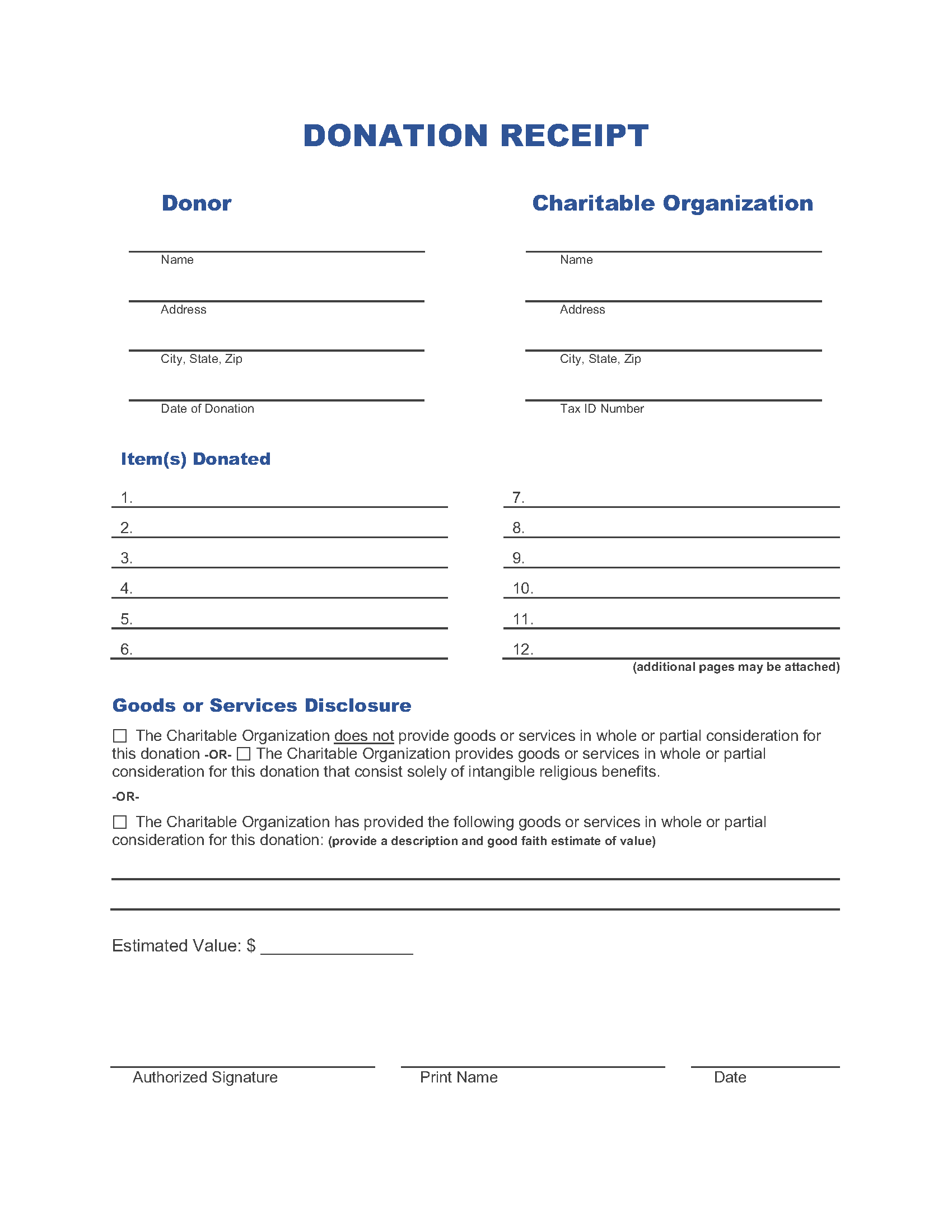

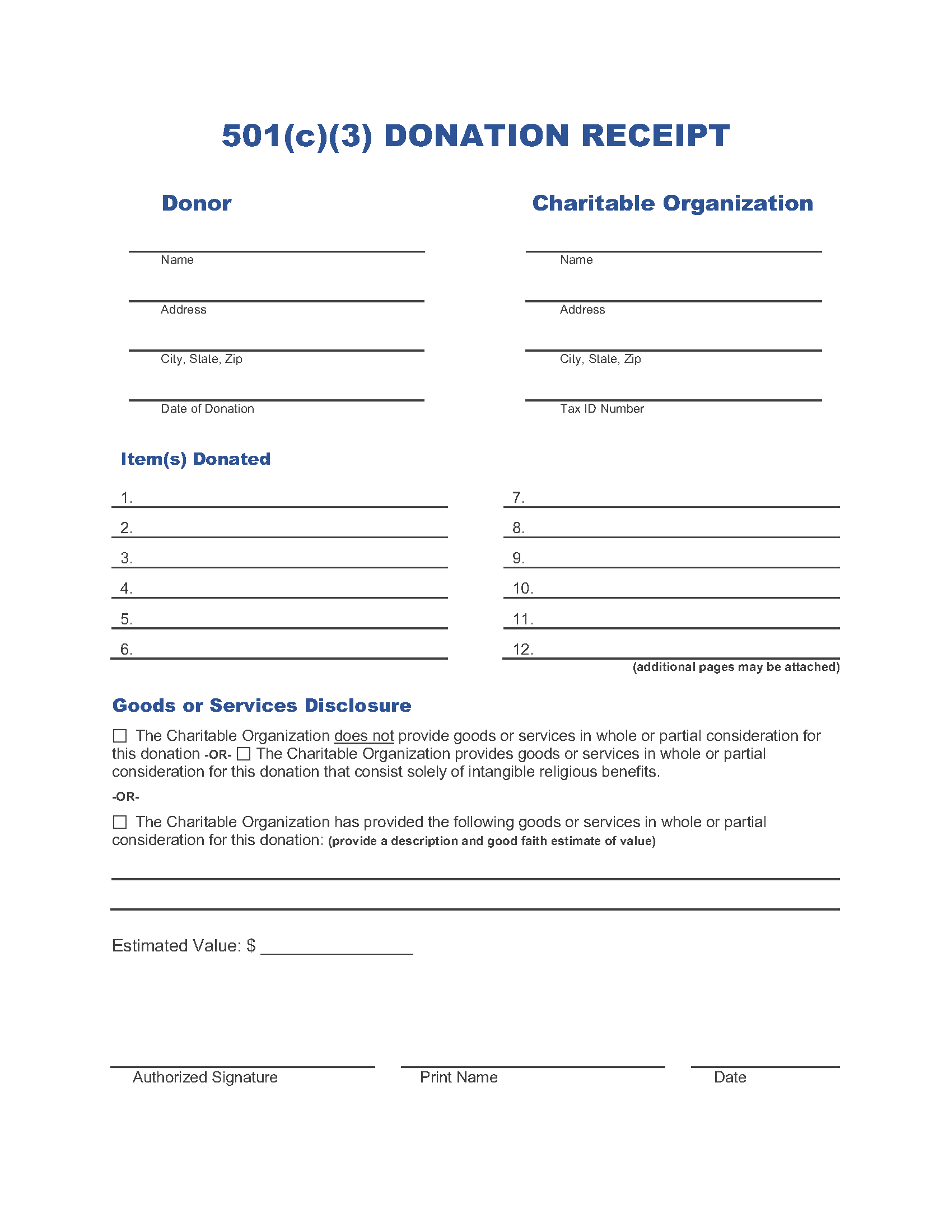

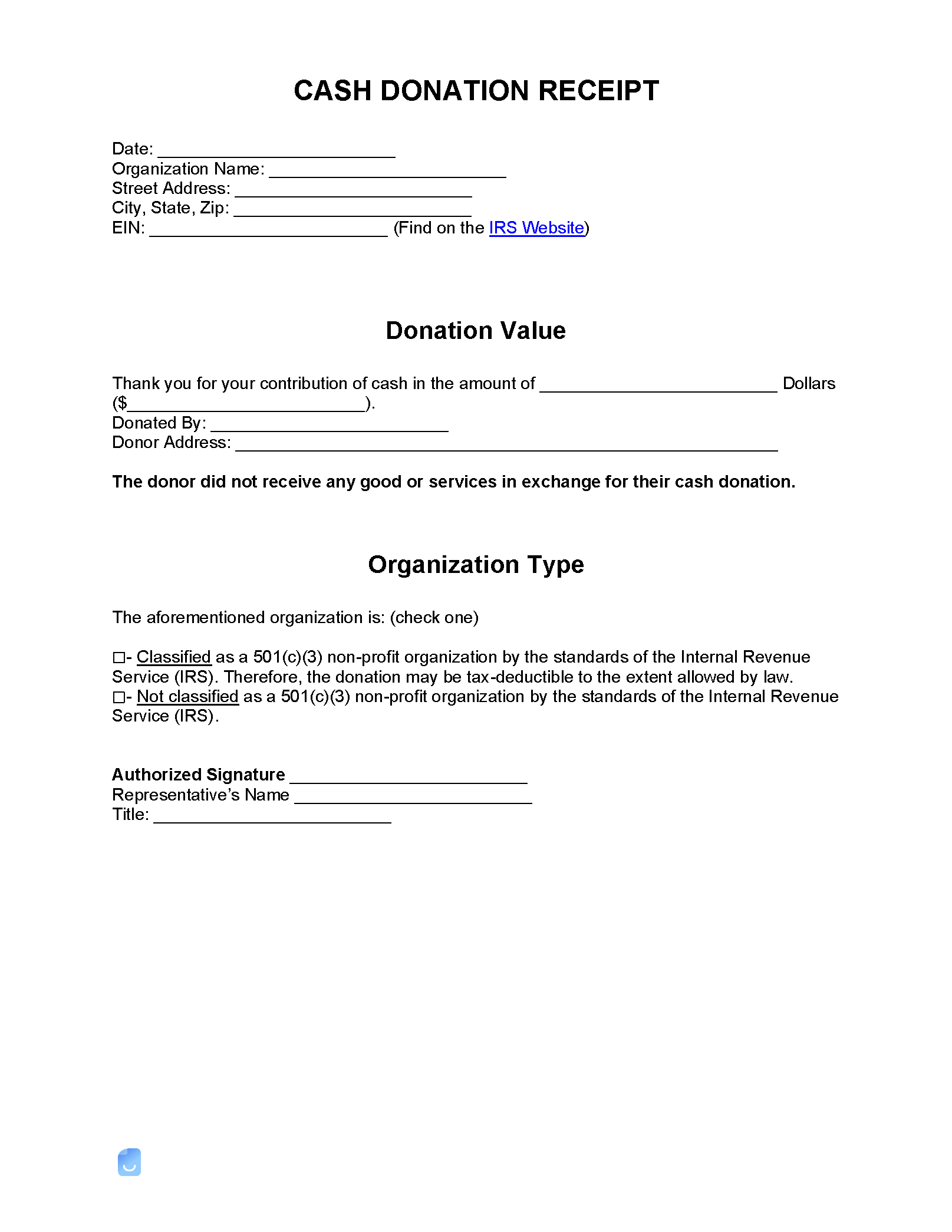

