Billing Invoice Template

Billing is the process of requesting payment for a product or service either before or after a transaction occurs. The most common document used for billing is a billing invoice. Small businesses, freelancers, and self-employed professionals typically use billing invoices to request payment and track transactions.

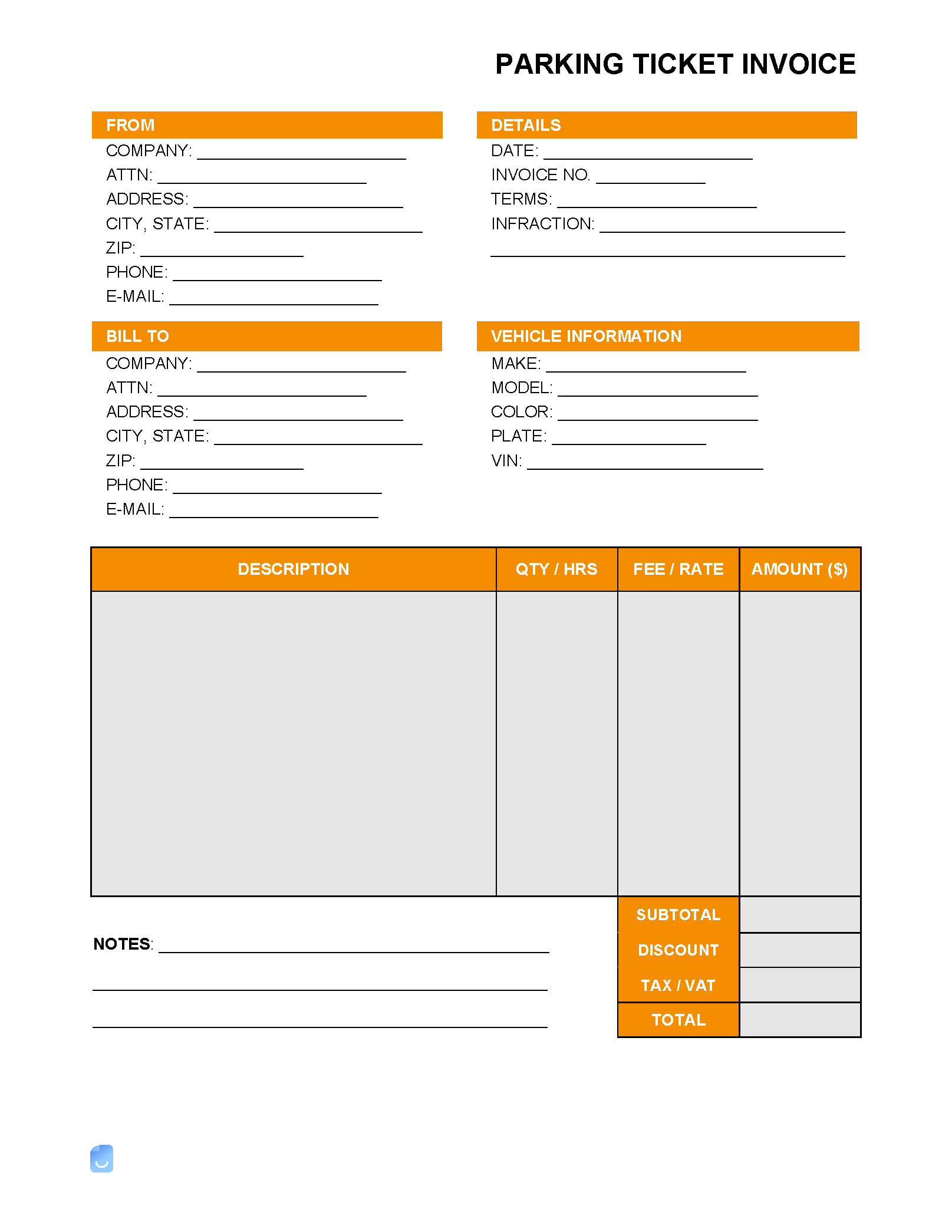

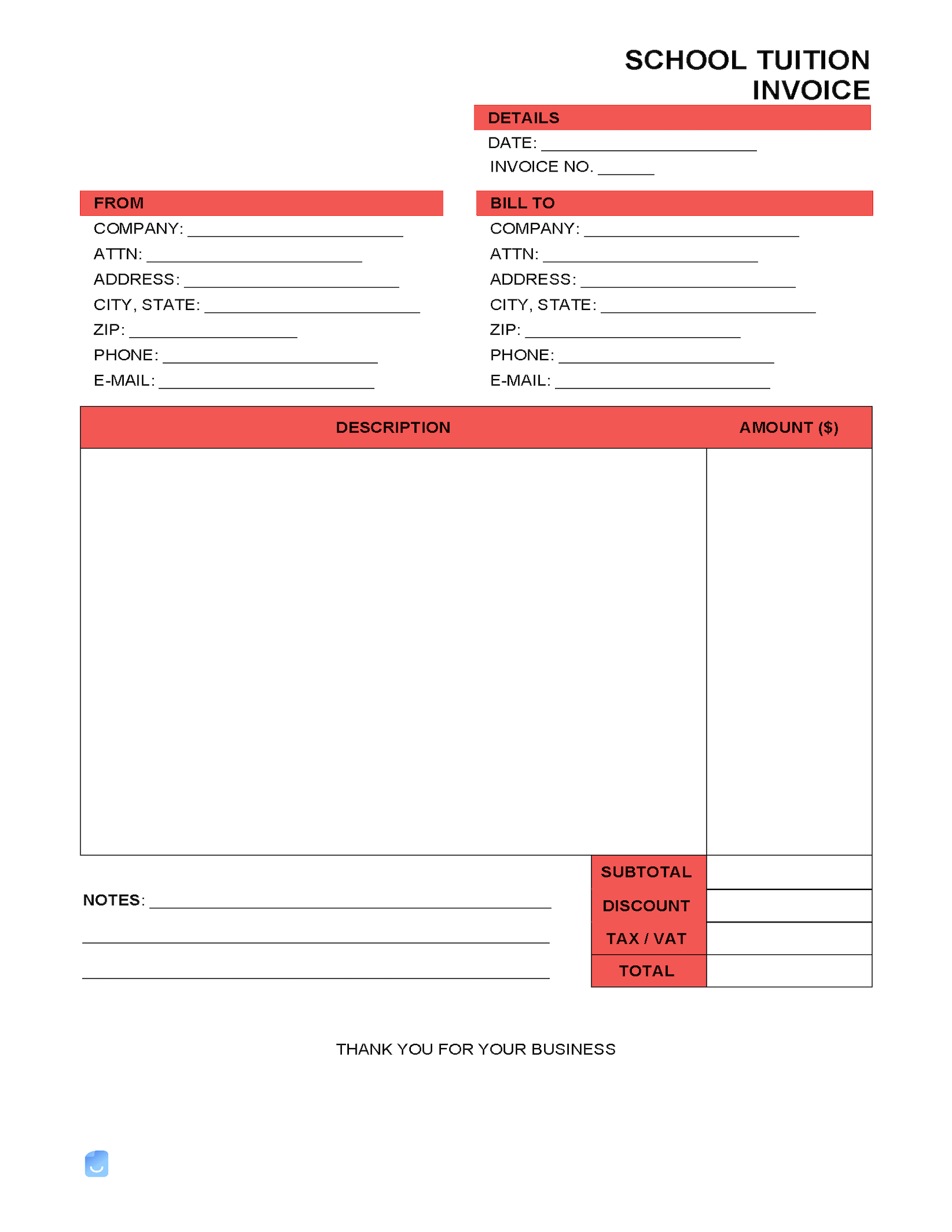

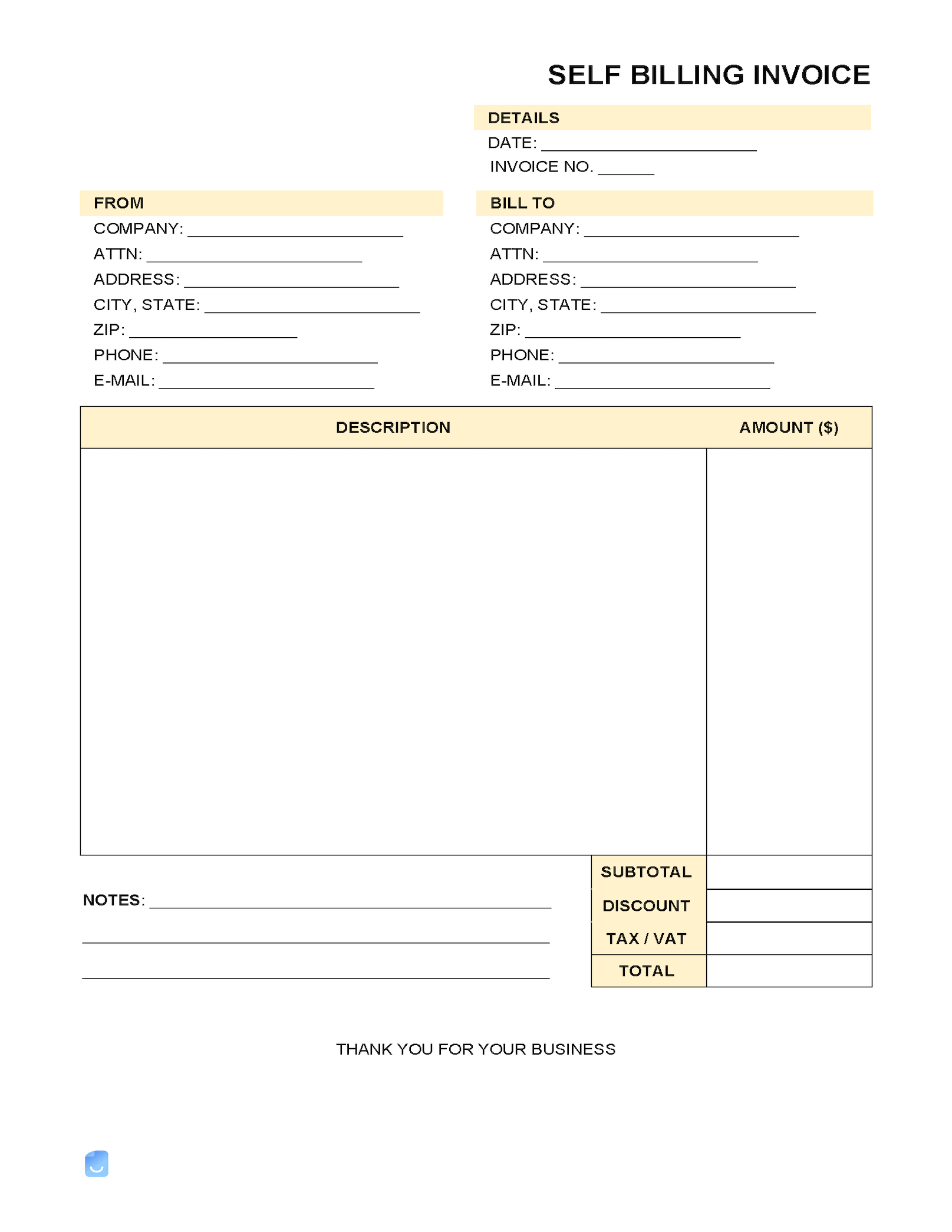

Billing Invoices: By Type (17)

How to Create a Billing Invoice for Your Business

An invoice includes a description of the products and/or services provided from a vendor to a client and a full breakdown of their cost. The invoice typically states the timeframe in which the customer is responsible for providing payment for the stated charges. A billing invoice can be sent either physically (by mail) or electronically (by email). The billing invoice can be paid by check, credit card, debit card, money order, cash, or other methods such as app-based services.

Is an Invoice a Bill?

While the words “invoice” and “bill” can sometimes be used interchangeably, this is not always the case.

