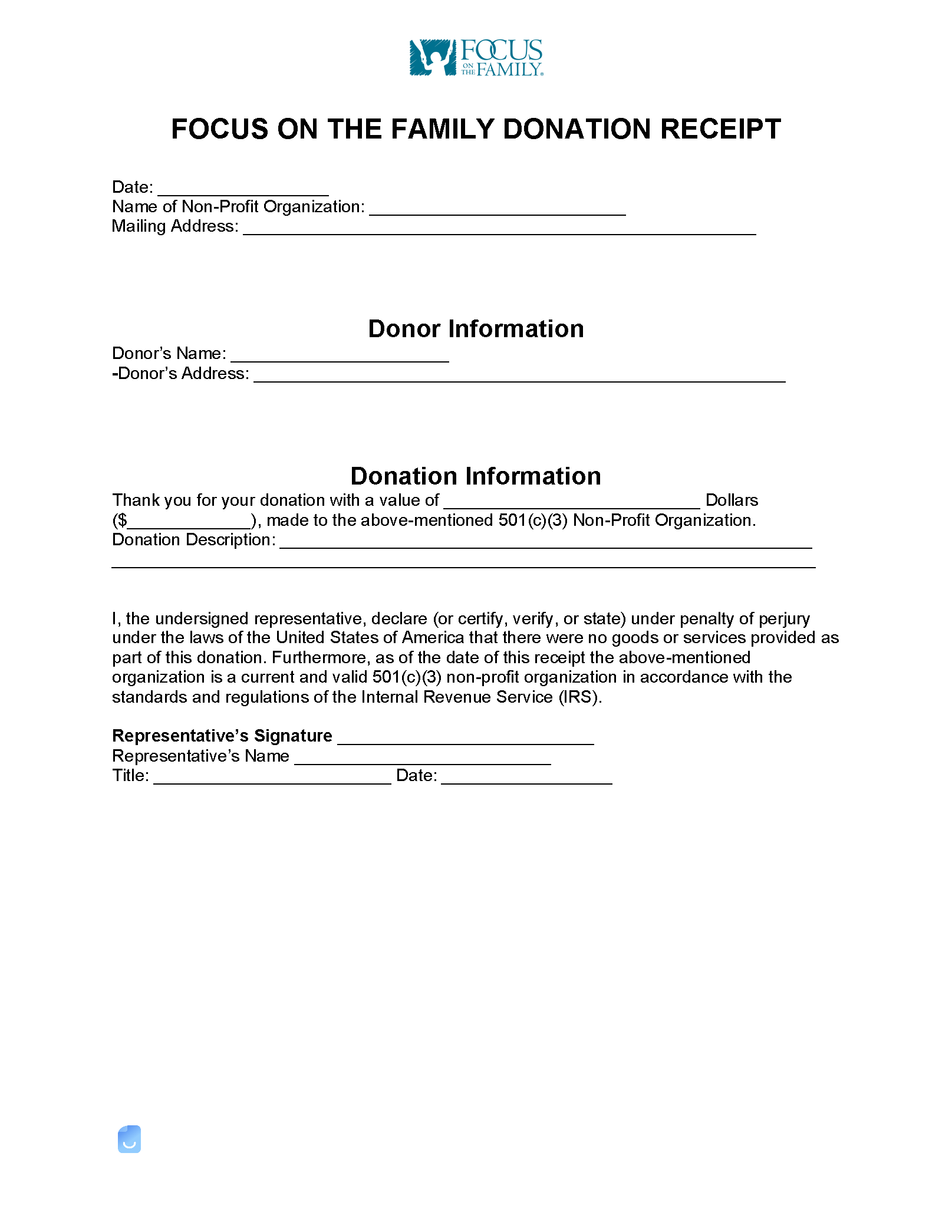

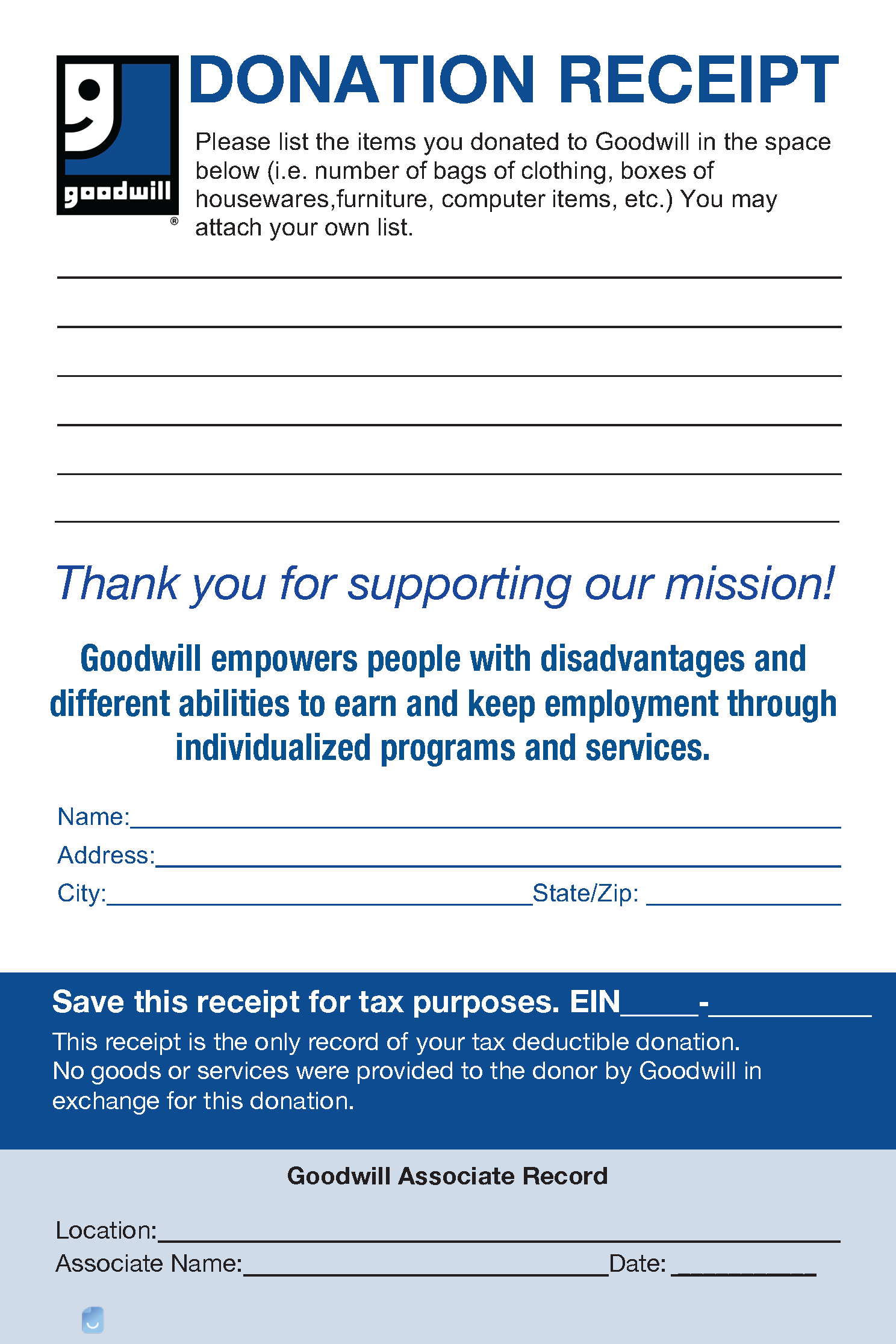

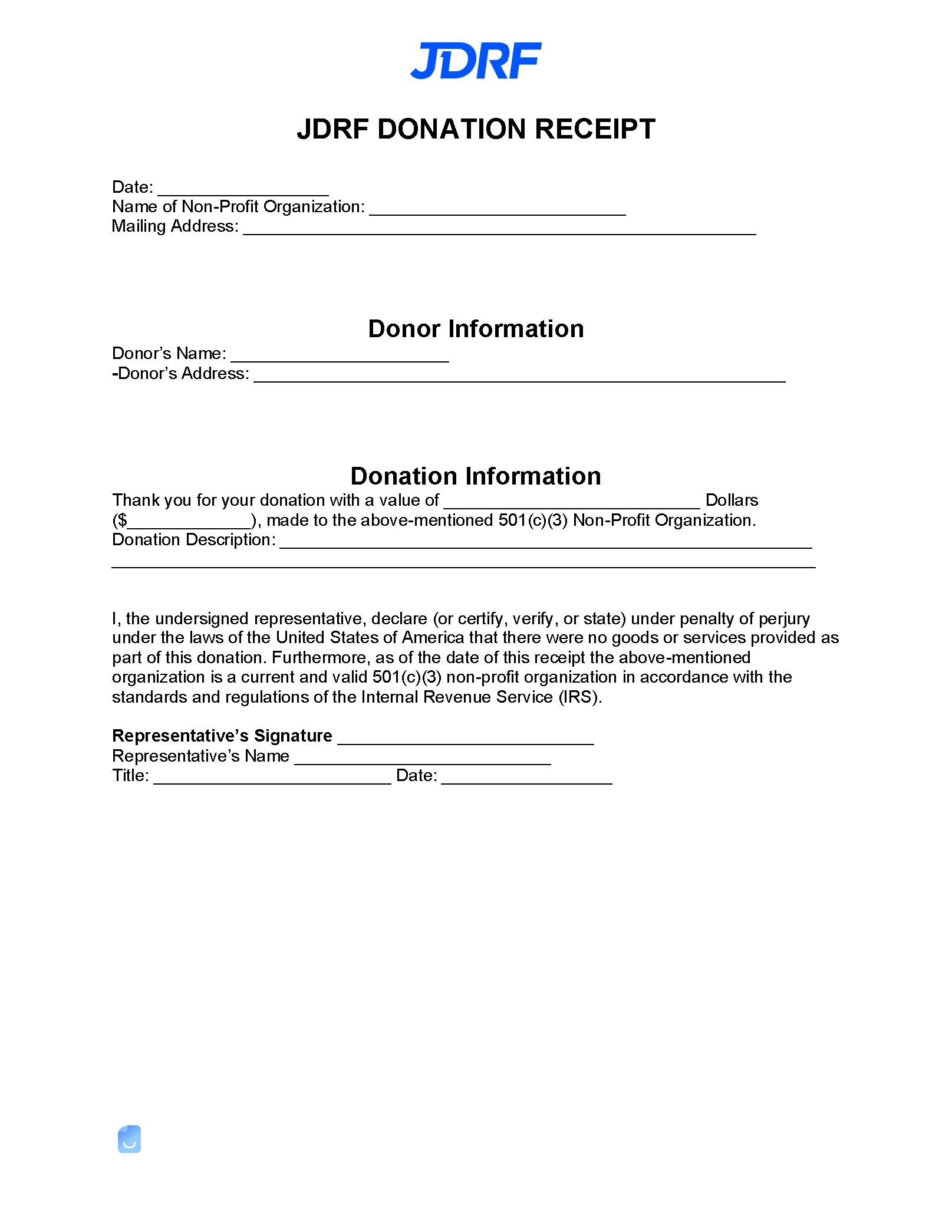

By Type (9)

Requirements: By Amount ($)

If an individual or business entity would like to deduct a donation made from their annual tax filing.

Less than $250

For any donations of $250 or less, no receipt is required (26 U.S. Code § 175(f)(8)(A)).

More than $250

Donations of $250 or more, in order to obtain a deduction on the taxpayer’s filing, must include a written acknowledgment by the organization (26 U.S. Code § 175(f)(8)(A)).

More than $500

Donations of more than $500 must have a full description of the item being donated (26 U.S. Code § 175(f)(11)(B)).

