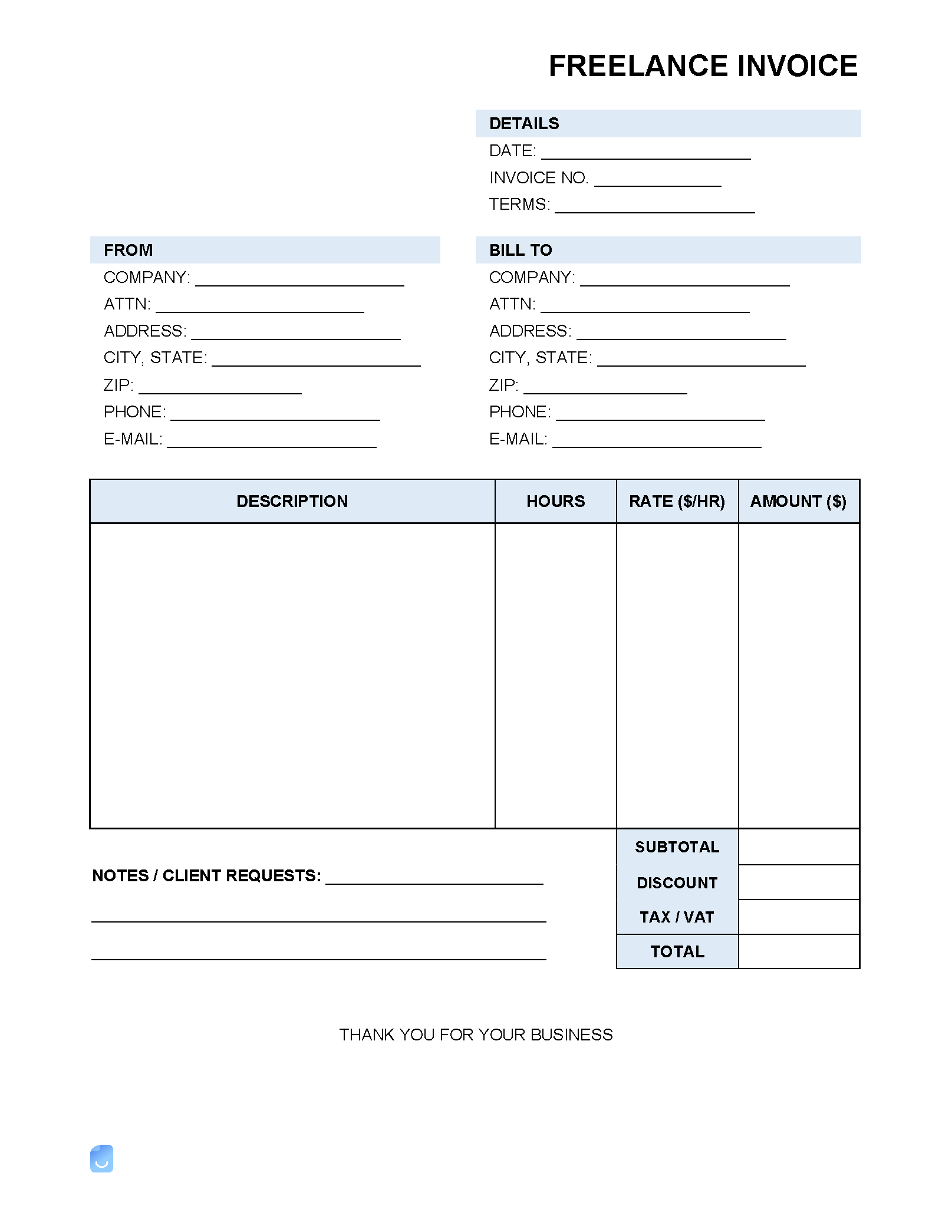

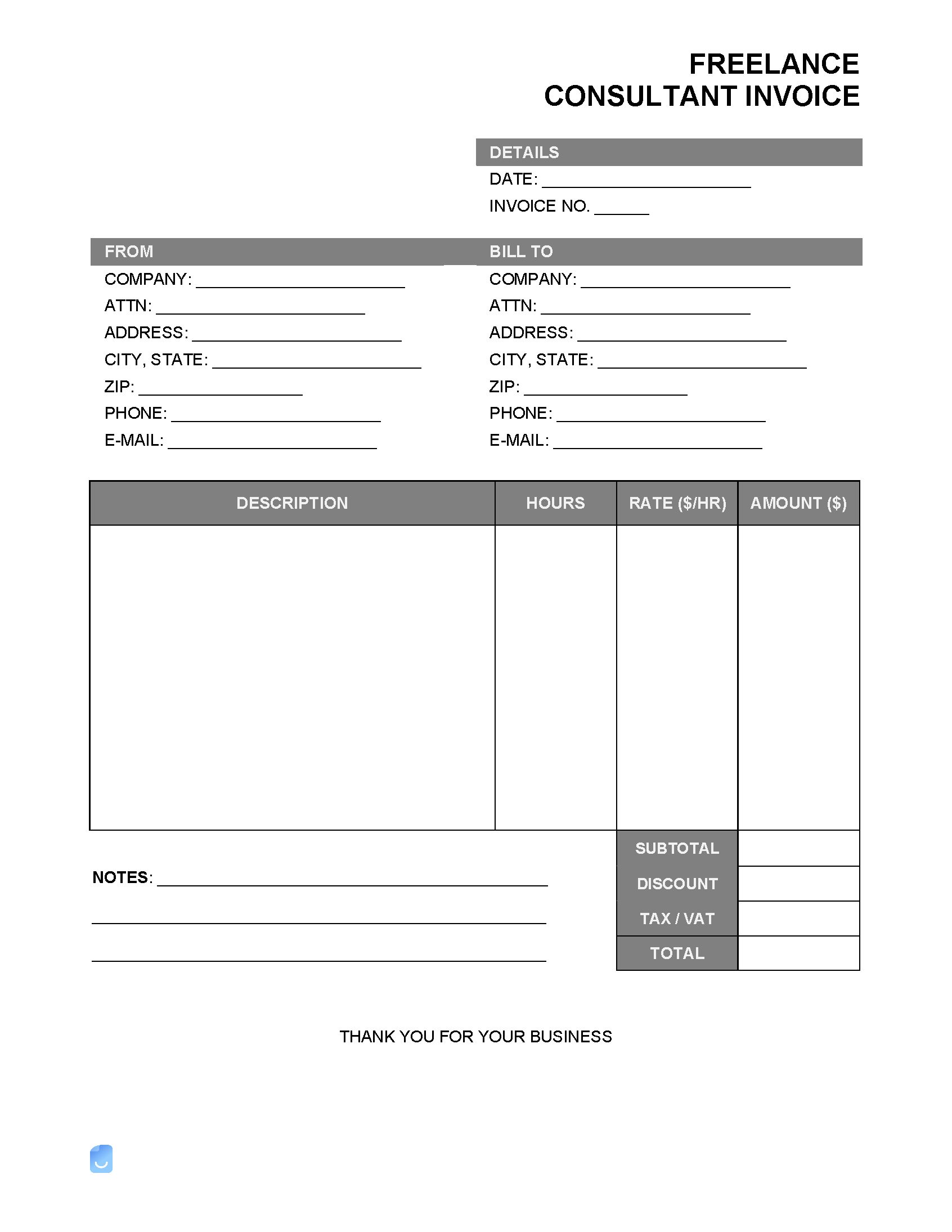

