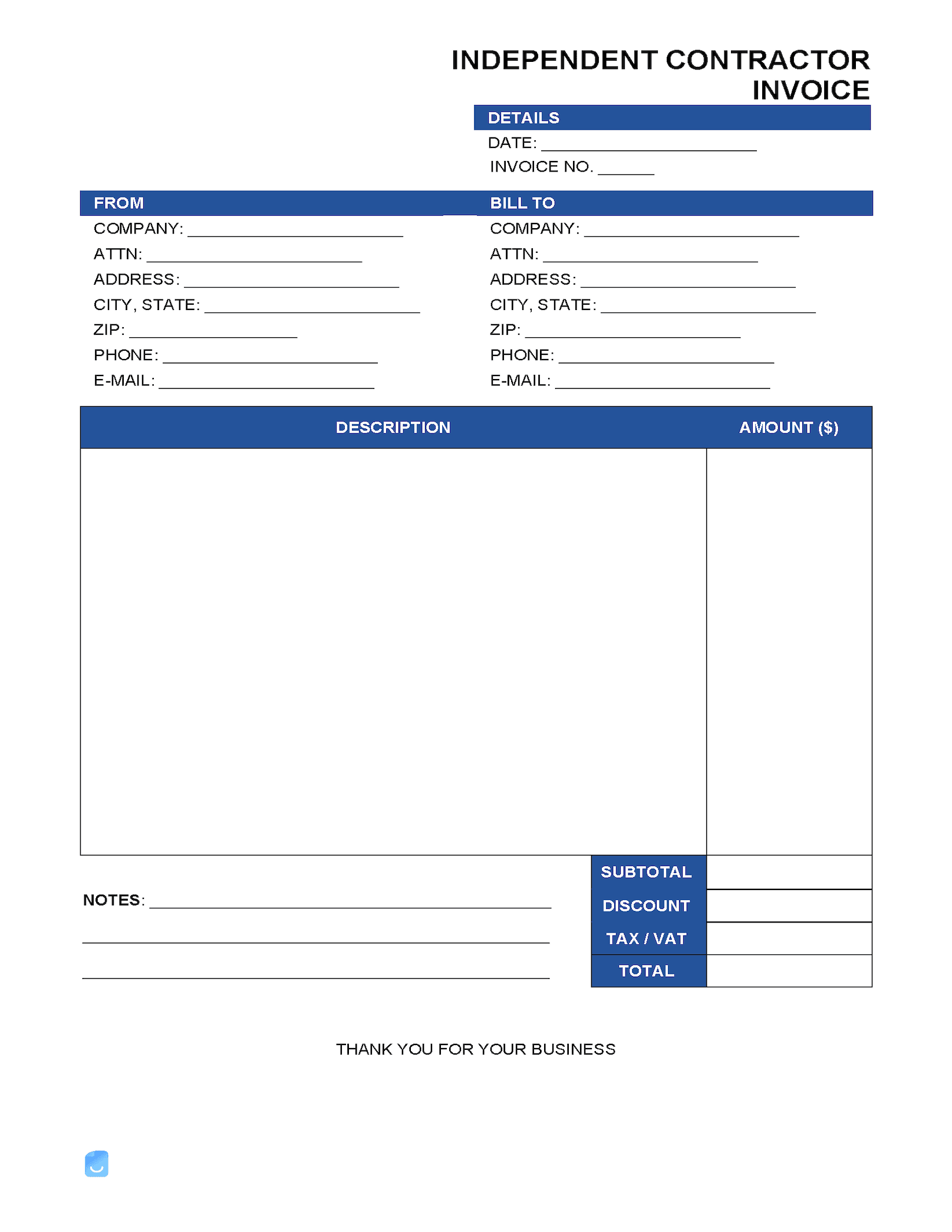

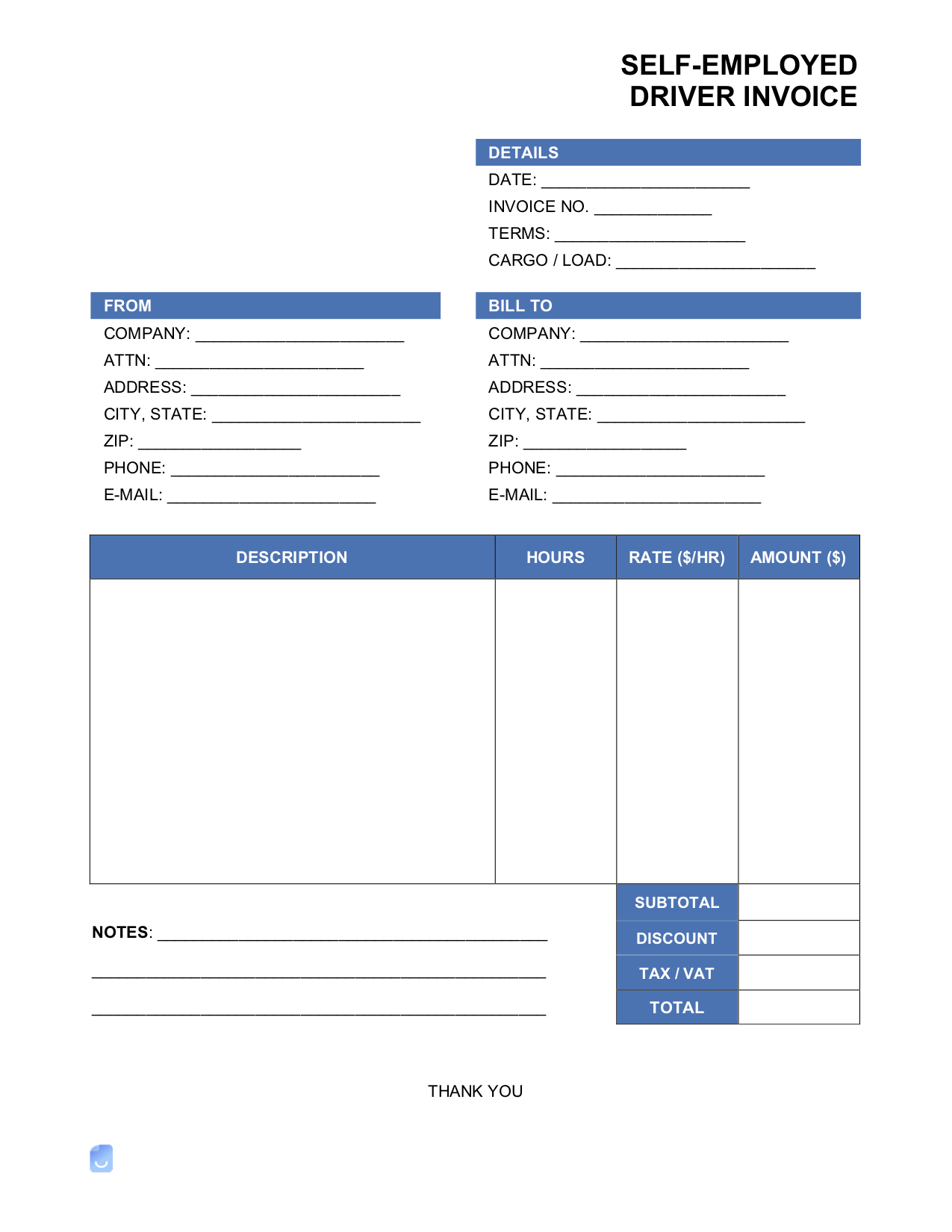

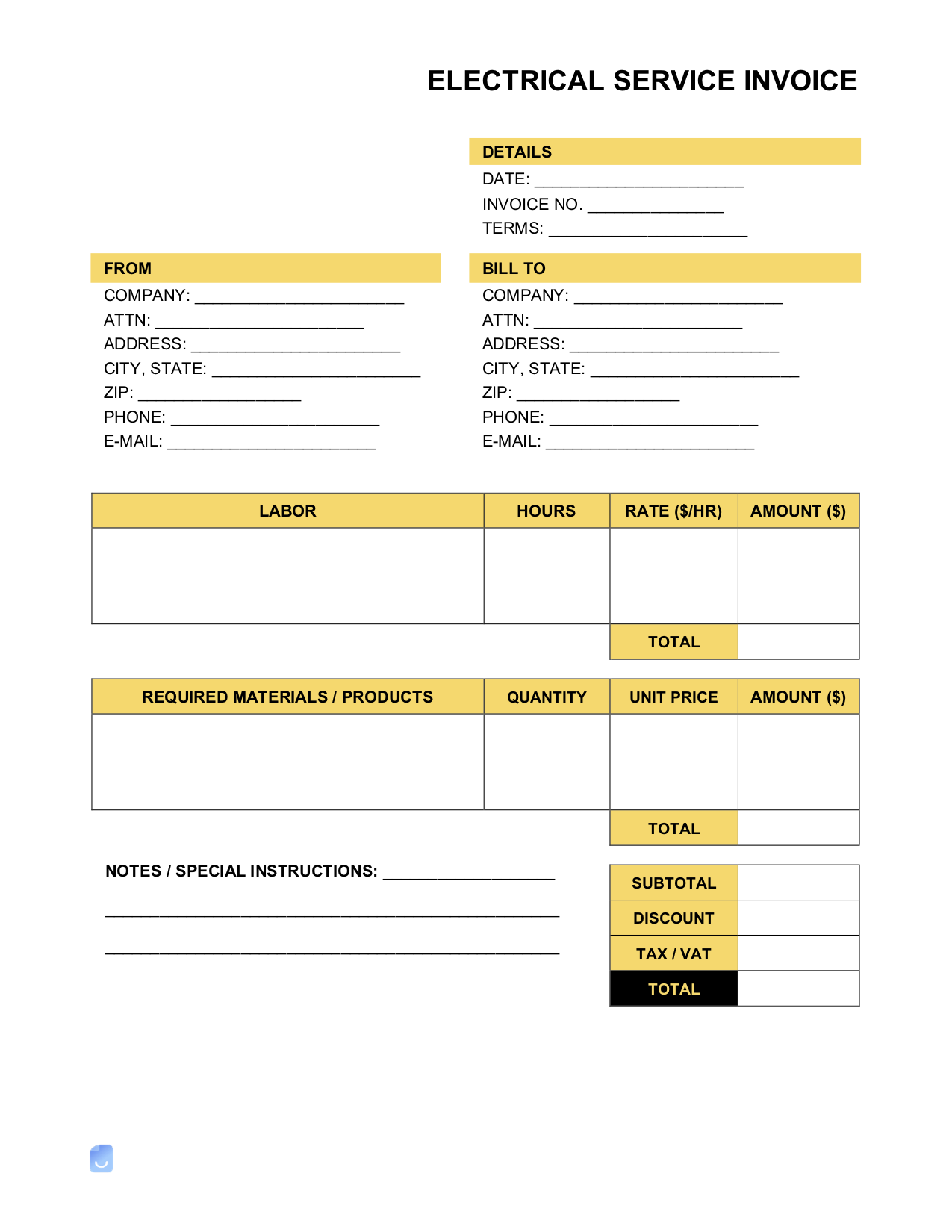

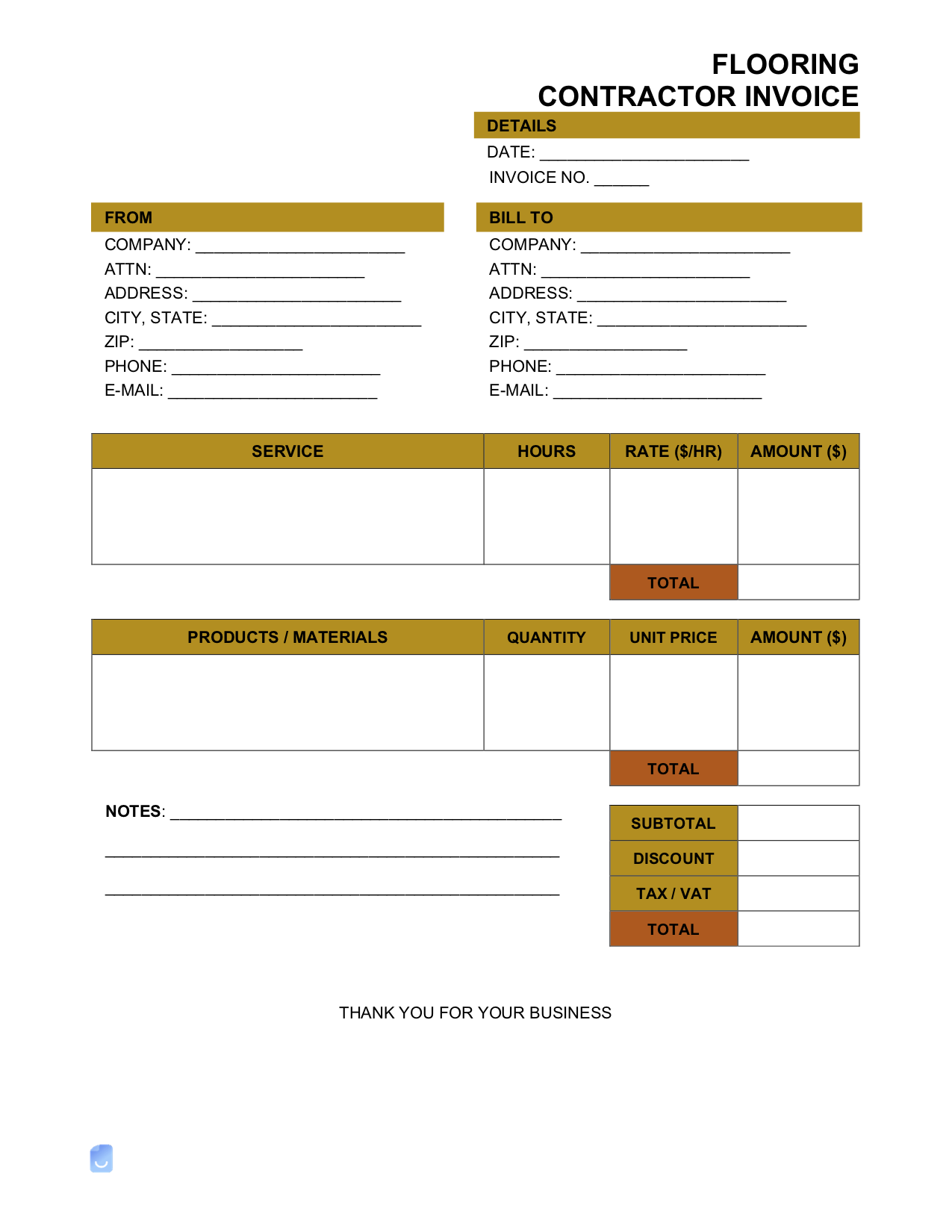