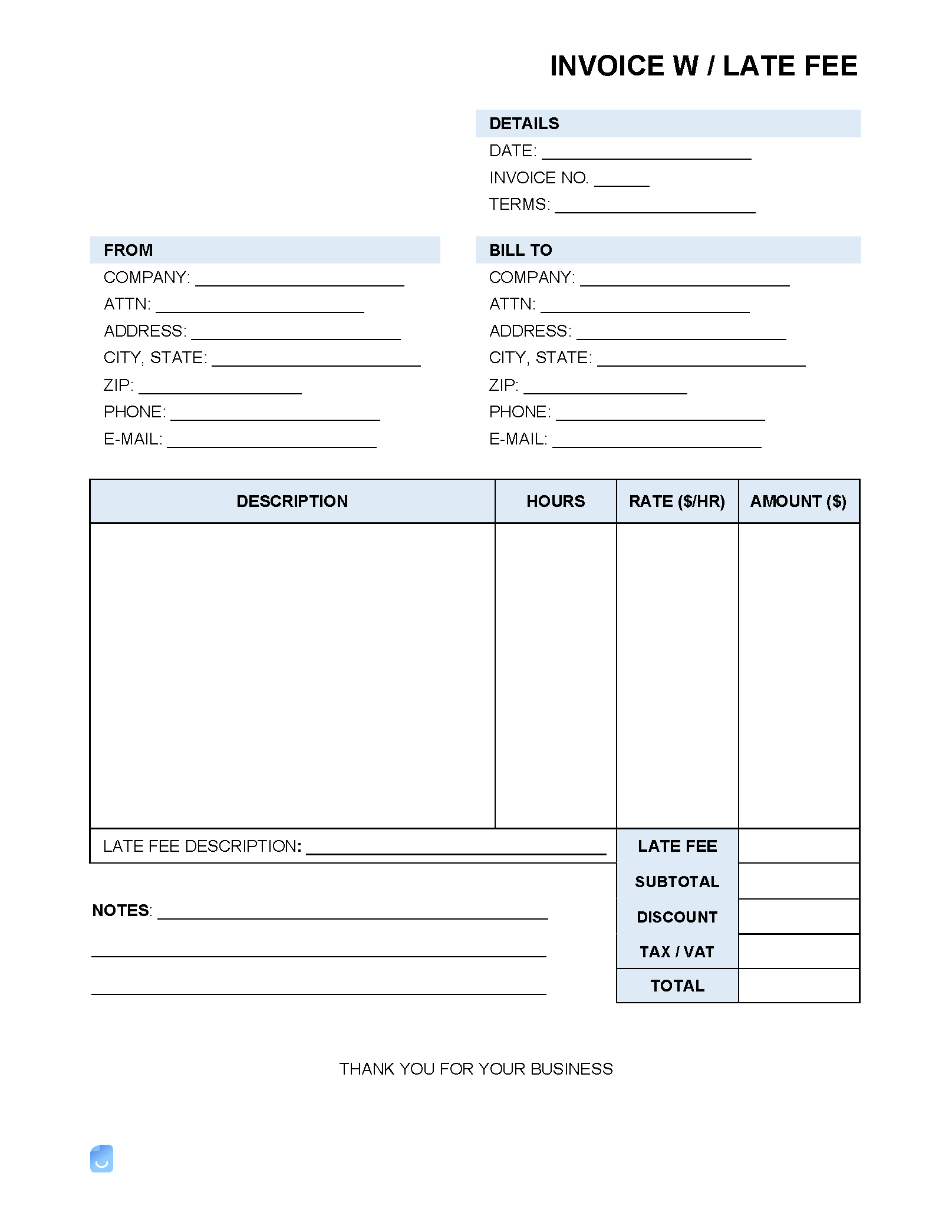

A bill is a document that requests immediate payment, such as the check a waiter leaves at a table after a meal. An invoice, however, is an itemized record of charges that gives the client or customer a timeframe in which to pay or face penalties, late fees, or legal action.

Invoices for Utilities

Utility bills are a common form of billing invoice. Most companies that provide gas, cable, electricity, or water issue monthly invoices to customers. These notify customers of an outstanding balance but have the added advantage of allowing customers to track and monitor their usage of a particular resource from month to month to determine whether a system needs maintenance or a routine needs to change. Rather than sending physical payments each month, customers now have the option of setting up auto-pay, which is a feature that allows for the logging of credit/debit card information and thus automatic payments at regular intervals.

All About Invoices

Invoices can be created using simple word processing programs or, for greater ease and convenience, by online invoice generators such as Invoice Maker.

