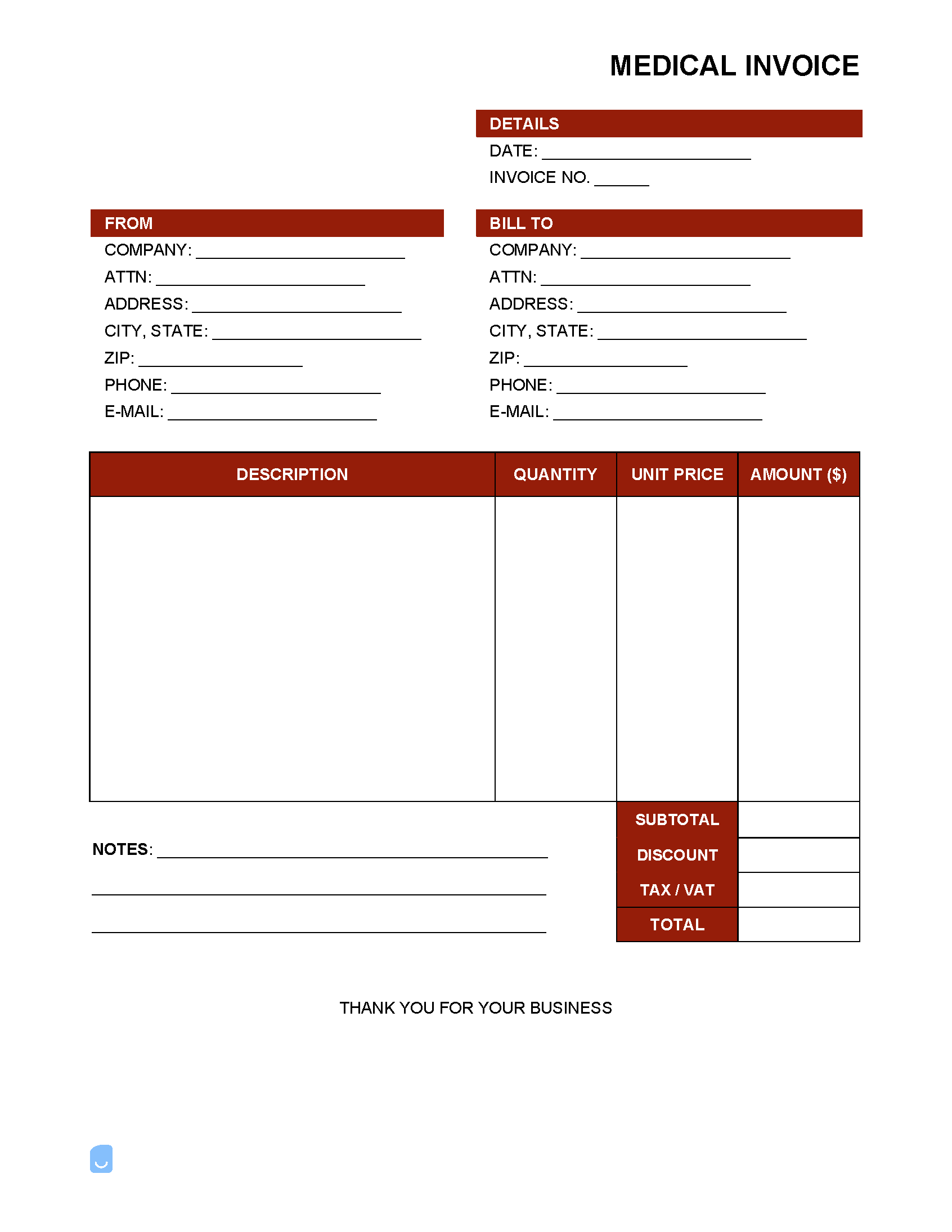

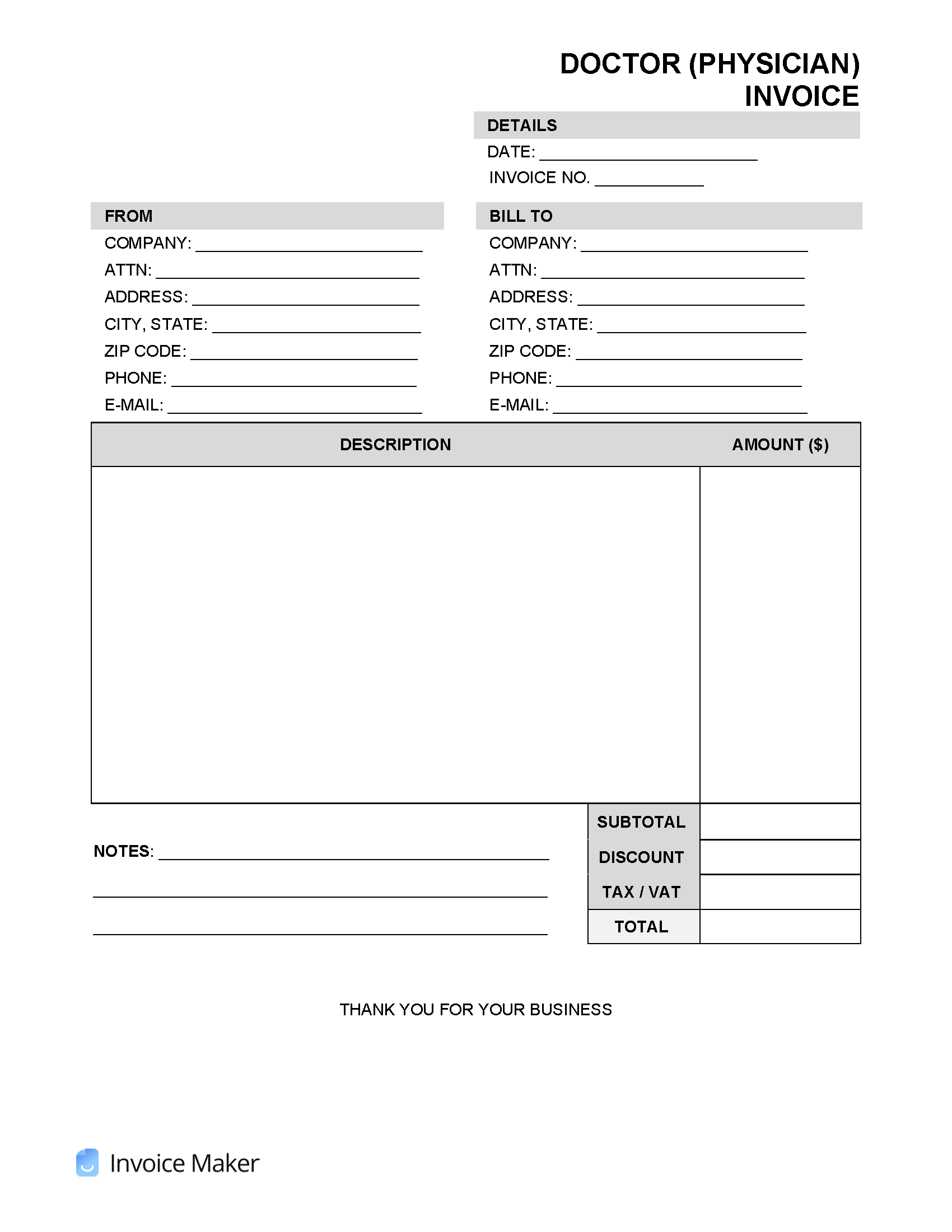

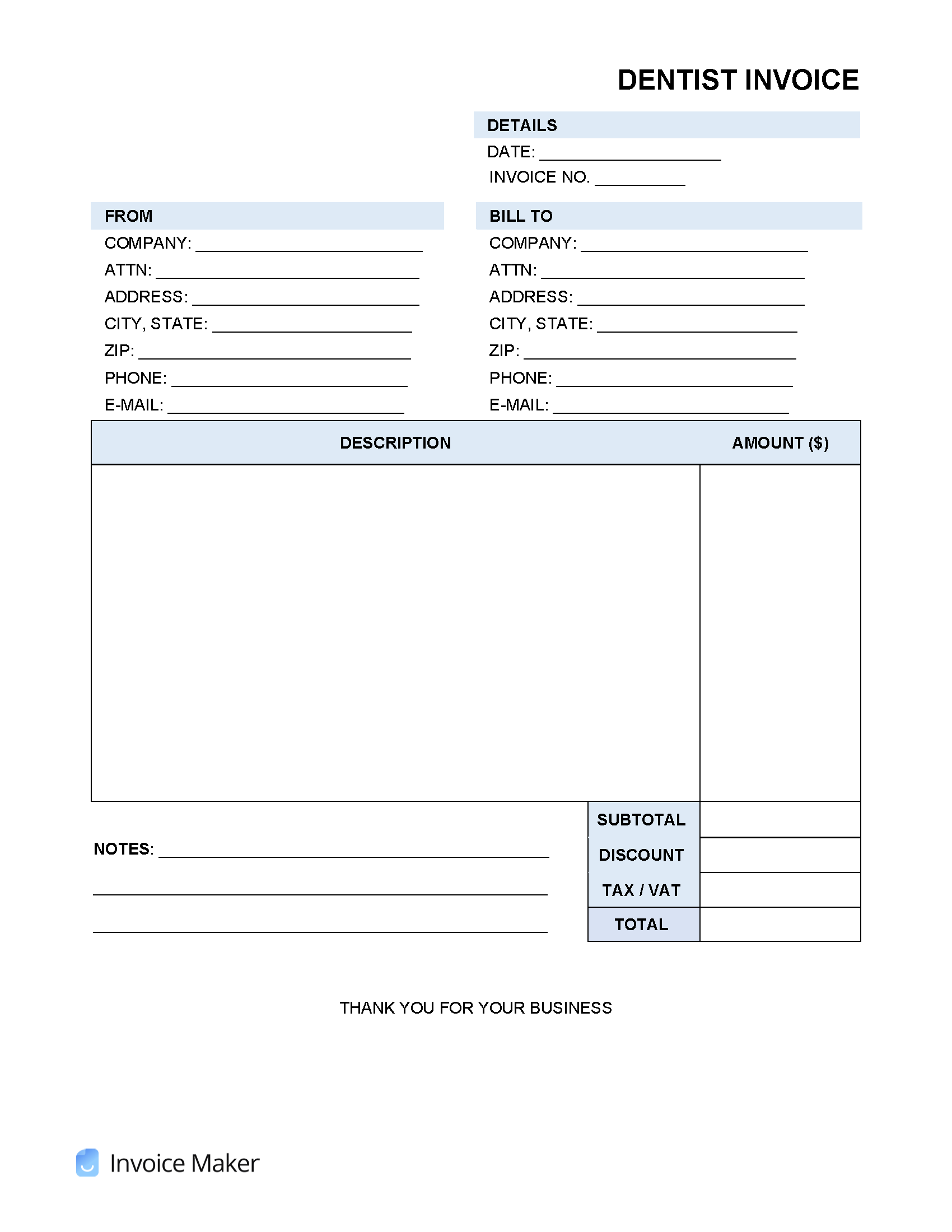

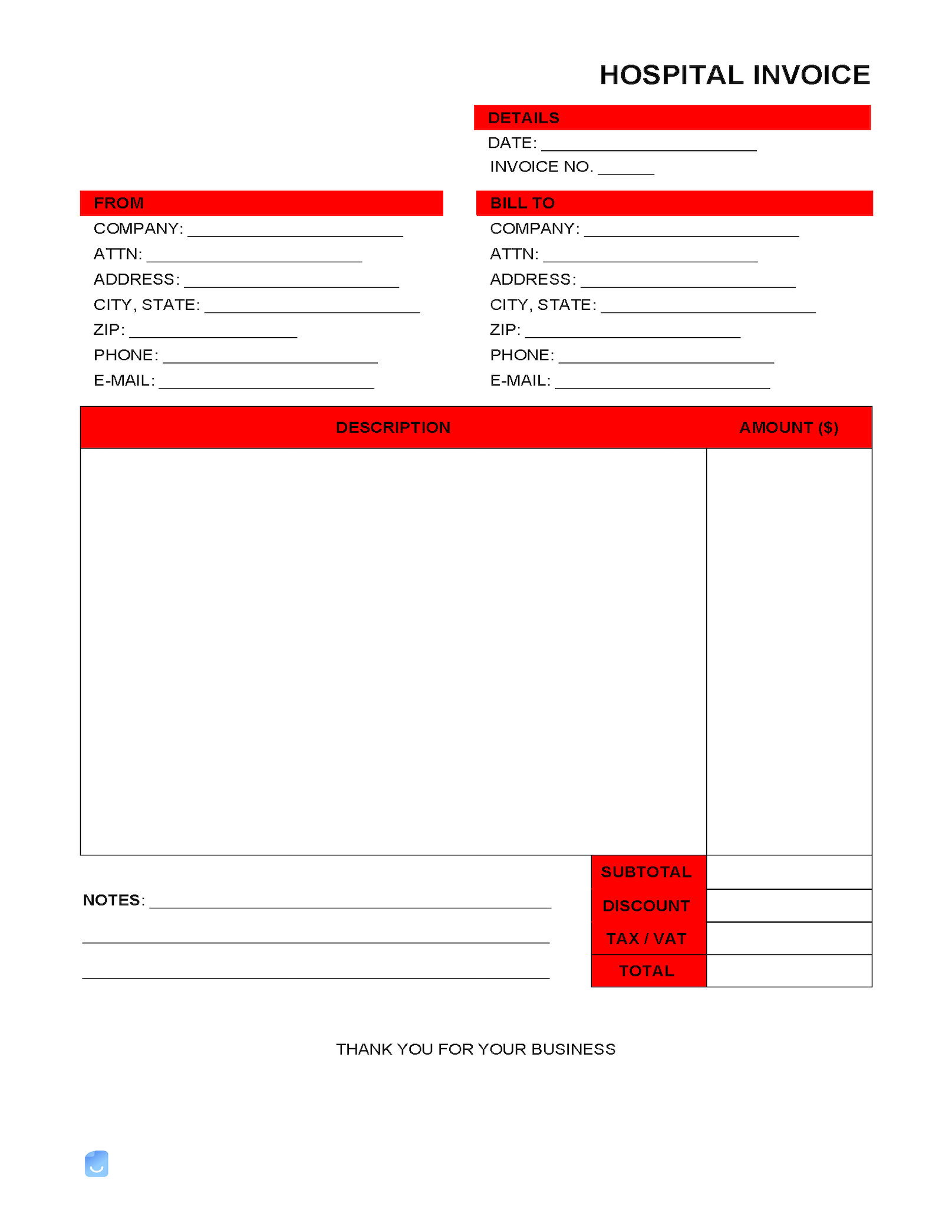