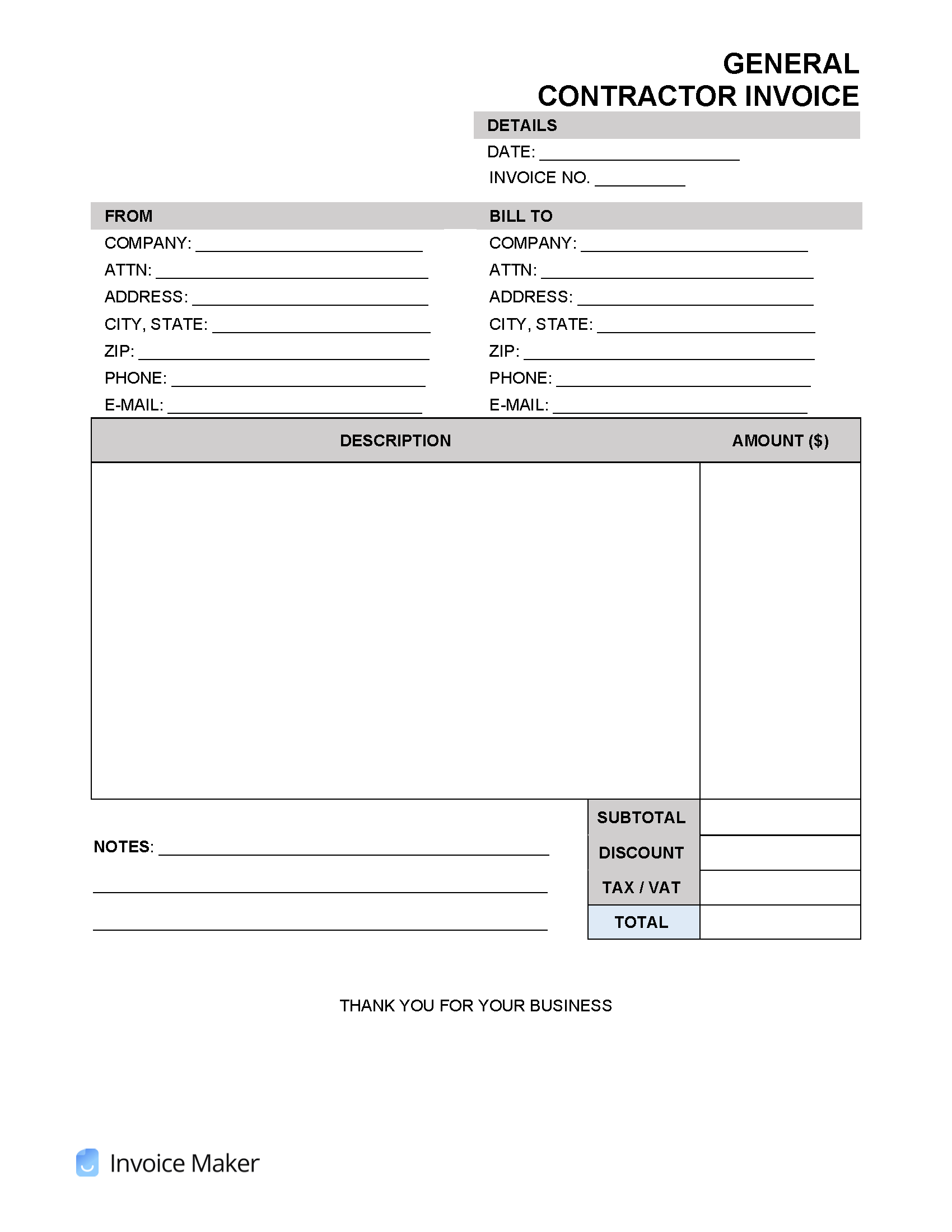

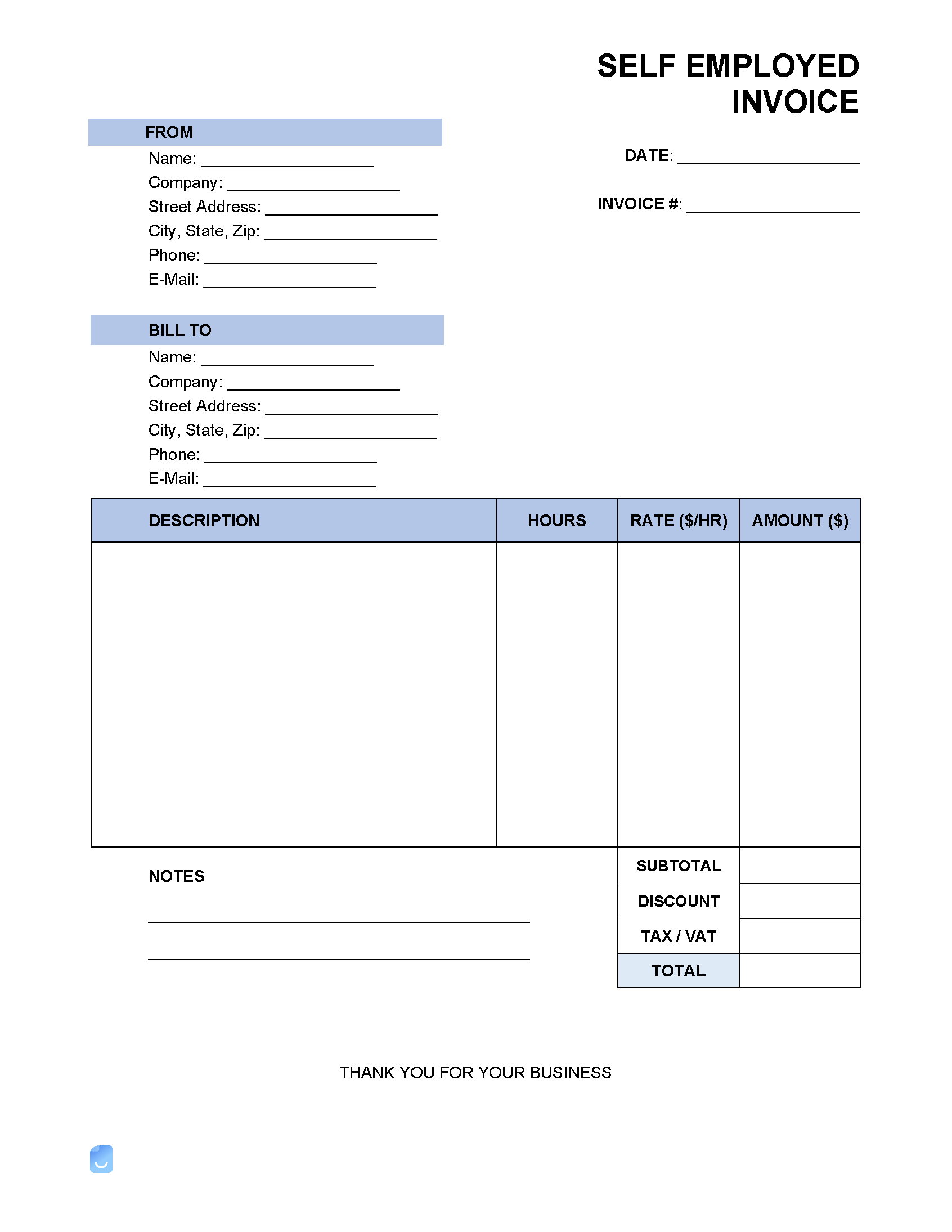

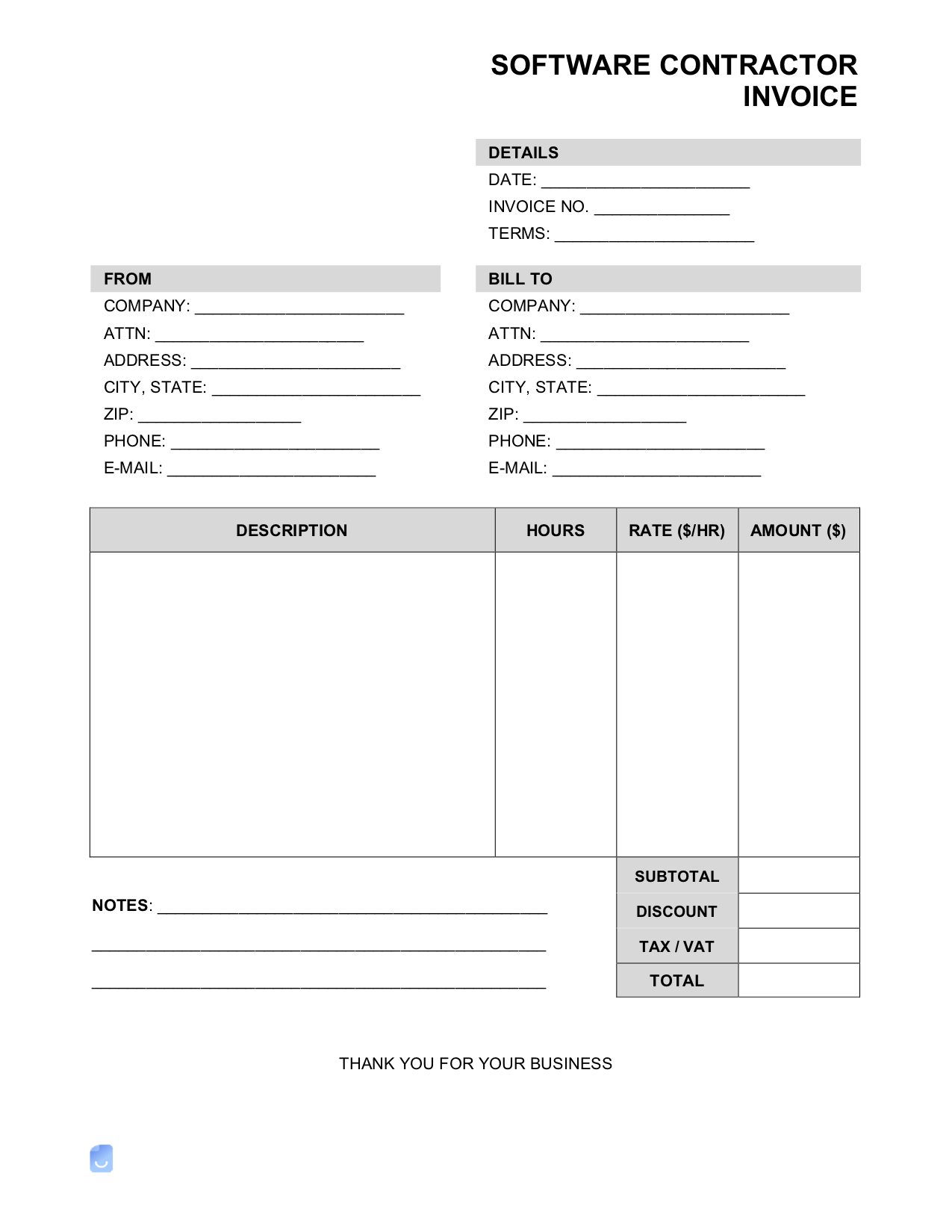

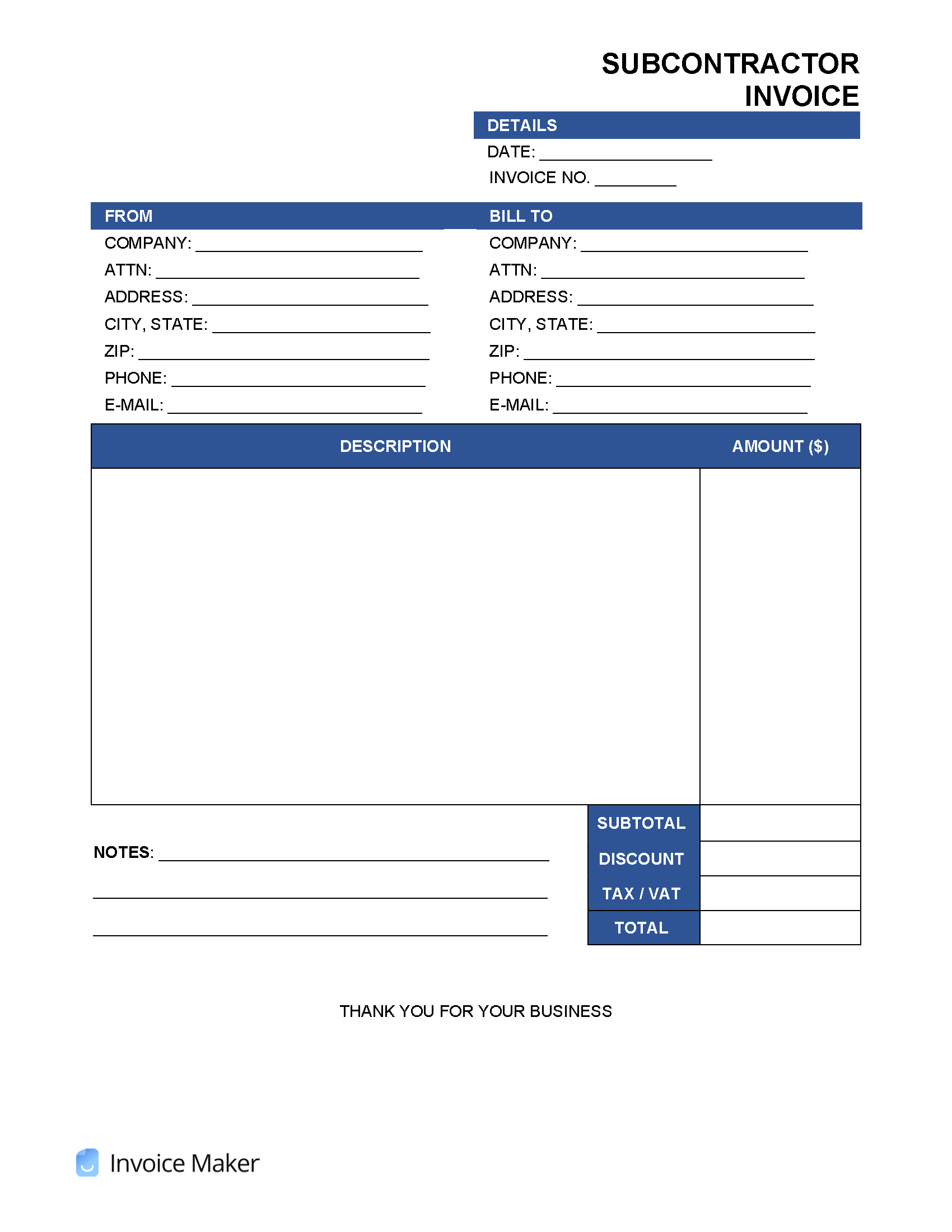

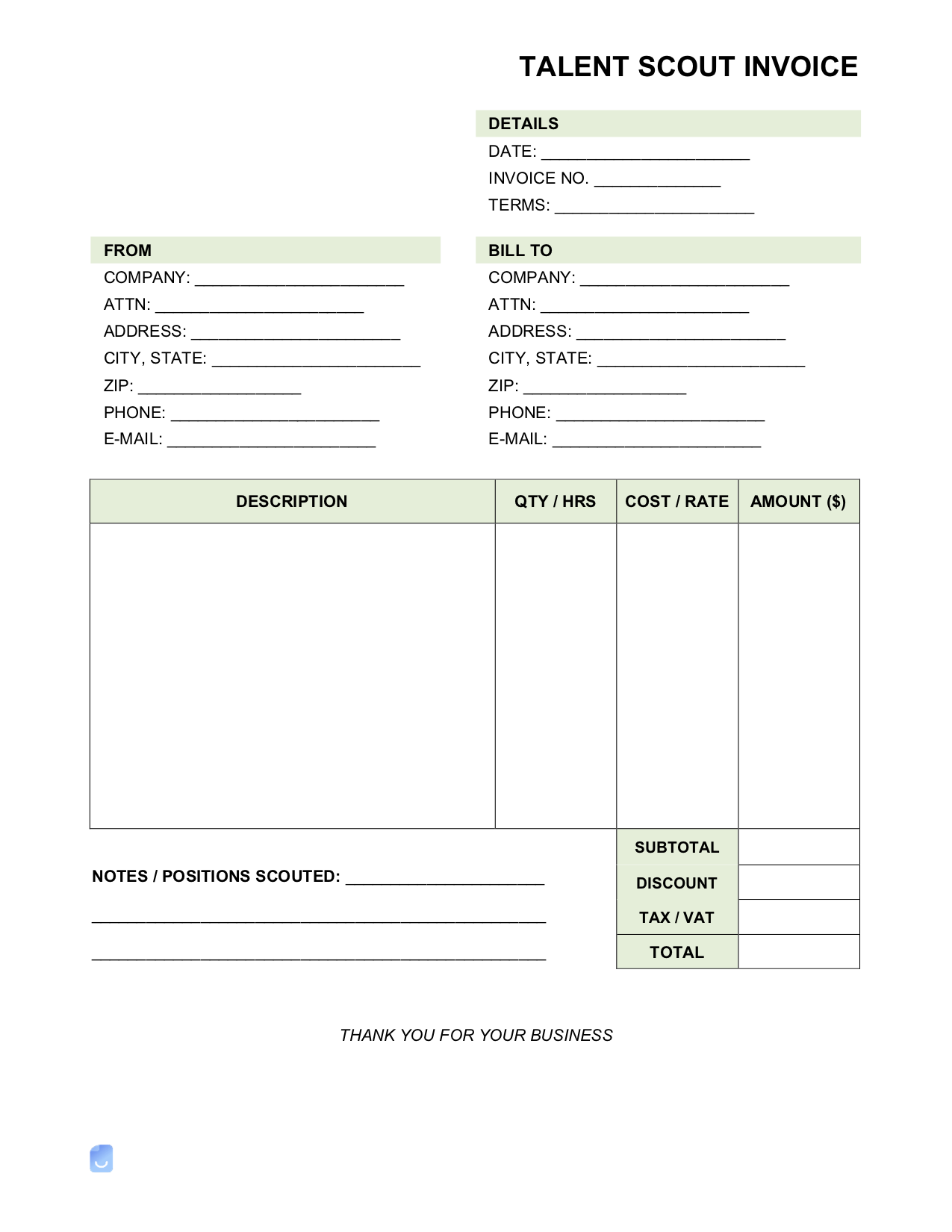