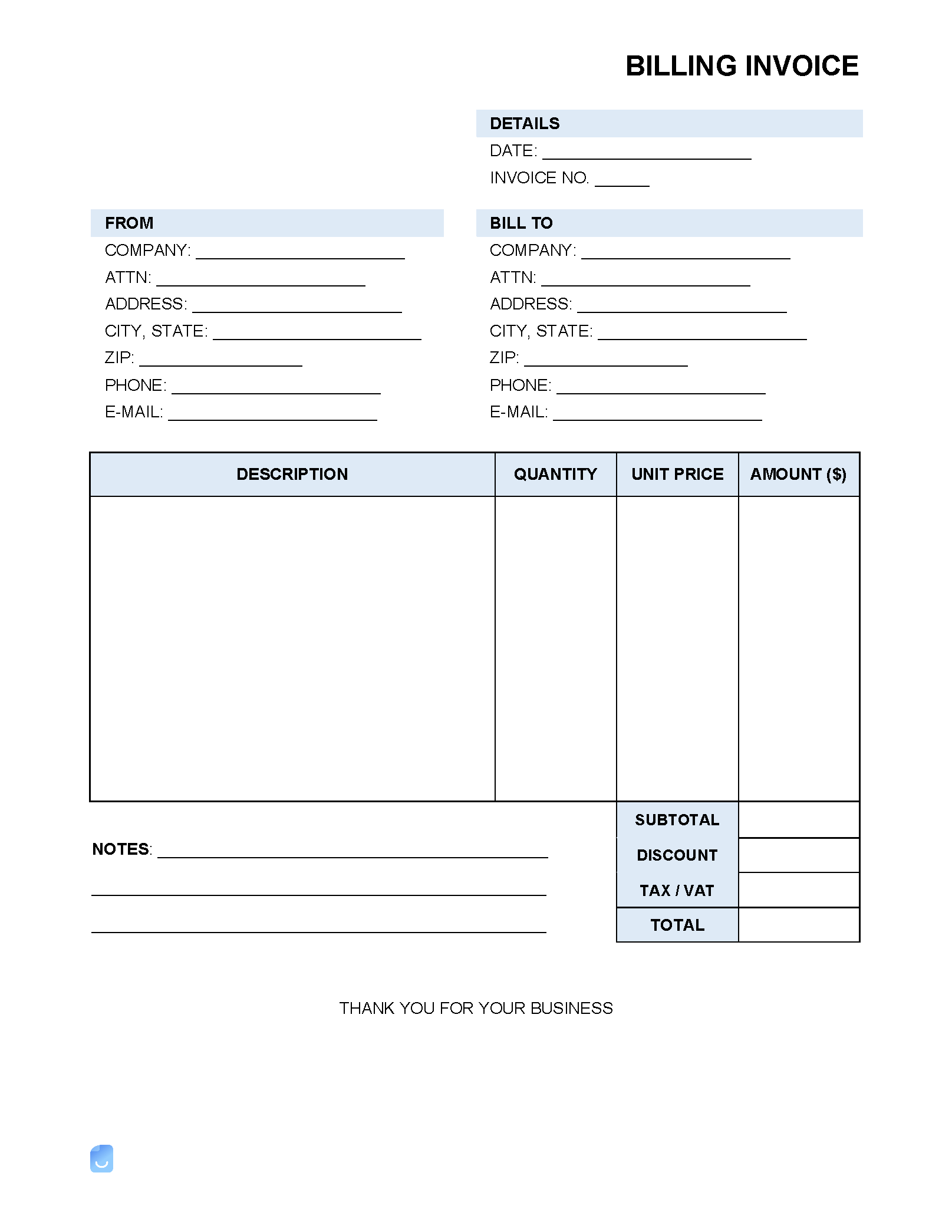

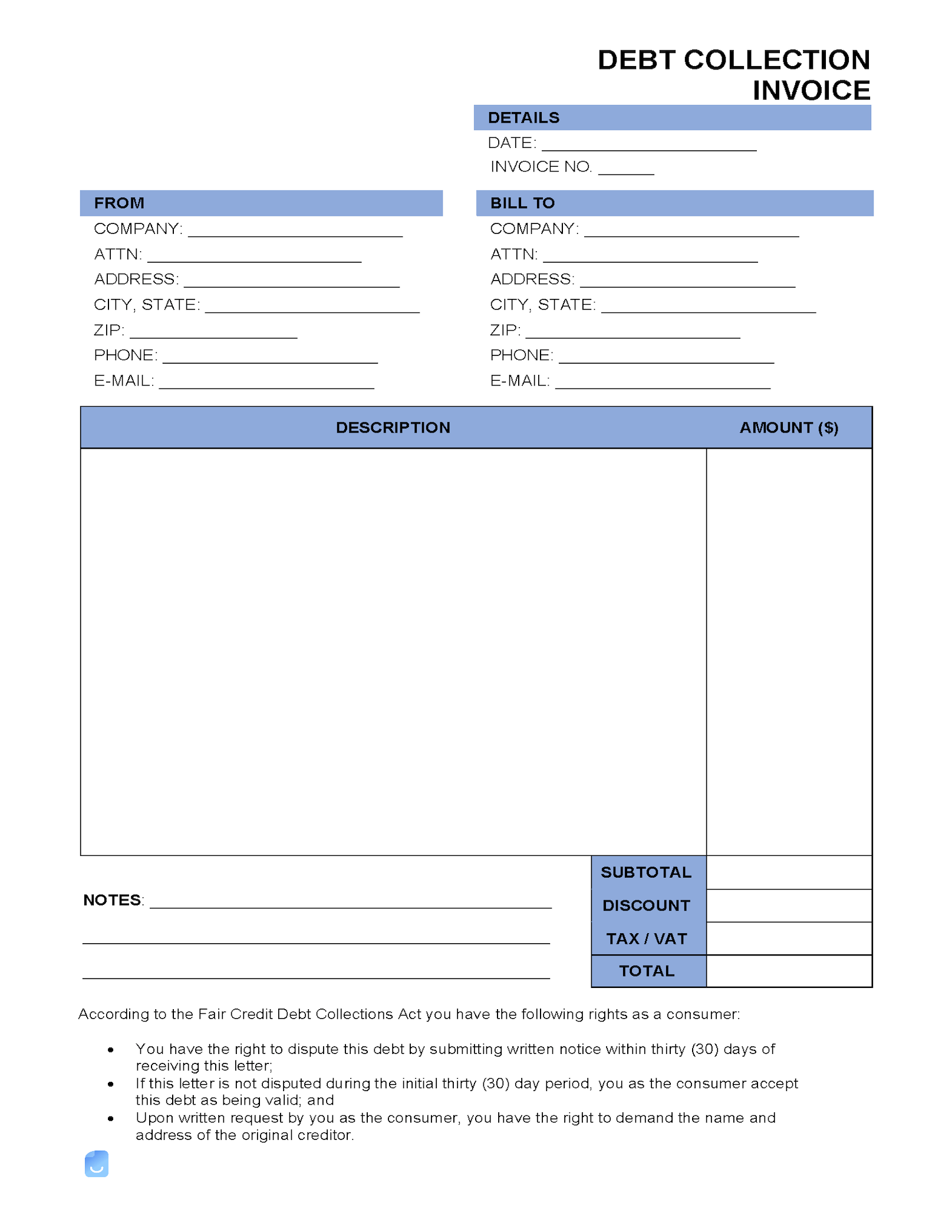

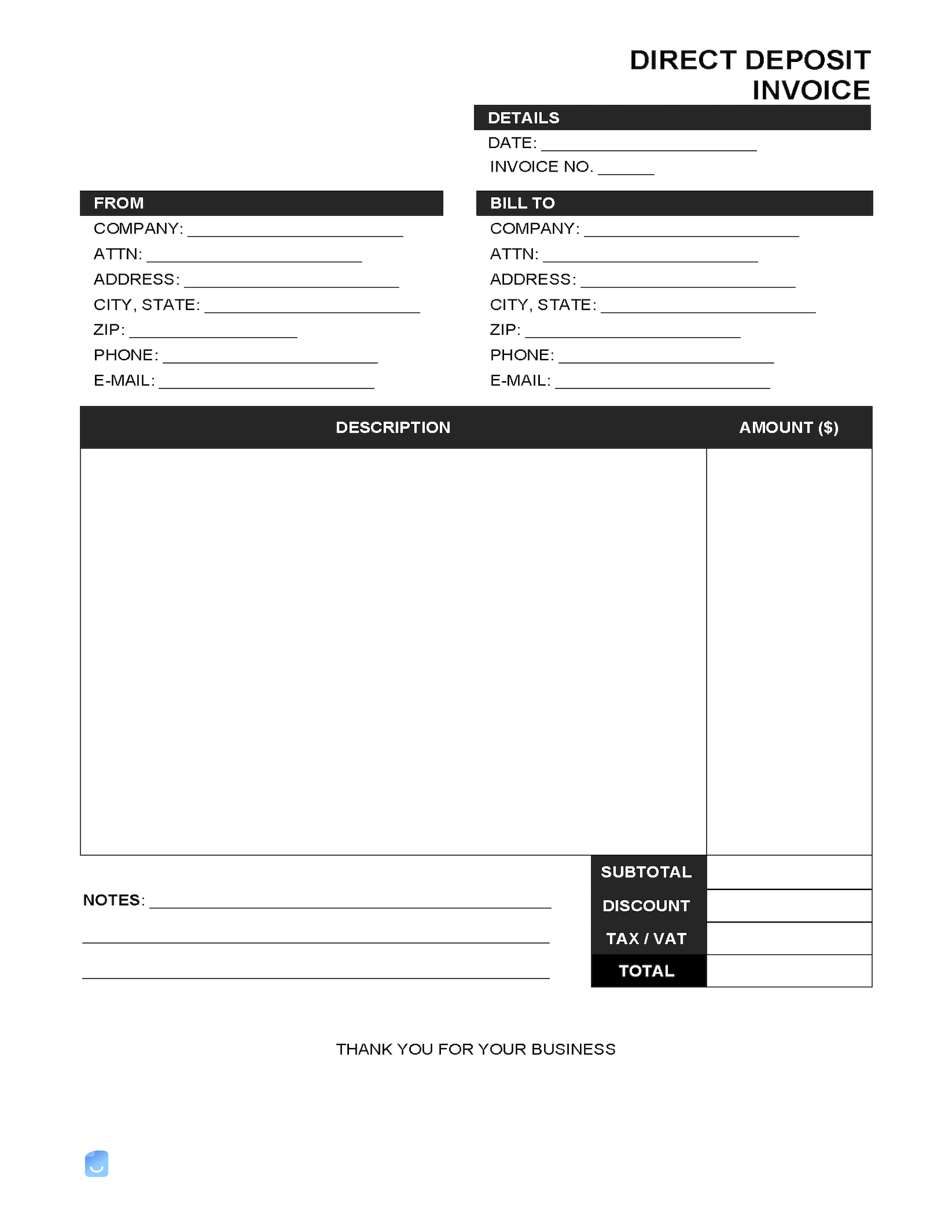

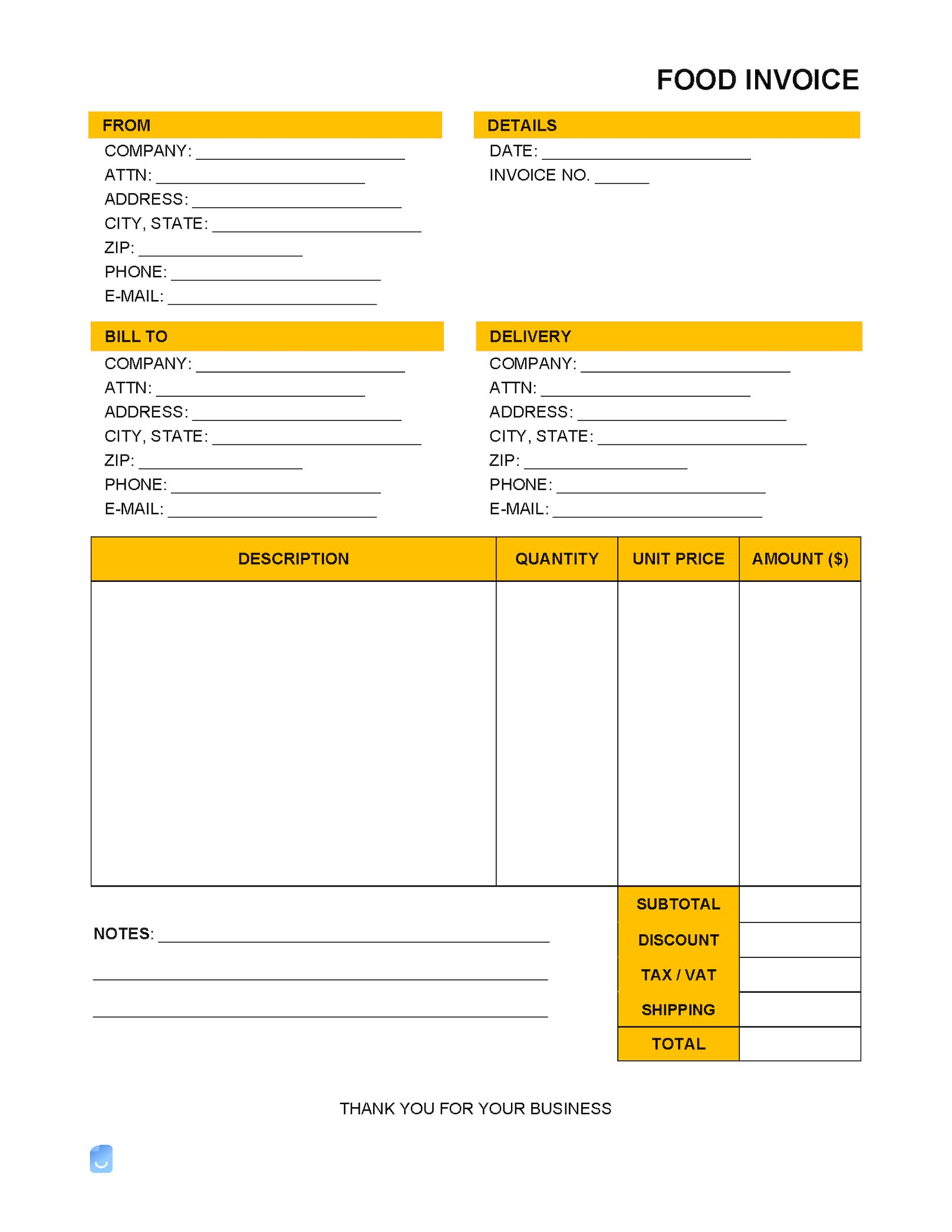

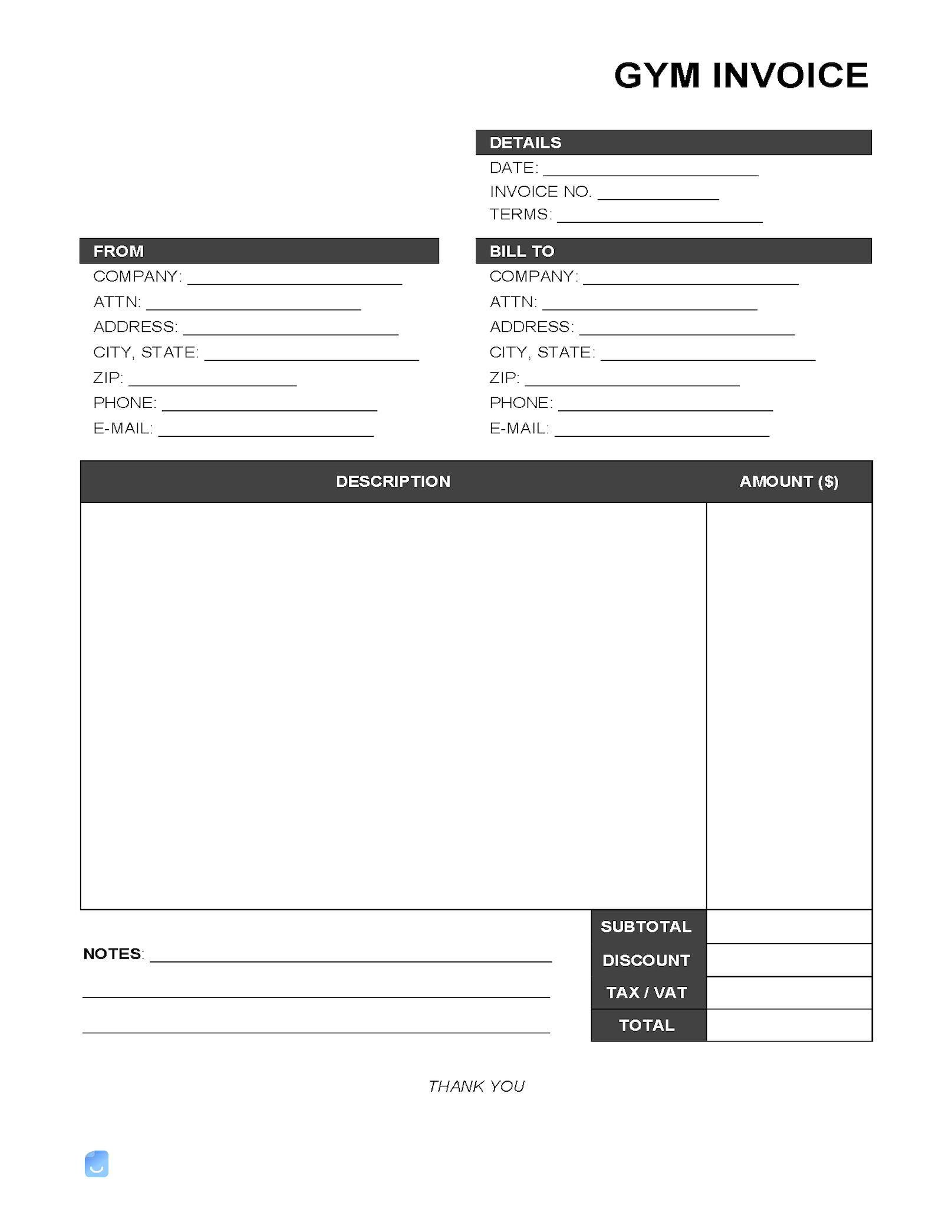

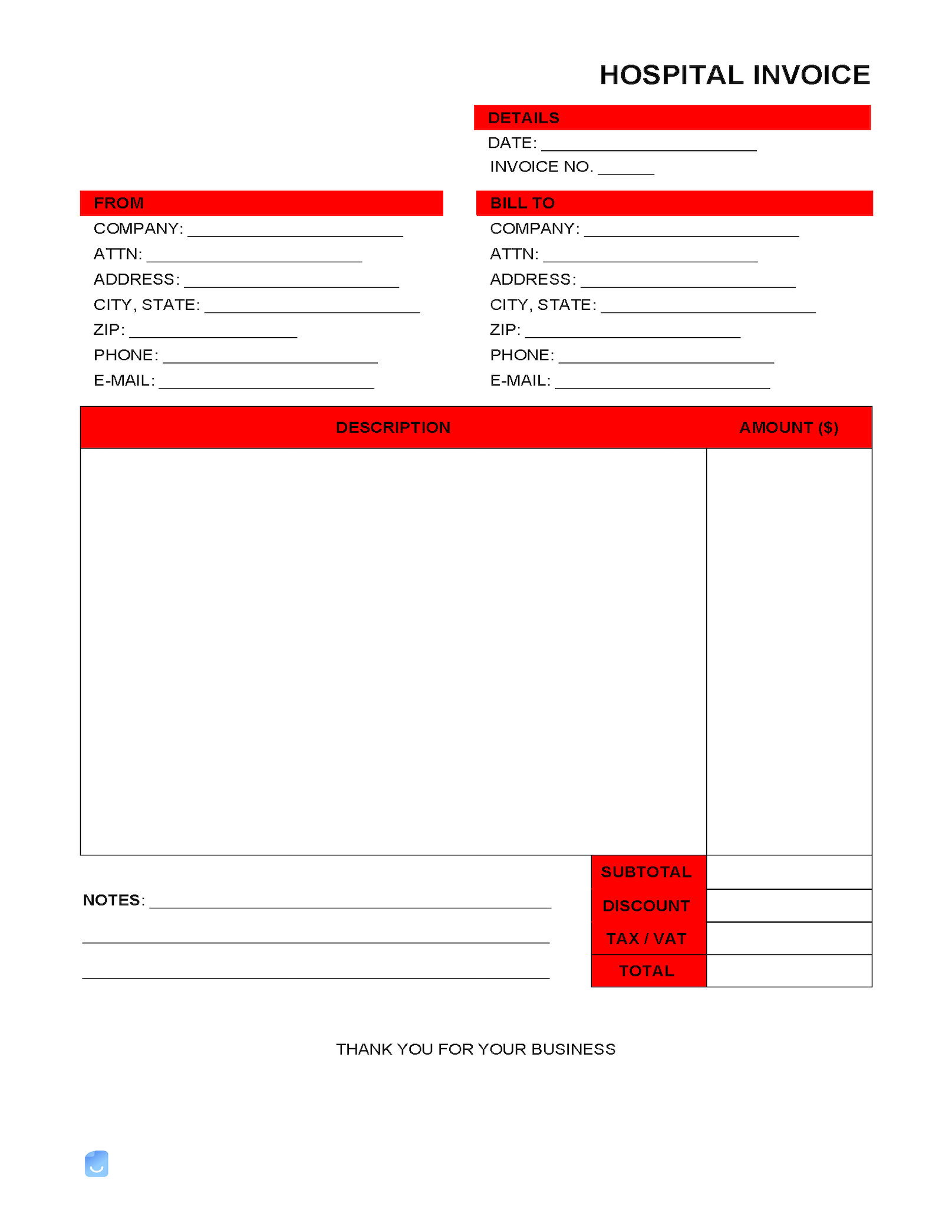

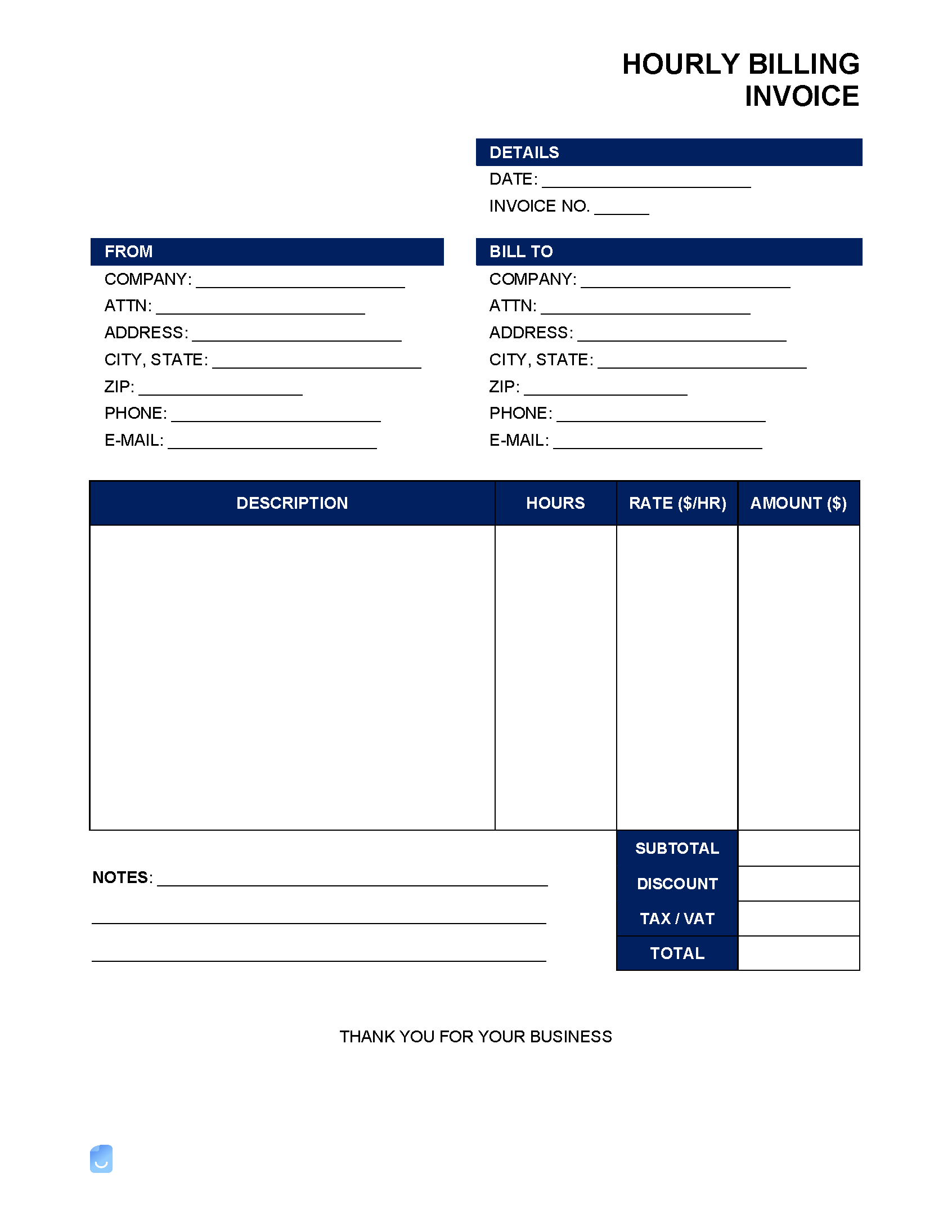

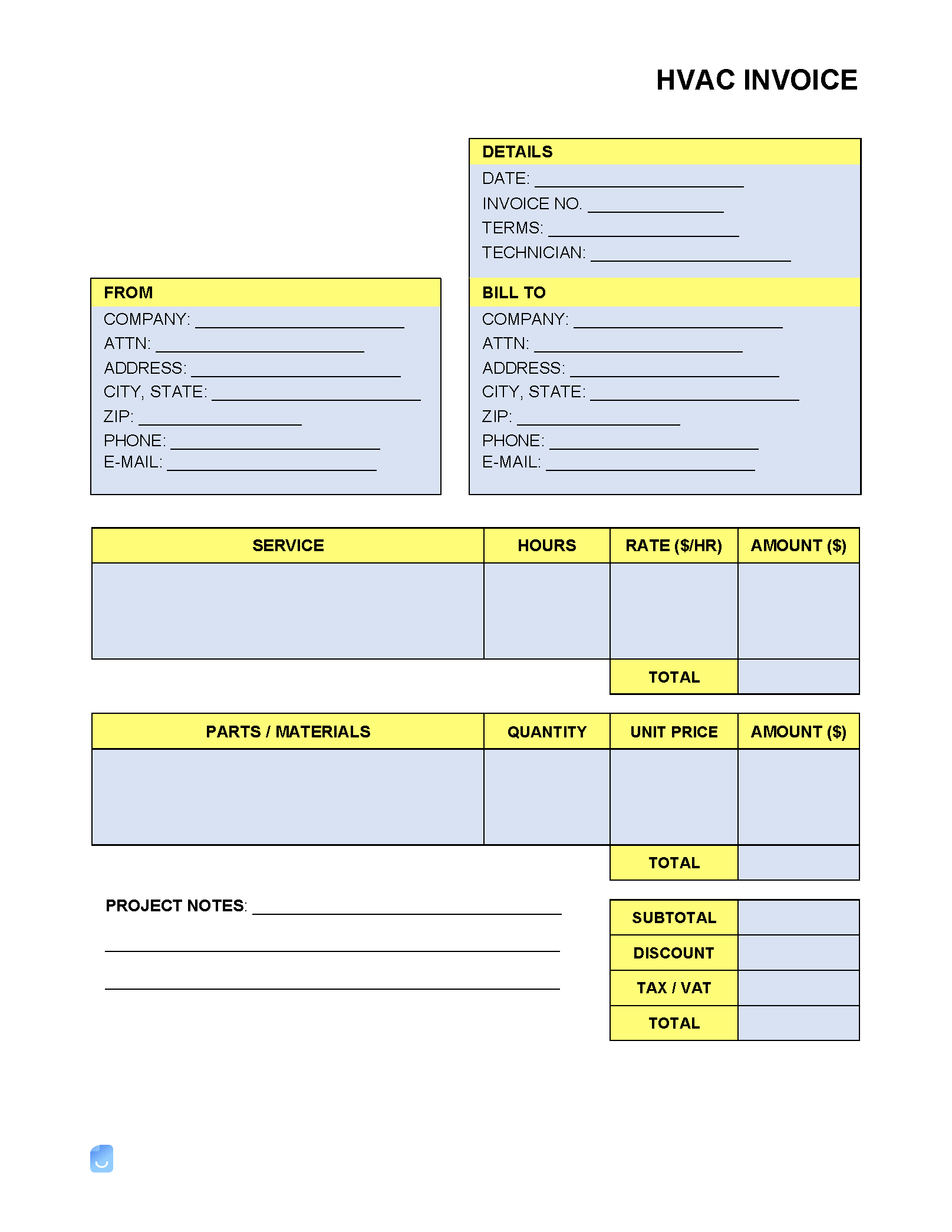