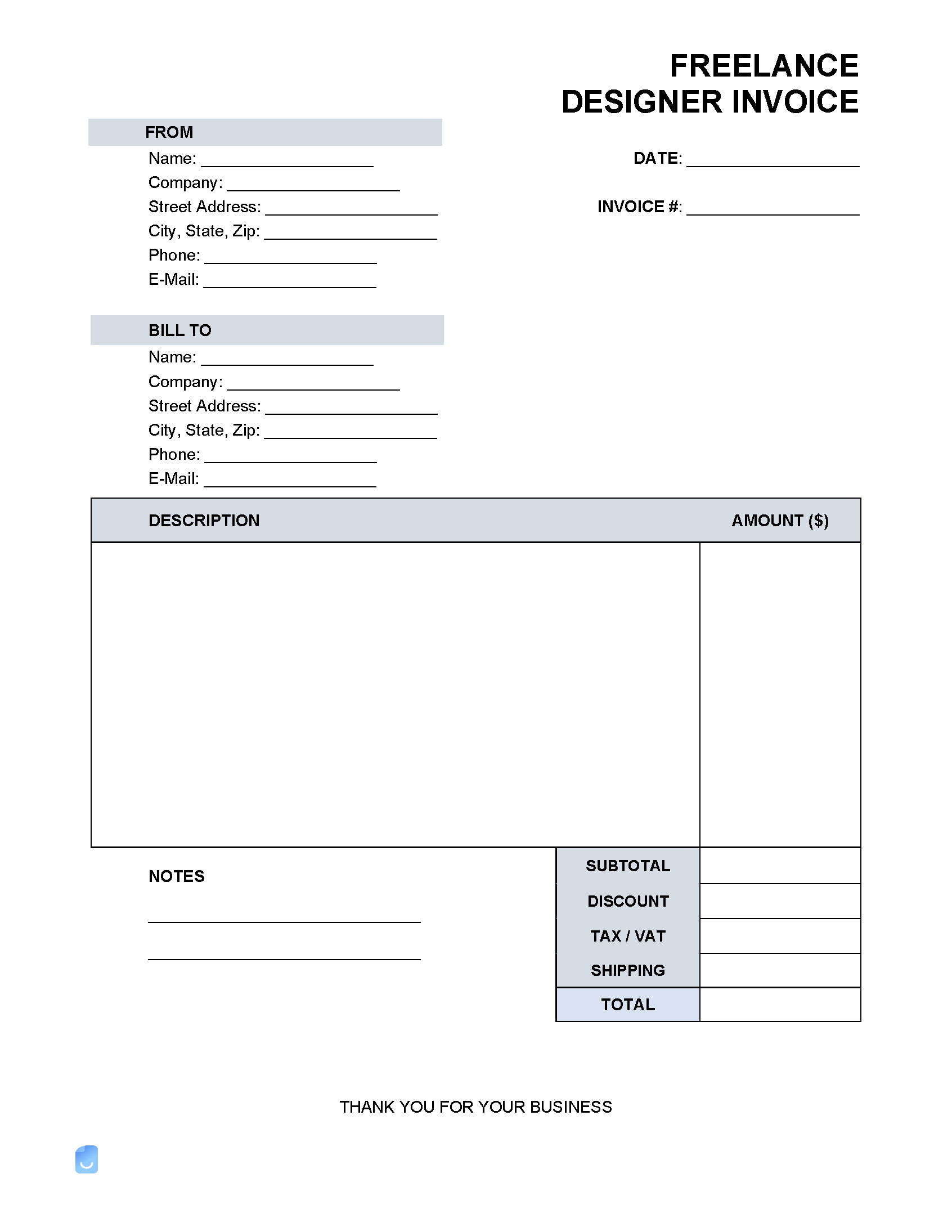

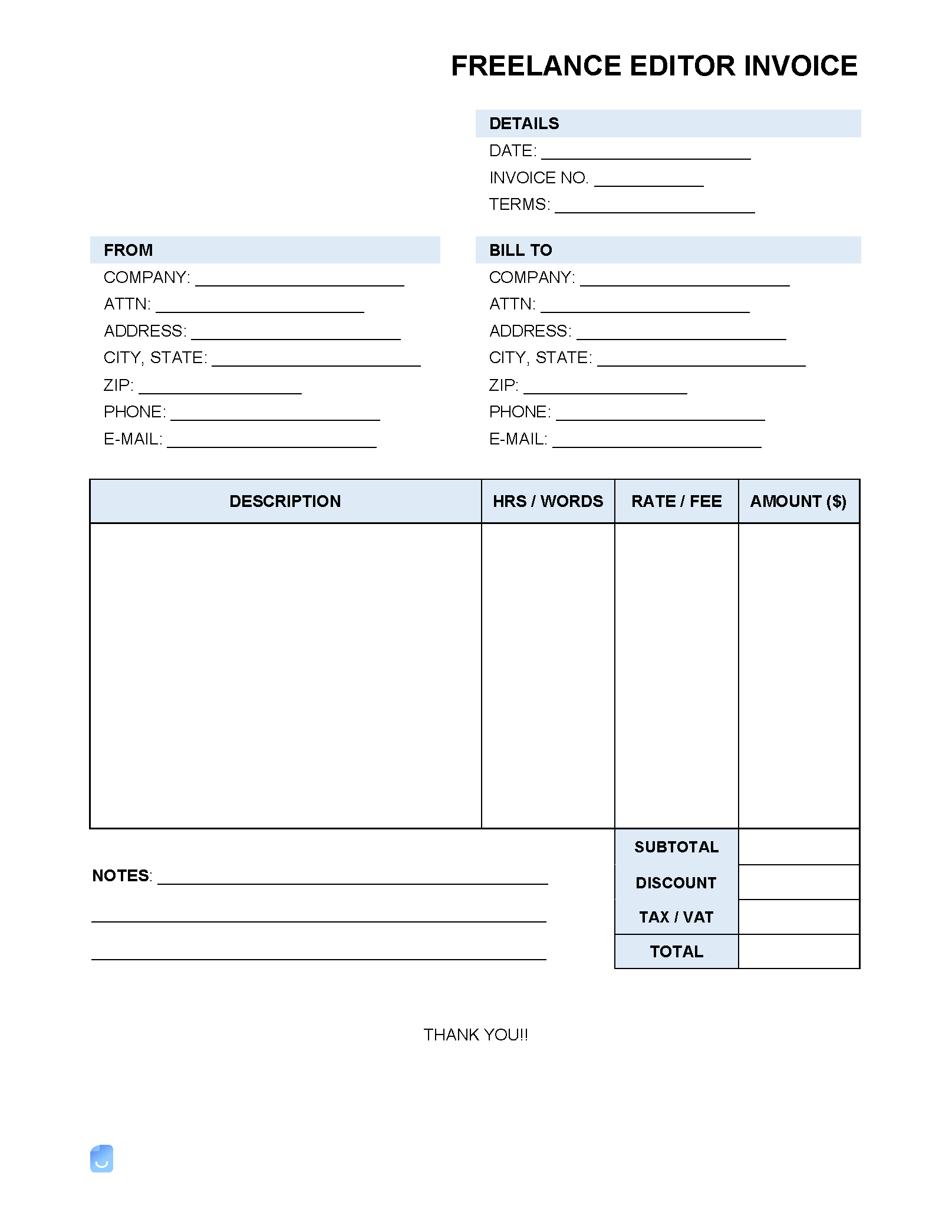

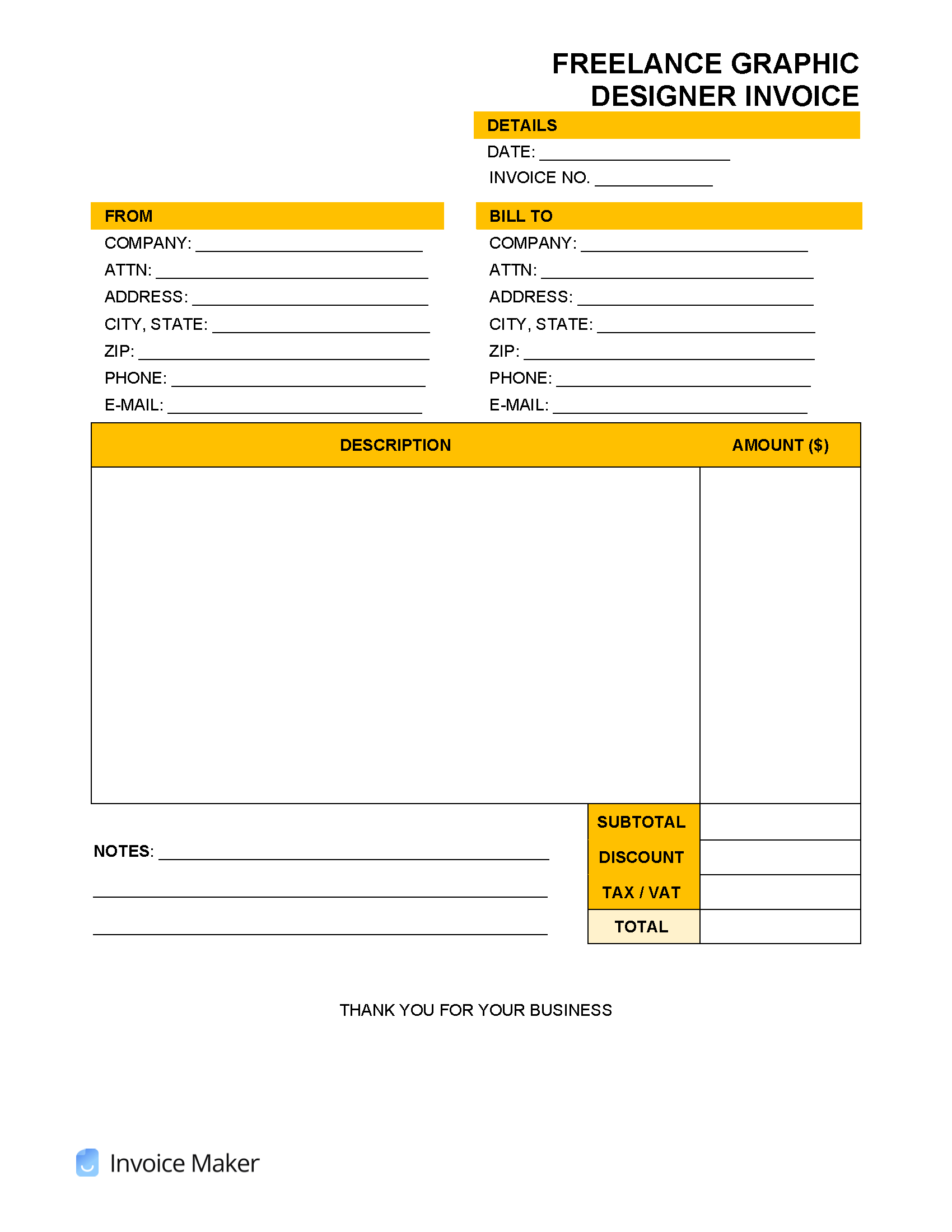