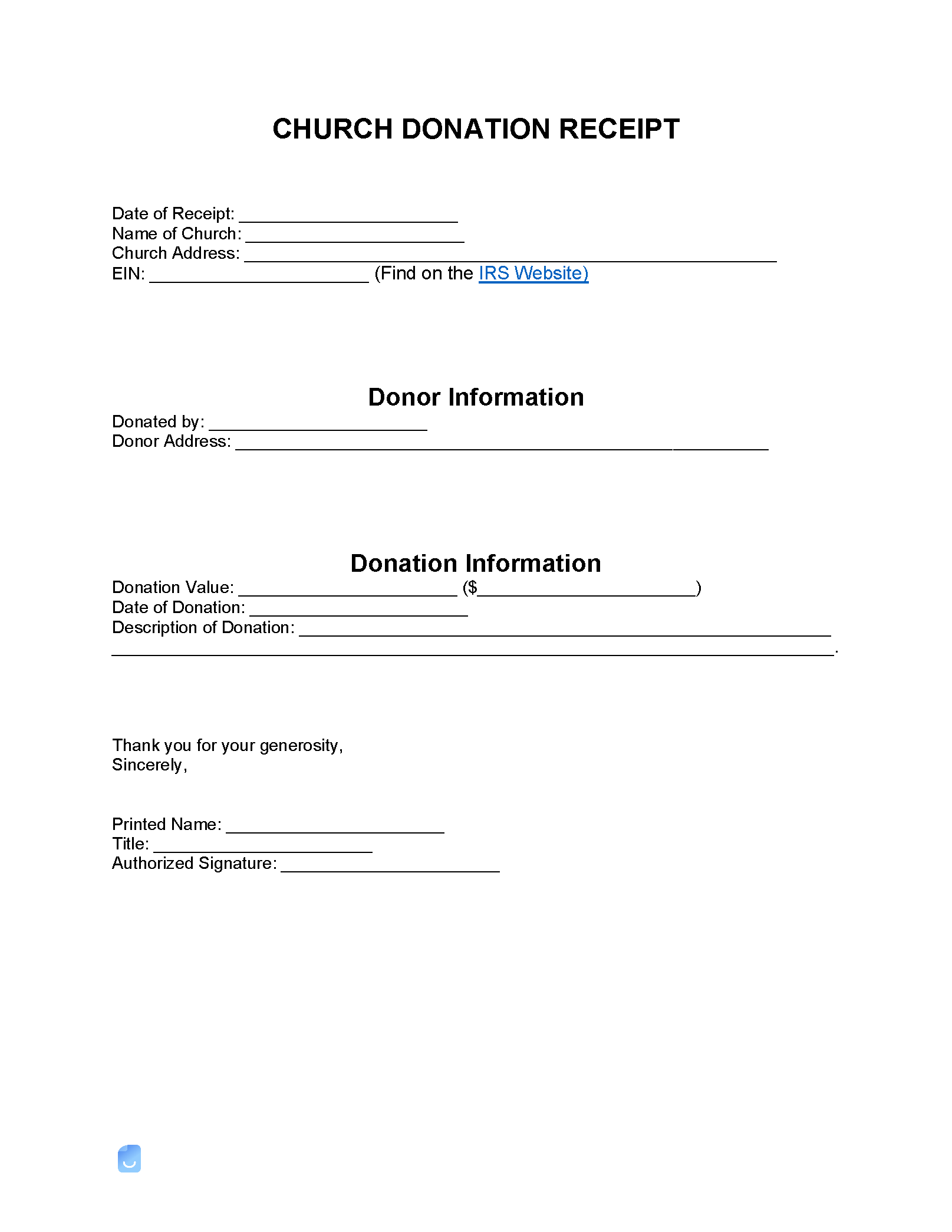

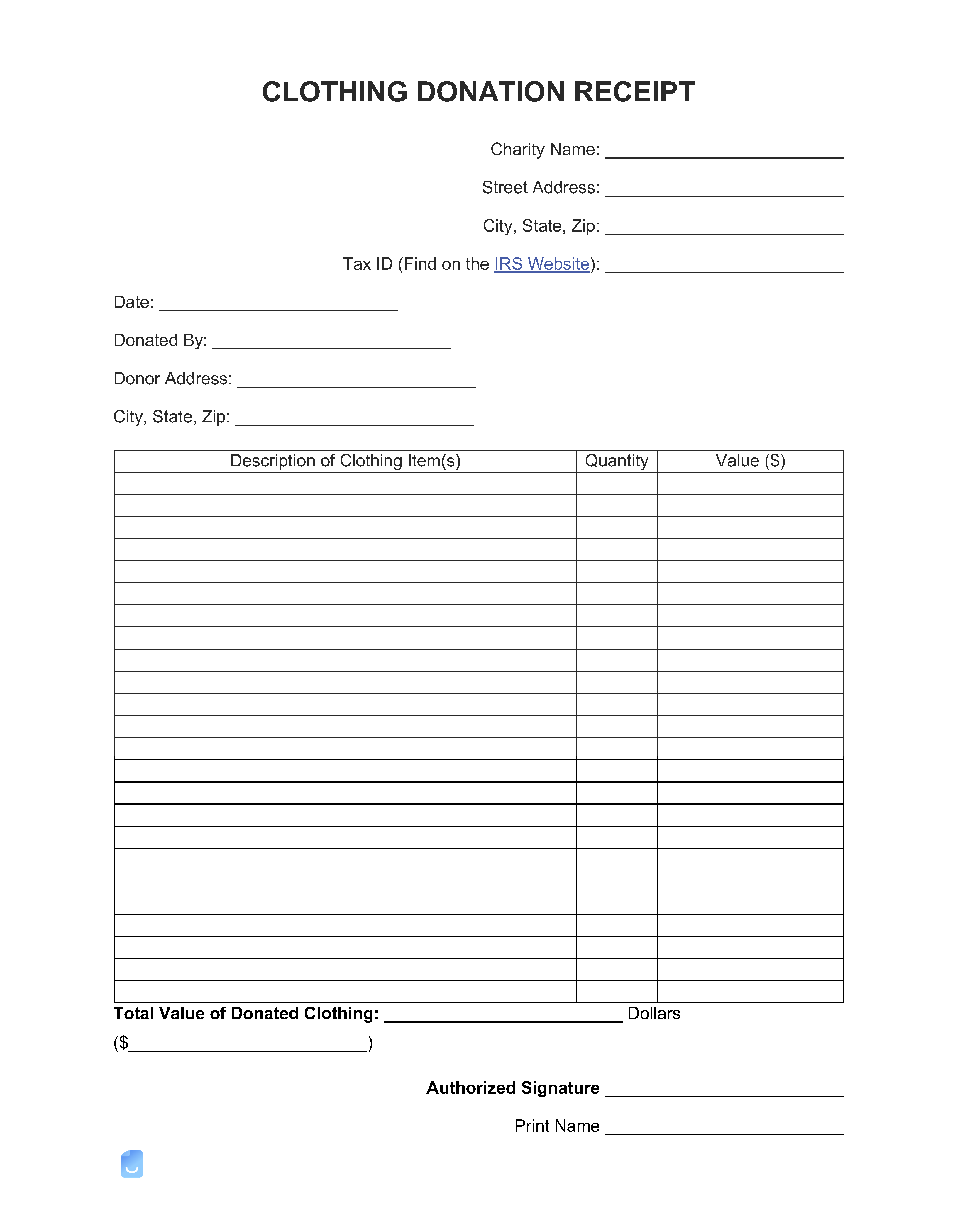

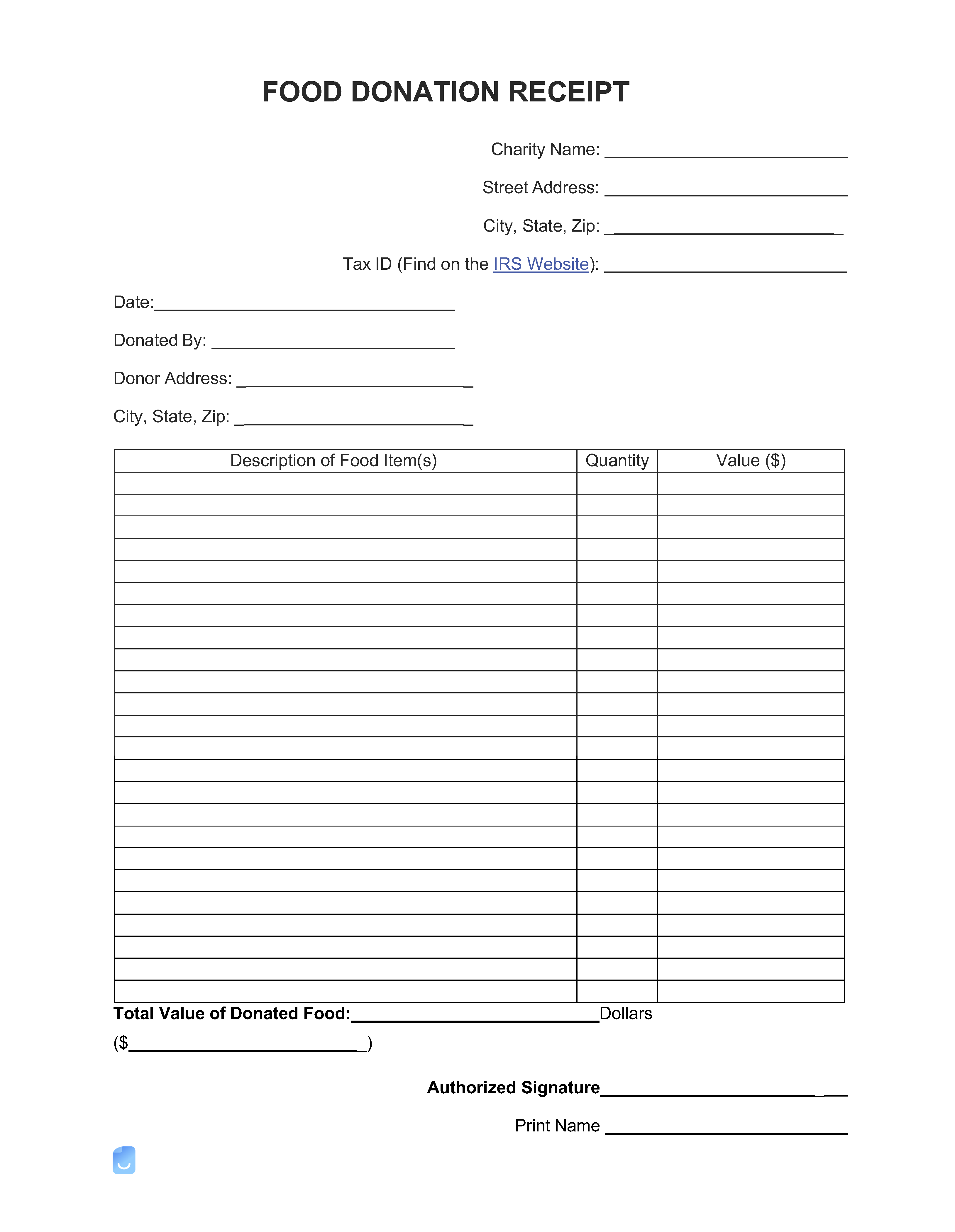