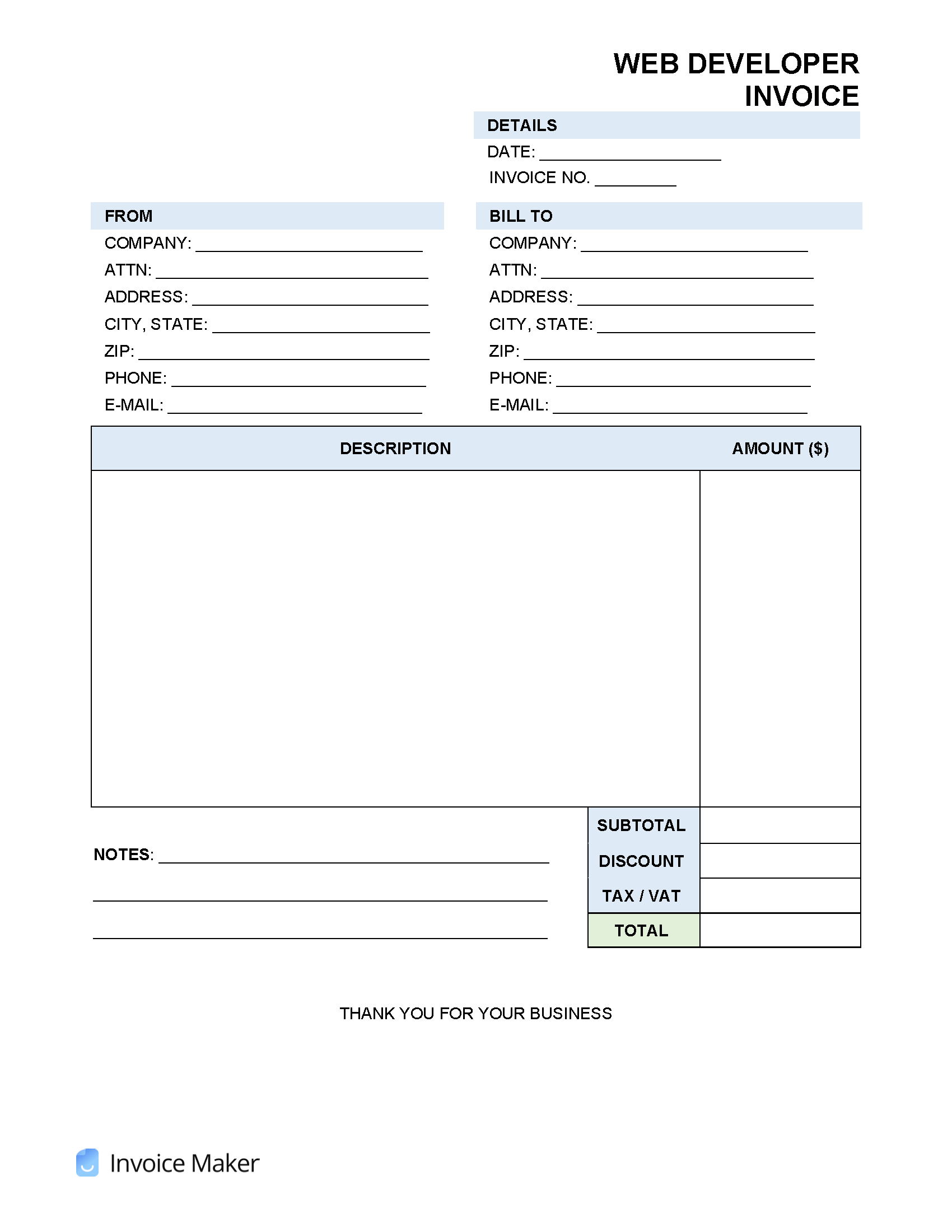

Independent Contractor (1099) Invoice Template

An independent contractor invoice is used by anyone independently working for themselves to request payment for services provided to a client or customer. Clients are not responsible for paying the contractor’s taxes; therefore, payments should be made in full.