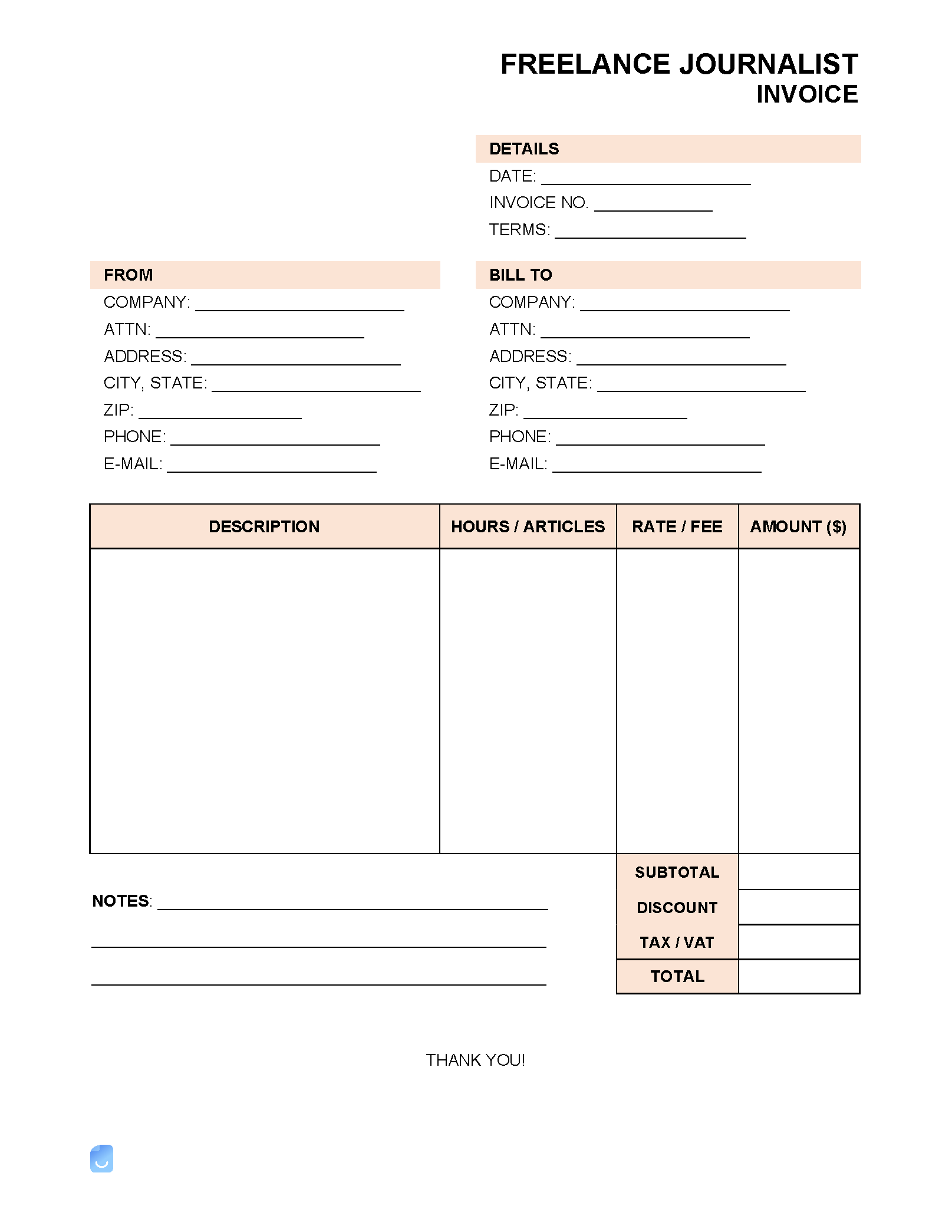

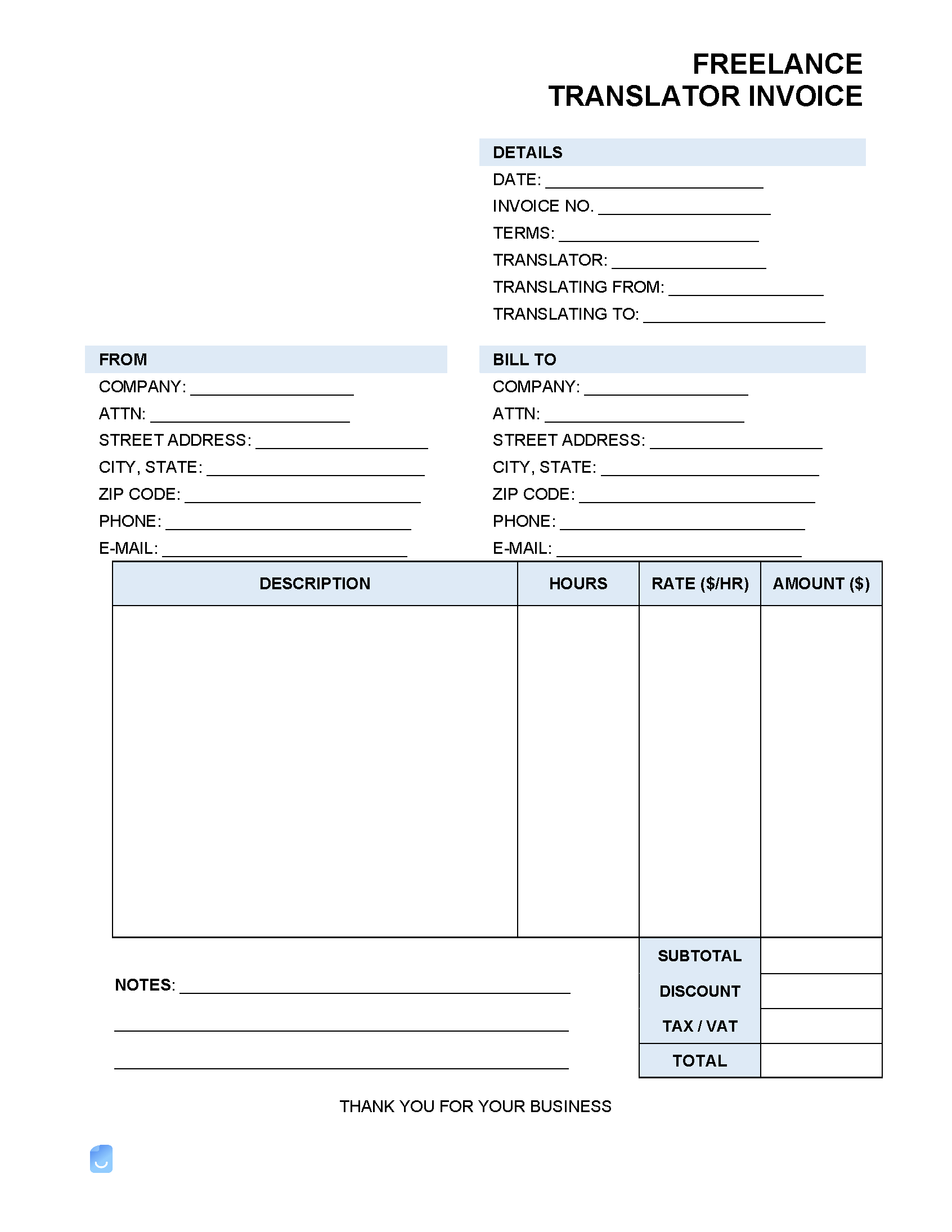