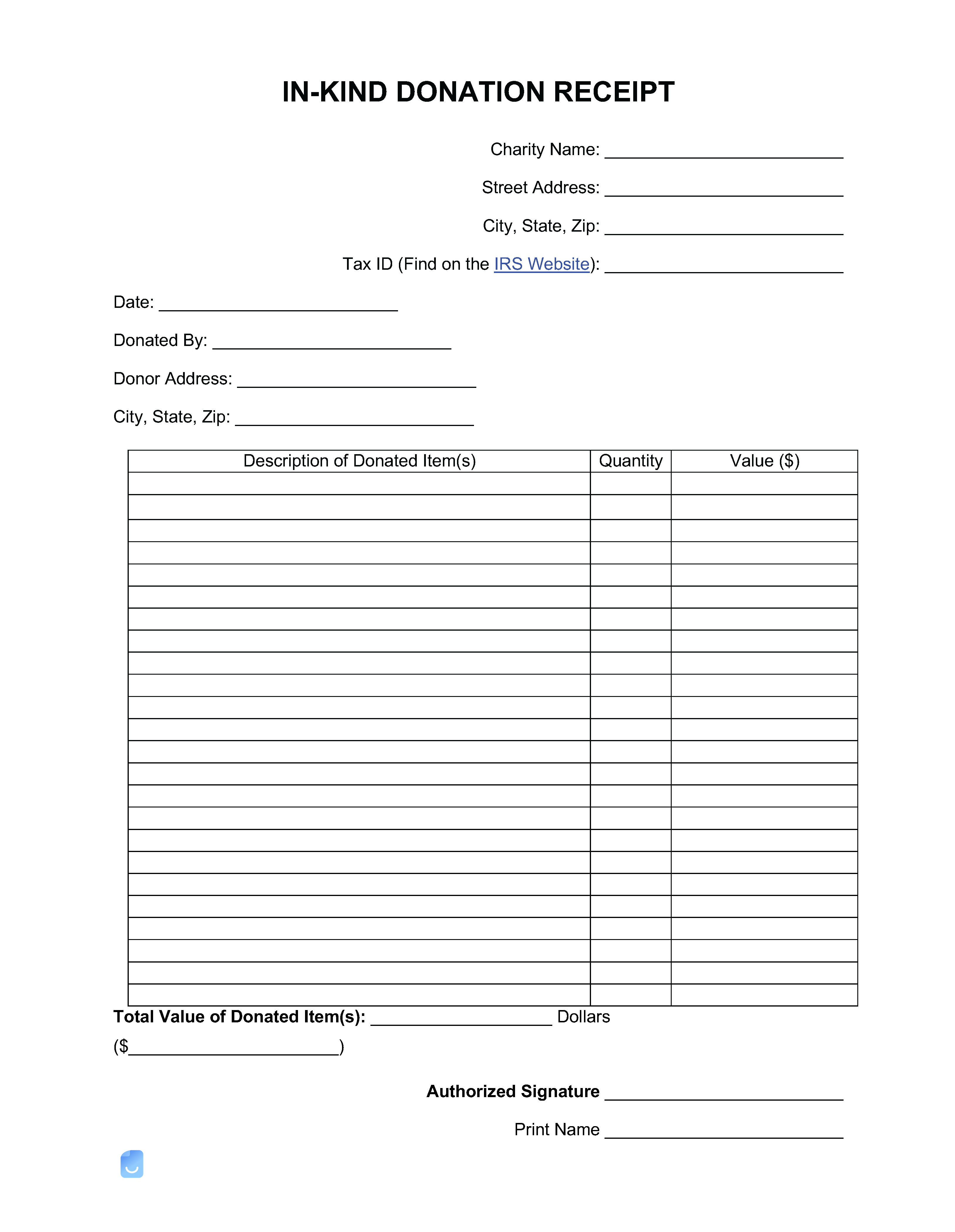

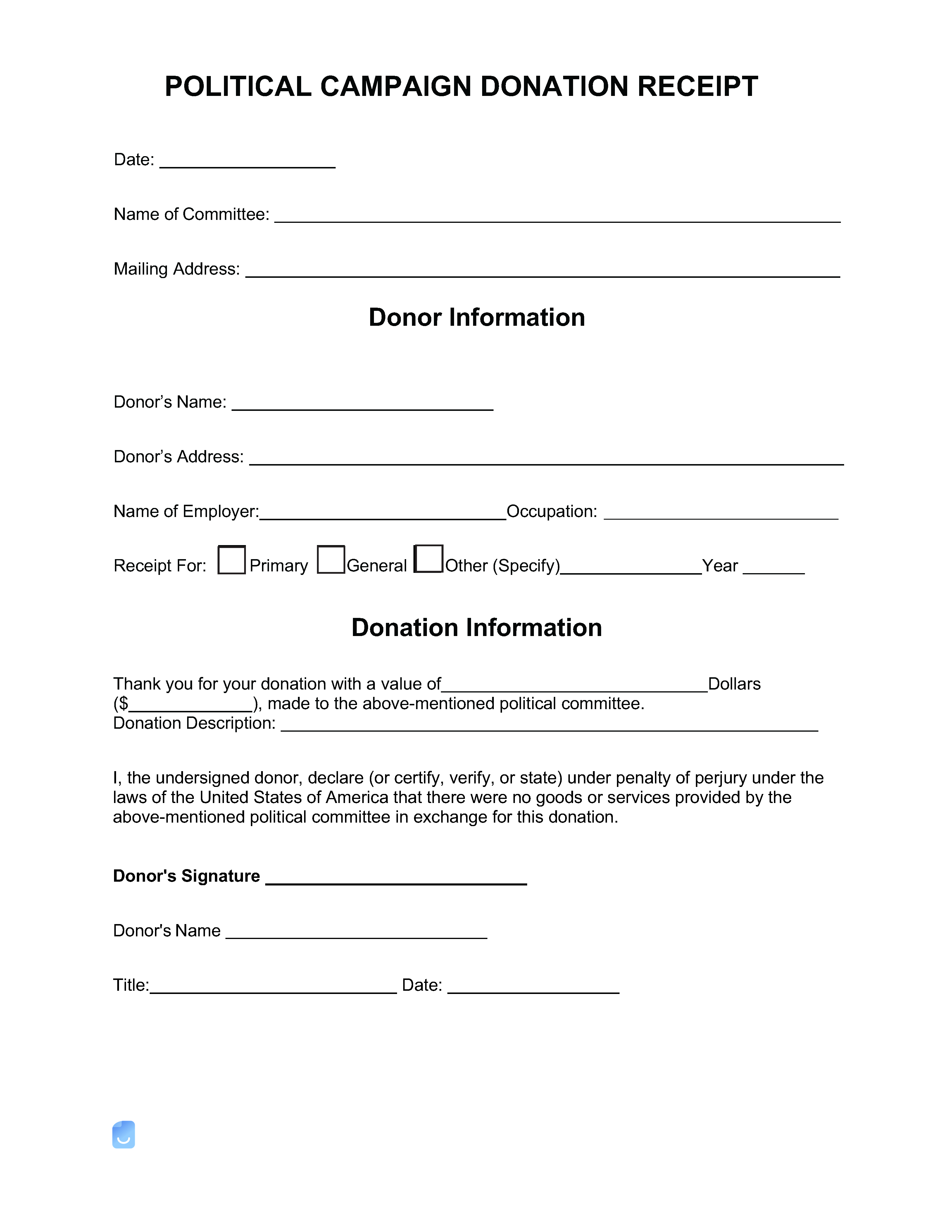

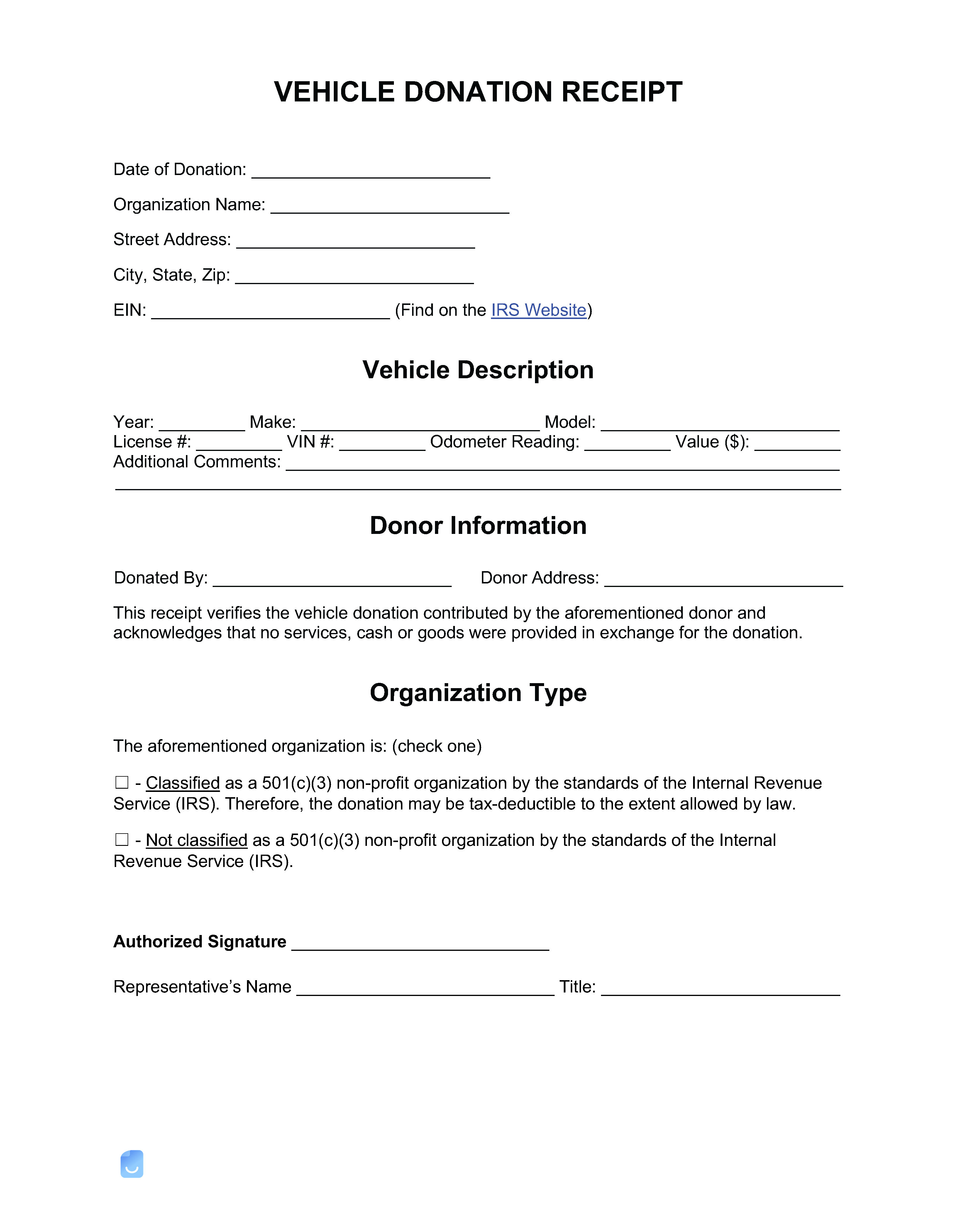

Donation Receipt Template

A donation receipt is given to a donor that proves their contribution for tax authorities. A copy is required to be saved by the donor for a period of three (3) years if the amount is over $250 (P. 526). Tax Deductible – A donation is only tax-deductible if given to a registered 501(c)(3) organization.

By Type (8)

Are Donations Tax Deductible?

Yes, a donation is tax deductible if it’s given to a 501(c)(3) organization. This includes most popular non-profit organizations. For example, money given to political organizations are not tax-deductible.