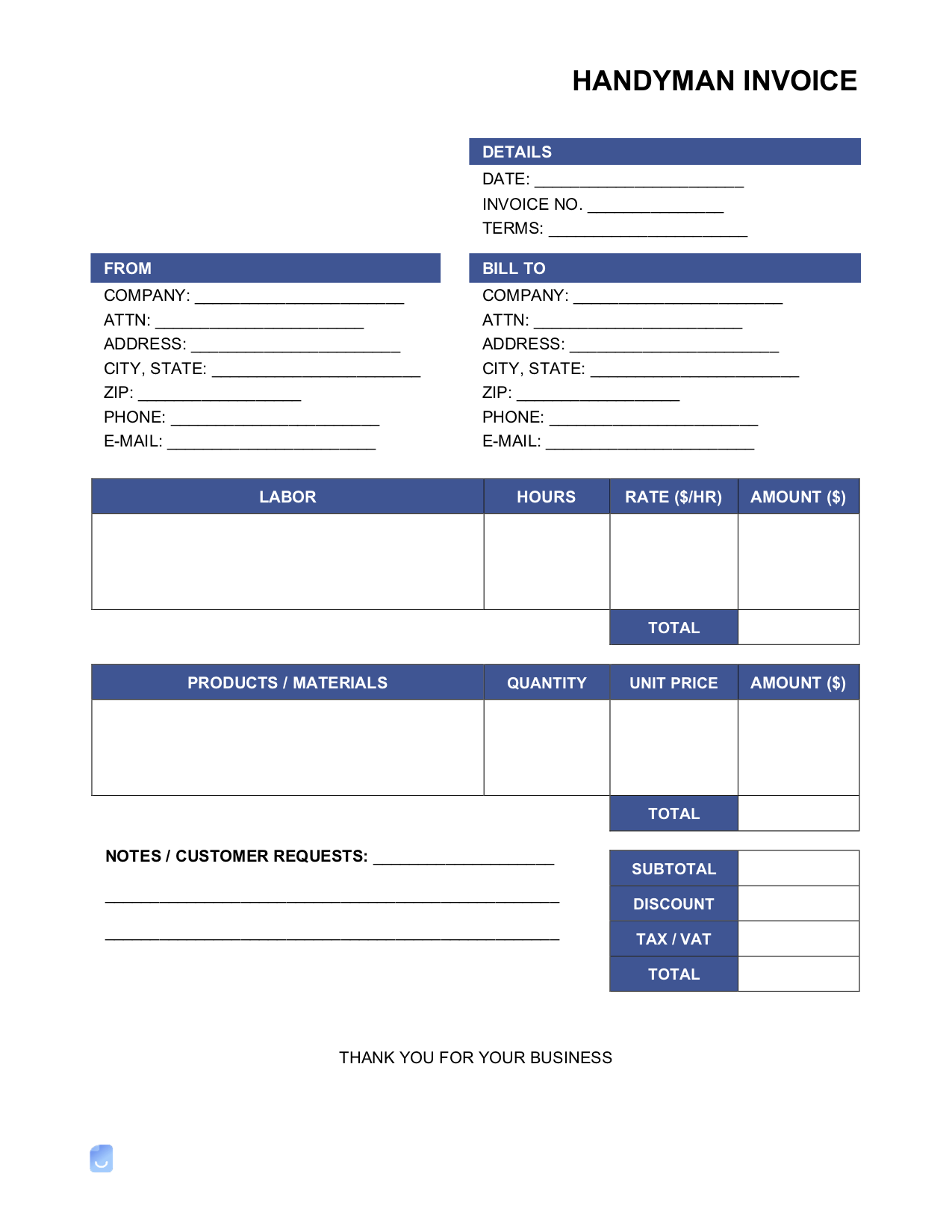

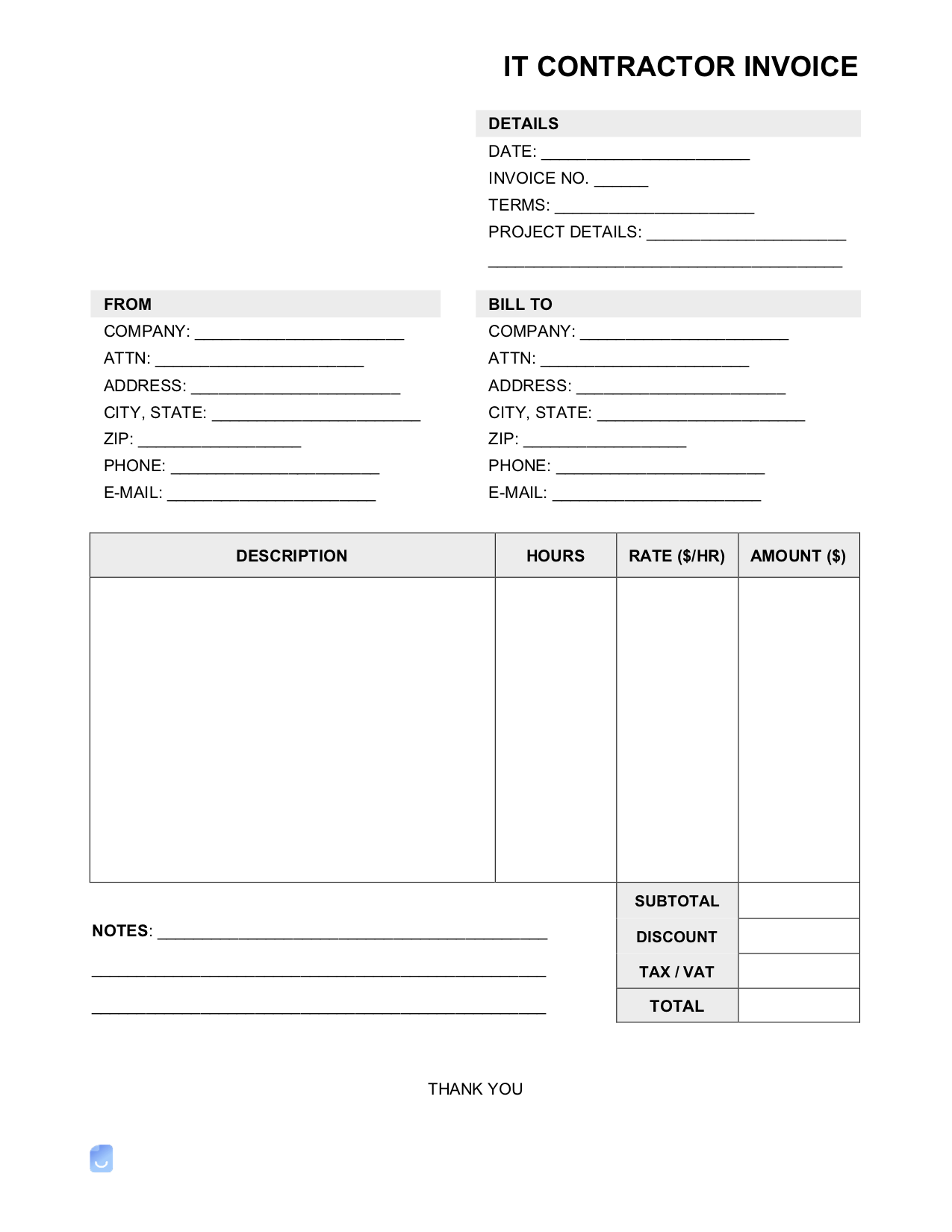

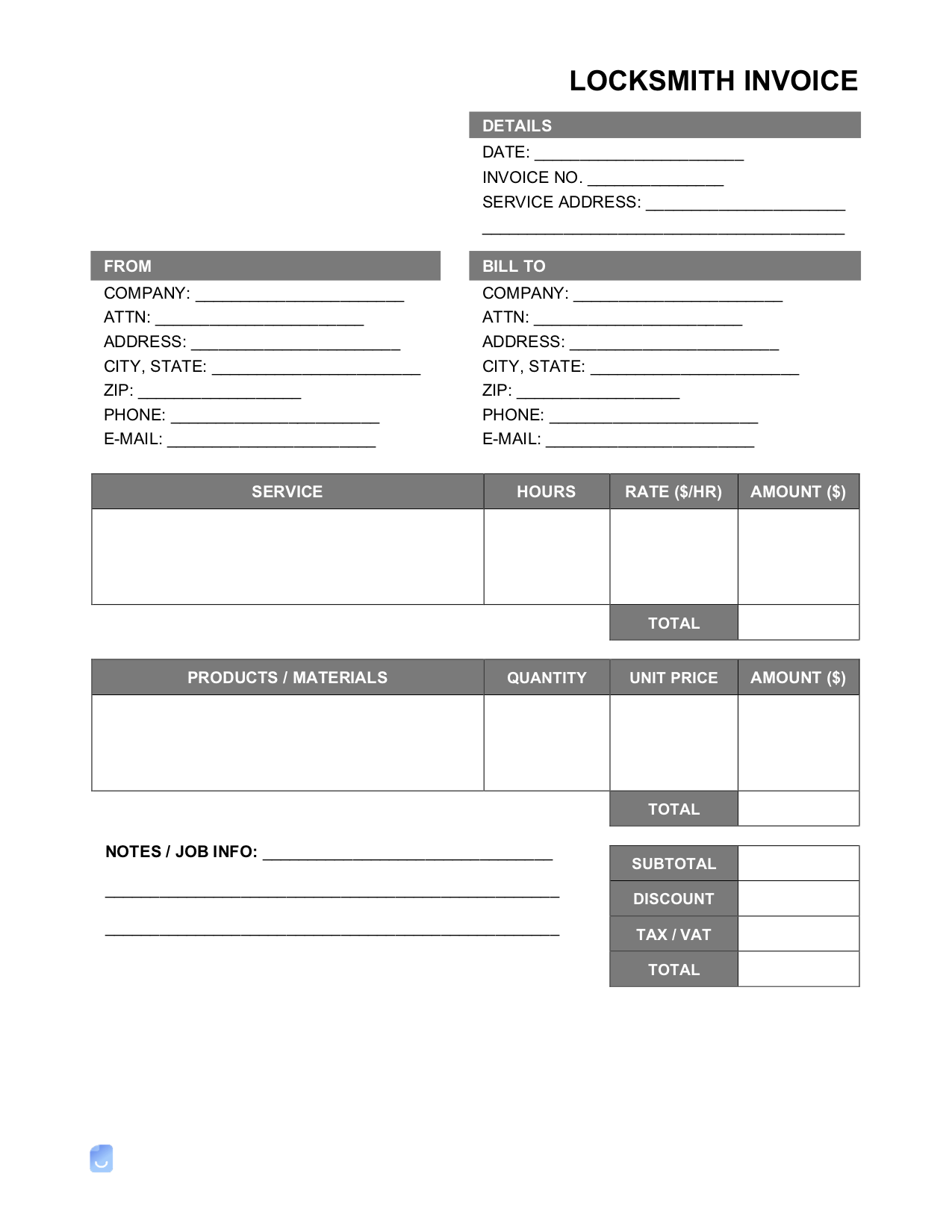

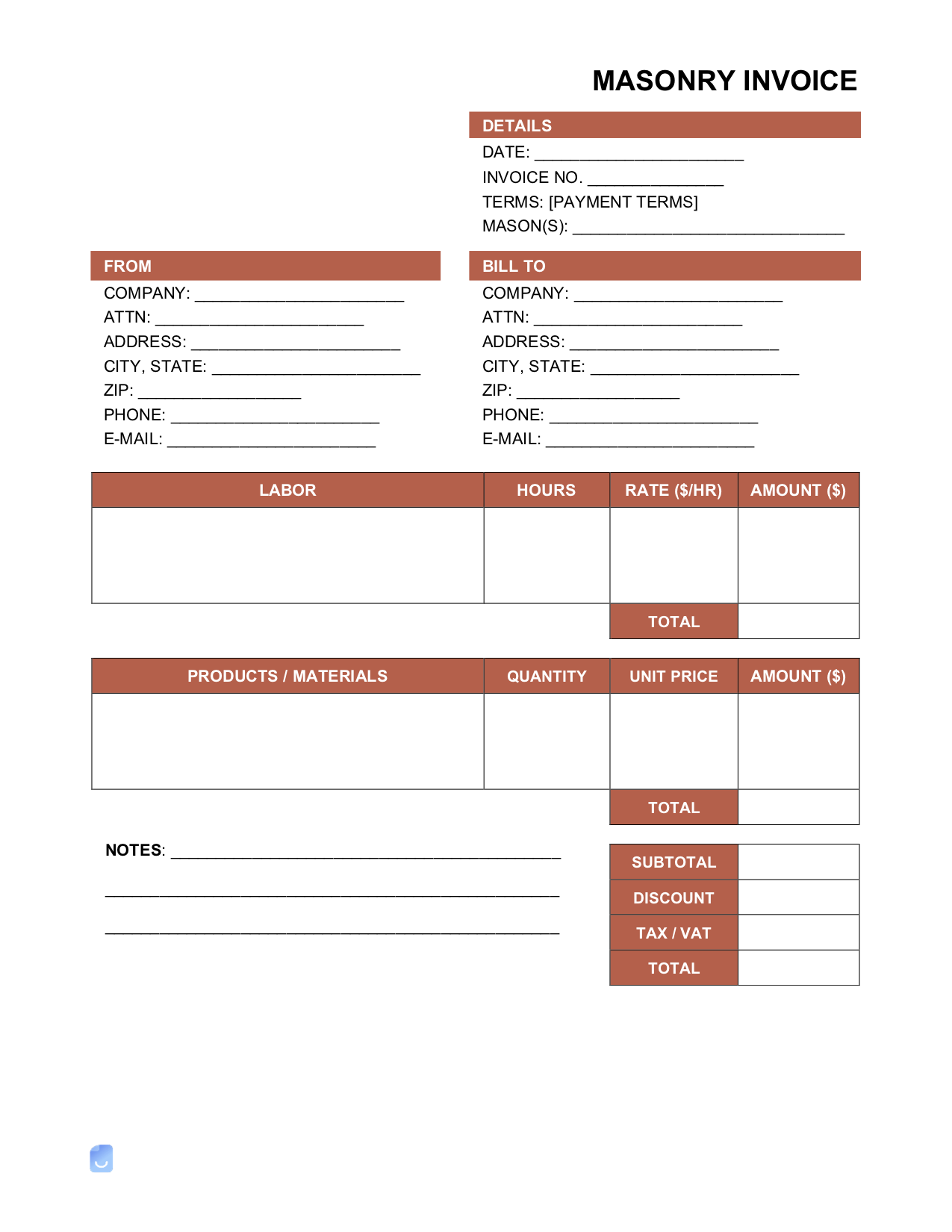

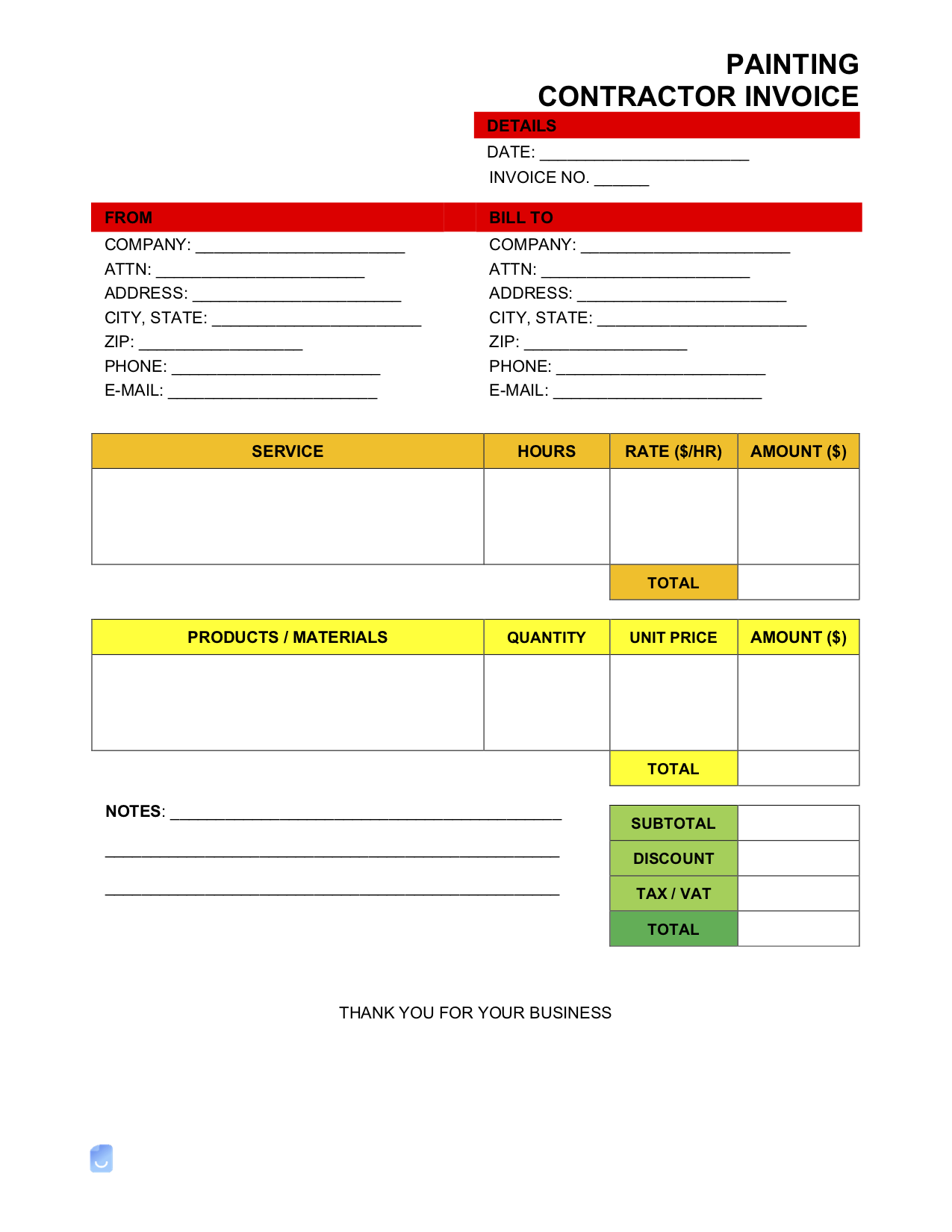

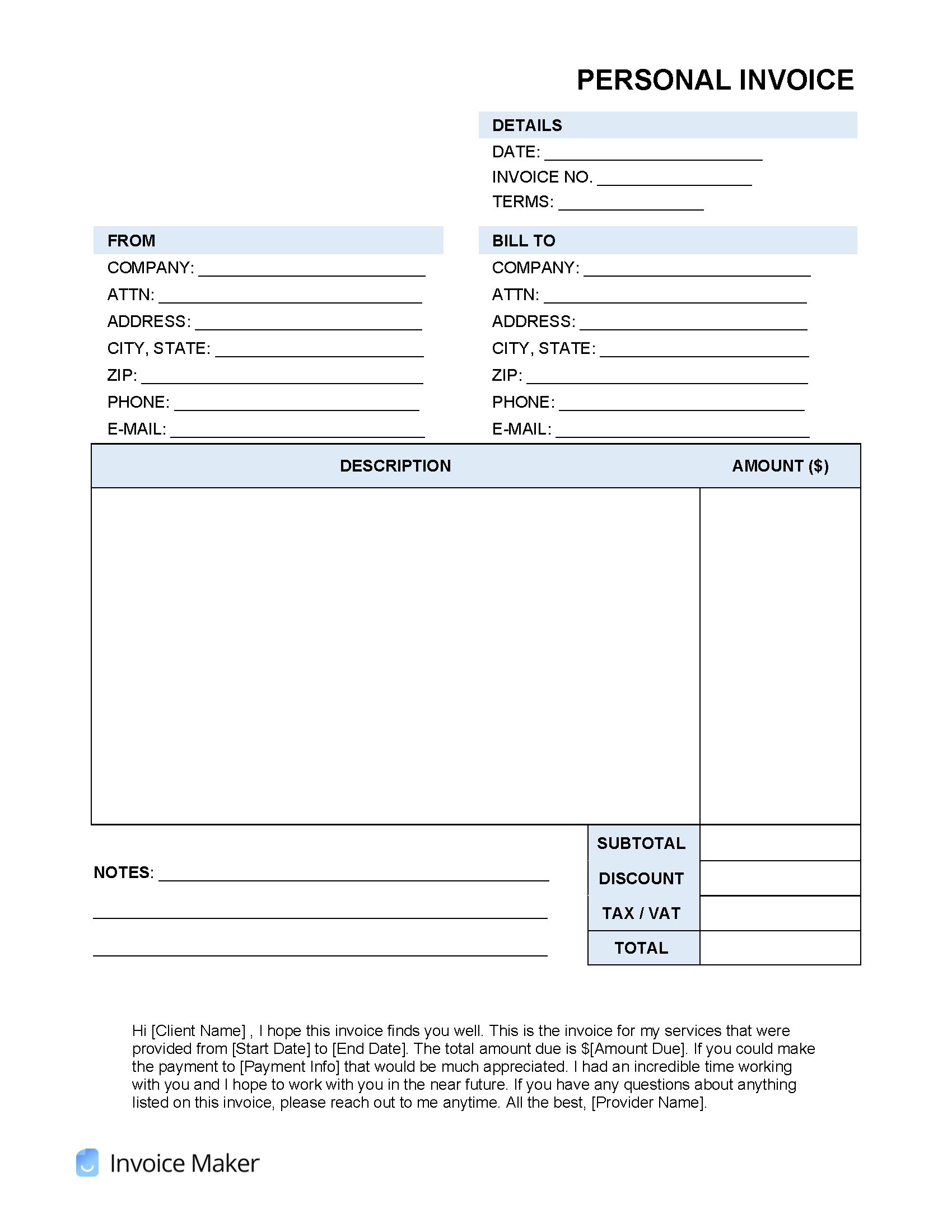

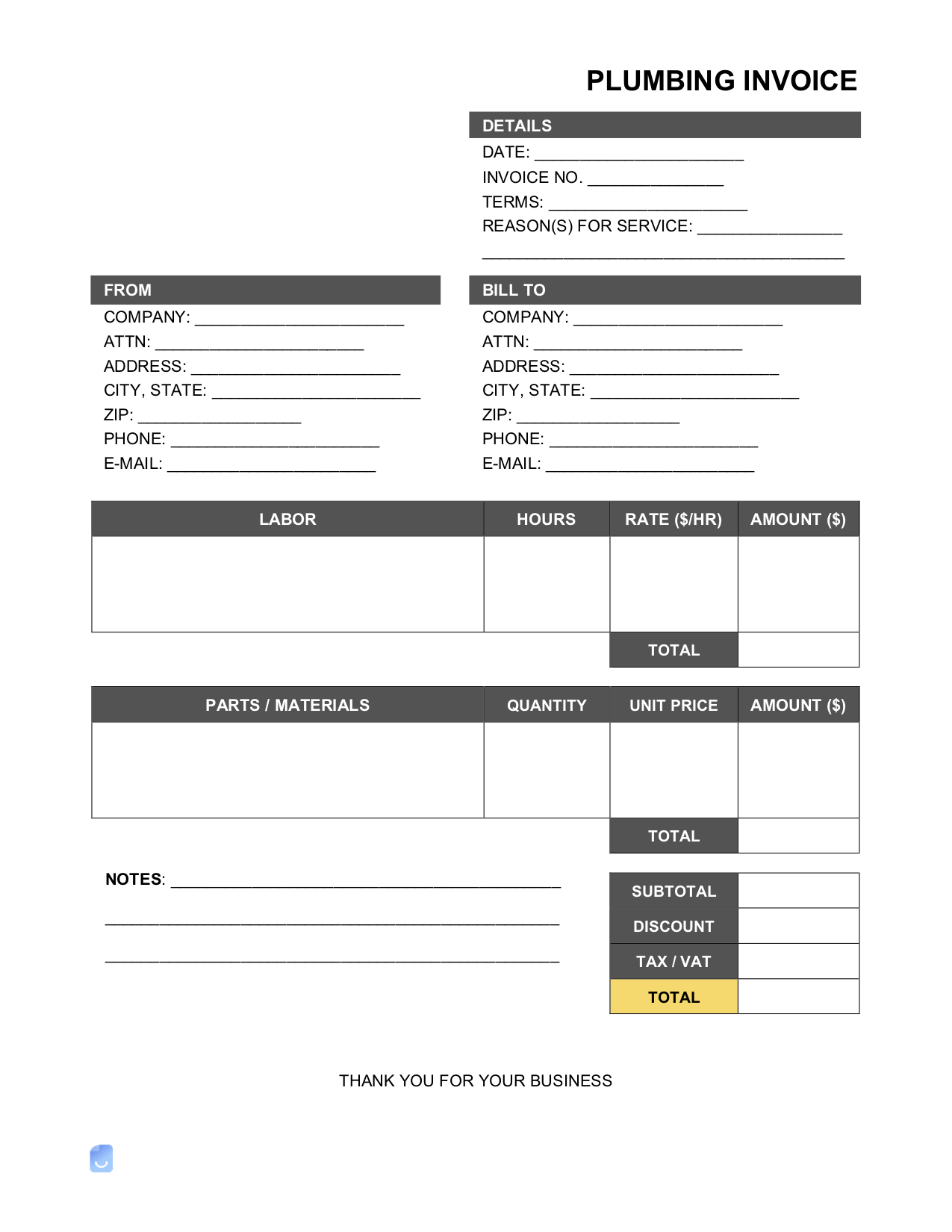

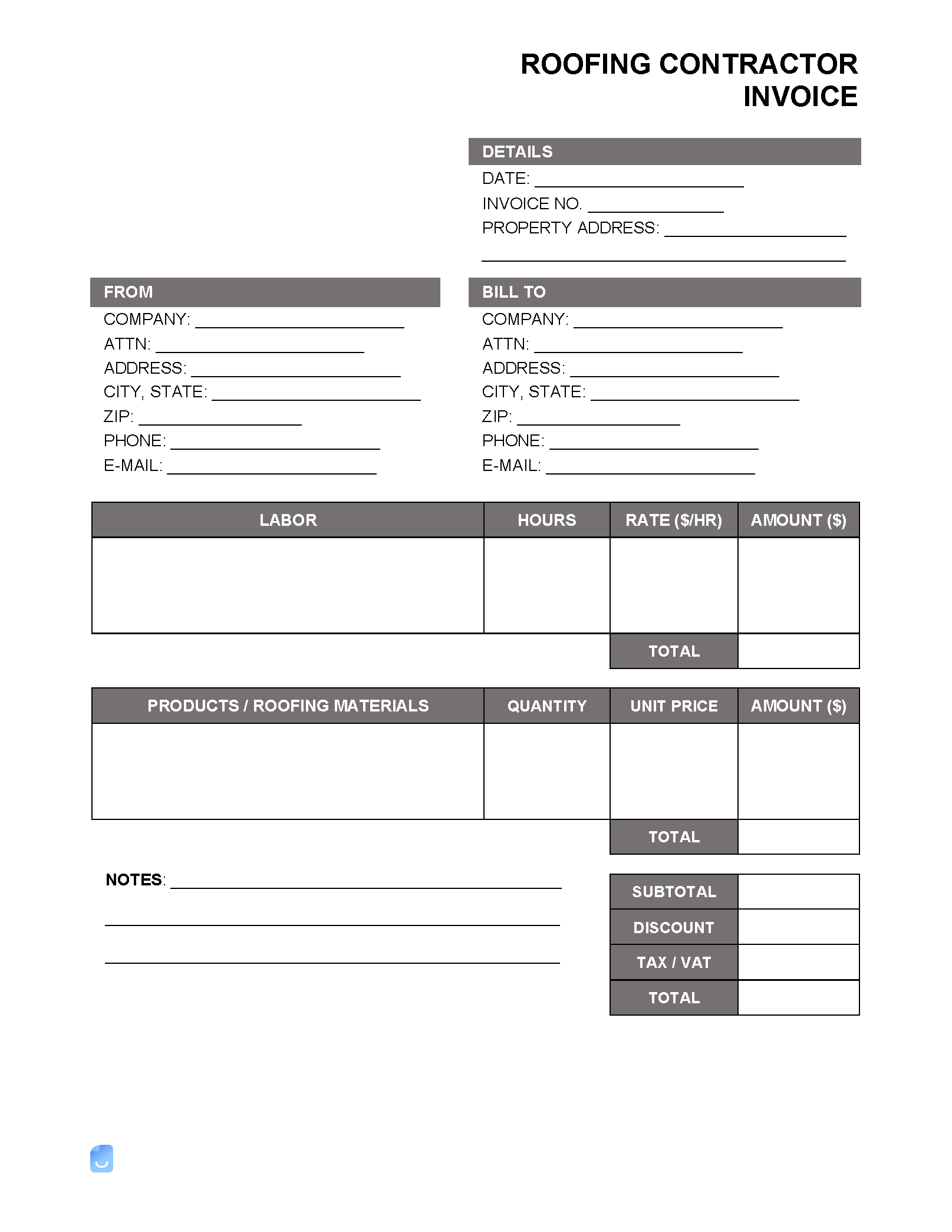

By Type (21)

What is an Independent Contractor?

An independent contractor is an individual that is hired to do a job rather than being employed. This type of work contract between an employer and a worker can be beneficial to both parties. An independent contractor, even if it’s only one person, can act as their own company. Therefore when a job commences, it’s essentially one company working for another company with no