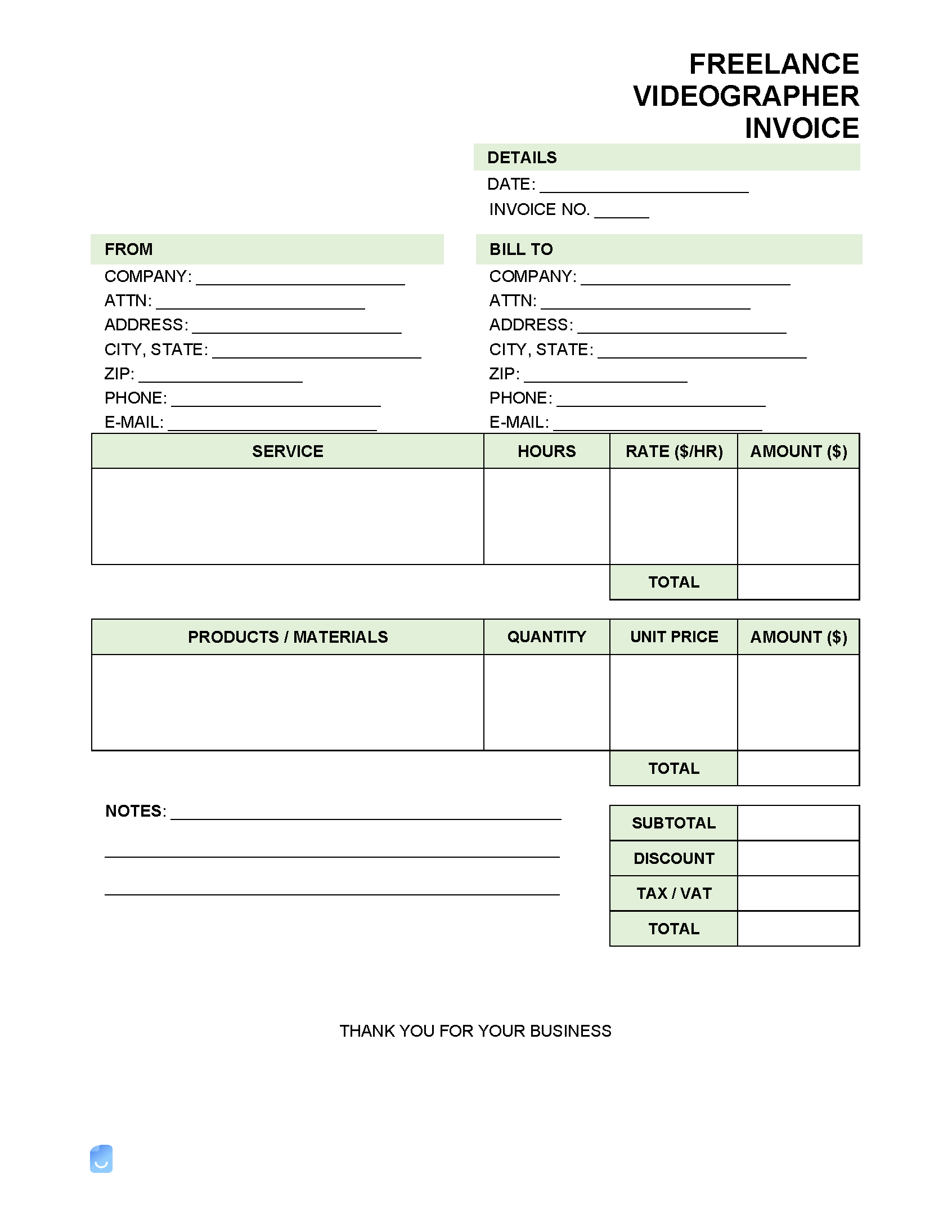

Freelance Invoice Templates

A freelance service invoice is a document used to request money for any product delivered or service provided individually, detached from any company or other association. Freelancers are considered independent contractors by the IRS and are responsible for deducting their share of withholding taxes.