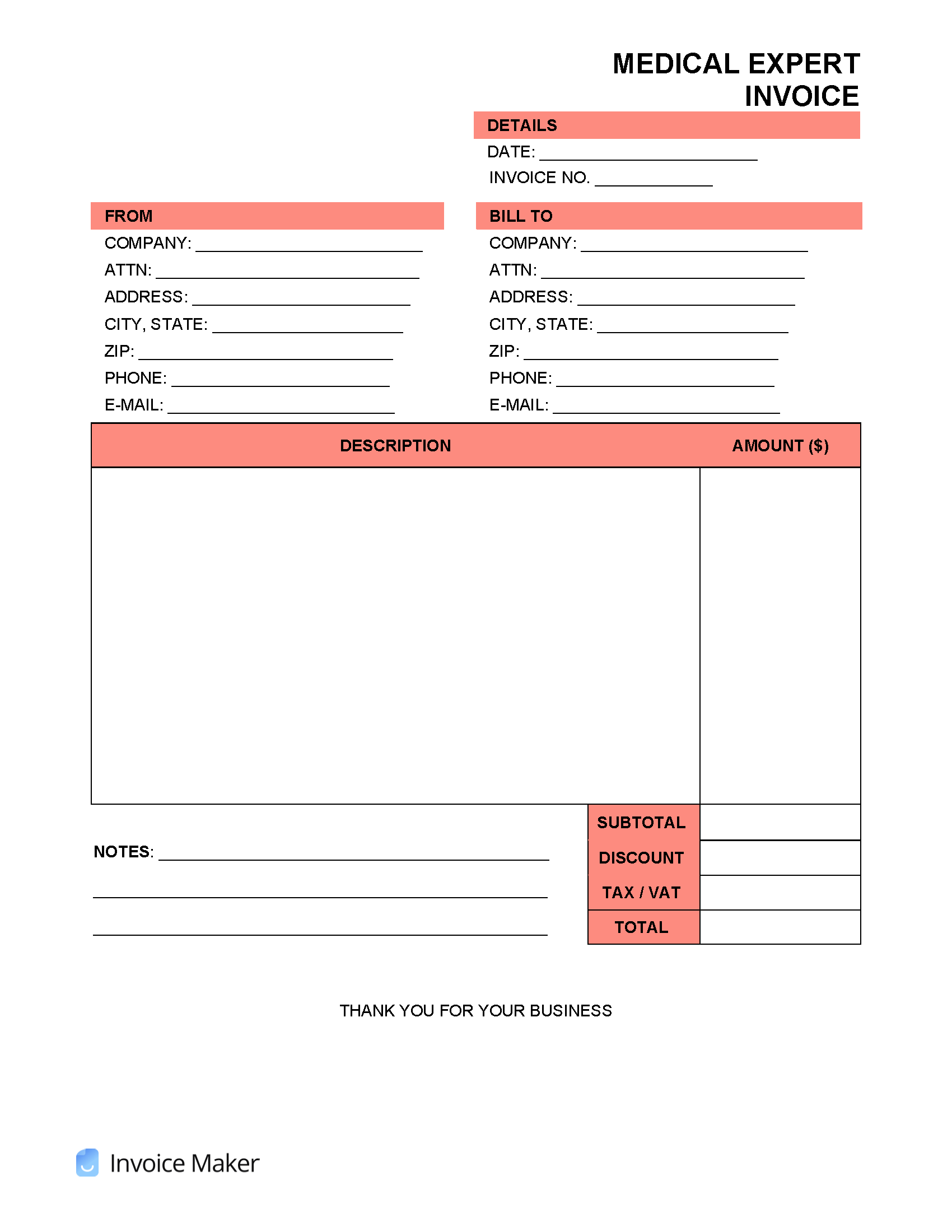

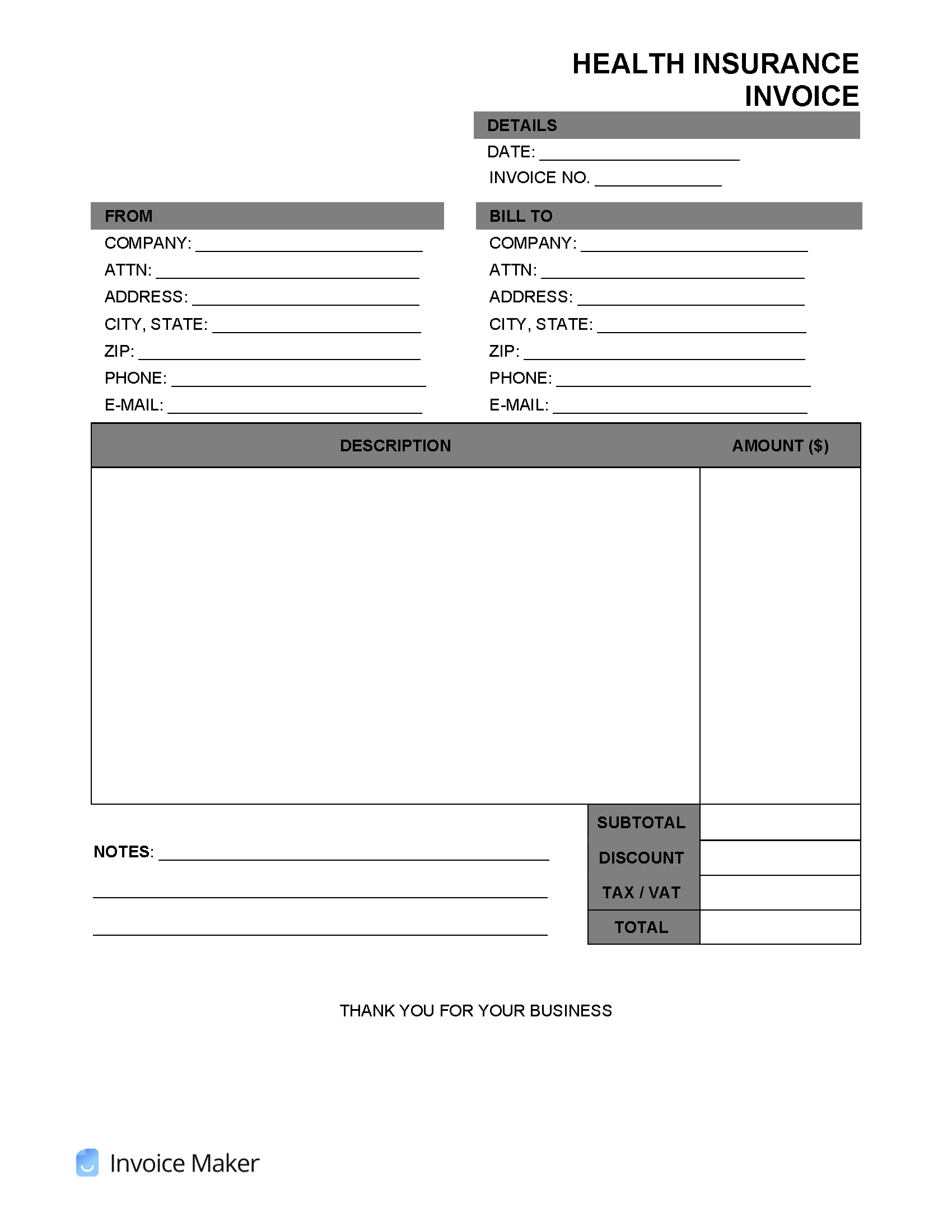

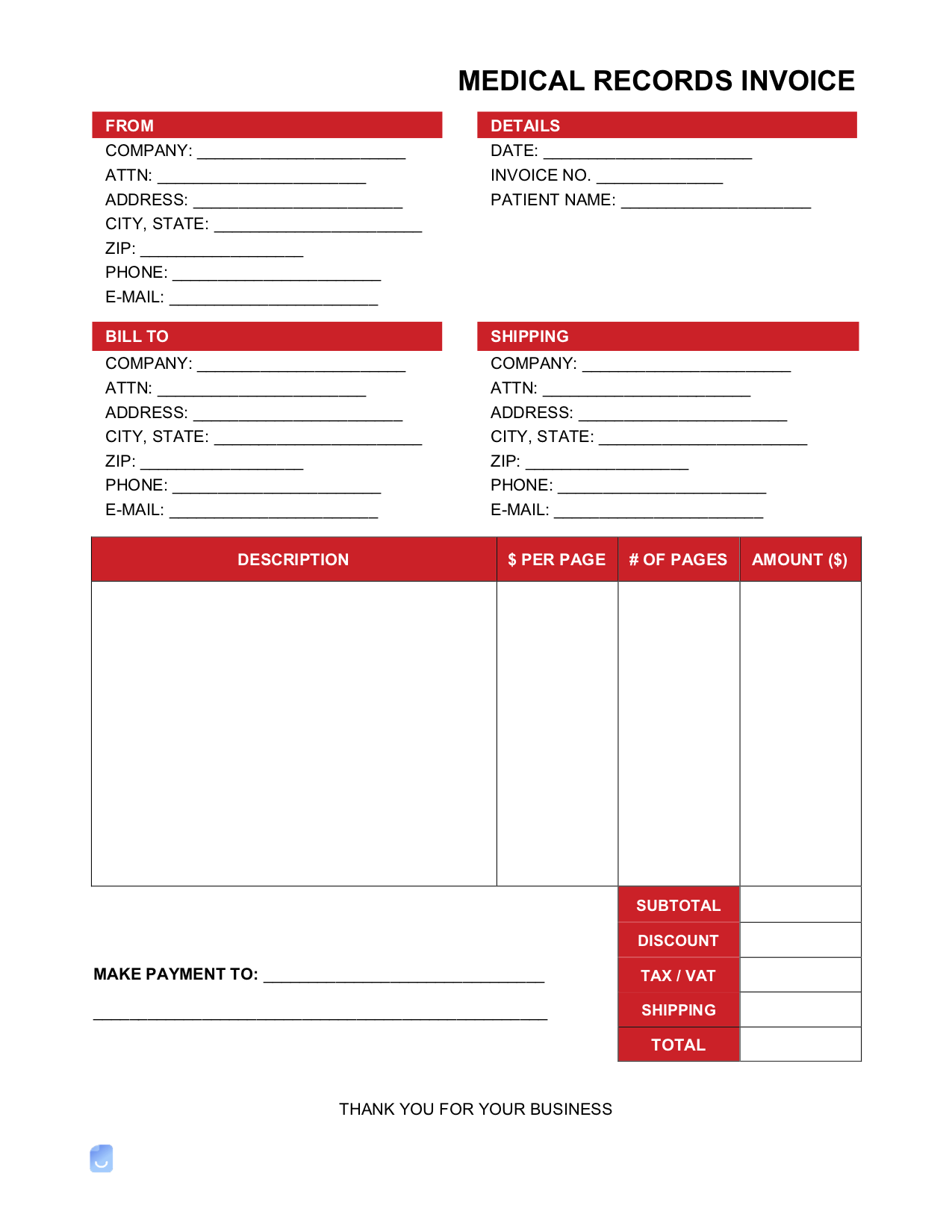