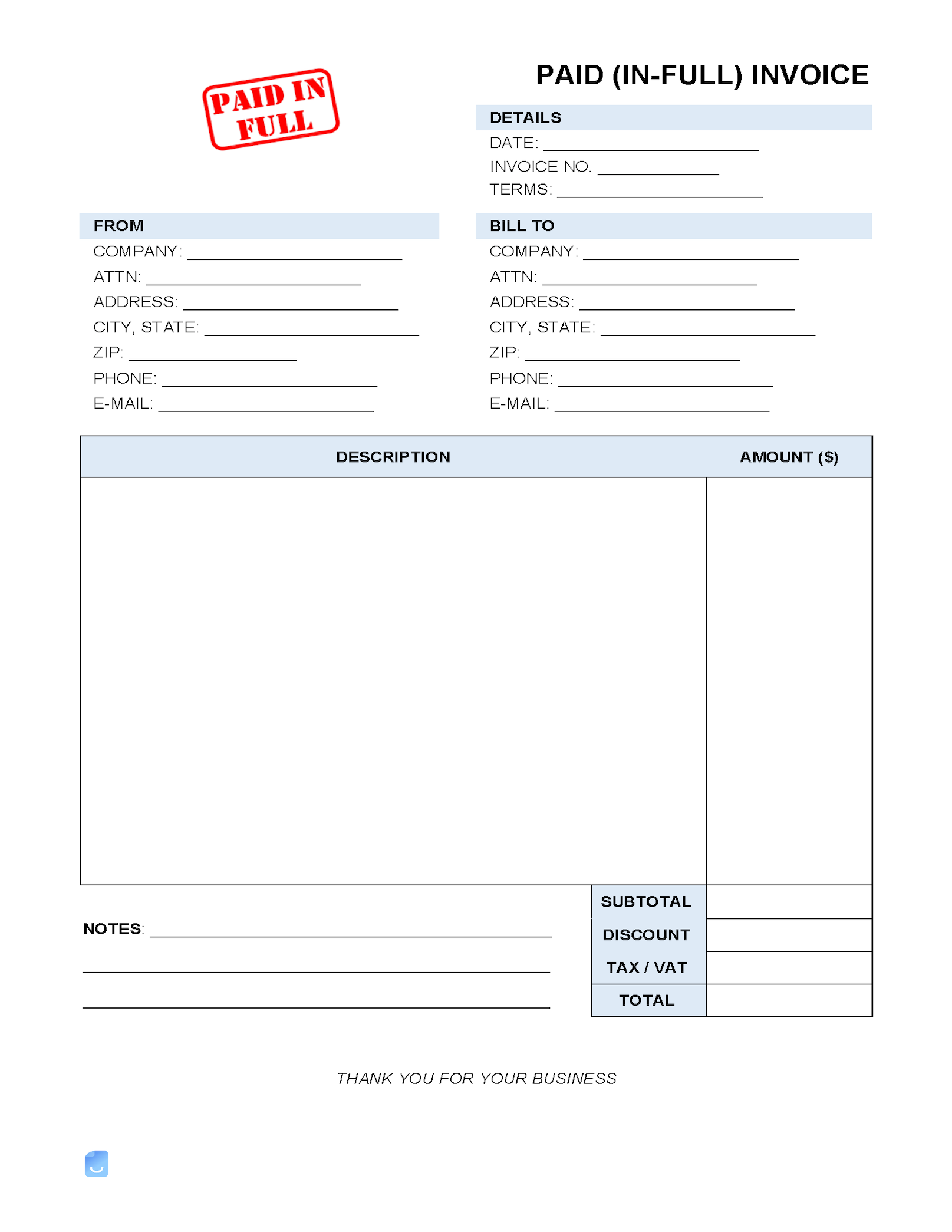

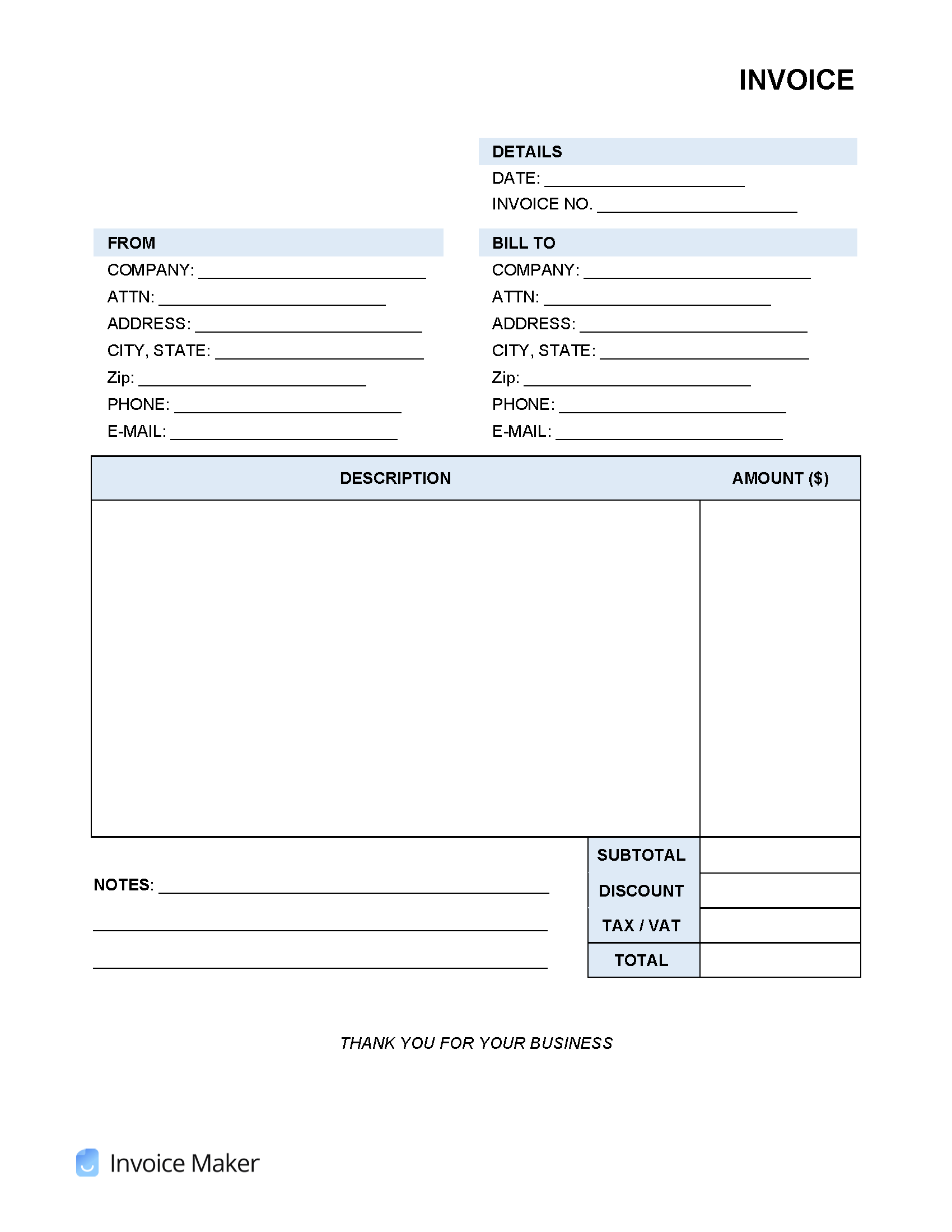

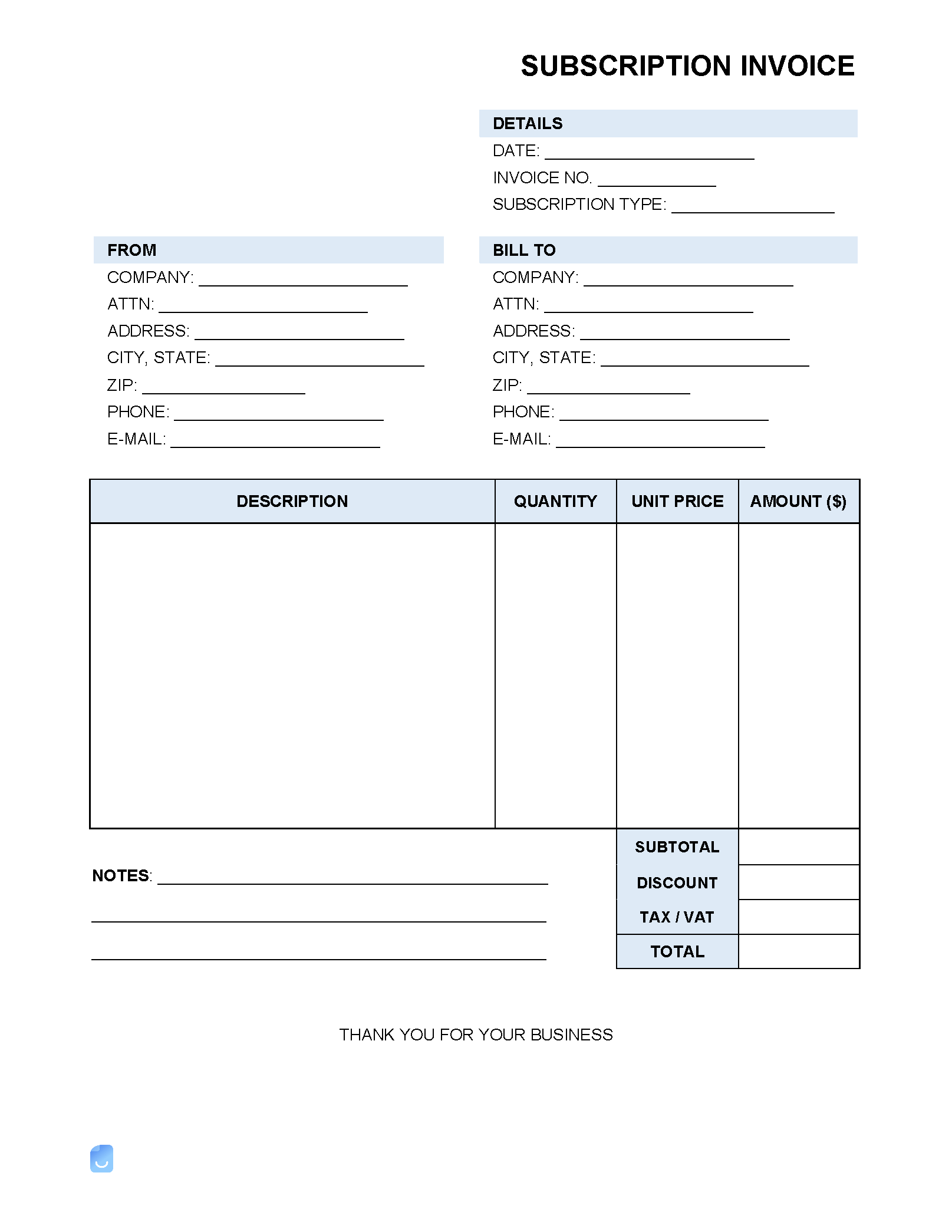

What to Include in a Billing Invoice

To create a billing invoice in the simplest way, open a new document in the word processing program on your computer or create a new Google Doc. At the top of the page, make sure to include the vendor’s name and address, as well as contact information. Below that, include the date and the name and address of the customer being billed.

The date of the invoice should be centered and prominently displayed so that the person or business being billed knows when the payment is due.

Billing invoices typically also include:

- Company logo

- A description of goods or services sold

- Quantities of goods or services sold

- The unit price of goods or services sold

- The date of the sale

- The invoice number

- Applicable taxes and sales tax

- Date payment is due

- Payment details (e.g. bank account number)

Billing Invoice Example

RR Creative Ltd. 123 Main Street Los Angeles, CA 90001 Bill Jones 456 Center Place Los Angeles, CA 90001 Invoice 0005 Date: 6/6/22 Payment due by: 6/26/22 Item: Business Logo Quantity: 1 Unit Price: $1000 Sales Tax Rate: 12% Total Tax: $120 Total: $1120 Billing Information: Please pay within 20 days via PayPal or Venmo (RRCreative@RRCreative.com). Thank you for your business!