- Products – Payment is due upon delivery of the finished product to the client or customer.

- Services – Payment is due upon completion of the project or on a recurring basis (e.g. weekly, monthly, etc.).

By Type (7)

How to Create a Freelance Invoice That Gets You Paid Fast

A freelance invoice is a document that a freelancer uses to request payment. The client has the responsibility to pay the invoice within the agreed-upon timeframe. If the client does not pay the invoice, the freelancer has the right to take legal action.

What Is a Freelancer?

A freelancer is a self-employed professional experienced in a specific field of work. Freelancers are hired by companies, startups, and individual clients who may need one-time or seasonal help but do not have enough money or work to warrant hiring on a full-time basis. The services freelancers offer are often very desirable due to the hiring entity not having to reimburse expenses, pay for insurance, or pay for sick leave/vacation time. While freelancers typically account for this by charging slightly higher rates than salaried employees performing the same job, their convenience and affordability make them attractive to employers.

Types of Freelancers

According to ZipRecruiter, these are the most popular types of freelance jobs:

- Art director

- Photographer

- Designer

- Copywriter

- Graphic designer

- Writer

- Web designer

- Recruiter

- Content writer

How to Become a Freelancer

To become a freelancer, one must have a skill or an education in a field or specific task often desired by employers. For example, an engineer with a degree and many years of experience may wish to offer their skills to companies as a consultant. Another example may be a professional writer who wishes to write on a freelance basis for blogs, news sites, content publishers, and other online companies. Once the freelancer has identified their marketable service, the next step is to market themselves on one (1) or more freelance job boards. Popular platforms used for freelancers include UpWork, Fiverr, Toptal, and Freelancer. Upon landing their first gig, freelancers must perform exceptionally to ensure they receive good reviews. While excellence should always be strived for, it is crucial initially as one poor review can cause other potential hirees to look elsewhere. After building up a repertoire of good reviews and building connections wherever possible, a freelancer can begin to increase their rates. Essentially, the more desirable/competitive the freelancer’s services become, the higher the rates they can justify charging. The general path to becoming a freelancer might look like this:

- Identify marketable skills

- Apply for jobs on freelance sites

- Work

- Earn positive reviews

- ncrease rates

How to Send an Invoice as a Freelancer

The requirements for creating and sending an invoice for hourly or fee-based freelance work are similar to that of any other invoice. Structurally, both require the use of tables to arrange charges and fields to list contact information. However, due to freelance work being more personal than services provided by companies, it is recommended that freelancers include less strict terms and add personal customization where applicable. Adding an invoice cover sheet can offer freelancer’s a convenient means of adding personalization while simultaneously informing the client of important information such as due dates, terms, and any other notes regarding the service.

Key Elements of a Freelance Invoice

These are the suggested features of a freelance invoice:

- Name and contact details for freelancer (e.g. address, phone number, website, etc.)

- Freelancer’s company logo (if applicable)

- Name and contact information for client

- Invoice number

- Description of service rendered (including time/hours worked)

- Cost of service rendered

- Amount owing

- Payment methods accepted (e.g. credit card, PayPal, etc.)

- Payment terms

An invoice can be generated manually using a program such as Microsoft Word, then exported as a PDF and submitted to businesses or clients via email. Alternatively, and to simplify and accelerate the process, an online invoice generator such as Invoice Maker can be used to produce invoices.

Freelance Tax Calculator

Using an online calculator to determine the monetary value of taxes that have to be paid in a given year can simplify the process considerably while simultaneously reducing the likelihood of making a computational error. The following calculators can be used for calculating taxes:

United States Tax Calculator

- CalcXML’s – Self-Employment Tax Calculator

England (UK) Tax Calculator

Freelance Invoice FAQ

Invoicing is one of the most important aspects of running a freelance business – but it can also be one of the most confusing. How often should you send invoices? What information should you include? How do you chase up late payments? Here are some tips to help you get started: 1. Send your invoices as soon as the job is completed. 2. If a client misses a due date for payment, follow up immediately. Send a reminder email and then send an invoice with a late fee. 3. Sometimes offering an incentive for early payment can help to ensure that a client doesn’t miss a due date.