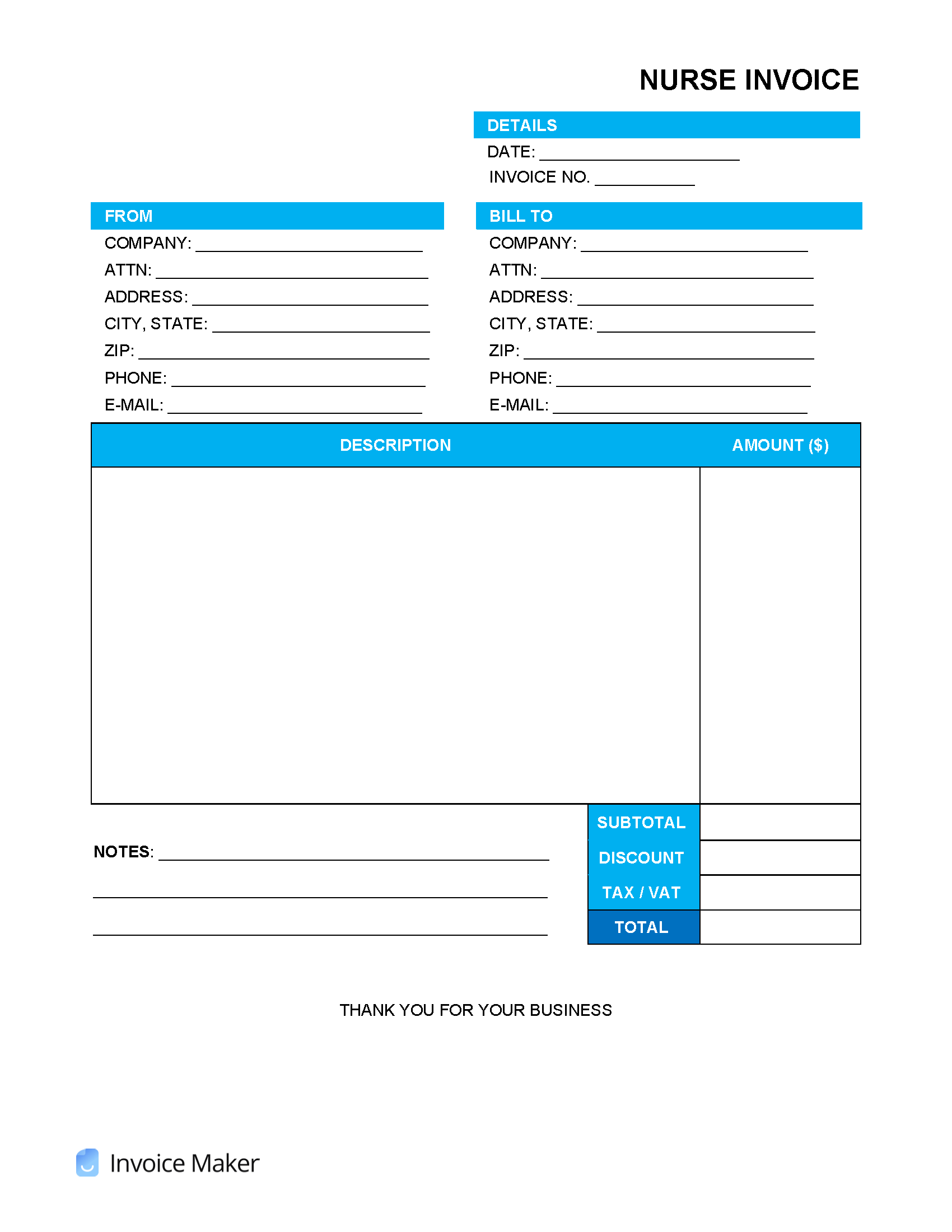

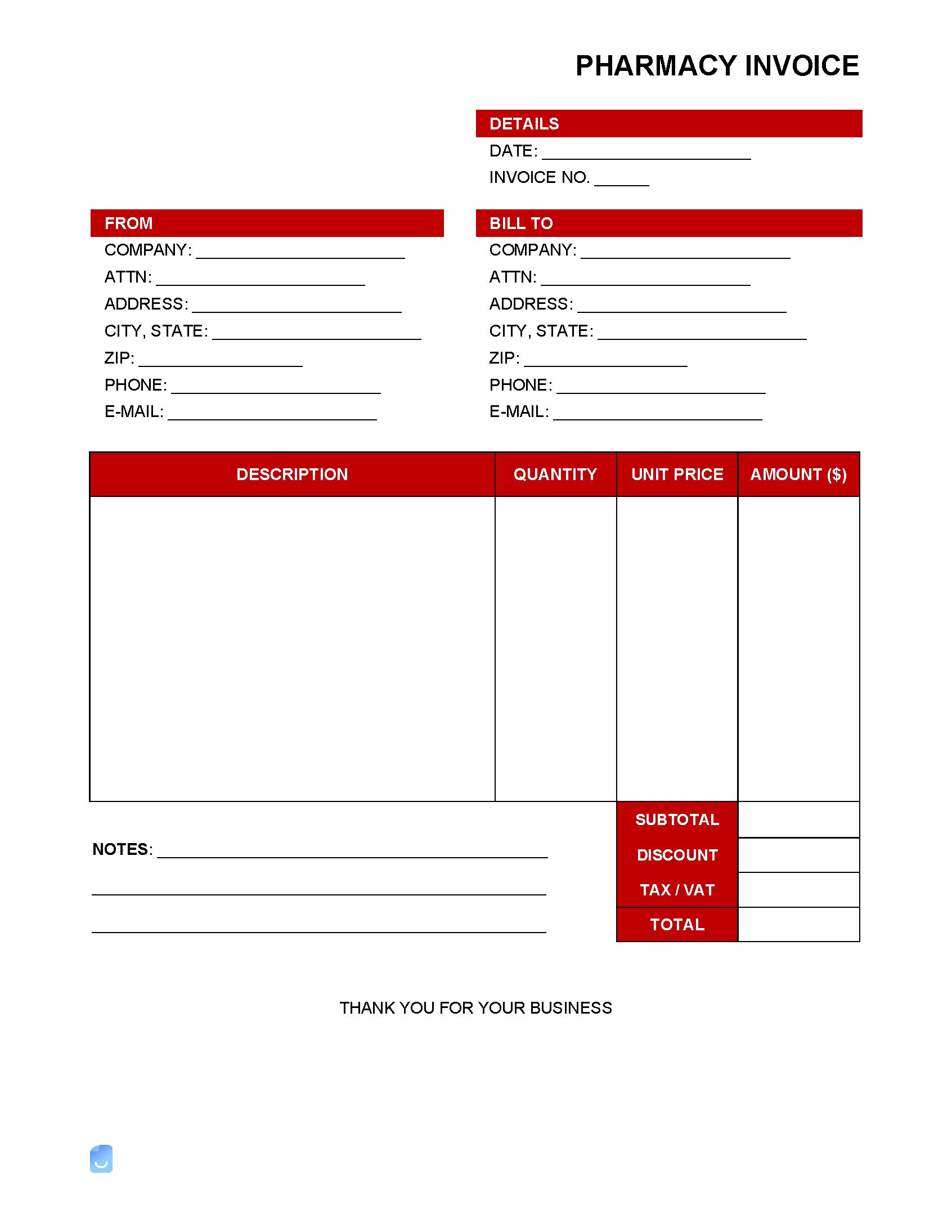

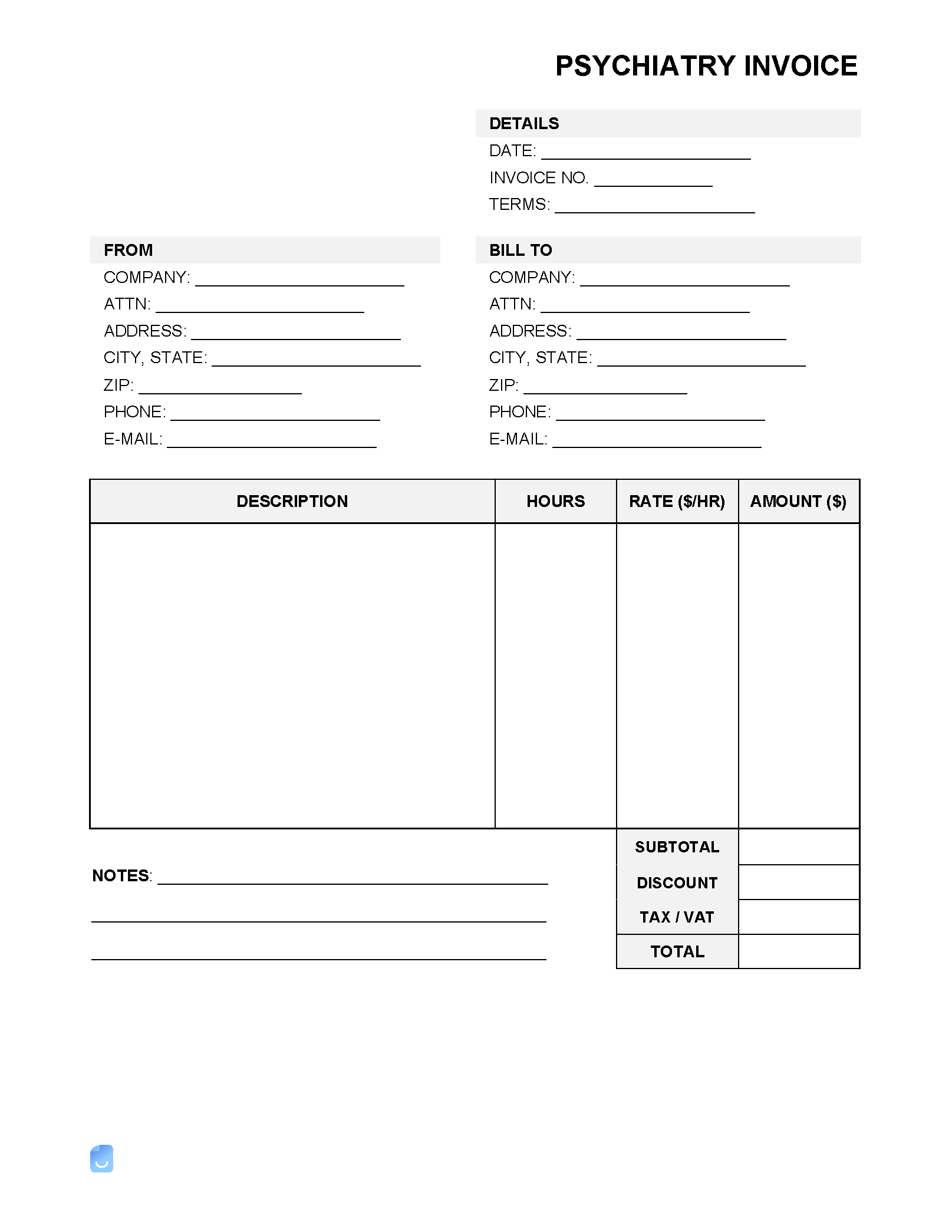

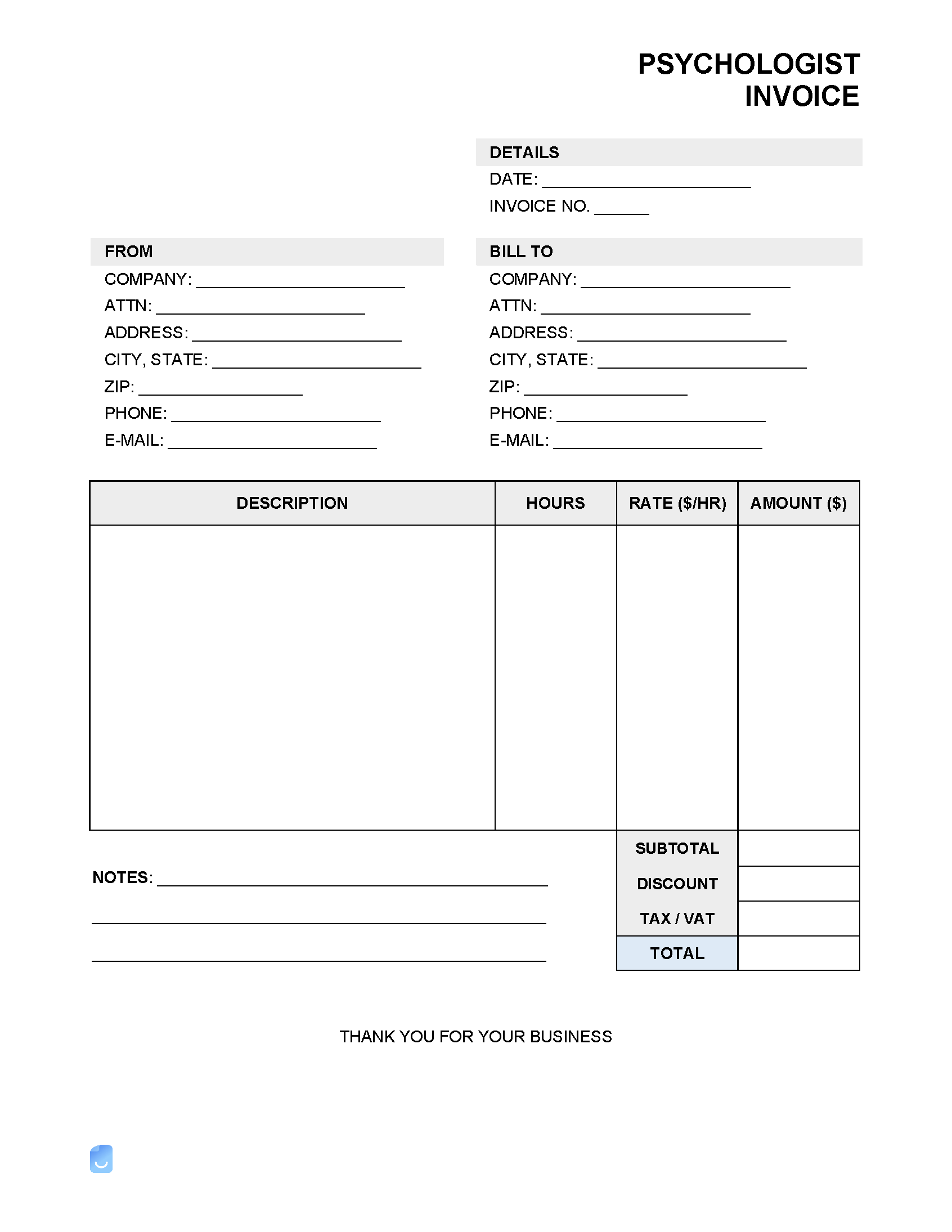