More than $5,000

Donations of more than $5,000 must have a “qualified appraisal” performed within 60 days of the contribution. In addition, IRS Form 8283 Section B must be attached to the tax return.

How Much Can I Deduct?

In accordance with the IRS (26 U.S. Code § 170(b)(1)(B)), a filer can deduct up to 50% of the adjusted gross income on their return (located on line 36 of IRS Form Schedule 1).

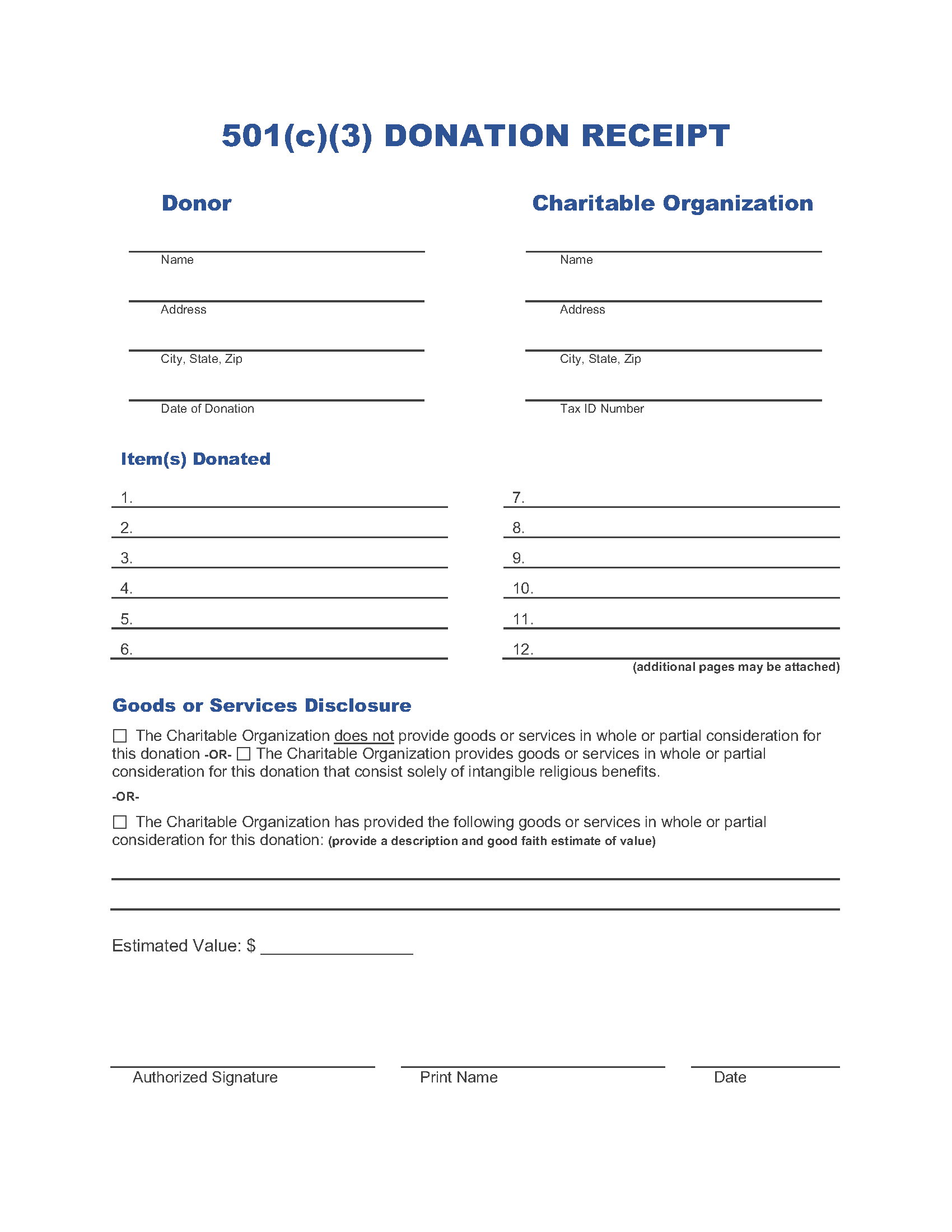

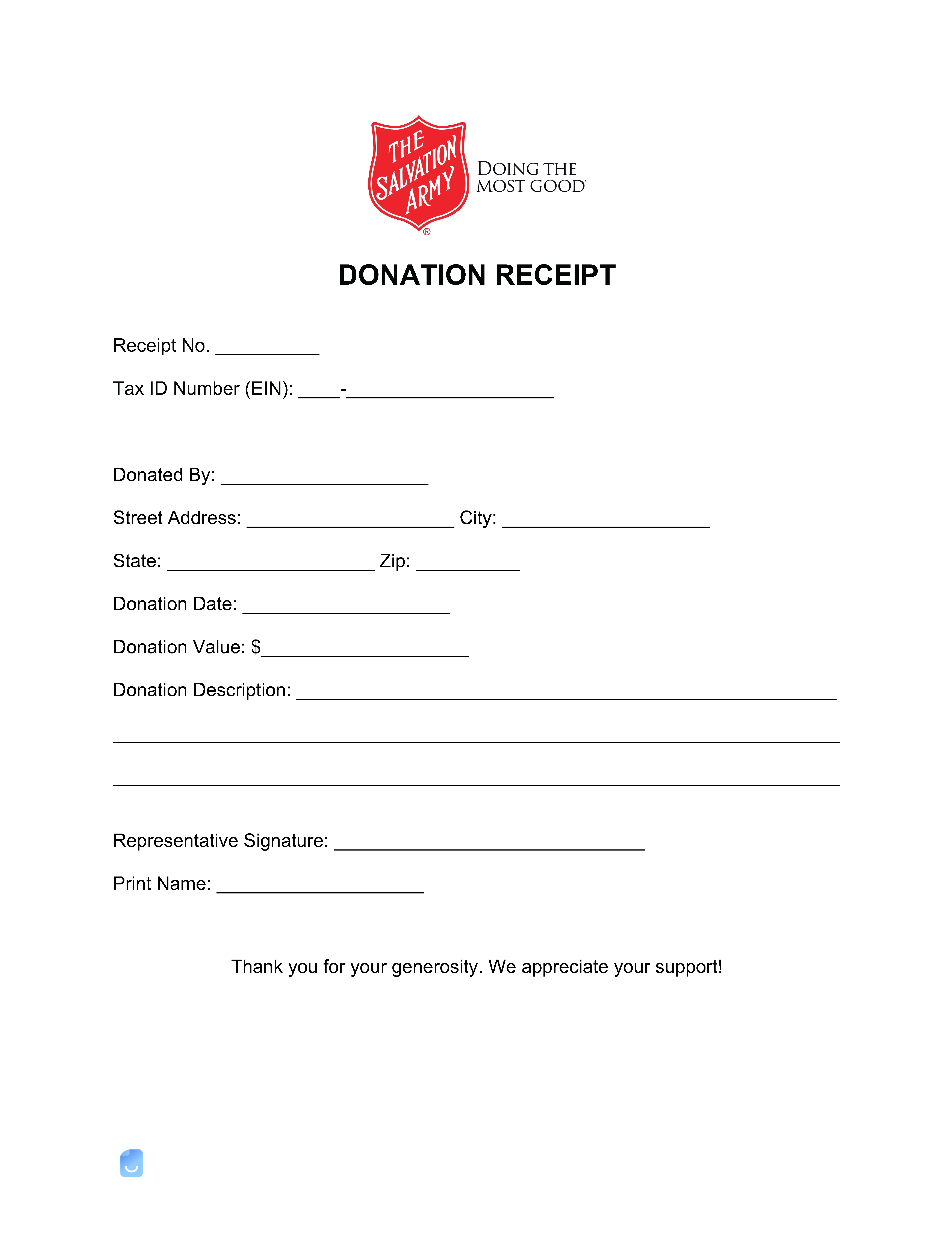

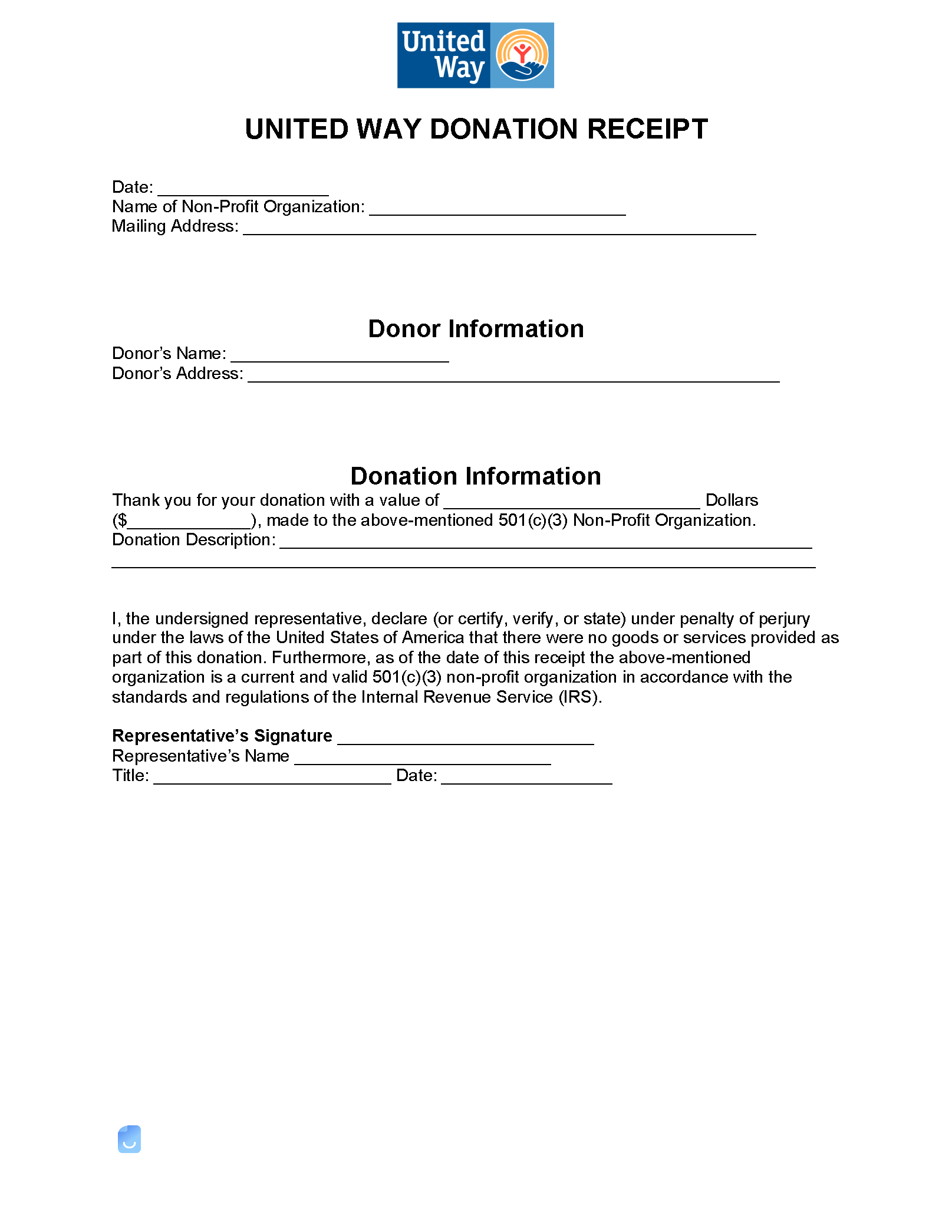

Sample: 501(c)(3) Donation Receipt

Download: Adobe PDF, MS Word, OpenDocument