strings attached. Because an independent contractor works for themselves, they are able to take advantage of tax laws (and pay their own taxes) that they would otherwise be incapable of doing if hired as an employee. The person hiring the independent contractor benefits from the relationship as they are not required to pay for health care, 401k, and other costs as they would if the individual was employed.

Benefits

- Can be their own boss

- Taxes are not withheld

- Can deduct certain expenses

Independent Contractor vs. Employee

Employee

Employees often have an employment contract and are required to show up for work every day at a specific time. Their pay is always the same and only fluctuates when given a raise. Employees work for an employer and have no control over their upside potential (besides a raise or a promotion). Employees are subject to withholding taxes, which means taxes (local, state, and federal) are deducted before every paycheck is issued.

Independent Contractor

An independent contractor is their own boss. Their pay is a result of their work ethic. Almost every profession allows for independent contractors to thrive. They can take advantage of tax laws and loopholes to make more money and are not bound to an employer’s rules. Taxes are not withheld when paid to do a job, as they handle that issue themselves. According to the IRS, there are three factors that classify an independent contractor from an employee, which are:

- Behavior control – How the worker performs work within their own right.

- Financial control – Controlling the business side of the work.

- Relationship of the parties – How the relationship between the parties is perceived.

How Does an Independent Contractor Pay Taxes?

Filing taxes as an independent contractor is as simple as filing IRS Form 1099 (whereas an employee would file IRS Form W-2). The hard part is being disciplined enough to save and allocate funds to pay taxes when it comes time. Independent contractors should file their taxes quarterly.

Related Forms

Contractor Work Orders – Used before starting a project to estimate costs and timelines to a client. The work order may also be used to bind the client to ensure they are legally responsible for payment after the work is complete.