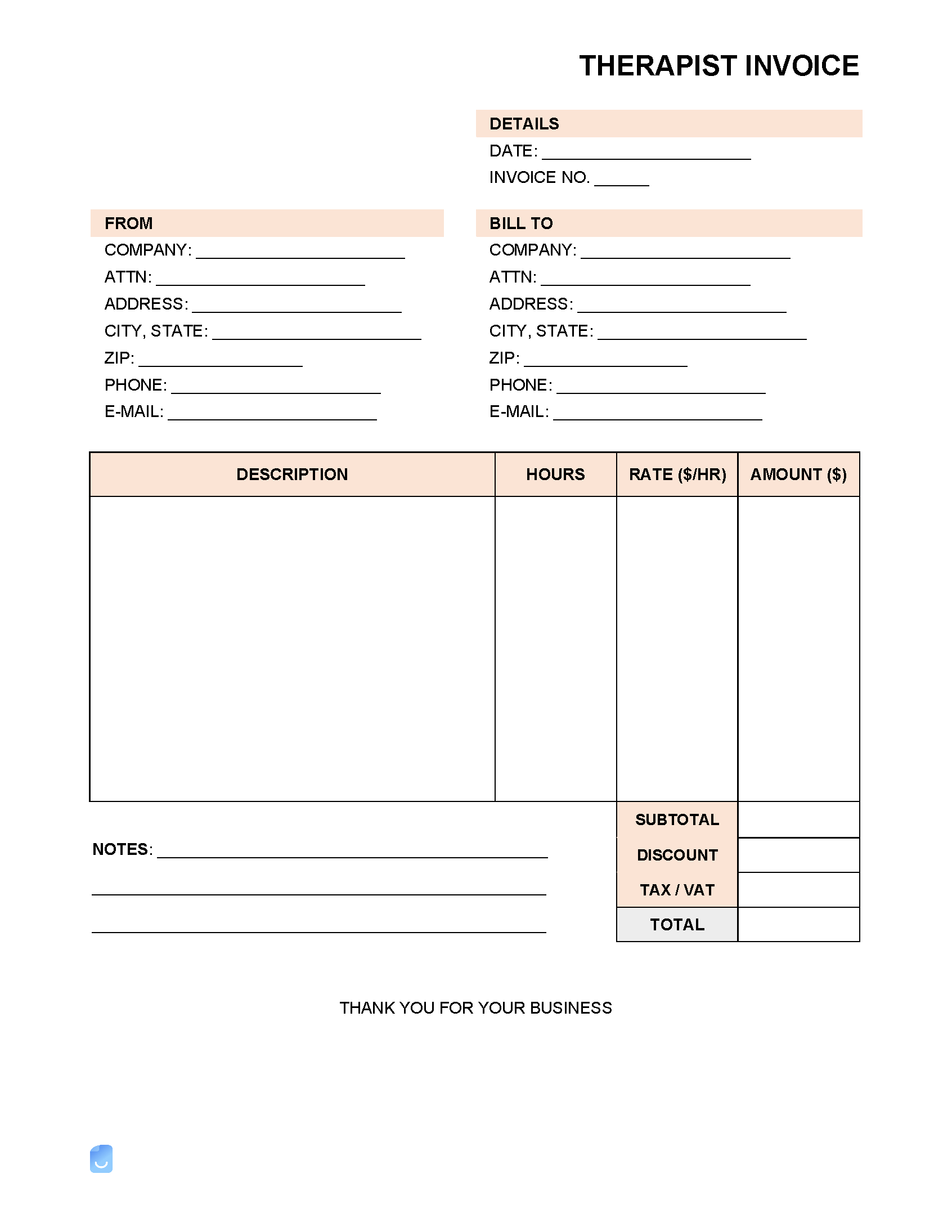

Medical Invoice Template

A medical invoice is for any licensed practitioner to request payment from their patients for the health care provided. The invoice is commonly sent to the patient’s home address, like a bill, and requests that payment be made within 30 days. Under FDIC regulations, medical bills cannot be placed on a consumer’s credit report until 180 days after being outstanding.