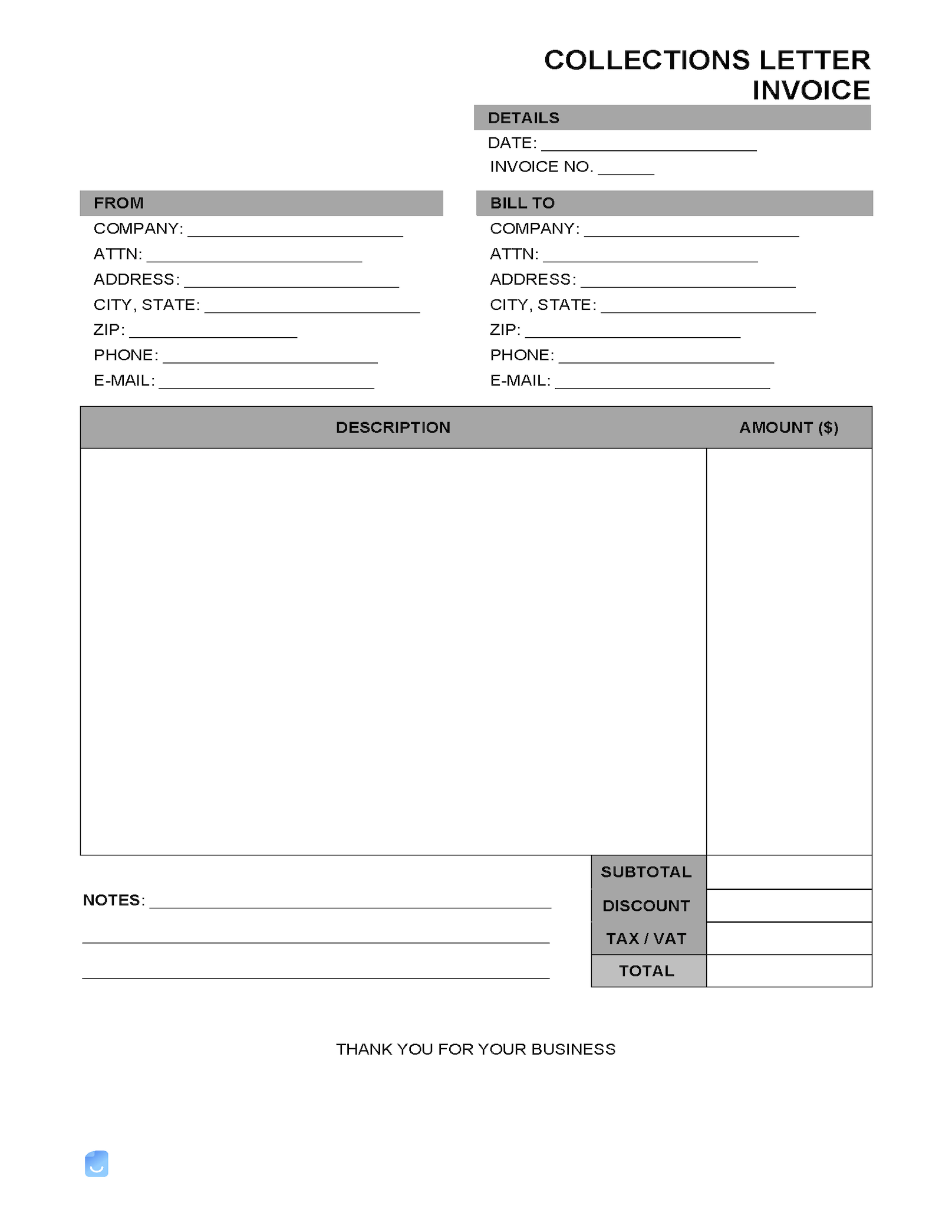

Billing Invoice Mistakes

As is the case for any kind of bill or monetary transaction, the potential for conflict and disputes over invoices exists. A dispute can occur for a variety of reasons, but most often because the customer disagrees with the charges listed on the invoice. Another common cause of conflict is a customer missing a due date for payment. Any disputes related to a livelihood or living income can be time-consuming and frustrating, so let’s talk about some common mistakes to avoid in order to reduce the risk of conflict occurring. 1. Not prominently displaying a due date The best rule of thumb is to make sure the billing invoice is clear and concise. It’s also wise to include details about what will happen if the payment is not submitted on time and to clearly state the penalties and interest rates that will apply and accrue. 2. Not requesting a billing address Another common mistake is not requesting the buyer’s billing address. This is because the billing address on the invoice must be identical to the billing address of the credit/debit card being used to pay for the charges listed. Requesting a billing address reduces the possibility of fraud occurring. If a credit card is stolen, there is a good chance that the person who stole the credit/debit card will not know the billing address on file with the banking institution. 3. Not sending late payment notices When a customer misses a due date, the first step a vendor or supplier can take is to send a notice to the customer. The notice should include the amount owed, the date the payment was due, and the late fees being added to the bill. It should also be clear and concise. Failing to send late payment notices can lengthen the delay in payment, but it can also reflect poorly in court in the unfortunate event that a non-payment incident has to end in legal action. 4. Not creating a backup of invoices Consider using invoicing software, which allows for the quick, easy, and automated storage of paid and unpaid invoices. Another option is to create a folder on your computer and save invoices, categorized by time period.

Billing Invoice FAQ

Are there any ways to streamline the billing process?

Automating the billing process saves time and energy. There are many software programs that can help with this. It’s also helpful to set up a system using online tools. Having a system in place will help you keep track of your bills and payments with ease.

How do I calculate taxes on a billing invoice?

What you charge in terms of taxes will depend on the tax rate in your area. To calculate the tax, multiply the tax rate by the total amount. For example, if the tax rate is 5% and the total amount of the invoice is $100, the tax would be $5. You would then add the tax to the total amount of the invoice to get the total.

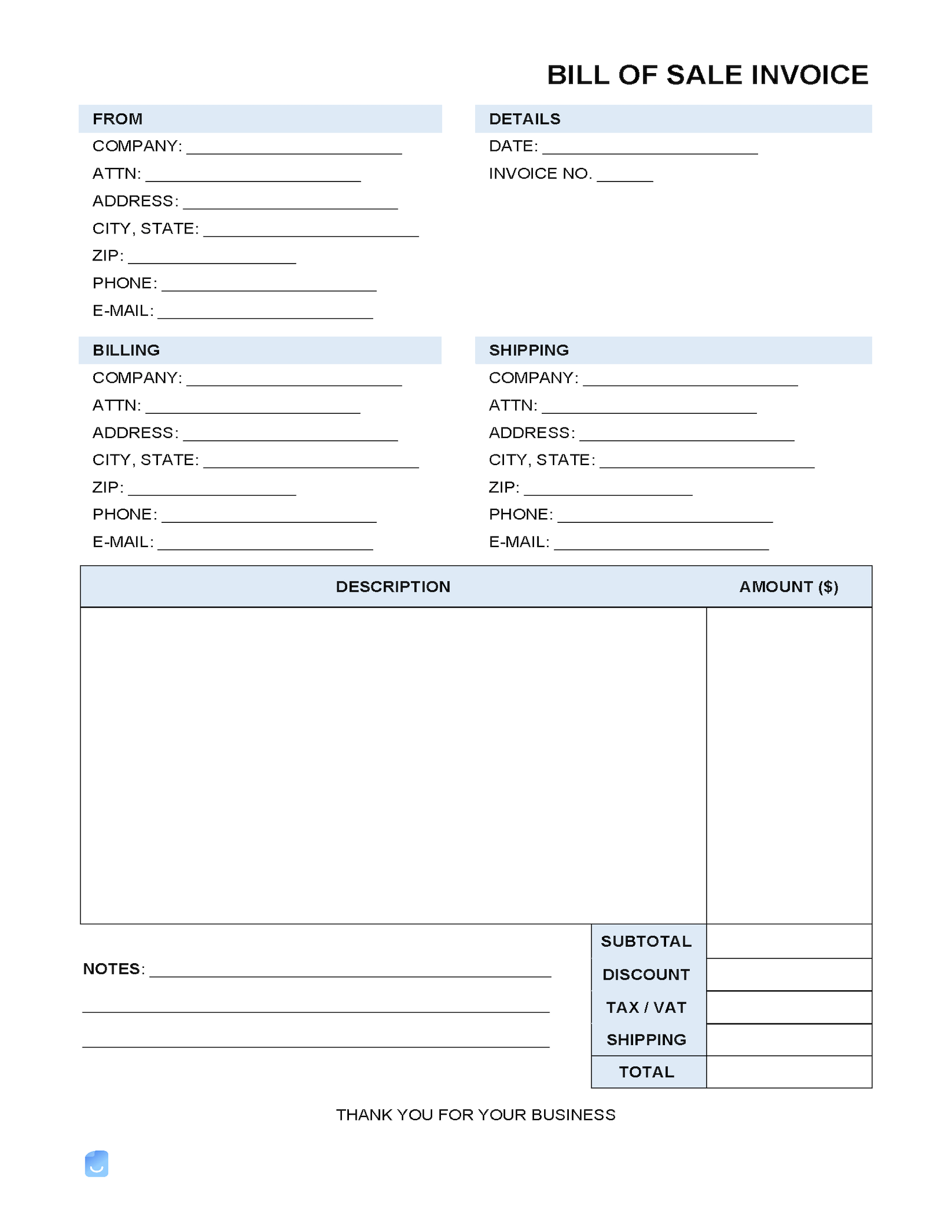

How do I calculate shipping costs on a billing invoice?

When calculating shipping costs on a billing invoice, take into account the weight of the shipment, the dimensions of the shipment, the distance the shipment will be traveling, and the shipping method that will be used.