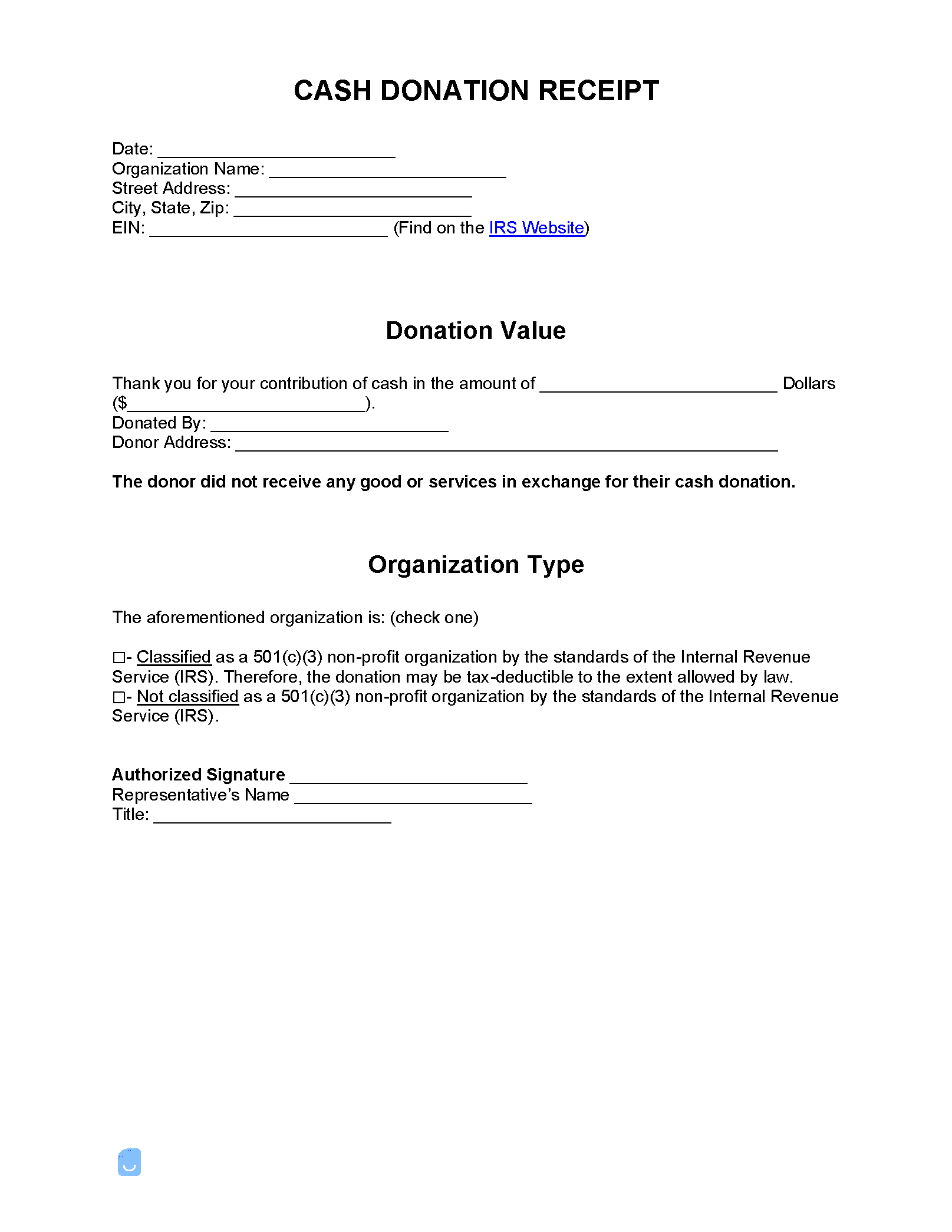

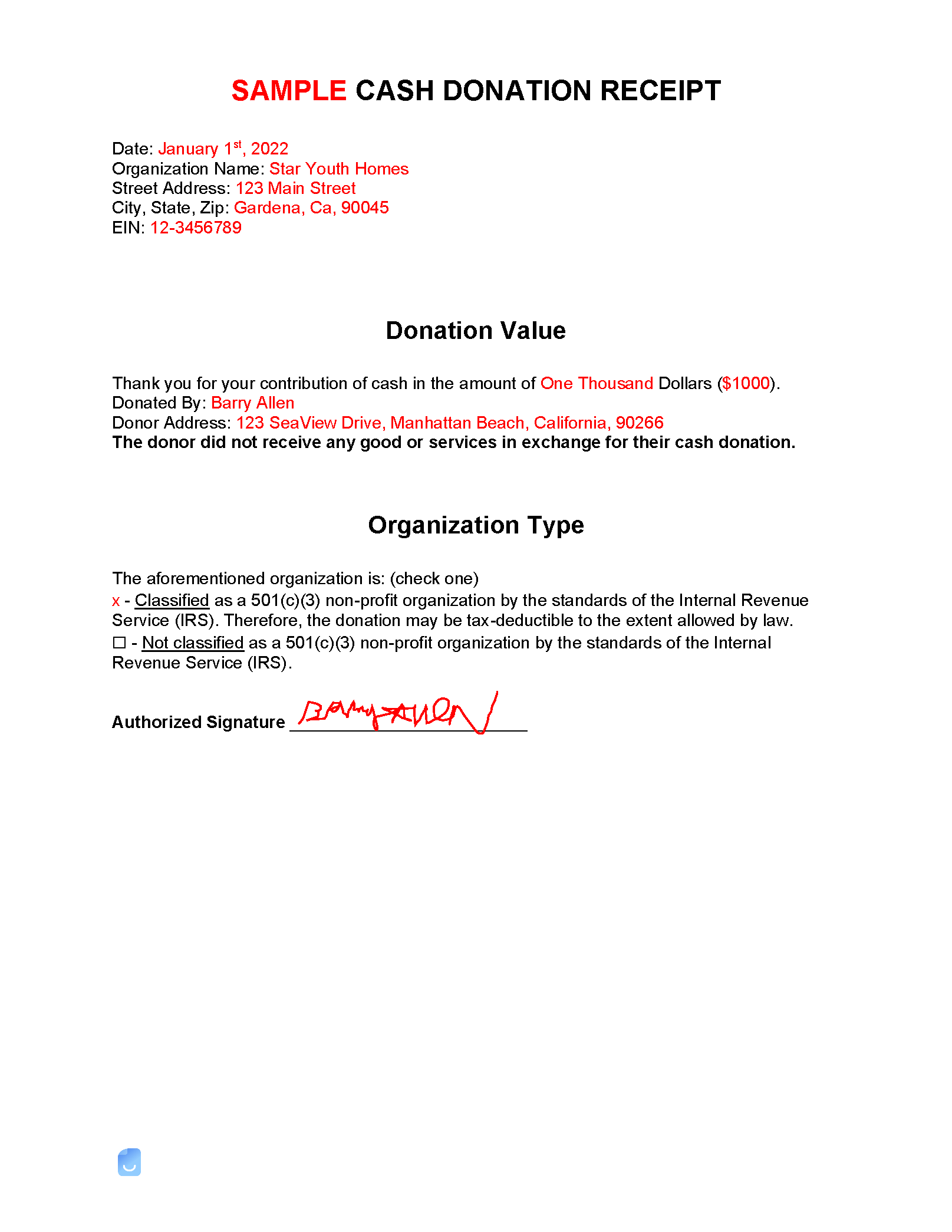

Cash Donation Receipt Template

A cash donation receipt details a payment given by a donor by cash, credit card, or check. Receipts are usually given to the donor by charities or organizations so that the donor may validate a tax-deductible contribution.

IRS Requirements

The IRS requires six (6) items to be listed on cash receipts in order for charitable contributions over $250 to be substantiated:

- Charity name

- Donor name

- Contribution date

- Contribution details

- Statement indicating whether goods/services were provided in exchange for contribution

- If goods/services provided by the charity, the value of goods/services and a statement citing deduction may be limited (Publication 1771)