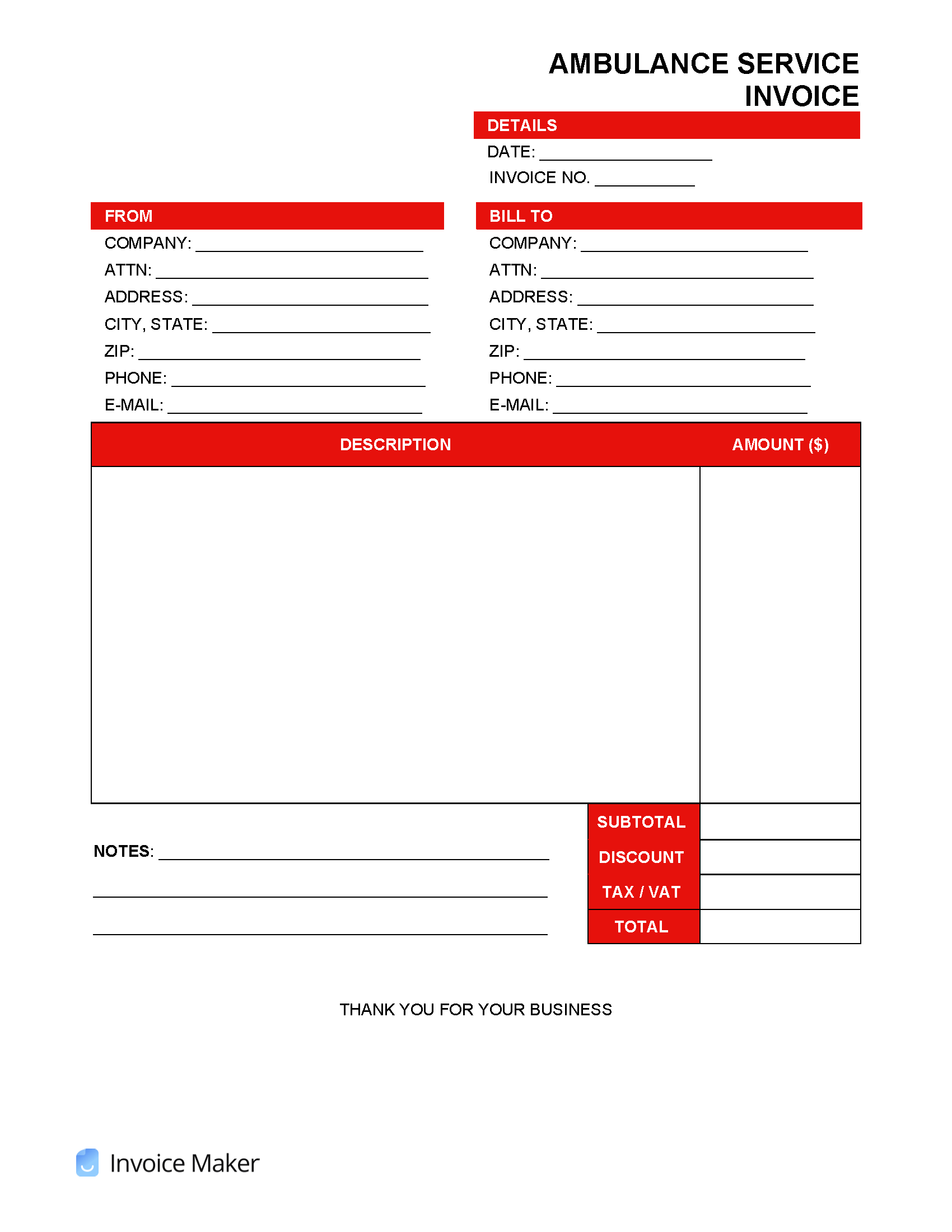

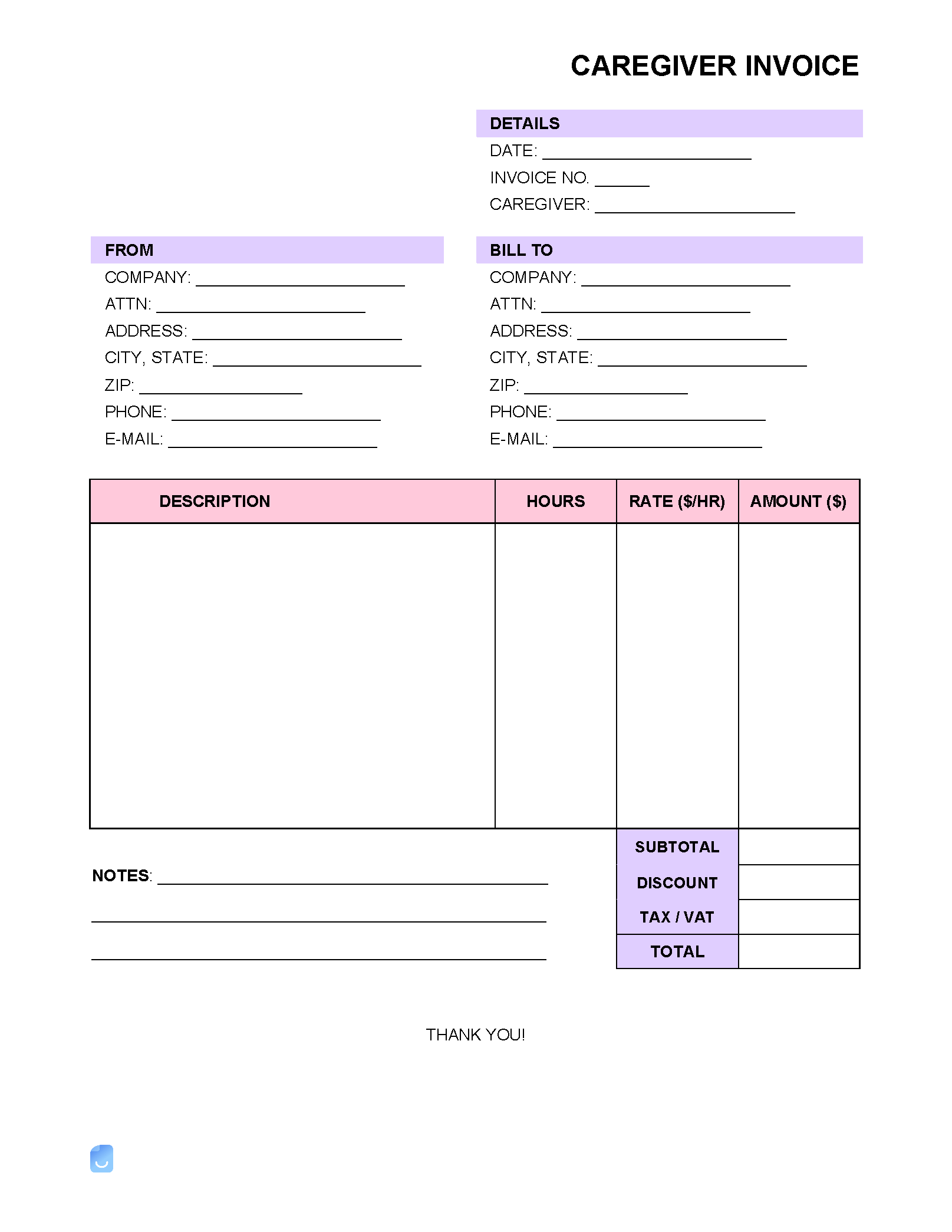

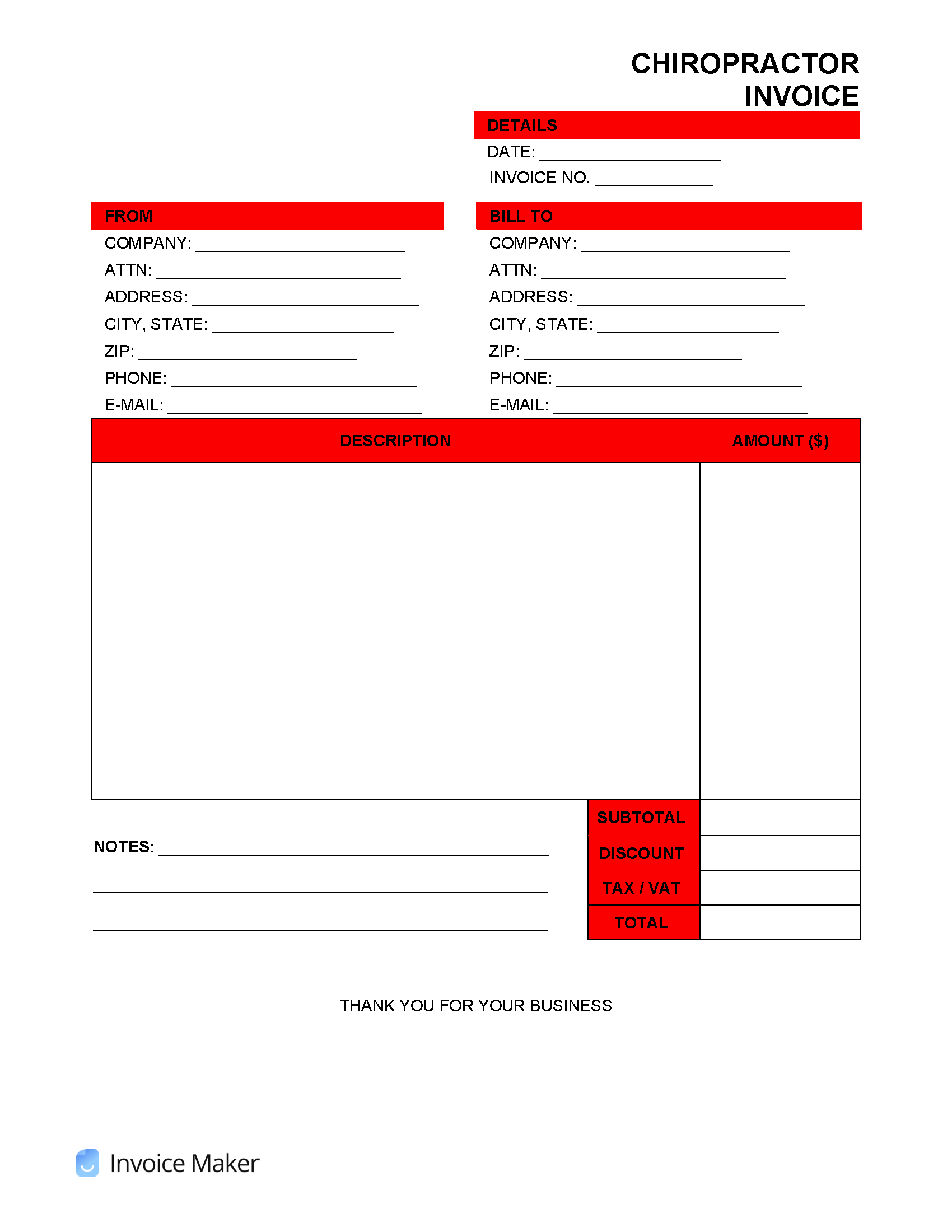

By Type (14)

What is Medical?

Medical is any type of service related to health care or medicine prescribed to a patient. The medical industry comprises 3 primary sectors, which include services provided by hospitals, businesses offering medical and dental services, and human well-being. The majority of patients, even those with medical insurance, are confused as to how their medical bills are calculated, which is why it’s important to use a medical invoice that is clear and concise when requesting payment from patients.

Are Medical Expenses Tax Deductible?

According to the IRS (Topic No. 502), an individual can deduct medical expenses that exceed 7.5% of their adjusted gross income (taxable income). This deduction must be stated on Form 1040, Schedule A. If the individual has dependents (spouse, children, etc.), medical and dental expenses procured by them can be applied to the individual’s total medical expenses. For example, if an individual has an annual income of $60,000, they would be able to deduct medical expenses that exceed $4,500. Almost all medical expenses are qualified, even the cost of travel when it pertains to going to and from to receive treatment. Those that are self-employed are eligible for the self-employed health insurance deduction. Funds reimbursed from a health insurance provider are not eligible to be deducted. Meaning that if an individual has medical expenses that exceed their adjusted gross income, they can not claim to make a deduction if their medical provider pays off their medical expenses. Therefore, if an individual has medical insurance, it’s important to know what their coverage covers.

What is Medical Billing and Coding?

Medical billing and coding is a classification system published by the World Health Organization (WHO) that currently uses the ICD-10-CM (for diagnosis) while used in conjunction with CPT (for procedures). This coding system is used during the billing process when reporting patient services to health providers and insurance companies. An official medical bill (invoice) that is itemized will detail a code matching each diagnosis and treatment on an invoice. This coding is mostly irrelevant to the patient, but it’s essential for medical providers and health insurers when billing or when a patient makes a claim.